A new frontier for Digital Asset Treasuries

VeradiVerdict - Issue #331

The DAT wave

Everyone thought the bitcoin ETF would replace Microstrategy as the best way for public markets to gain exposure to bitcoin. Last January, analysts were predicting “the premium that MicroStrategy shares trade to bitcoin could fall from roughly 40% to between 15% and 25%”.

But it didn’t. Today, Microstrategy trades at a $104B market capitalization, only a mere $24B short of the market capitalization of all Bitcoin ETFs combined. Being traded at a 70% premium to bitcoin, it is clear that the public market believes that Microstrategy offers unrivaled exposure to bitcoin.

Two months ago, Janover, a Nasdaq listed company, was acquired and rebranded under the name DeFi Development Corp. Under the ticker DFDV, the company announced they are “the first public company focused on accumulating and compounding Solana (SOL)”. A month ago, SharpLink Gaming announced the closing of $425 million in private placement funding. Under the ticker SBET, they will “adopt ETH, the native asset of the Ethereum blockchain, as its primary treasury reserve asset”.

In the last two months, two Microstrategy like products have entered the public markets – DFDV for Solana, Sharplink for Ethereum. As a lead investor into both DFDV and Sharplink, Pantera Capital is a strong believer in the unique crypto exposure corporate treasuries bring to the public markets. Now let’s break down what corporate crypto treasuries are and Pantera Capital’s thesis on them.

Digital Asset Treasury Explained

In order to explain what kind of exposure DAT stocks offers to crypto, and how its exposure to crypto differs from ETFs, we have to first understand how Digital Asset Treasuries (DATs) work.

The creation of DATs are fairly simple on paper. A corporation only has to

Raise capital from investors in the form of debt or equity

Use the capital raised to acquire the treasury asset of your choice. In DFDV’s case, you would purchase Solana

Since treasury assets are part of the corporation’s balance sheet, owning equity of the corporation gets you exposure to the treasury asset; owning DFDV stock gets you exposure to Solana.

Having a smaller operating business helps investors focus on the treasury value rather than the operating business. Therefore, as our GP Cosmo mentioned in the unchained podcast, Nasdaq listed companies with little to no non-treasury related business operations are the best companies to adapt such strategies as most of the equity’s value can be attributed to its treasury.

A deep dive into DATs

As of late May, Microstrategy is traded at 1.7 times the treasury it owns, DFDV at 5.6 times and Sharplink at 8.1 times. If the value of a company is based on its treasury, why does its stock trade at a premium to the value of its treasury? How do we value DATs?

Metrics that Matter

As explained by Cosmo on the Unchained podcast, there are two valuation metrics that Pantera pays attention to – Premium to NAV and Average Growth of Asset per Share.

Premium to NAV

NAV stands for net asset value of the treasury a corporation holds. For DFDV, the NAV would be the value of the Solana DFDV held in its treasury. The premium to NAV metric represents how much more investors are willing to pay to acquire the treasury’s stock relative to purchasing its underlying treasury asset directly. It is calculated by dividing the market capitalization of the stock by NAV.

Average Growth of Underlying Asset per Share

To understand what these metrics means, we have to first understand how there is a premium to NAV. As shown in our newsletter A New Frontier of Crypto Exposure, this premium for MSTR exists as investors believe it is possible to own more BTC per share (BPS) over time through MSTR than just buying a single BTC. Let’s walk through the simple math:

If you buy MSTR at two times NAV (Premium to NAV is 2.00x) , you are buying 0.5 BTC instead of buying 1.0 BTC via spot. However, if MSTR can raise capital and grow BPS 50% per year (last year it grew 74%), by the end of year two you would have 1.1 BTC – more than if you had simply bought a spot.

In the above example, the average growth of underlying asset per share would be 50%. The growth of 0.5 BPS to 1.1 BPS is the upside you captured, justifying your purchase of MSTR at a two times premium to NAV.

Therefore, the average growth of underlying asset per share captures the growth of the treasury in token value normalised by the number of shares issued.

Valuating DATs

What is the underlying asset?

In order for a DAT to be attractive for investors. The treasury asset should be:

A widely known asset.

An asset that people want exposure to.

An asset that is hard to access.

All of Bitcoin, Solana and Ethereum check the first two points. On the third point, cryptocurrency is hard but not impossible for the public market to access. However for large swaths of investors, including equity mutual funds and ETFs, their mandate only allows them to buy operating companies and not assets directly, precluding them from buying BTC but allowing them to buy a BTC-DAT.

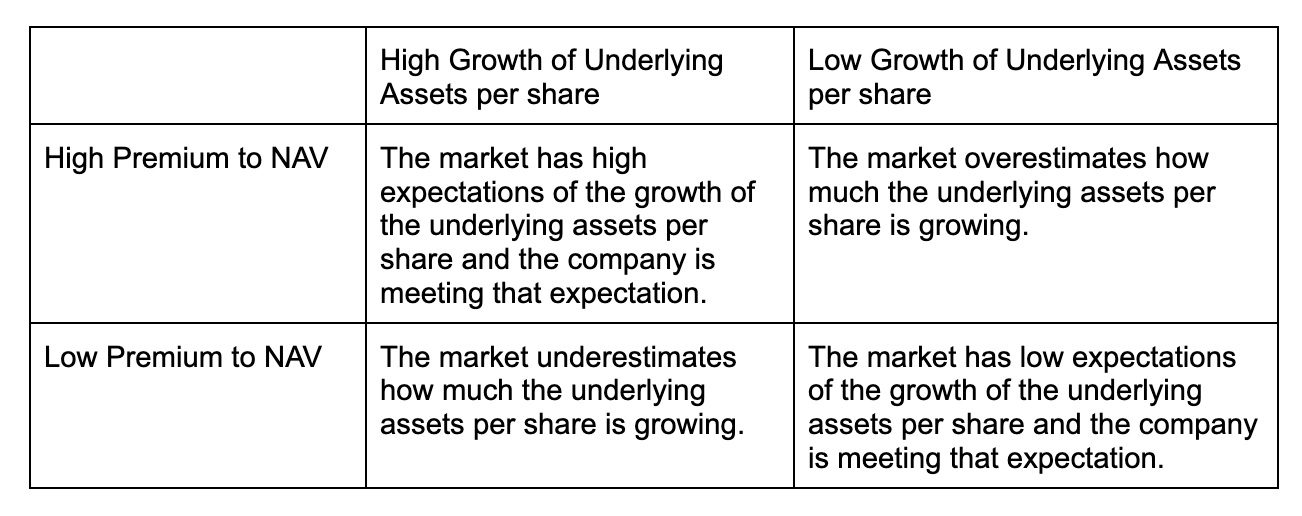

Are the Premium to NAV and Average Growth of Underlying Assets per Share justified?

As mentioned in the previous section, people buy DATs at a premium to its treasury in hopes of the corporation to accumulate more tokens such that the number of tokens your share holds in the future is more than the buying 1 unit of the underlying token.

As we can see, the sweet spot is DATs with a low premium to NAV and a high growth of underlying assets per share. But how do we quantify the growth of underlying assets per share? What are common ways DATs increase their treasury?

Purchase More Crypto

One of the easiest ways to raise more capital is to expand the treasury. There are a few ways capital is raised; two common ways include convertible debt and private investment in public equity (PIPE). Private investors can either purchase debt with the option to convert into equity when the stock hits a certain price, or equity.

If the company raises debt, the number of outstanding shares doesn’t increase, thus the number of underlying assets per share would increase. If the company raises equity, as long as it issues equity at a premium to its NAV, the number of underlying assets per share would increase.

It is worth noting that due to the size of DATs, they have exposure to opportunities retail investors don’t have. For example, last month, Upexi purchased 77,879 locked SOL at $151.50 each for a total of $11.8 million. At the current $178.26 price of SOL, this represents a $2.1 million, or 17.7%, built-in gain for investors. Locked tokens are usually held by institutional investors who are willing to sell their tokens at a discount to unlock liquidity. DATs like Upexi can take advantage of their need for liquidity and purchase tokens at a discount.

Validator and Network Participation

Another way a company can increase its treasury is by staking and trading with their treasury. DFDV is a DAT adapting this strategy – they purchased a staking business with 500K staked Solana, generating protocol-native cash flow through self-staking. Since all the yield gained from staking flows back into their treasury, staking increases the underlying assets per share.

What are the risks?

The scenario you want to avoid is the DAT is forced to sell its treasury, decreasing the underlying asset per share. The two main reasons a DAT will be forced to sell are to pay down debt maturities or to cover negative operating cash flow.

Therefore, it is important to look at how much of the capital raised is debt and scrutinize the debt term structure. It is important that the operating company is a self-sustaining and not in a cash burn situation. The competence and reputation of the management team is also important because they need to effectively navigate between the various capital markets tools and effectively market to a larger reach of investors.

What makes DATs unique

They don’t sell

While ETFs are designed to track the price of assets and may rebalance or liquidate positions to meet redemptions or regulatory requirements, these companies buy and hold assets like Bitcoin, Solana, or Ethereum as a long-term strategy. For example, MicroStrategy has consistently added Bitcoin to its treasury regardless of market cycles. This conviction-based approach contrasts with the more passive management of ETFs.

Access to special opportunities

These corporations may also provide access to special opportunities that ETFs generally cannot. DFDV leverages its Solana holdings to participate in staking and validator operations, generating yield and supporting network growth. SharpLink’s Ethereum strategy, backed by industry leaders like ConsenSys, opens the door to protocol-level activities such as staking and DeFi participation, which are unavailable to ETF investors.

Looking ahead

Pantera Capital has actively participated in financing DATs through our investments in DFDV and Sharplink. We believe they not only offer public markets unrivaled exposure to crypto, they also help crypto ecosystems grow by providing staking infrastructure and deflationary pressure on their tokens.

- Paul Veradittakit

DIGESTS

Cypherock X1 Review: A Crypto Hardware Wallet With a Slick Card-Based Security Model

The Cypherock X1 employs a shard-based security model using cards with secure elements, to guard against the threat of wrench attacks.

BUSINESS

Coinbase Knew of Its Data Breach Months Before Disclosing: Reuters

Coinbase reportedly knew of a January data leak at outsourcing firm TaskUs, tied to a wider breach and a $20 million extortion attempt.

Meta Shareholders Overwhelmingly Reject Proposal to Consider Bitcoin Treasury Strategy

The company has $72 billion in cash on its balance sheet, but barely any of the 5 billion shares that voted were in favor of adding bitcoin.

REGULATION

Crypto Lobbyists Urge U.S. Senators to Dodge Distraction in Stablecoin Debate

Top industry advocacy groups requested that the Senate stick to the task at hand as it mulls its stablecoin bill while unrelated amendments loom.

NEW PRODUCTS AND HOT DEALS

Solana Meme Coin Bonk Launches 'Kill-to-Earn' Shooter Game

Bonk has just launched its very first video game, with Bonk Arcade featuring a pay-to-spawn, win-to-earn economic model.

CRO ETF? Canary Capital Files for US Cronos Fund as Altcoin Interest Intensifies

Canary's move to expose U.S. investors to Cronos (CRO) comes soon after Crypto.com revealed a Trump Media team-up.

THIS WEEK AT PANTERA

Pantera Blockchain Letter

Our latest Blockchain Letter breaks down two of the hottest trends in crypto: – Digital Asset Treasury ("DAT") companies emulating the MSTR (Strategy) playbook – Stablecoins and their impact on dollar dominance.

Avantis announce our $8M Series A

Avantis is leading the charge to scale on-chain markets for the rest of the world. Over the last year, the team has become the largest derivatives DEX on Base $7.5B+ in volume. 60K+ users. Novel products: Loss rebates, Zero-fee perps, Zero-slippage BTC trades.

Pantera Capital Doubles Down as Revolving Games Prepares for Publisher Ecosystem Expansion

Their titles like War of Nova, HatchKings, Hatchlings and Genesis have collectively driven millions of downloads, brought users into Web3, and generated millions in revenue.

LETS MEET UP

New York City, June 11-12

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early-stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have any projects that need funding, feel free to DM me on twitter.

Thanks much great overview!