Decentralized Museum

VeradiVerdict - Issue #213

Arkive landing page: “We are building a museum.” Source: Arkive

Arkive is a decentralized physical museum democratizing access to art and collectibles that are traditionally inaccessible to most. The DAO recently raised an exciting $9.7M seed round led by TCG Crypto and Offline with participation from Coinbase Ventures, NFX, Freestyle Capital, and others.

Culture is ever evolving; museums are collecting dust. Since the dawn of collecting, fine art has become a vessel for lucrative investments and power. As a result, much of art history is lost in the common biases of gallery curators or stored away in the exclusivity of rich private collections. Arkive is building the world’s first decentralized museum to reimagine the way we own and display culture. Functioning as a DAO, the neo-museum allows its members to hand-pick the items that will join Arkive’s growing collection.

Fractionalization of fine art

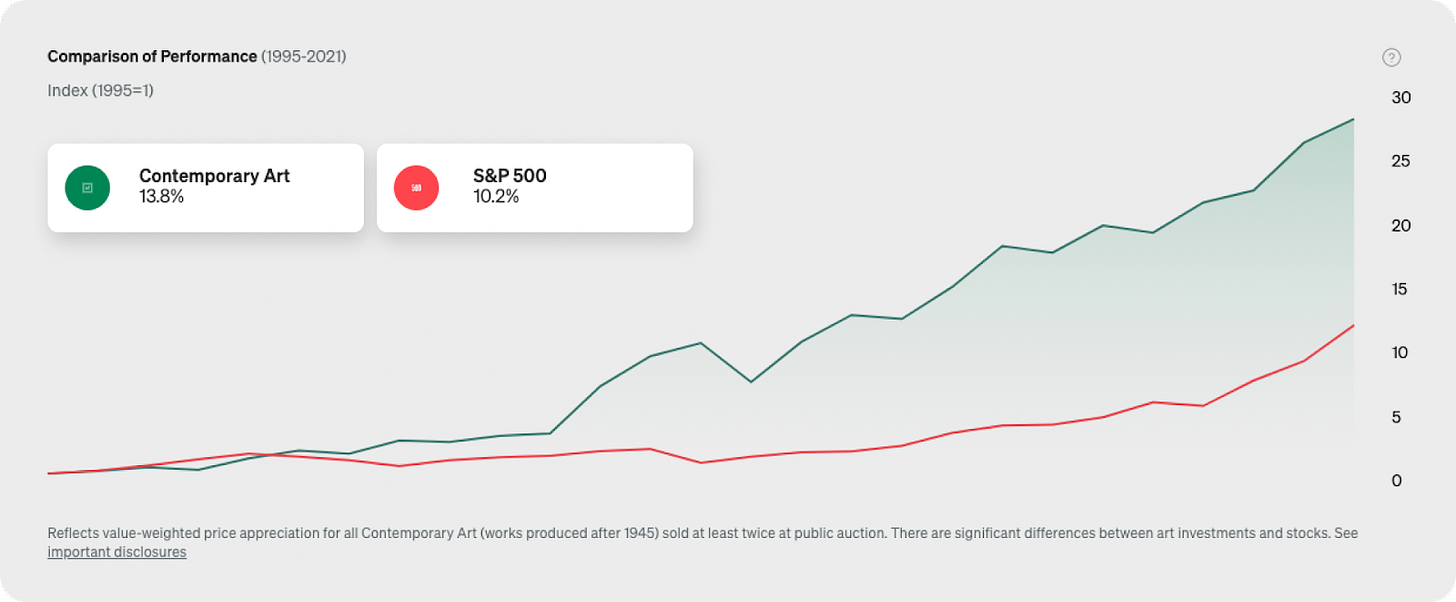

Traditionally, fine art has catered to the uber wealthy, with Basquiats and Da Vincis selling for hundreds of millions of dollars and the average “investment-quality” piece averaging over $10 million. Nevertheless, art as an investment vehicle has performed dominantly over the recent decades, keeping the rich wealthy with the spoils. Over the past 25 years, contemporary art has performed better than the S&P 500, averaging about 13.8% annual appreciation.

How can retail investors start cracking into this lucrative market? The early steps into democratizing this exclusive asset class began in 2017 with the launch of New York startup Masterworks. By allowing retail investors to chip into high-end art, Masterworks began the revolution into fractionalizing fine and contemporary art works. Arkive takes it a step further with greater democracy, social value, and the power to earn passively by lending the artworks for display.

Internal Masterworks analysis. Bloomberg. 12/31/2021. Source: Masterworks

A new agency over culture

Coming out of stealth in July of this year, Arkive operates as a DAO, admitting a limited number of members weekly. Its members each token vote through their Eth wallets on pieces of work for the organization to acquire. Every item is tied to a concurrent theme that was initially voted on by the collective. While it purchases physical pieces of art, Arkive operates as a decentralized museum by lending pieces out to various other showcasing organizations. This means that in the future members not only can invest in the value of the art piece, but also can earn through passive income from many different elements of the art-as-a-service model.

To be a part of this neo-museum, there are currently no fees. However, in the future, Arkive plans to convert to a bifurcated model where members can buy NFT based memberships as well as a potential token representing the fractionalization of the Arkive collection. At the moment, prospective members are asked to apply through a selective application process. Arkive members are typically unique collectors and art connoisseurs; nevertheless, the end goal is to work to democratize the landscape of those involved in art. As a result, the team focuses especially on building a diverse community that is tightly connected via its custom built community portal “The Atrium.

Arkive Team. Source: Arkive

Unlike Masterworks, Arkive is aiming to democratize art through more than just financial accessibility but also by redefining culture. Arkive plans to lend the artifacts to various other showcasing institutions, allowing for their art pieces to move around and not be held to a single hosting site. Thus, more people are brought into the thought process of selecting culturally significant art to preserve and showcase. In this case, Arkive is bringing to light the more than 90% of fine art locked away in private collections and shipping bays.

Purchasing the patent for the world’s first computer

Arkive’s current community defined curatorial theme is “When Technology was a Game Changer,” with the museum's first tour as a travel exhibition. The initial acquisition came with the original patent filing for the ENIAC computer, the first programmable general-purpose digital computer. They have since acquired the piece “Seduction” by Lynn Hershman Leeson, The Prototype for MTV Music Awards Moonman, “Eulogy for a Black Mass” by artist Aria Dean, and Madonna’s ‘Vogue’ fans used in her 1990 MTV VMA performance.

Lynn Hershman Leeson’s Seduction in the Atrium Gallery. Source: Arkive

To cofounder Tom McLeod, this is not his first rodeo trying to reinvent a capital intensive sector. McLeod previously founded Omni, a decentralized storage leasing company that was acquired by Coinbase in 2019. His other co-founders, Aleksander Rendtslev and Jordan Topoleski, are also serial entrepreneurs, and together they boast a team of visionaries.

Arkive puts forth an enduring thesis: "What if the Smithsonian was owned and curated by the Internet?" Recently raising $9.7 million, the team is pushing full-steam ahead to ghost curate the most transparent and self-sovereign trove of culture and history. In the future, Arkive plans to have over 20 new acquisitions and grow its membership base to several thousand by the end of 2023.

- Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

Bridging DC and DeFi: Can crypto decentralize politics?

Crypto firms are a growing presence in Washington, DC, including those focused on decentralized protocols and services.

The Merge: Ethereum upgrade Bellatrix is live, what comes next?

The Paris upgrade is expected between September 14 and September 15.

NEWS

NFT and metaverse trademark applications for 2022 have already eclipsed 2021's total

Almost 4,200 US trademark applications were filed for metaverse, virtual and web3 goods and services from January to August.

Crypto Lender Voyager to Auction Off Assets on Sept. 13

The firm will liquidate its assets via auction as it moves through the bankruptcy process.

REGULATION

US Bank Watchdog Says He’s Not Budging on Crypto Distrust

Michael Hsu, acting chief of the Office of the Comptroller of the Currency, is sticking to his guns on keeping most crypto activity out of the U.S. banking system.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

NBA to Develop NFT-Based Fantasy Basketball Game With Sorare

Sorare has become the "Official NFT Fantasy Partner" of the NBA.

Binance Introduces Ether Staking in US as It Steps Up Competition With Rivals

Binance will start offering 6% annual percentage yield (APY) to its U.S. customers from as low as 0.001 ETH.

LETS MEET UP

NEARCON, Lisbon, September 11-14

Geneva, Switzerland, September 15-16

Bangkok, Thailand, September 22-23

Pantera Asia Blockchain Summit, Singapore, September 27

TOKEN2049, Singapore, September 28-30

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.