Circle IPO: Feeding the Public Market’s Hunger for Crypto Exposure

VeradiVerdict - Issue #332

Summary

Circle’s IPO surged 168% on its first day, highlighting strong public demand for stablecoin and crypto exposure

Pantera Capital was an early investor, supporting Circle’s pivot from crypto brokerage to launching USDC

Pantera Capital believes CRCL will serve as a proxy for stablecoin exposure for the foreseeable future

USDC holds 24.2% of the stablecoin market and leads on Solana

USDC is favoured by institutions for its compliance

The stablecoin industry matures as B2B is the dominant type of stablecoin transaction

Circle’s Evolution

On the 4th of June, Circle went public at the New York Stock Exchange, and the stock appreciated in value by 168% in a single trading day. We believe CRCL’s strong performance sends a definitive message –public markets have been starving for stablecoin and crypto exposure.

However, the making of the internet financial system isn’t done overnight. Pantera Capital was an early investor in Circle back in 2014. We’ve supported the team through the many ups and downs of our industry.Let’s take a trip down memory lane and share Circle’s success story from Pantera Capital’s perspective.

Pantera Capital invested in Circle’s Series B round in March of 2014. Since Jeremy has a track record of founding startups such as Allaire Corporation that went public, the investment in Circle was driven by our trust in Jeremy’s ability to execute. Their first product was a beautifully designed brokerage for crypto. It was so well designed I actually got my first bitcoin on Circle.

During the ICO boom in 2018, Circle acquired Poloniex, a crypto exchange. But what caught our eyes is their new product – CENTRE. They believed crypto assets and blockchain technology will allow humans to exchange value and transact with one another instantly, globally, securely and at low cost. Bitcoin was the only known option for value transfer then. But it was too volatile; no one would buy coffee with a volatile currency. CENTRE’s vision was to provide technology to address price volatility and transaction scalability challenges of existing blockchain infrastructures such as bitcoin. CENTRE planned to create a network scheme to manage the creation, redemption and flow of price stable crypto assets under a new organisation independent and separate from Circle.

As huge believers of decentralization and the importance of a price stable alternative to bitcoin, Pantera Capital was the earliest and largest investor on CENTRE’s presale. Circle ultimately decided that a centralized version of CENTRE made more sense. USDC was born.

As big supporters of USDC, Pantera Capital invited Jeremy and the Circle team to speak at Pantera Summits, webinars and worked closely with Circle’s business development team. USDC’s early success cemented Jeremy’s resolve to bring tokenised dollars to the world. He abandoned the exchange part of the business to focus solely on USDC. Jeremy’s decision aligned with Pantera Capital thesis at the time: we believed stablecoins would be first used in DeFi as a stable unit of account. But it would eventually eat into the payments sector to become the dominant means of transfer. Pantera Capital helped build out the ecosystem by onboarding portfolio companies such as Bitso onto USDC. Since USDC is a platform business, Pantera Capital also fostered the Circle ecosystem by co-investing with Circle ventures.

Circle’s IPO is one of many Pantera success stories, and we are proud to have been a part of Circle’s journey to build the next generation of internet money.

USDC and the Stablecoin Market

How has the Stablecoin Market Changed over the Years

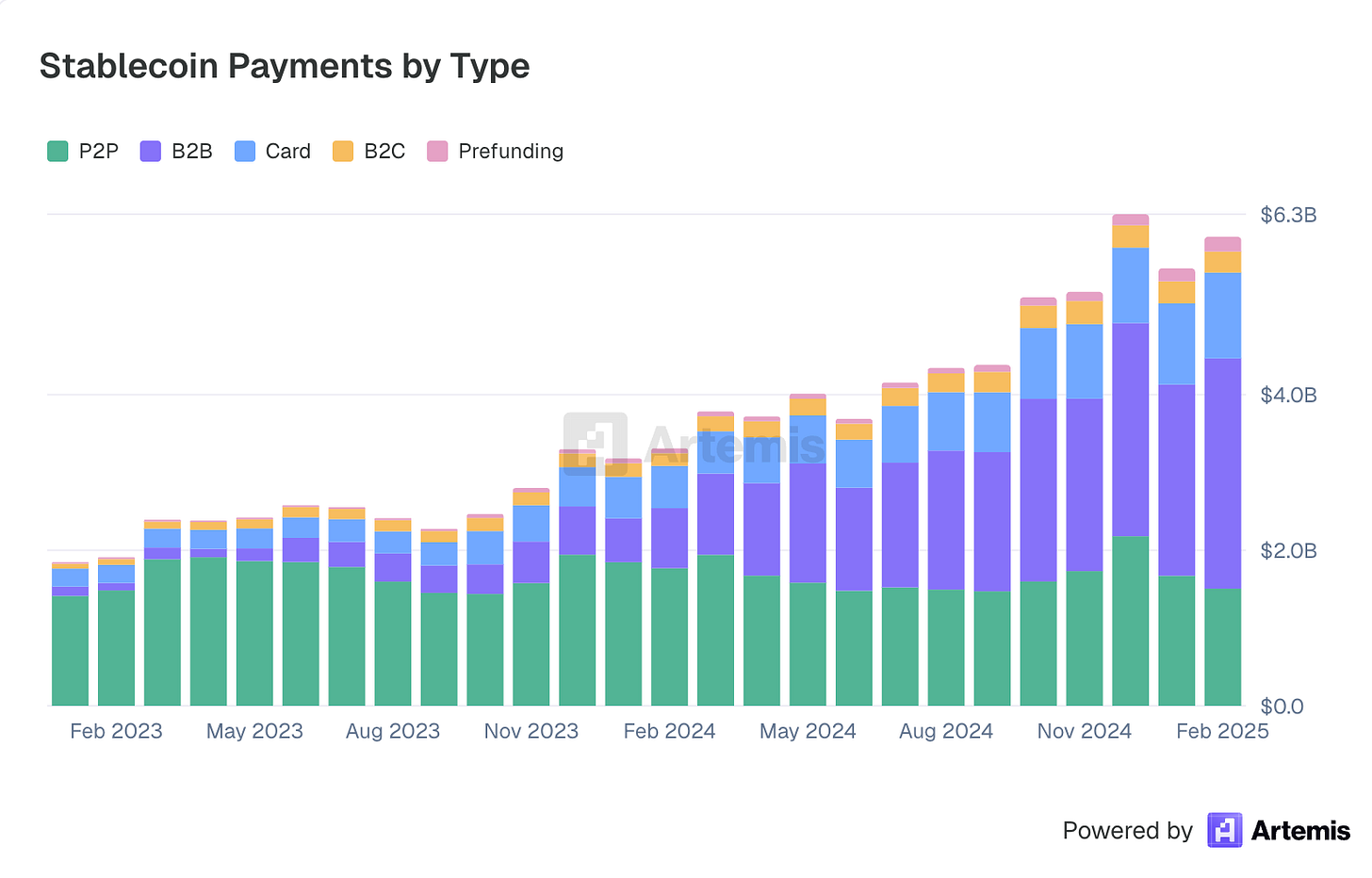

Source: Artemis

As we can see above, the volume of stablecoins has grown from 1.9B USD to 6.0B USD in the last two years. Out of all transaction types, B2B payments grew the most, from 119.7M USD to 3.0B USD. Global corporations such as Uber are considering the use of stablecoins to reduce currency costs. Pantera Capital believes this is a strong signal of industry profitability due to the following reasons:

B2B clients are more price inelastic than P2P clients

B2B clients transfer large amounts of capital around the world frequently

How is USDC Positioned in the Stablecoin Space

USDC is the world’s second-largest stablecoin, holding about 24.2% of the total stablecoin market, while Tether (USDT) leads with around 61.7%. On Solana, USDC is the dominant stablecoin, representing $9.7 billion of Solana’s $12.5 billion stablecoin market as of March 2025. USDC is widely considered the most trusted and regulatory-compliant stablecoin, making it the preferred choice for institutions seeking transparency and lower risk.

Tailwinds

Expanding Product Suite and Strategy

Circle’s growth strategy centers on expanding the Circle stablecoin network by building products that make Circle stablecoins (like USDC) widely accessible and easy to use across the globe. A key part of this strategy is forming partnerships with leading financial and technology companies worldwide. Anchor collaborations include Grab in Singapore, Mercado Libre in Latin America, Nubank in Brazil, SBI Holdings in Japan, Coins.ph for Filipino remittances, and Binance for treasury and platform promotion. Partnership agreements typically involve payments or rebates based on wallet usage and USDC transaction volumes on partner platforms, with terms ranging from one to four years.

CRCL is the only Public Exposure to the Stablecoin Industry

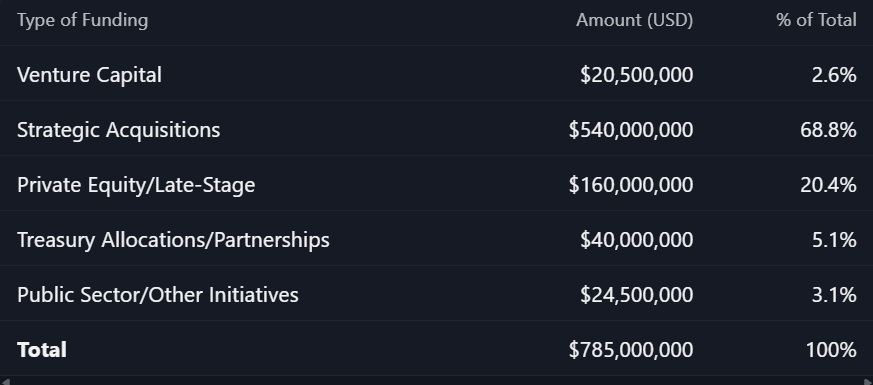

Source: Messari Copilot

Stablecoin has always been a sector of interest, but there was a big jump of funding from 10.7M to 785M USD in 2024. Since 160M of the funding was from late stage private equity funds, we can see there was significant appetite from institutional investors for stablecoin exposure. The 540M USD worth of M&A deals also signaled that the industry is mature and is beginning its concentration phase. But at this point, there are no options in the public market for stablecoin exposure. No retail trader or hedge fund can bet on the winner of this trillion dollar industry.

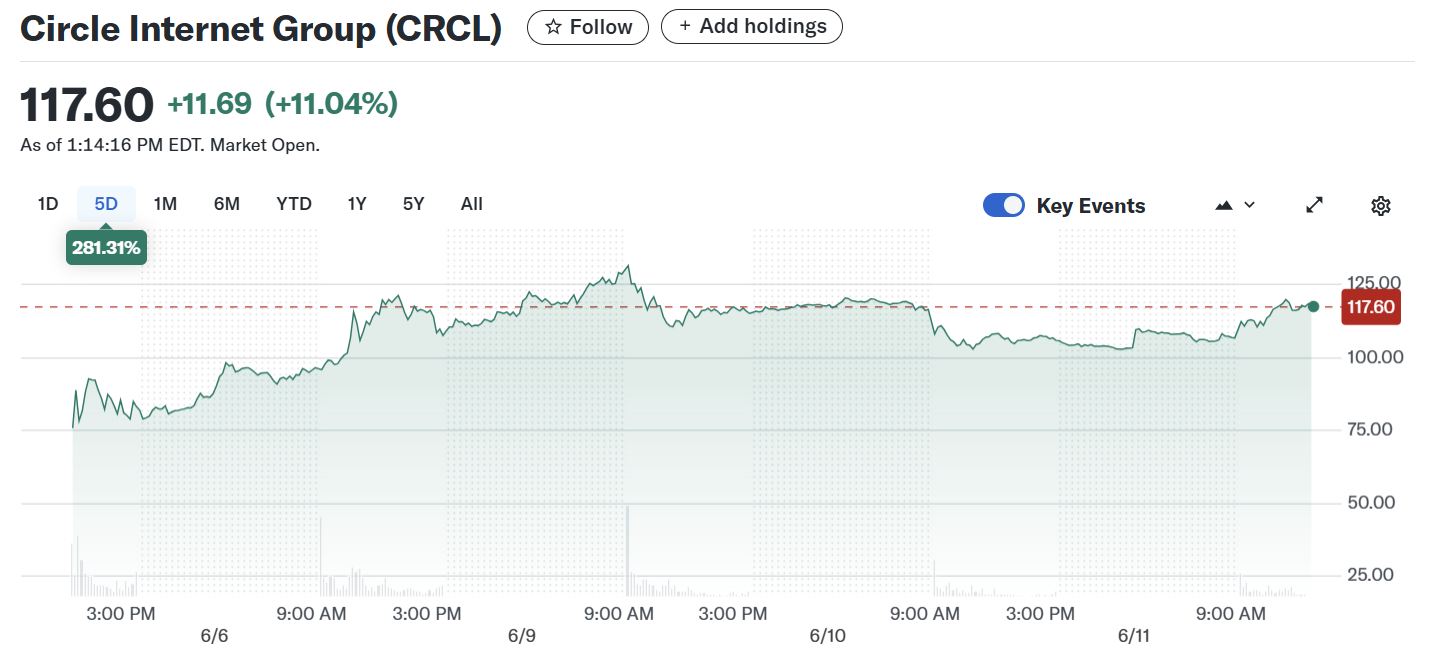

Source: Messari Copilot

Circle’s IPO is the first time a stablecoin issuer has gone public - giving public markets a piece of stablecoin's unprecedented growth. We strongly believe CRCL’s incredible one week performance of +281.31% indicates that there is huge demand in the public sector for stablecoin exposure. As of today, Circle is one of the only regulation compliant stablecoin corporations that is mature enough for public markets. Thus, Pantera Capital believes CRCL will serve as a proxy for stablecoin exposure for the foreseeable future.

GENIUS Act

CNBC interview with Jeremy, ““To achieve our vision, we needed to build connections with governments and engage with policymakers … because for this to be effective in mainstream society, it must be integrated into the existing framework. We have been among the most licensed, regulated, compliant, and transparent entities in the history of this industry, which has benefited us greatly.”

Circle’s compliance with the GENIUS Act will put it in front of competitors who need to adjust to the Act. Circle’s USDC and EURC are already fully backed by cash and short-term Treasuries, with regular attestations and audits. The GENIUS Act’s requirements enshrine these practices, giving Circle a regulatory “seal of approval” and boosting institutional and retail trust in its stablecoins versus competitors who must now catch up or exit the market.

Looking ahead

The joy of working in venture capital is supporting founders that change the world. Circle is changing how value is transferred and is strengthening the dollar as the global currency reserve. The next time you process an overseas transaction and it gets filled within the second, say thanks Circle!

- Paul Veradittakit

Business

Ripple & Solana Deals in UAE

Ripple's RLUSD stablecoin received regulatory approval in Dubai, and Solana signed an MOU with Dubai VARA to support crypto education and economic integration, reflecting UAE’s growing influence as a global crypto hub.

Regulation

House Advances Crypto Market Structure Bill ("Clarity Act")

The House Agriculture Committee approved the bipartisan Clarity Act, aiming to clarify digital asset regulation and assign the CFTC a leading role, as the Senate nears a final vote on the stablecoin-focused GENIUS Act.

Push for Developer Protection in US Legislation

Crypto advocacy groups are calling for the Blockchain Regulatory Certainty Act to be included in upcoming bills, to clarify that non-custodial platform developers aren’t money transmitters.

Singapore Enacts DTSP Licensing Regime

Beginning June 30, Singapore will require Digital Token Service Providers to hold a local license, with tough capital and compliance standards, in a sweeping effort to mature and consolidate the sector.

New Products and Hot Deals

Hedera Stablecoin Studio

Hedera released Stablecoin Studio, an open-source SDK suite to help developers easily issue and manage stablecoins with native compliance and proof-of-reserve functionalities on the Hedera network

Robinhood Completes its $200M Bitstamp Acquisition

Robinhood completed its $200 million acquisition of Bitstamp, marking its entry into institutional crypto and expanding its global client base across the EU, UK, and Asia.

Pumpfun's $1B Token Sale and Project Moves

Pumpfun revealed plans for a $1 billion token sale at a $40 billion valuation.

Jump Crypto Invests in Securitize

Jump Crypto made a strategic investment in Securitize to strengthen its foothold in on-chain asset tokenization and the emerging onchain capital market.

This week at Pantera

Pantera Reveals Its Bets on Stocks That Adopted ‘Digital Asset Treasury’ Strategy

We were featured on CoinDesk about our investments in publicly-traded companies holding large digital asset reserves, including Bitcoin, Solana, and Ethereum.

Bitcoin as an Institutional Asset with Dan Morehead

Pantera Capital’s Founder Dan Morehead spoke at BITCOIN 2025

Ondo Finance Debuts $693M Treasury Token on XRP Ledger

DeFi platform Ondo Finance added the XRP Ledger as a supported network for its onchain U.S. government debt product.

Chainlink, JPMorgan, Ondo Finance complete crosschain treasury settlement

Chainlink, JPMorgan’s Kinexys, and Ondo Finance completed a crosschain DvP settlement between a permissioned payment network and a public RWA blockchain.

Ondo Expands Tokenized Treasuries to XRP Ledger

Ondo Short-Term U.S. Government Treasuries, or OUSG, the onchain product will integrate Ripple’s U.S. dollar-backed stablecoin RLUSD for subscriptions and redemptions

Symbiotic Launches Tool to Connect Blockchains Using Staked Crypto

Symbiotic enables developers to use staked assets from one blockchain to validate decisions on others, supporting secure, decentralized cross-chain coordination and simplifying multichain infrastructure for dApps and protocols. Relay aims to reduce the need for custom code or centralized relayers.

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early-stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have any projects that need funding, feel free to DM me on twitter.