CoinDCX’s $135M funding round, co-led by Pantera

VeradiVerdict - Issue #198

CoinDCX is one of the largest crypto trading apps in India that has seen explosive traction recently. With a user base of over 12.5M, Pantera is delighted to have recently co-led CoinDCX’s $135M funding round as we help build out a strong crypto landscape in India and globally.

Crypto usage has been permeating into more and more societies, and developing countries may have the most economically profound use cases for the blockchain. Individuals in these countries typically grapple with unstable governments, volatile currencies, and face difficulty escaping the cycle of poverty. While such issues are not very grave in India, the country could still benefit tremendously from crypto usage. Furthermore, India’s GDP is expected to surpass US GDP (PPP) in 15-20 years. This robust economic growth, combined with the fact that many Indians are becoming more digitally native and crypto-curious, is fuelling the demand for an intuitive crypto trading app. We expect India to have one of the largest number of retail crypto consumers, and the largest web3 developers in the world in the next 1-2 years, which will help establish it as a very attractive web3 destination.

Company

CoinDCX is currently one of largest and most popular crypto trading apps in India, and offers over 100 cryptos to over 12.5M registered users. CoinDCX is supported on Android and iOS, where users can seamlessly invest, and trade in cryptos. Over two-thirds of Indians now use smartphones, so CoinDCX’s app is the easiest way to access these crypto markets.

Whenever CoinDCX lists a new token, they write an educational post about it to inform their users. Source: CoinDCX.

CoinDCX now has over 100 INR (Indian Rupee) crypto pairs, and 400+ crypto to crypto (C2C) pairs. In the last quarter alone, they have launched over 100 new C2C pairs and over 20 INR pairs. The company also recently enabled staking for over 10 tokens, which allows users to earn yield on their crypto assets.

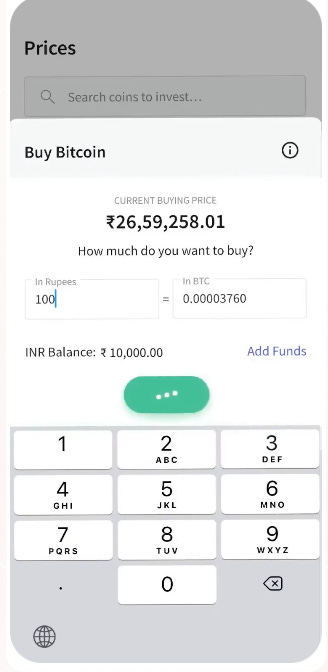

Part of the INR deposit process via the CoinDCX app. Source: CoinDCX

Over 25 tokens were launched on the CoinDCX Earn program as well, which increases token optionality and user engagement. By investing in these tokens, Indian citizens can diversify their portfolio. The platform currently has over 12.5M verified users and is constantly growing, proving the demand for a user-friendly Indian crypto trading app.

CoinDCX charges a trading fee of 0.2% of the total transaction amount on both buying and selling of crypto tokens. For spot and margin trading fees, the company offers “club levels” with greater fee discounts as the level increases.

CoinDCX’s fee structure. Source: CoinDCX

Product

Exciting product upgrades have been a key part of CoinDCX’s explosive growth. The company recently launched Crypto Investment Plan (CIP), which enables recurring and automatic buying via the app. This encourages disciplined investment among users in the crypto markets. They also enabled limit orders on the app, a popular feature that now contributes to over 15% of all orders on the platform. The team has also been working diligently to improve the user experience, and recently implemented revamps to the login flows by reducing automatic logouts and launching Google OAuth based onboarding and login.

The user experience is seamless and intuitive: users download the app on their smartphone, sign in with their email and mobile number, connect their bank account(s), and can then access and trade a range of assets. The app is secure and fast, with 95% of all funds on CoinDCX stored in multi-sig cold wallets.

DCXLearn

A key feature of CoinDCX is DCXLearn, the company’s education platform that features free courses that teach users about blockchain, crypto, and fundamentals of trading. Navigating crypto and trading can be difficult for beginners, especially because the industry as a whole is quite new and evolving rapidly. These educational courses make crypto more accessible to the masses and educates users on how to invest in an informed way. DCXLearn also offers free collections of curated articles, blog posts, and research pieces to help users who are new to the ecosystem and wish to learn more. The company also offers free masterclasses, e-books, and sign-language crypto guides to further educate users and promote inclusion in the crypto sphere.

A few of CoinDCX’s course offerings. Source: CoinDCX.

India’s Crypto Landscape

CoinDCX is currently strongly outpacing competitors in terms of both total and organic downloads. Whereas its competitors operate as either a crypto broker or a crypto exchange, CoinDCX operates as both and has the most offerings (spot, margin, lending, and staking). In addition, CoinDCX has the most customer-friendly fee structure and the best-in-class in compliance, custody, and APIs.

Vision

As CoinDCX popularizes in India and worldwide, their vision includes launching more crypto-based products, building crypto as an asset class, and supporting the crypto economy at large. CoinDCX wants to strengthen their current offerings on staking, borrowing, and lending, as well as expanding its venture arm, CoinDCX Ventures. The team also wants to build a trusted brand synonymous with the industry, making crypto accessible to 50 Million Indians. Enabling trading for individuals in developing countries and expanding out use cases for crypto globally is so important for the ecosystem and is a core part of Pantera’s thesis. We look forward to supporting CoinDCX’s growth and impact as they allow Indians to invest in crypto in a more seamless, safe, and cost-effective way and build out the Indian crypto/web3 landscape.

- Paul Veradittakit

DIGESTS

Terra Snapshot Expected This Week. Here’s How 'New' Luna Will Be Distributed

The supply of tokens on the new blockchain will be just over 116 million, developers said.

'Not About Playing It Safe': Krista Kim on How Artists Inspire the Metaverse

As contemporary artist Krista Kim sees it, there are too many corporate executives conceiving these new virtual worlds and not enough genuine creatives.

NEWS

Consider Digital Assets Instead of Still-Pricey Real Estate, Say JPMorgan Strategists

Nikolaos Panigirtzoglou and team mull the outlook for crypto following the Terra collapse.

Nvidia’s Crypto Mining Chip Revenue Now ‘Nominal’ Following Months of Decline

A drop in crypto mining chip sales dragged down the chipmaker’s OEM business unit year-over-year.

IN THE TWEETS

REGULATION

Circle Asks US Fed Not to Step on Its Toes by Launching a Digital Dollar

The public is already served well by private-sector tokens, the USDC stablecoin issuer said in a comment letter to the central bank.

NEW PRODUCTS AND HOT DEALS

Adam Neumann-backed blockchain startup Flowcarbon raises $70 million

Flowcarbon has raised $70 million for its carbon credits platform. It’s currently undergoing a private sale for its token, with a public launch to follow.

Ethereum Scaling Company StarkWare Quadruples Valuation To $8 Billion Amid Bear Market

Markets are down, but blockchain companies can still attract capital at sky-high valuations

LETS MEET UP

Los Angeles, June 3-7

Consensus 2022, Austin, June 8-13

NFT.NYC, New York City, June 20-24

London, July 14-18

EthCC, Paris, July 19-22

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.