Algorithmic Stablecoins

VeradiVerdict - Issue #119

Stablecoins have been a very hot topic lately, so I figured a very high-level primer might be helpful. Stablecoins range from more centralized fiat-collateralized to more decentralized algorithmic non-collateralized stablecoins. Thanks to Lewis Freiberg of Empty Set Dollar and Dan Elitzer of Nascent for providing comments. If you want to get deeper into Stablecoins, check out The Delphi Podcast for the Algorithmic Stablecoins Series.

Stablecoins Overview

Stablecoins are fiat-backed tokens on public blockchains, whose values are pegged to stable, conventional currencies like U.S. dollars. Designed to minimize volatility, the asset allows USD-denominated transfers and balances on certain exchanges and DEXs, and offers a way for traders to reap many of the benefits of crypto assets like BTC and ETH without the price volatility.

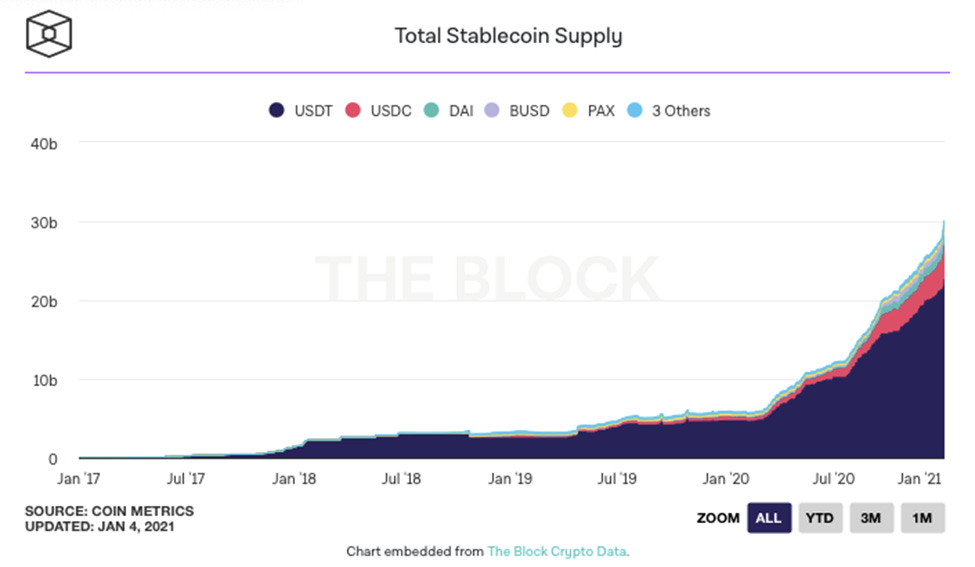

Stablecoins have gained impressive growth in 2020, influenced by the surge in the decentralized finance (DeFi) market. In fact, the U.S. Office of the Controller of the Currency (OCC) announced this past week that federally regulated banks can use stablecoins to conduct payments and other activities. The federal banking regulator states in a letter that blockchains have the same status as other global financial networks such as SWIFT, ACH and FedWire, endorsing the use of stablecoins and cryptocurrencies as legitimate alternatives to other real-time payment systems. The total value of stablecoins has currently surpassed $30 billion, reflecting investors’ heightened demand for inherently price stable assets during volatile times.

More than 200 stablecoins have been developed, with Tether and Centre’s USDC taking the lead by total supply. The market cap of Tether, the most popular stablecoin, has surged in recent weeks to over $21 billion. Tether’s market cap has increased over four times since the start of 2020, accounting for more than three-quarters of the stablecoin market.

Source: The Block Crypto

Stablecoins have surged in ever-changing crypto markets, and unlike real dollars, they can be easily held or moved around within the digital ecosystem, offering investors the benefits of blockchain technology and peer-to-peer value transfer. Many traders also see stablecoins as an intermediary step before investing in riskier cryptocurrencies. After buying stablecoins with U.S. dollars or other government-issued currencies, traders can move the stablecoins to exchanges and trade for cryptocurrencies like bitcoin and ether.

What are Algorithmic Stablecoins?

Algorithmic Stablecoins use a price stabilization algorithm to track a particular unit price – typically $1. Algorithmic stablecoins work on top of a public blockchain either backed by a base cryptocurrency such as ether (ETH), or non-collateralized. Price parity is supported by market and technical mechanisms based on smart contracts that lock in crypto collateral and implement a price stabilization algorithm. Unlike other types of stablecoins, algorithmic stablecoins are not redeemable 1:1 for U.S. dollars or backed by crypto-asset collateral, and are often highly reflexive. Demand is driven largely by market sentiment and momentum, influencing token supply.

The first instances of algorithmic stablecoins were launched on the Bitshares blockchain in 2013. Now, the longest-running algorithmic stablecoin is Ampleforth (AMPL), though 2020’s DeFi hypergrowth brought forth the creation of similar projects like Yam and Based.

For AMPL and the like, supply changes in response to deviation from the target asset price (called “rebases”) affect every account. Rebases usually happen at predefined intervals, and make the network highly reactive. An algorithm will correct imbalances between supply and demand by issuing more coins when the price rises, and decreasing supply when the price falls. For instance, an algorithm could be designed in such a way that when a stablecoin worth $1 drops to $0.70, the algorithm will automatically set a market buy order to push the price back up. If the price grows higher than $1, the algorithm will sell assets.

Conversely, new projects Basis Cash and Empty Set Dollar limit rebases to traders who want to take the associated risks and rewards, removing the impact of supply changes on every single wallet.

Source: CoinGecko

Basis Cash is a new, multi-token protocol based on the stable coin Basis, an algorithmic stablecoin project that raised $133 million in funding in 2018 but never launched. Basis Cash consists of three tokens:

BAC - the algorithmic stablecoin. Current BAC supply is close to 90 million.

Basis Cash Shares – holders can claim BAC inflation when the network expands

Basis Cash Bonds – can be purchased at a discount when the network is in contraction and can be redeemed for BAC when the network exits its deflationary phase

Basis Share and Basis Bond designed to move Basis Cash towards the price of $1. For example, when Basis Cash is traded below $1, users can burn Basis Cash to purchase Basis Bonds, causing a decrease in the circulating cash supply. Bonds do not have interest payouts, nor maturity or expiration dates, and purchased bonds can be redeemed with cash when the price rises above $1. Conversely, when the price of Basis Cash exceeds $1, the contract allows bond redemptions, with increased demand of BAC resulting in new tokens being minted and distributed to Basis Share holders.

The initial distribution of Basis Cash – a total of 50,000 tokens – prioritizes users who deposit DAI, yCRV, USDT, sUSD, and USDC to the distribution contract. Afterward, distribution extends to those providing liquidity to the Basis Cash (BAC)-DAI Uniswap v2 pair, where users can deposit LP tokens to the distribution contract and earn Basis Shares.

Basis launched on November 30 2020, peaking at nearly $200M in TVL, which has since dropped to $169M. DeFi traders initially rushed to provide liquidity to the project, with ~10,000% APYs on the BAC stablecoin liquidity pools. Currently, BAC/DAI daily and annual yields are 1% and 365%, respectively. DAI/BAS daily and annual yields are 2% and 365%.

Empty Set Dollar (ESD) is another Basis-inspired stablecoin that launched in late August, and now has over $100 million in market capitalization. The protocol is centered around an ERC-20 token, ESD, which acts as both the stabilized dollar and as the governance token for the protocol. Total token supply is currently over 500 million, with DAO daily and 30-day yields of 4% and 206%. LP daily and 30-day yields are 1% and 40%.

While Basis Cash is still in its early stages of development, ESD has undergone multiple expansion and contraction cycles. ESD has three main features:

Stability – ESD’s algorithmic approach maintains price stability around $1 USDC, using voluntary supply expansions and contractions around a Time Weighted Average Price (TWAP) oracle from the incentivized trading pool on Uniswap, rewarding actors who promote stability within the protocol.

Composability – ESD adheres to the ERC-20 token standard, enabling seamless integration across DeFi infrastructure.

Decentralization – ESD has always had decentralized on-chain governance, in which the community of token holders vote on any changes or upgrades to the protocol.

In fact, of ESD’s 200+ supply “epochs” thus far, nearly 60% have occurred when the TWAP of ESD is within the $0.95 < x < $1.05 range. This signifies that ESD has been more than twice as stable as longest-running algorithmic token Ampleforth, albeit over its much shorter life span.

ESD vs. Basis Cash

Like Basis Cash, ESD utilizes bonds (“coupons”) to finance protocol debt, which must be purchased by burning ESD and can be redeemed for ESD once the protocol goes into expansion. However, unlike Basis Cash’s three-token model, ESD does not have a third token that claims inflationary rewards when the network expands after it has paid off its debt. In place of this third token, ESD holders can ‘stake’ their ESD in the ESD Decentralized Autonomous Organization (DAO) to receive a pro rata share of supply expansions, which are capped at 3%.

ESD’s “staging” model ultimately functions similarly to the three-token system of Basis Cash Shares. The “staging” period is needed to un-bond ESD from the DAO, during which ESD tokens are temporarily “staged” for 15 epochs (5 days), neither tradable by their owner nor accruing inflationary rewards.

While bonding ESD to the DAO presupposes liquidity risk and purchasing Basis Cash Shares presupposes price risk, both share the potential for users to reap future inflationary rewards. However, the staging requirements for bonding and un-bonding ESD from the DAO also creates additional “time risk” and illiquidity of the third token, both unique to ESD.

Source: Lewis Freiberg

Stablecoins also pose new regulatory challenges. A new U.S. congressional bill – the Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act— would require stablecoin issuers to secure bank charters and regulatory approval prior to circulating any stablecoins. Algorithmic stablecoins like Basis Cash, along with numerous other stablecoin issuers currently operating without banking charters, would fall under this proposal. As a result of the Basis.io shutdown and possible future regulation, the founders of Based and ESD are anonymous. Despite the evolving regulatory landscape, algorithmic stablecoins innovations are shaping the future of DeFi currencies, and can play a key role in enabling safe and secure digital transactions while maintaining price stability.

Forks of Basis and ESD

New algorithmic stablecoins have launched as forks of the Basis Cash and ESD protocols. Mithril Cash, a fork of Basis, launched on December 30th. The economic model of Mithril functions similarly to how central banks determine the target value of fiat money. By buying or selling bonds, Mithril controls the overall token supply to achieve a target value of $1. Smart contracts that fulfill the algorithm behind MIC are set to maintain the token’s price between 0.99 USD to 1.01 USD, aimed to ensure long-term predictability and reliability.

The Mithril Cash protocol has three tokens:

Mithril Cash (MIC) – the stablecoin token in the system with a target value of $1. Currently, circulating supply is almost 29 million.

Mithril Share (MIS) – an ownership token which receives inflationary rewards since Mis tokens are held by those who stake their assets to the protocol. Total MIS supply is 1 million.

Mithril Bond (MIB) – these bonds hold a value of one MIC each and are redeemable for one MIC as well once it goes beyond $1. Both MIC and MIB are designed to move in price and guide MIC towards its target value.

As the need for strong stablecoin options continues to grow, Mithril Cash provides a promising model for a reliable token.

Dynamic Set Dollar is a new algorithmic stablecoin and a fork of ESD. The protocol offers two main features – a price reactive, ERC-20 algorithmic stablecoin aimed to maintain a stable value, and financial opportunities for speculators as $DSD fluctuates between its expansion and contraction phases. DSD offers important improvements to the ESD’s protocol, including the addition of a coupon redemption penalty to reduce the impact of bots, and a shortened epoch of 2 hours, making it more reactive to price fluctuations. With DSD, bots still redeem but reduce the impact of

Greater Impact of Stablecoins

The emergence of stablecoins to facilitate transactions and transfer value combines the efficiency, security, and speed of digital currencies with the stability of fiat currencies. Billions of dollars’ worth of stablecoins currently trade globally, with demand continuing to grow.

Stablecoins represent a disruptor to the traditional payment and finance industries in an evolving economic and technological era where financial product and system offerings by big tech companies are substituting the services of conventional banks. For example, large-scale user adoption of Facebook’s Libra stablecoin project could reshape the digital payment landscape, and introduce new risks for the global financial system, circulation of sovereign fiat currencies, and challenges for monetary policy.

Evolving U.S. regulation, such as recent OCC approval of stablecoin usage for banks, highlights growing institutional demand for use of stablecoins for banking and authorized payment activities. In a global economy where approximately 70% of the additional value generated over the next decade is expected to come from digital platforms, stablecoins offer a new secure, price stable payment system well suited for dynamic financial markets.

- Paul V

DIGESTS

Building in defi sucks (part 2)

Development takes time, much longer than even you, as a developer, think it will.

NEWS

What Publicly Traded Companies Have Bitcoin On Their Balance Sheet — And Why

One of the reasons for for the surge in bitcoin’s price is institutional support.

Intercontinental Exchange’s Cryptocurrency Venture to Go Public Through a SPAC

Intercontinental Exchange Inc., or ICE, will take its cryptocurrency venture public by merging it with a special-purpose acquisition company, a deal that will further its goal of launching a consumer app for trading and making payments with digital assets.

REGULATIONS

Gensler Said to Be Named SEC Chairman: Reuters

The former CFTC chairman has testified before Congress about cryptocurrency and blockchain on multiple occasions.

Anchorage Becomes First OCC-Approved National Crypto Bank

The crypto industry has its first federally chartered bank: Anchorage.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

NYDIG acquires Digital Assets Data as crypto M&A looks poised to pick up

Bitcoin custody and trading services provider NYDIG announced Monday that it has acquired crypto data firm Digital Assets Data ahead of a bigger push to expand its platform.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.