Coinbase of Africa

VeradiVerdict - Issue #194

VALR is a popular and performant crypto trading and investing platform for African markets. It currently offers the widest selection of crypto assets that can be bought with ZAR (Rand, the national currency of South Africa). Beyond crypto exchange, VALR’s app offers P2P payments, investing rewards, and rich trading data. Pantera is thrilled to have led VALR’s $50M Series B raise with Alameda Research, Cadenza, CMT Digital, Coinbase Ventures, Distributed Global, GSR, Third Prime, and Avon Ventures participating as the company enables crypto trading for South Africa and beyond.

The citizens of many nations around the globe still suffer from unstable and ineffective government policies that lead to significant inflation, devaluing of local currencies, and an inability of citizens to securely save and invest. Further, many countries also experience more endemic issues such as corruption, sudden regime change, supply chain problems, and a lack of free and fair democracies. Cryptocurrencies can provide significant advantages to citizens of these nations due to its trustlessness, decentralization and inability for bad actors to change rules at any time. Further, crypto can act as a stabler store of value and medium of exchange for individuals affected by these issues. As Timi Ajiboye points out, blockchain has profound use cases for African countries in particular, including “contract management, gaming, land registry, supply chain, and tracking.” Research by Chainalysis ranks Kenya, South Africa, and Nigeria in the top twenty countries for crypto use. In fact, Africans received $105.6B worth of cryptocurrency payments between July 2020 and June 2021. This is up 1200% from the year before, where value received was just $8B. The figure below illustrates South Africa’s high ranking in P2P exchange trade volume, proving the region’s strong market potential.

The top 20 countries in Chainalysis’ Global Crypto Adoption Index. Source: Chainalysis

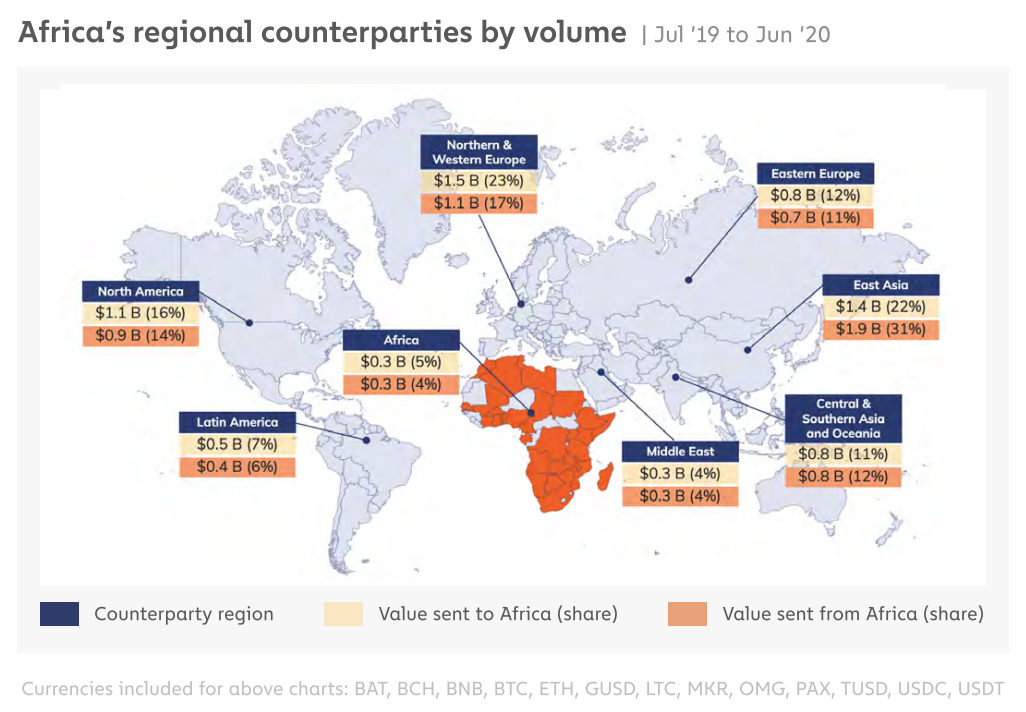

In June 2020 alone, there were nearly 500,000 transfers in and out of Africa worth just under $1B. Africa comprised roughly 30% of overall cryptocurrency transaction volume from July 2019 to June 2020. These impressive numbers prove that cryptocurrency in Africa had become widely adopted as early as 2019. Today, the African market is dominated by VALR, an easy-to-use and performant crypto trading and investing platform. Pantera is delighted to announce its investment in VALR’s $50M Series B to support the cryptocurrency market in Africa.

Breakdown of assets sent to and from Africa. Source: Chainalysis

VALR is a centralized currency exchange platform headquartered in South Africa which offers the widest selection of crypto assets that can be bought directly with ZAR (Rand, the national currency of South Africa). Users can buy, sell, save, earn, and pay all via the VALR app. The company was founded in South Africa in March 2018, and quickly opened customer registrations, Bitcoin-rand trading, and crypto-to-crypto trading in 2019. Shortly after, they enabled Ethereum-rand trading and launched an iOS and Android app. According to the Independent Communications Authority of SA (ICASA)’s 2020 State of the ICT Sector report, nearly 92% of South Africans own and regularly use a smartphone. This proves that VALR’s app is the easiest given way for most individuals in South Africa to access these tokens.

Users can easily analyze trading data in VALR’s app. Source: VALR

After launching its initial offerings, VALR enabled XRP-rand trading in early 2020 and VALR Pay, an easy way to pay a friend in the user’s choice of currency, in early 2021. In July 2021, VALR became an official credit provider in South Africa and launched Simple Swaps, which gives users with ZAR access to over sixty assets. Most recently, the company enabled BNB-ZAR trading, and plans to expand their token offerings even further in the future. In addition to having a large number of crypto offerings, VALR has incredibly low fees ranging from -0.01% to 0.75% depending on the kind of swap. VALR Pay is free for users to receive and send ZAR, deposits are fee-less, and withdrawal fees are minimal.

Details on VALR’s pricing and fee structure. Source: VALR

The VALR app is available on iOS and Android and provides an intuitive interface and setup experience. To activate an account, users must simply create an account, verify their email, and provide proof of identity. They can then start funding their account and trade crypto via the desktop or mobile app. The app has features like QR codes for receiving crypto, live exchange data pages, trading rewards, referral codes, and top-tier security.

Screenshot from VALR’s UI. Source

Like Coinbase, VALR generates QR codes for crypto receival. Source

VALR has impressively scaled to over 275,000 customers today from less than 100,000 in January 2021. By the end of 2021, trading volumes were nearly 80B ZAR. This rapid growth showcases the demand for crypto’s general thesis of decentralization and the strength of its use cases. Many South African citizens may choose to store their savings in a currency other than ZAR – one that they feel more comfortable with or simply are more bullish on. The traction VALR has gained shows that the app is the best place for citizens to do this.

Taking crypto global still has huge growth potential. Source: VALR.

VALR’s team is well-suited to tackle the goal of making crypto trading accessible globally. VALR’s CEO, Farzam Ehsani, was the former Blockchain Lead at FirstRand Group, Africa’s largest bank by market cap. He’s also had experience as the inaugural chair of the South African Financial Blockchain Consortium and at McKinsey and Deloitte. Theo Bohnen is VALR’s CTO with over a decade of programming experience in the finance sector, including as a Senior Blockchain Engineer in the RMB blockchain team. Badi Sudhakaran, VALR’s CPO, has nearly twenty years of product design and development experience, most notably at the RMB blockchain team and Yahoo!. The team has grown to 63 employees in February 2022 by expanding its engineering, operations, and compliance divisions. With their diversity of experience in fintech, blockchain, and African markets, this team is the ideal fit to lead and expand VALR.

In March 2022, Pantera led VALR’s Series B $50M round which was Africa’s largest ever crypto funding round and valued the company at $240M. We believe there is huge potential for blockchain in emerging markets and countries that have less stable stores of value or limited access to cryptocurrencies. The underlying themes of blockchain have clearly resonated with VALR’s target market, and an easy-to-use crypto exchange app is exactly what these country’s citizens are demanding. VALR is perfectly positioned to provide these usages for South Africa, other African countries, and the world at large.

- Paul Veradittakit

DIGESTS

Fitness Metaverse: This Tech Company Trades Sweat For Crypto And NFTs

OliveX wants you to earn while you burn. The Hong Kong-based digital fitness company rewards players with crypto and NFTs as they flee marauding pirates and monsters across a dystopian wasteland.

NEWS

Edward Snowden Played Key Role in Zcash Privacy Coin’s Creation

The NSA whistleblower and privacy advocate was one of six participants in the cryptocurrency’s fabled 2016 “trusted setup” ceremony, using a pseudonym.

LUNA Supply Drops to All-Time Low – But Don’t Call It Deflationary

To keep up with the demand for Terra’s UST stablecoin, LUNA tokens are burned to maintain the $1 peg. All things being equal, less supply could help to support the price.

IN THE TWEETS

REGULATION

Elon Musk Wants to Authenticate Every Twitter User. Crypto Twitter Should Take Notice

Twitter’s soon-to-be owner says he wants to “authenticate” all humans, but did not say what that actually means.

EU Crypto Laundering Plans Could Overwhelm Authorities, Bank Regulator Says

Officials urged lawmakers to think again as they approach the last stage of privacy-busting proposals.

NEW PRODUCTS AND HOT DEALS

Peter Thiel's Founders Fund co-leads $20 million Series A for Ondo Finance

Ondo Finance has raised $20 million in new funding as it looks to build a decentralized investment bank.

Coinbase NFT Partner 0x Labs Raises $70 Million From Greylock Partners, Jump Crypto, and Jared Leto

San Francisco-based decentralized exchange infrastructure provider 0x Labs has closed a $70 million Series B financing round led by Greylock Partners at an undisclosed valuation.

LETS MEET UP

Indianapolis, May 16-18

Los Angeles, May 18-20

Los Angeles, June 3-7

Consensus 2022, Austin, June 8-14

NFT.NYC, New York City, June 20-24

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.