BitClout: Decentralized Social Network

VeradiVerdict - Issue #132

Sequoia, Andreesen Horowitz, Social Capital, Coinbase Ventures, Pantera Capital, and Reddit co-founder Alexis Ohanian recently invested into BitClout, a decentralized social network, that has provided the most compelling attempt so far at a social network that empowers creators but the project has also brought quite a bit of controversy.

What is BitClout?

BitClout is a new decentralized social network that enables users to speculate on the clout and reputation of online personalities using cryptocurrency, and it’s built from the ground up as its own custom blockchain. Its architecture is similar to Bitcoin, only it can support complex social network data like posts, profiles, follows, speculation features, and much more at significantly higher throughput and scale.

The platform itself mimics the structure and feel of Twitter but integrates an exchange currency (the CLOUT token) and a user-specific currency (called creator coins) to power reputation-based speculation.

When joining the platform, users can buy CLOUT tokens with Bitcoin. The price of CLOUT doubles for every million CLOUT sold, keeping the token naturally scarce.

Users can then use CLOUT to buy and sell creator coins which are essentially a token that represents the representation of an online profile. Buying creator coins drives their price up, and selling them drives their price down, meaning users can use creator coins as a financial vehicle to speculate on a profile’s public perception.

Beyond pure speculation, BitClout also plans to build more features natively into the creator coins to power better influencer-follower engagement through premium content, sponsored posts, the ability to bid for retweets, etc.

Prior to launch, BitClout pre-loaded the top 15000 influencers from Twitter onto the platform, meaning that users could buy and sell their creator coins even the influencer had not joined BitClout themselves. To date, nearly $190 million has been locked up through purchases of creator coins, demonstrating the public demand for speculation.

Despite the removed focus on ad revenue, several critics of the platform fear that monetizing individuals’ online likeness may compromise their personality and honesty, since they are incentivized to engage with fans in a way that stimulates buyer demand. Many have also taken issue with how the platform did not request permission for the 15000 profiles it pre-loaded and how there is no current mechanism for users to exchange CLOUT back to BTC, somewhat reminiscent of Ponzi schemes from the 2017 ICO bubble.

With all of its praise and criticism, BitClout has become one of the most prominent crypto projects of recent months and has inspired much reckoning about the role that crypto can play beyond pure DeFi. BitClout presents an exciting model for what monetized social interactions could look like at scale, on a platform with the flexibility and mass appeal of Twitter.

The Inspiration for BitClout

BitClout was designed to address several issues the team saw with social media today:

There has been relatively little innovation with regard to how creators monetize. Most creators earn much less than they should on existing platforms, if they earn anything at all.

A handful of companies effectively control public discourse. Their decisions on what we see and don't see are driven predominantly by what maximizes ad revenue, rather than something more aligned with public good.

The dominant companies have cut off third-party developers. The incumbents have moved all development of new products and features completely in-house, which has significantly stifled product innovation and competition.

The inspiration for BitClout hinges on one key insight: If you can properly mix monetary speculation with social media, you not only end up with a novel product that creates innovative ways for creators to monetize, but you also end up with a totally new business model that solves a lot of the problems with social media today.

To achieve this, BitClout takes inspiration from Bitcoin and Ethereum. These platforms took an ecosystem that was fundamentally closed, namely the traditional financial system, and showed that creating a more open alternative that anyone can build on top of could significantly increase competition and innovation. Bitcoin and Ethereum don't have data moats to protect. In fact, the more open they are and the more people that build on top of them, the more value accrues to Bitcoin and Ethereum holders. These projects showed, for the first time, that dominant platforms could be built around a community with open data rather than a company benefiting shareholders at the expense of everyone else. The team thought: What if the same model that is decentralizing the financial system could be applied to decentralize social media?

The Long-Term Potential of BitClout

Today, a post submitted to Facebook or Twitter belongs to these corporations, rather than the creator who posted it. And the monetization goes predominantly to these corporations as a result.

In contrast, BitClout stores all of its data on a public blockchain, which means that anyone in the world can run a "node" that exposes their own curated feed. Today, bitclout.com operates one such node and its feed highlights crypto content. But there is no reason why other "verticalized" players can't enter the market to create feeds that they're uniquely suited toward curating. For example, imagine if ESPN ran a node that curated a feed of the best sports content. Or if Politico ran a node that curated a feed of the best political content. Additionally, since BitClout will be fully open-source, these players could even customize their UI and build custom algorithms to rank the influencers and posts in a way that serves their specific target customer. This could quickly move us from a world in which a handful of juggernauts control the dominant feeds to one in which consumers will have thousands of feeds to choose from, each with their own specific focus.

In addition, storing all of the data on a public blockchain makes it so that, with one engineer, anyone can build a social media experience that's competitive with the existing incumbents. It becomes possible for existing publishers to trivially spin up social apps and experiences as direct adjacencies to their core business, and allows upstarts to innovate on a relatively even footing with megacorps for the first time. Compare this to today where building a competitive social app generally requires building a billion-user data moat first.

Moreover, anyone who runs a node to curate their own feed also contributes data back to the public pool of profiles, posts, follows, etc... that's stored on the public blockchain. A post or a like on ESPN's node can be surfaced on Politico's feed. A post made in China can be surfaced on a feed running on a node in America and vice versa. And with every node that runs, more content gets contributed back to the global data pool stored on the blockchain, making every other node on the network more powerful and more engaging to users. In some sense, BitClout can solve a collective action problem among smaller publishers: Instead of being forced to contribute to a privately-owned data pool controlled by a single company who's not aligned with them, smaller publishers can now contribute to a public data pool that nobody controls and that they'll never be dis-intermediated from. Thus we can move from a world in which data is a heavily-guarded, privately-owned resource to one in which it is more like a globally-accessible utility that anyone can build on. All without the need for any government intervention.

All of the above can give the creators unprecedented reach, and a more direct relationship with their followers than has been afforded to them with existing platforms. But reach is only one side of the coin-- the other side is monetization.

Creator coins are already changing the game in terms of how creators monetize on the internet, but the team tells us that they're only the beginning. Because BitClout is money-native and open-source, anyone in the world can start to experiment with new ways for creators to monetize. For example, imagine a major creator wants to start offering premium content in exchange for a monthly subscription. All it takes is for one person on the internet to build this feature, and the entire BitClout user-base gets access to it instantly. The same goes for other features like an inbox where creators can be paid to Reclout posts, or paid to answer messages from their followers. And this goes for other things like detecting harmful content or weeding out spam, where the best machine learning researchers in the world can build solutions, with access to the full firehose of data, without asking for permission, no matter where they are. Fundamentally, BitClout is a protocol that the entire world can build on collaboratively, which we believe could ultimately create even more ways to unlock creators' true potential, and bring competition and innovation back to social media.

Moreover, because BitClout is money-native, new signals emerge that can be used to rank content more effectively. For example, the first experiment the BitClout devs launched was ranking comments by the coin price of the commenter. Amazingly, this extremely simple ranking mechanism has already produced results that appear to be competitive with centralized platforms. The devs believe that ranking messages by coin price will help significantly reduce spam for influencers as well in a way that's truly unique to BitClout, and this is still just the beginning. Imagine what else will be built off of the "Clout Signal" once the entire world starts contributing to BitClout.

How BitClout Works

BitClout tokenizes high-profile Twitter personalities and allows users to speculate on them, effectively monetizing reputation and clout.

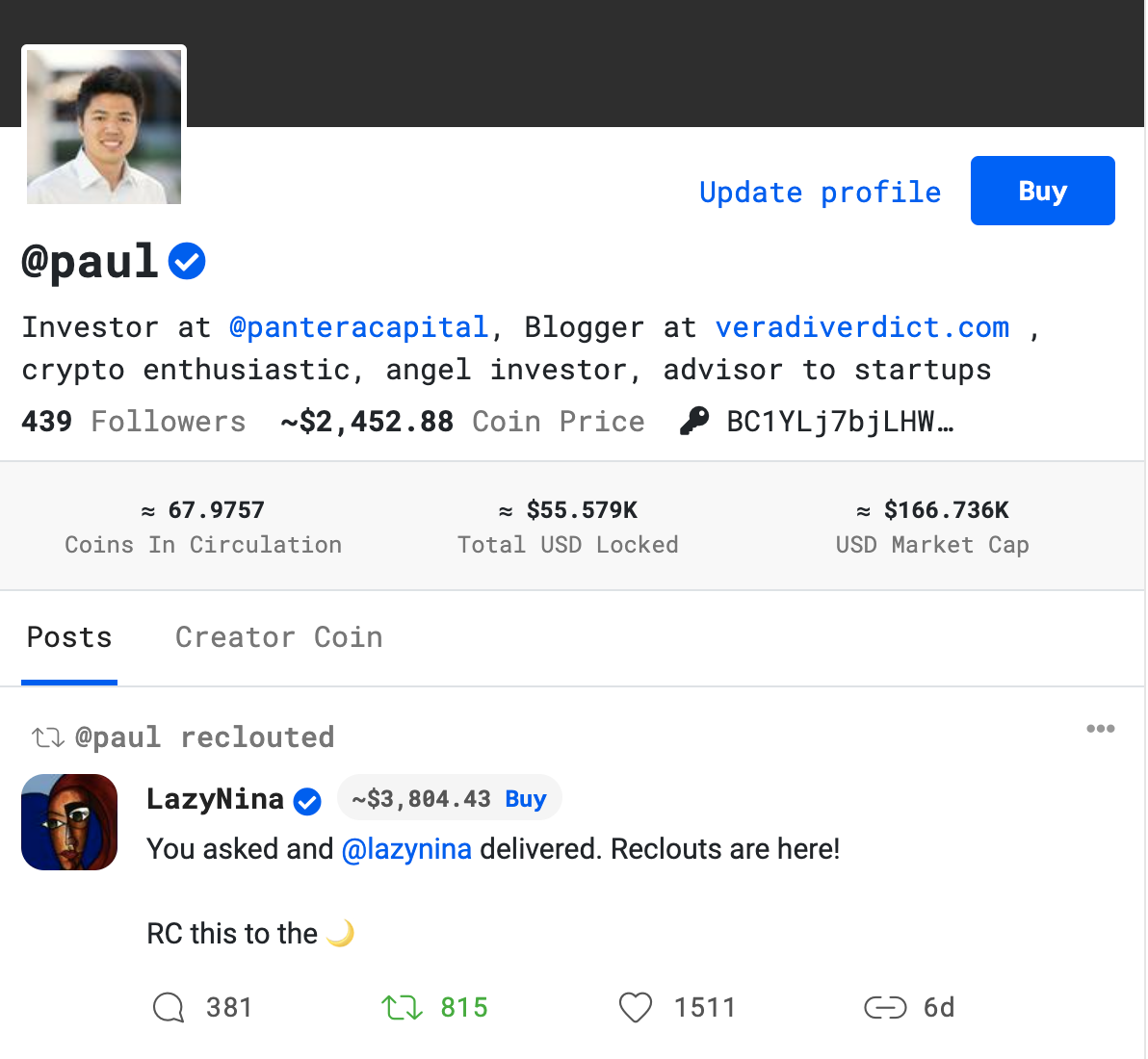

Fig 1. A Sample BitClout Profile (source)

The platform itself emulates the social experience of Twitter, with feeds driven by short posts (called clouts instead of tweets) that can be liked, replied to, and shared (or reclouted).

The crux of the network is the BitClout token (CLOUT), which users can purchase in the app using Bitcoin. For each million CLOUT sold, the price of CLOUT doubles, making the token naturally scarce and capping the supply between 10 and 19 million tokens altogether. In addition to the CLOUT tokens, each profile has their own unique token, called a “creator coin.” These assets essentially monetize a profile’s “social clout”; users can buy or sell any profile’s creator coins, and the price of a creator coin goes up as more users buy it and down as more users sell it. The system creates (or mints) creator coins when they are purchased by users and destroys them by buying them back from the user (using the value locked up from sales) when the user intends to sell. Profiles can also set a “founder reward” rate, which allows them to profiles to earn a share of the creator coins that the public purchases from them, aligning their incentives with their buyers.

Fig 2. The Creator Coin Supply Curve (source)

Currently, creator coins offer a mechanism for users to financially speculate on the social reputation of various online personalities; for instance, a user who predicts that Elon Musk will land someone on Mars might buy Musk’s creator coin, expecting buyers’ demand to surge in the future. In the future, the platform plans to build many more features natively into the creator coin, including exclusive access to replies/interaction with profiles, premium content, sponsored posts, bidding for visibility, and much more.

As of launch, BitClout has scraped the top 15,000 influencers from Twitter and has pre-loaded their information onto the platform, so users can already buy and sell their creator coins, even if the influencer themselves has not joined BitClout yet. These users can join the platform and claim their profile by tweeting out their BitClout public key, at which point they can also earn founder rewards. Nearly $190 million has been locked in creator coins, with the top three profiles at time of writing being @elonmusk ($66964), @naval ($46067), and @chamath ($32040).

The Likes

Many are optimistic about BitClout’s ability to remain incentive-aligned with its users and reinvent the business model behind social media, an industry that has caught much criticism for its relentless focus on ad revenue and data farming. By eliminating the reliance on ad revenue and structuring the financial model around social interactions themselves, BitClout presents a much more natural way to monetize social media, that optimizes for both community engagement and financial output.

BitClout also presents several promising new ways in which influencers can better engage with their followers by leveraging their creator coins. Pay-walled content, like Patreon, Substack, etc., is no stranger to social media, but BitClout offers a native way for influencers to cater to both non-paying fans and paying fans all on the same platform. Creators can offer exclusive access to content, can allow followers to bid for retweets (to promote merchandise and other items), and more, all using their creator coins and CLOUT tokens.

From a social perspective, BitClout also offers an interesting solution for objectively measuring an influencer’s social reputation, literally by the price of their creator coin (which is influenced by how many everyday users are buying and selling). Previous measures of social reputation were overwhelmingly qualitative, and often rely on sparse and biased data, like specific vocal pockets of the Internet. BitClout captures sentiment data via buys and sells and standardizes it across all profiles, giving a more unbiased quantitative estimate of the public’s perception of an influencer.

Arguably most interesting, however, is the idea of fully decentralized social media. BitClout is implemented on its own proof-of-work blockchain, built from the ground up. Anyone running a BitClout node can leverage the full set of data on the network to build apps and can natively integrate CLOUT and creator coins into their user experiences. This creates potential for a future of social networks, all of whom operate on the same set of “clout” data, but vary in terms of user experience, features, business model, etc. in contrast to the siloed experience across Instagram, Twitter, LinkedIn, etc. today.

The Dislikes

Many fear that monetizing an individuals’ likeness could warp the social dynamics behind social media, where social interactions are now explicitly designed for financial gain as opposed to genuine connection. For example, influencers may be less likely to express unpopular opinions or act against the grain, in fear that their actions may negatively affect the value of their creator coins. In some sense, this model incentives users to moderate their behavior online which can partially correct for issues like harassment, inappropriate comments, etc. However, by monetizing social reputation, the platform places a greater incentive on influencers to create financial value with their online presence, a pressure that many feel might compromise some of the raw and unfiltered aspects of social media.

Several critics have also raised issue with how BitClout pre-loaded 15000 influencers onto the platform without explicitly asking for their permission first, meaning that everyday people could speculate on an individual’s social reputation (by buying and selling their creator coin) without the individual even knowing. Many have sent cease-and-desist letters to BitClout to have their profiles and information removed, to which BitClout has complied. The platform has also reported that they plan to have a fleshed-out process for requesting that someone’s profile be removed.

The BitClout platform also does not currently support any mechanism to exchange CLOUT tokens back for Bitcoin, or any other kind of financial asset, meaning that users are effectively burning Bitcoin when they purchase CLOUT. Many fear that the lack of robust on- and off-ramps are reminiscent of Ponzi schemes from the 2017 ICO bubble, like BitConnect.

Who is the team behind this?

Very little is known about the team behind BitClout, who have chosen to stay anonymous in their goal of building out a truly unbiased social media network. The team’s leader goes by the pseudonym “@diamondhands” in interviews and press releases. Nonetheless, the team has raised significant capital from major backers; BitClout has nearly $170 million in a Bitcoin wallet, from sources like Sequoia, Andreesen Horowitz, Social Capital, Coinbase Ventures, Pantera Capital, and Reddit co-founder Alexis Ohanian.

How to get involved

Getting set up on the platform as an everyday user is fairly straight forward. Users can set up an anonymous account with a secret phase and can connect a Bitcoin wallet to purchase CLOUT tokens from the platform. Creator coins can be bought and sold directly from the creator profiles.

Each profile has its own creator coin, which is available as soon as the profile is created. Users can complete their profile by adding a username, avatar, and bio and setting a percentage for the founder rewards. Other users can then buy and sell the user’s creator coins from their profile directly, and founder rewards will be sent to the user who created the profile.

Fig 3. Setting up a creator’s BitClout profile

Final thoughts

BitClout has become one of the most prominent and controversial projects that the crypto (and broader tech) community has seen in recent months. The platform offers a radically new model for how social networks can be financially rooted in social interactions themselves, not ad revenue, and provides interesting primitives for how influencers can better engage with their followers by using tokens and quantified “clout.” The high levels of purchase activity on the platform, with nearly $200 million locked up in creator coins, also speak to the interest from the point of view of everyday users that want to speculate on online personas’ clout and reputation.

Nonetheless, BitClout has earned significant criticism for some of its more questionable choices, like allowing users to buy and sell creator coins for profiles that haven’t even been claimed yet and limiting users’ ability to off-ramp back into Bitcoin. Despite its criticisms, it has become clear that users are generally getting more frustrated with existing models of online engagement and are seeking alternatives. And BitClout provides a fascinating model for how crypto-economic incentives might be incorporated into more general, widely used platforms, like Instagram and Twitter, potentially changing the landscape of social media for the masses.

- Paul V

SPECIAL: COINBASE IPO

The Coinbase IPO is a monumental milestone in the cryptocurrency industry, empowering more mainstream exposure, the next generation of entrepreneurs, and capital to push forward the ecosystem.

Pantera is a proud shareholder of Coinbase.

DIGESTS

Coinbase IPO: Everything you need to know about the ‘watershed moment’ in crypto

Coinbase, whose users primarily deal in bitcoin and ethereum, reported last week that its revenue soared 847% in the first quarter to $1.8 billion, and that it now has 56 million verified users.

Announcing Iron Fish - Privacy for Everyone

Today, Iron Fish enters its first public testnet phase—anyone (yes, you too!) can now run and mine a full Iron Fish node.

NEWS

Topps baseball card maker and MLB will issue official NFTs

A set of Topps Series 1 Baseball nonfungible token collectibles will be issued by the major card maker in partnership with Major League Baseball and MLB Players Inc.

1inch (1INCH), Enjin Coin (ENJ), NKN (NKN) and Origin Token (OGN) are launching on Coinbase Pro

Starting Today Wednesday April 7, transfer 1INCH, ENJ, NKN, OGN into your Coinbase Pro account ahead of trading.

REGULATIONS

SEC’s Peirce Updates Safe Harbor Proposal for Token Sales

The updated proposal adds a number of new reporting requirements for startups.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Social Token Platform Rally Raises $22M in RLY Sale on CoinList

The “Creator Coin” startup saw more than 40,000 investors participate in its CoinList distribution, a record for the token-sale platform.

Fidelity, Square, Coinbase Launch Bitcoin Trade Group

Council will lobby policy makers, serve as industry’s voice in championing digital currencies

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Hey Paul, have you heard of Subsocial? It's a decentralized and censorship resistant social media platform that can be set up/customized to act like Twitter as well, but it could also be set up to mirror any existing social media site or something entirely new. The team is also going to add built in decentralized monetization features. Here's an article that summarizes the platform and the link to the main site.

https://subsocial.network/

https://app.subsocial.network/4779/the-death-of-traditional-social-media-is-nigh-19060