Anchor Protocol

VeradiVerdict - Issue #131

Terra, the protocol’s unique blockchain, is best-known for its fiat-pegged stablecoins—most notable being TerraUSD (UST) with the fifth-largest stablecoin market cap—and has over 2 million users of its payment rail, Chai, in South Korea. They’re also behind Mirror Protocol, a decentralized platform for transacting synthetic shares in select publicly traded companies.

Last month, Terra unveiled their latest project, Anchor, an easy-to-use savings platform that could prove to be a game-changer in the DeFi space.

What does DeFi look like today?

If you’ve been following the meteoric rise of decentralized finance (DeFi), you’ve no doubt heard about “yield farming” and “liquidity mining” being profitable activities. In June 2020, when the lending platforms Compound and Aave launched, individuals could earn outsized returns by strategically moving their funds between various protocols to maximize their gains. As a result, DeFi’s flywheel began to turn: early adopters earned handsome returns in exchange for providing the liquidity the protocols needed to operate.

Decentralized lending platforms work by matching depositors, who seek low-risk interest rates in exchange for lending their funds, with borrowers. While the traditional banking system uses “creditworthiness”—through credit scores and other KYC practices—to extend a loan, most DeFi lending platforms require that loans are over-collateralized. In other words, a borrower must deposit more currency in collateral than the total value of the loan, typically 2-3x. This guarantees that loans are repaid without trusting, or even knowing, the other party.

Today, almost a year after “DeFi Summer,” the space continues to innovate in exciting ways, with new protocols attempting to offer competitive rates to credit providers and recipients. As a result, decentralized lending has reached nearly $25B in total value locked (TVL), an exciting accomplishment for open finance.

Source: DeFi Pulse

Why isn’t DeFi more mainstream?

If there’s anything the recent NFT craze has revealed, it’s that technology can move from the fringe to popular culture faster than ever before. In the course of a few months, NFTs turned from a mystifying acronym to a topic of national discussion. Using DeFi is, in many ways, as easy to use as transacting NFTs, oftentimes with more reliable and lucrative financial rewards. Why, then, has DeFi failed to infiltrate the public consciousness in the same way?

There are a few possible reasons:

Barriers to entry. Using lending platforms like Compound and Aave would be intimidating for non-crypto-natives. In addition to the clunky technology (browser wallet, unintuitive UX, etc.), newcomers are also more likely to distrust the protocols, particularly if they lack an understanding of cryptocurrency.

Interest rate variability. Yields on DeFi lending protocols can sometimes vary wildly. This is largely because of the volatility of the underlying collateral, which affects the “utilization ratio” and the resulting yield. For investors, this complicates long-term financial planning and also indirectly exposes them to the fluctuations of the broader cryptocurrency market.

Source: DeFi Pulse

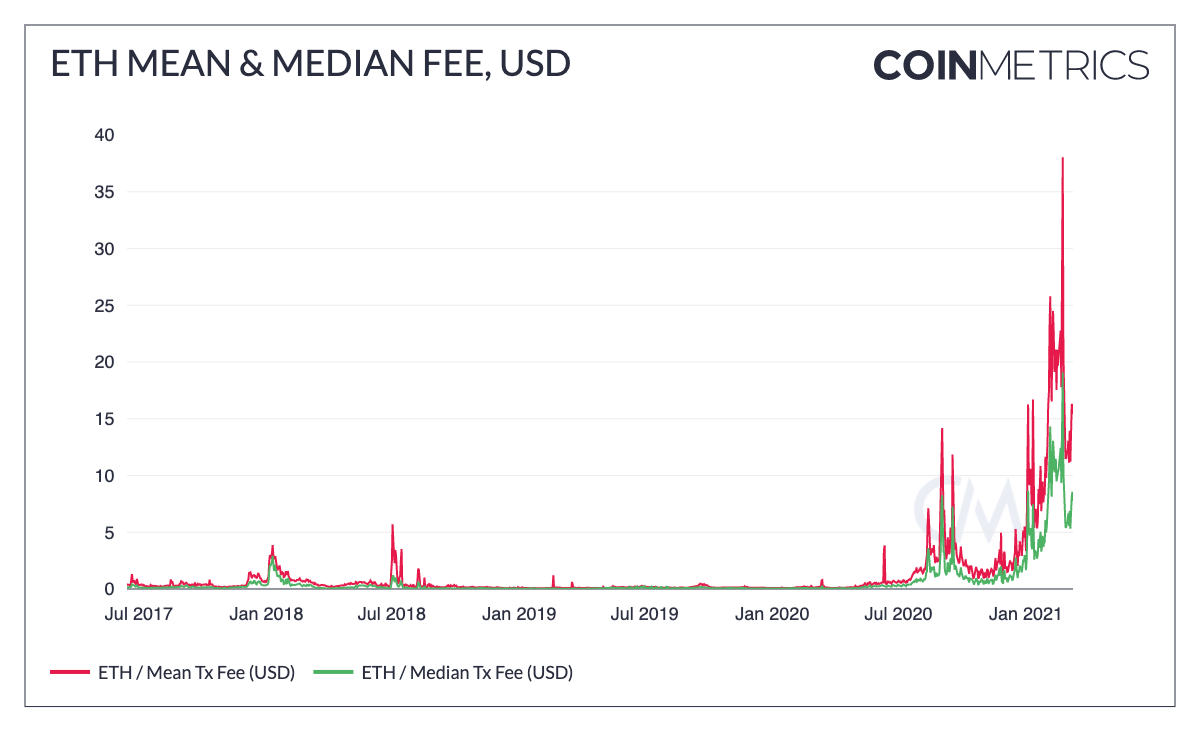

High gas fees. Congestion of the Ethereum blockchain has resulted in new peaks for fees, making it difficult for users to engage with decentralized applications without breaking the bank. The costs may be high enough to deter some from experimenting with DeFi.

Source: CoinMetrics

How does Anchor fit into this?

Anchor is a decentralized savings protocol that targets a yield of around 20% for UST depositors, a rate that is over 200x the average interest rate for a savings account at a bank of 0.07% APY.

While other decentralized lending providers have attracted arbitrageurs and traders seeking to maximize their yields, Anchor has uniquely targeted the use case of saving. The whitepaper lays out an ambitious vision:

Despite the proliferation of financial products, DeFi has yet to produce a savings product simple and safe enough to gain mass adoption. [...] Ultimately, we envision Anchor to become the gold standard for passive income on the blockchain.

A few characteristics set Anchor apart:

Separate blockchain. Anchor is built on the Terra blockchain, which is part of the Cosmos ecosystem. While this may limit interoperability with Ethereum-based applications and could be a short-term barrier to adoption, it drastically lowers fees and gives the protocol more flexibility. However, with Terra Bridge now live, a cross-chain bridge solution from Terra to both Ethereum and Binance Chain, Terra assets can be easily ported between chains at low cost, all within a single interface.

Ease-of-use. Using Anchor is easy—once the web application is connected to a Terra wallet, the user can deposit, borrow, vote, and stake. The layout is clean and intuitive. While it may still remain intimidating for those in the world of CeFi, it’s a meaningful step in the right direction. Anchor’s API is simple to integrate into fintech platforms, neobanks, crypto exchanges, digital wallets, and more, with the team positioning its fintech compatibility as the “Stripe for Savings.”

20% APY. A fixed-income, low-risk financial instrument with returns as high as Anchor’s is truly incredible. If the yield continues to stabilize at around this level, saving money on Anchor becomes a no-brainer for individuals and capital allocators alike. For a competitive crypto front-end application space, Anchor’s fixed-rate 20% APY can serve as a distinctive feature that attracts a broader set of users since it is unpegged to crypto price movements, making it attractive in the next bear market.

How is the APY so high?

Source: DeFi Rate

While DeFi has produced its fair share of jaw-dropping numbers, a savings product that promises 20% APY seems too good to be true. How do they do it?

The secret lies in the way loans are collateralized. At a high level, Anchor is a decentralized money market like Compound. However, Anchor only accepts liquid staking derivatives on the supply-side from borrowers as collateral. Liquid staking derivatives are tokenized claims on the cash flows of bonded staking positions on major proof-of-stake (PoS) chains like Cosmos, Polkadot, Ethereum, Solana, and more. Staking derivatives on Anchor are called bAssets, and bLUNA, the staking derivative for Terra’s native asset LUNA, is currently the first derivative.

Staking yields from borrowers are passed onto depositors. In addition, since loans are over-collateralized, the staking rewards are magnified. These earnings are split between the borrower and lender, contributing to the high interest rates. An intuitive walkthrough of how Anchor achieves a low-volatility 20% APY can be found in a Tweet thread by Terra’s Co-Founder and CEO, Do Kwon here.

What’s interesting is that staking derivatives are untethered to short-term debt cycles and speculative investment in crypto markets compared to the variable yields of other DeFi protocols, specifically money markets. This is because staking yields for securing consensus on most major PoS chains are a function of native token supply emissions (i.e., network inflation) and transaction fees across networks that are captured by stakers as a reward for securing the network.

Staking derivatives allow Anchor to adjust and stabilize the deposit rate on the demand-side without being subject to speculative demand cycles, like when sharp downturns in token prices are accompanied by dampened yields as investors are less likely to demand credit to trade on margin and capture larger returns.

As an unlevered source of yield, Anchor’s 20% APY can serve as a primitive for DeFi’s emerging yield curve. Analogous to the Federal Funds Rate, of which most TradFi interest rates are derived, the Anchor rate can be thought of as a decentralized Federal Funds Rate (DFR), the benchmark rate of DeFi.

The protocol has set its preliminary “Anchor Rate” at 20% but it can be adjusted in the future using Anchor’s governance system. As the proportion of lenders and borrowers changes, this rate can sometimes slightly fluctuate, with current incentives for borrowers in the ANC token adjusted based on demand for borrowing. So far, though, Anchor’s stabilization mechanism has been successful in keeping the yield at around this rate.

How do I use it?

I’d suggest watching this video walk-through from The Defiant to play around with Anchor. From my experience, you can go from not having a Terra wallet or any UST to earning 20% APY on your funds in less than 30 minutes.

Once you’re set-up, you can use Anchor in all kinds of ways:

Deposit UST for ~20% APY.

Borrow funds and receive a reward higher than the interest itself. (Net APR is currently ~110% with rewards distributed in the ANC token).

Purchase ANC, Anchor’s governance token, to benefit from the platform’s usage, earn staking rewards, and be involved in the protocol’s future. Surplus yield from the supply-side (borrowers) is also used to purchase ANC on the open market, and distributed to ANC holders, scaling ANC’s price linearly with the protocol’s AUM.

Where does it all go from here?

Only two weeks after going live, over $160M has been deposited and $110M has been borrowed using the protocol. This speaks to the attractiveness of Anchor’s yields, its technological resilience, and the desire for savings-as-a-service on the blockchain.

The team’s vision is to become the decentralized world’s mainstream savings product with DeFi’s “gold standard” interest rate. Only time will tell if Anchor executes on this ambitious future, but it certainly has the pedigree and momentum to become an indispensable component of the open finance ecosystem.

- Paul V

DIGESTS

Coinbase estimates Q1 revenue jumped nine-fold to about $1.8 billion ahead of public market debut

Net income grew to between $730 million and $800 million from $31.9 million a year ago. Coinbase said it has 56 million verified users.

State Street to Use New Crypto Trading Platform It’s Helping Build, Platform’s CEO Says

State Street, the second-oldest bank in the U.S. with $3.1 trillion in assets under management, has signed up to use a new bank-grade trading platform for digital assets set to go live mid-year

NEWS

National Burrito Day 2021: Chipotle to give away free burritos and $100,000 in Bitcoin Thursday

Free burritos or Bitcoin?

Sacramento Kings to Offer Bitcoin Salary Option to All Players

The NBA franchise has long been one of the most crypto-forward teams in professional sports.

Here Are the Biggest Celebrities Who Have Launched NFTs

Snoop Dogg, Grimes, and Tony Hawk are among the many celebrities who've joined the NFT hype train and minted their own non-fungible tokens.

REGULATIONS

Thai Central Bank to Pilot Its Retail Central Bank Digital Currency in 2022: Report

Thailand’s central bank is open to accepting public feedback on its retail CBDCs by June 15.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Crypto Investment Platform Amber Hits $1B AUM

The Hong Kong-based company now provides trading and asset management services to 500 institutional clients.

Overly Attached Girlfriend NFT Sells For $411,000

The NFT meme sold to 3F Music, the avid collector of NFTs.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

LMFAO Whoops!