Introduction

We live in a multichain world; from L2s to appchains to non-EVM ecosystems, it is clear that there does not exist a one-size-fits-all public blockchain for all use cases. Yet, interoperability has been a notoriously difficult problem to solve, due to the great diversity of codebases, frameworks, and design choices that various ecosystems have made. Without a unified interoperability protocol, many blockchains and applications need to build in-house implementations of cross-chain interactions that are expensive, error-prone, and highly unscalable [1].

Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which launched on mainnet at EthCC in July 2023, is one of the boldest attempts at solving this problem of interoperability. Through leveraging its unique position in the blockchain ecosystem as the market-leading Web3 services platform, Chainlink seeks to build the “industry standard” protocol for interoperability between a diverse set of ecosystems. Within this article, we will explore the conceptual design of CCIP, its architecture including the novel Risk Management Network, and the use cases unlocked by this groundbreaking new idea.

Conceptual Design

Historically, most cross-chain interactions have been moderated through blockchain bridges, which have traditionally been centralized and unscalable, introducing counterparty risk that has led to some of the largest cryptocurrency hacks by volume [2]. On a high level, CCIP seeks to solve this “centralized bridge problem” by leveraging Chainlink’s decentralized oracle networks (DONs), which have already gained industry recognition and adoption for Price Feeds and other off-chain data.

CCIP primarily supports three main capabilities [2]:

Arbitrary Messaging between smart contracts on different blockchains – eg. A “buy NFT” function on Polygon triggers the minting of the NFT on the Ethereum mainnet.

Token Transfers, such as transferring an ERC-20 token from a smart contract on Avalanche to a user’s wallet on Arbitrum.

Programmable Token Transfers, which are a mixture of both of the above – you’re sending both byte data parameters (eg. transaction price) and a token cross-chain.

Through this cross-chain transfer of tokens and arbitrary byte data, one of the main problems that CCIP seeks to solve is the fragmentation of liquidity across different chains and ecosystems. This is especially an important issue for DApps such as Uniswap, which is deployed on 10+ chains [3]. Currently, even if all the chains are EVM-compatible, and the same smart contract can be deployed on multiple chains with minimal changes, the inefficiency of a cross-chain framework creates “liquidity islands” on each of the different chains. Rarer token pairs on Uniswap, for example, may only have sufficient liquidity on Ethereum mainnet, and if someone is trying to trade these pairs on Arbitrum Uniswap where there is little to no liquidity, they would be forced to migrate to Ethereum mainnet and pay for higher transaction fees.

Thus, CCIP may potentially usher in a new generation of cross-chain DApps that can leverage both the liquidity advantages of certain networks (such as Ethereum mainnet) and the throughput advantages of scaling solutions such as Arbitrum. This not only leads to greater capital efficiency of these DeFi platforms, but more importantly, a much cheaper, easier, and smoother experience for both developers and users, allowing them to abstract away the complexities of cross-chain interactions.

Components and Architecture

Overview

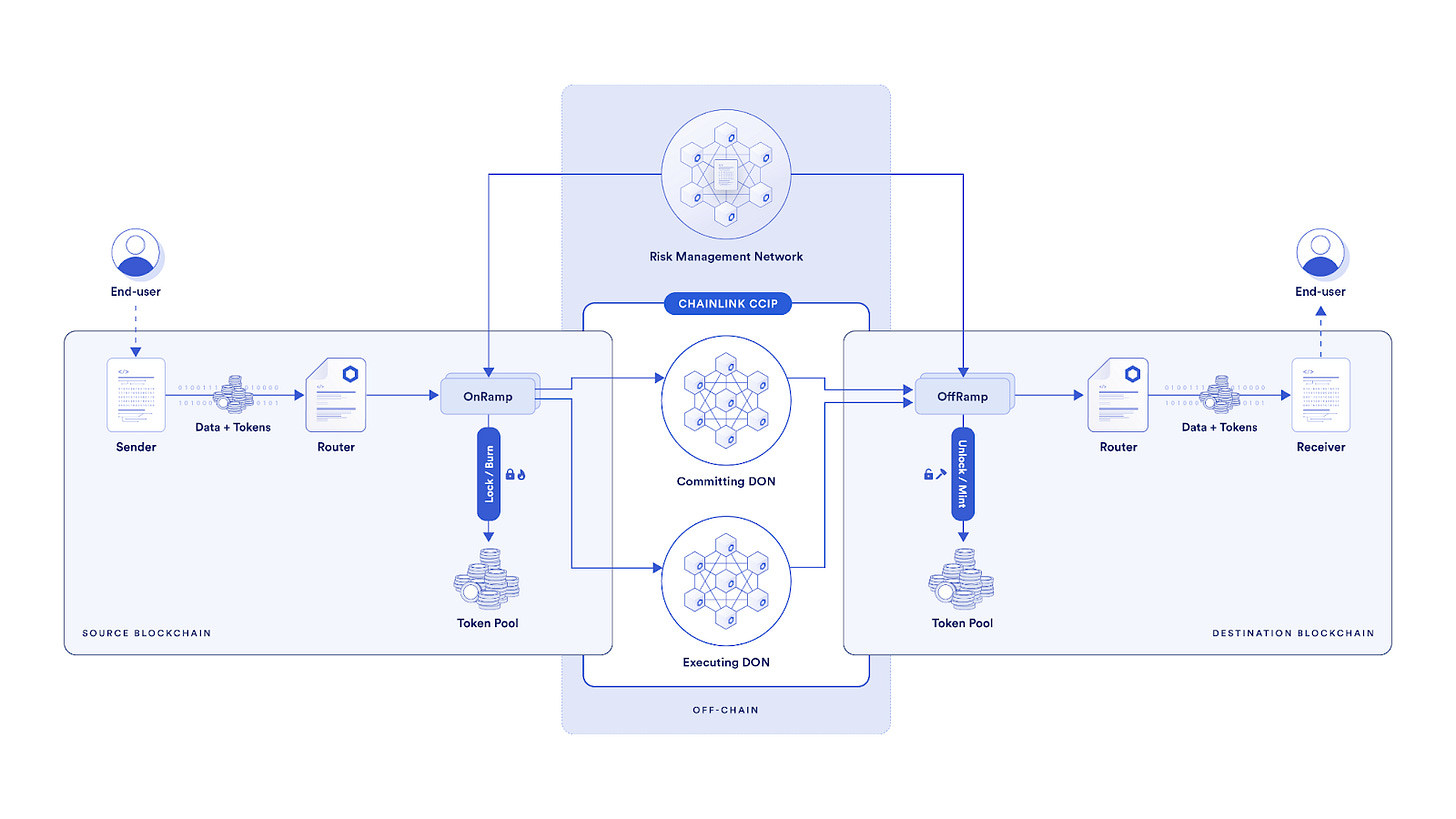

Although CCIP may sound relatively simple in concept, designing and guaranteeing the security of the system is anything but simple, as it requires a wide range of on-chain and off-chain verification mechanisms. A simple way to think of the overall architecture of CCIP is that it is an international airport hub where you are catching a “connecting flight” to your destination. Within this section, we will use this analogy to introduce the three most important parts of Chainlink CCIP’s security architecture: the Committing DON (a departure terminal), the Risk Management Network (airport security and air traffic control), and the Executing DON (the flight and arrival customs) [4].

Committing DON

The first part of the network is the Committing DON. This DON continuously monitors the input data from the “on-ramp” contract (which contains transaction information) on the source chain, the same way that a departuresterminal serves as a hub for outbound flights to different destinations. For each “outbound flight,” the Committing DON needs to make sure that there is finality on the original source chain (eg. Ethereum mainnet) before it gathers and bundles the transactions together ready to be sent to the destination blockchain. This DON essentially signs the Merkle root of the bundle, before writing this data to a “Commit Store” contract, or a “check-in process” on the destination blockchain (eg. Arbitrum).

Executing DON

The Executing DON is a separate decentralized oracle network that acts as the “flight and arrival customs”. Once a commitment to the bundled transactions is stored on the destination chain by the Committing DON and it has been “blessed” by the Risk Management Network (see below), the Executing DON will create cryptographic proof (Merkle proof) that the transactions it wants to submit on-chain for execution are included in the commitment (Merkle root) stored in the “commit store”. The “off-ramp” contract verifies this Merkle proof against the blessed Merkle root in the “commit store” before executing each transaction on the destination blockchain.

Risk Management Network

The core advantage of separating the “committing” and “executing” DONs is that we can introduce an extra piece of security in the middle, the Risk Management Network, which can stop transactions mid-way if there is found to be an anomaly. This is almost like the “airport security team” after check-in and up until departure, able to stop you before boarding the flight.

Chainlink CCIP’s Risk Management Network involves a separate set of independent nodes that monitors the Merkle roots written into the “commit store” by the Committing DON. The Risk Management Network was even developed by a different team and in a different programming language (Rust) and maximally avoids external dependencies (e.g. does not use OCR-based P2P networking) in order to minimize any possible chance for shared vulnerabilities between the Risk Management Network and the primary CCIP system.

For each record that is written into the commit store, the Risk Management Network will independently reconstruct the Merkle root from the transaction information in the “on-ramp” contract. If there is a match, Risk Management nodes will “bless” the committed Merkle root. Once a committed Merkle root has enough “blessings” from different risk management nodes, it is ready for the Executing DON. On the contrary, if there is a mismatch between the committed Merkle root and the information constructed by the Risk Management Network, then Risk Management nodes will not bless the message and it will not be executed. Additionally, Risk Management node can trigger an alarm and “curse” the transaction. If the Risk Management Network receives a certain number of curses from its operator nodes, it will pause all CCIP transactions, essentially instituting a “security lockdown” of the passenger at the departures airport for further investigation.

Thus, it is through this three-layered design that Chainlink CCIP seeks to guarantee the security of its cross-chain transactions and decentralize the roles and responsibilities amongst different groups of oracles. The Risk Management Network is unique to CCIP and no other cross-chain solution offers the same decentralization and security guarantees, given its novel architecture.

Use Cases and Adoption

As mentioned previously, Chainlink’s position as the standard-bearer for oracle services puts it in a prime position to lead the cross-chain interoperability space. Thus far, Chainlink CCIP is in the “Mainnet Early Access” stage, initially supporting 5 ecosystems: Ethereum, Optimism, Avalanche, Arbitrum, and Polygon [5]. More chains will also be supported in the near future.

Some of the earliest adopters of Chainlink CCIP include leading DeFi protocols Aave and Synthetix [6]. Aave, for example, is using CCIP to realize cross-chain governance so users can vote on other chains, while still using Ethereum as a hub for the aggregation and management of governance activities. Synthetix, on the other hand, uses CCIP to enable sUSD liquidity to be transferred cross-chain through a unique burn-and-mint model, where the source chain burns sUSD, and the destination mints the equivalent sUSD [7].

Although many of the early use cases of Chainlink CCIP are in DeFi, such as in cross-chain lending, lowering gas fees (through conducting transactions on a cheaper network instead of Ethereum mainnet), and optimizing cross-chain yield, CCIP’s long-term vision is far beyond just ordinary DeFi, but also to act as a bridge between traditional financial institutions and DeFi projects by connecting bank chain value to public chain value. For example, Swift, the leading network used by financial institutions to instruct international money transfers and financial transactions, announced a collaboration with Chainlink and more than a dozen financial institutions and market infrastructure providers—including the DTCC, Euroclear, BNY Mellon, and more—to test how firms can leverage their existing Swift infrastructure and CCIP to instruct the transfer of tokenized assets over a range of public and private blockchain networks [8].

Watch Chainlink Co-founder Sergey Nazarov explain the flow of value from bank chains to public chains via CCIP:

And the potential use cases for CCIP don’t just stop with banks. Up until now, although many enterprises, including Walmart [9], operate permissioned enterprise-grade chains, there has been a lack of integration and interoperability with the broader crypto ecosystem due to both the lack of bridging technology available and general skepticism about the industry. This could potentially catalyze a new wave of enterprise and institutional onboarding to leverage web3 applications and use cases.

Conclusion

Chainlink's Cross-Chain Interoperability Protocol (CCIP) represents a major breakthrough in connecting the fragmented liquidity and capabilities across different blockchains and ecosystems. By leveraging Chainlink's industry-leading decentralized oracle networks for secure message passing and token transfers, CCIP provides a robust foundation for building a new generation of cross-chain dApps.

The introduction of CCIP solidifies Chainlink’s position as a feature-complete Web3 services platform, offering developers all the tools they require to build advanced smart contract applications, from obtaining secure access to external data (e.g. Data Feeds) and performing off-chain computation (e.g. Automation) to now secure cross-chain messaging and token transfers. The addition of CCIP to the Chainlink Network, makes it the only platform where developers can get all the data, compute and cross-chain connectivity/value transfer, all in one place, which is a key hallmark of winning developer platforms.

Already, major DeFi protocols like Aave and Synthetix are using CCIP to optimize liquidity and improve user experience. Still, CCIP's potential stretches far beyond just DeFi - bridging enterprises, financial institutions, and permissioned blockchains to public chains, Chainlink can massively expand the use cases and real-world adoption of blockchain technology.

References

[1] https://docs.chain.link/ccip

[2] https://docs.chain.link/resources/bridge-risks

[3] https://axelar.network/blog/cross-chain-bridges-benefits-limitations-risks

[4] https://docs.chain.link/ccip/architecture#onramp

[5] https://docs.chain.link/ccip/supported-networks/

[6] https://chainlinktoday.com/chainlink-ccip-live-on-mainnet-early-adopters-include-aave-and-synthetix/

[7] https://blog.chain.link/ccip-mainnet-early-access/

[8] https://www.coindesk.com/tech/2023/06/06/swift-and-chainlink-will-test-connecting-over-a-dozen-financial-institutions-to-blockchain-networks/

[9] https://tech.walmart.com/content/walmart-global-tech/en_us/news/articles/blockchain-in-the-food-supply-chain.html

- Paul Veradittakit

PANTERA TOKEN2049 EVENT

Join Pantera Capital and SynFutures for a spectacular evening of drinks, appetizers, and conversation during Token2049 in Singapore. Connect with the global Web3 community and mingle with industry leaders, entrepreneurs, investors and more!

Event link here

DIGESTS

Grayscale’s Legal Win Shakes Up SEC’s Stance on Bitcoin ETF Approval

Amid the aftermath of Grayscale’s legal victory, the crypto community now stands at a crossroads, considering the potential move of the SEC on approval of Bitcoin ETF.

A Guide to TradFi Blockchain Adoption

As financial institutions look to come on-chain, total value locked, or TVL, is anticipated to be the leading indicator of where adoption will occur.

BUSINESS

Polygon Releases 'Chain Development Kit' for ZK-Powered Networks on Ethereum

The new software toolkit will allow developers to build their own customizable chains, and connect to each other through a ZK-powered bridge to form a “Value Layer.”

Shopify Customers Can Now Pay In USDC Via Solana Pay

The payment protocol, built on the Solana blockchain, has been integrated into Shopify.

REGULATION

Sam Bankman-Fried’s Planned Defense ‘Irrelevant’ Without More Details, Govt Says

The FTX founder’s constitutional rights are being violated because he is ‘unable’ to prepare his defense from jail, his lawyers argued

Controversial Digital Euro Plan to Be Led by Architect of Landmark MiCA Crypto Law

Center-right lawmaker Stefan Berger, who previously negotiated the MiCA crypto law for the European Parliament, now heads up a CBDC proposal many colleagues are skeptical about.

NEW PRODUCTS AND HOT DEALS

Virtue Poker Relaunches With Focus on Connecting NFT Communities

The ConsenSys-incubated startup is now targeting NFT projects that want to offer token-gated, crypto-backed online poker to holders.

Binance launches crypto-to-bank account payment product in Latin America

Binance’s Send Cash product will facilitate crypto payments from nine countries to bank accounts based in Argentina and Colombia.

LETS MEET UP

Korea Blockchain Week, Seoul, September 6-8

TOKEN2049, Singapore, September 11-13

Mainnet 2023, New York City, September 18-22

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Thanks for reading VeradiVerdict! Subscribe for free to receive new posts and support my work.