DeFi on Polkadot

VeradiVerdict - Issue #100!!!

Pantera Capital’s most recent investment is in Acala, a decentralized financial hub built on the Polkadot Network, with other top investors ParaFi Capital, Digital Currency Group, 1confirmation, Arrington XRP Capital, Polychain Capital, Altonomy and CMS Holdings.

Most of mainstream DeFi today runs on the Ethereum blockchain and uses ERC-20 tokens, which creates constraints around scalability, transaction speeds, gas fees, and more. As Ethereum becomes a less one-size-fits-all solution and more and more blockchains pop up, there needs to be a way to bring DeFi across different chains.

Acala is a decentralized financial hub that offers a suite of financial primitives across different blockchains by running on the Polkadot Network (a decentralized network that links different blockchains). Acala has two main protocols:

Honzon: Users can deposit a digital asset from any blockchain (including BTC and ETH) to open up a CDP, from which they can borrower Acala Dollar (aUSD), which is pegged to the USD. aUSD can be used across any blockchain connected to Polkadot and can be lended and borrowed (like Dai in MakerDao).

Homa: When users connect their blockchain to Polkadot, they must stake a Polkadot token called DOT. The Homa protocol allows users to use convert staked DOT into liquid DOT (L-DOT) which can be used as a liquid token across any blockchain. This offers an incredible model for how to turn staked assets into liquid ones.

Acala is governed by an ACA token which can be used as voting rights, to pay stability fees (a small fee collected when users close a CDP), and as a safe in case the CDPs become under-collateralized suddenly.

As of writing, the protocol already has 14,500 accounts, 142,000 transactions, and 52 million USD on its test network. The heads of the Acala Foundation (Ruitao Su, Bette Chen, Fuyao Jiang, and Bryan Chen) all come from strong backgrounds in decentralized finance, token economics, and blockchain interoperability, including work at Luminar, Polkadot, and more.

Acala ultimately presents a very promising model for what DeFi could look like agnostic to the blockchain. These simple primitives can help power a plethora of applications and an explosion of investment, as we’ve seen with DeFi on Ethereum; they will also unlock new areas of potential as DeFi protocols capture the diversity of features available on different blockchains.

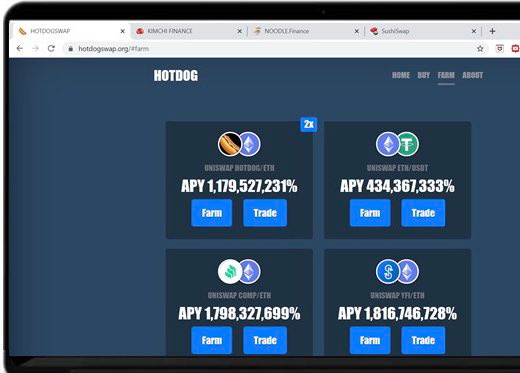

Expanding DeFi Beyond Ethereum

Decentralized finance (DeFi) has undoubtedly become one of the hottest blockchain verticals of this year and is likely to be a huge area of investment and innovation moving forward. Given the recent explosion of interest due to things like liquidity mining, crypto enthusiasts are looking at novel, disruptive ways that DeFi can expand further. One way to go about that is to think about its current constraints.

One particularly interesting constraint is that of the Ethereum blockchain. The vast majority of DeFi protocols right now run on the Ethereum network and use variants of ERC-20 tokens for their various use cases. Ethereum, however, is not immune to its own problems (including scalability, transactions speeds, exorbitant gas fees), and as more and more DeFi protocols spring up with diverse procedures and use cases, they’ll need to operate on different blockchains. One of the largest next frontiers in DeFi is expanding beyond purely Ethereum.

DeFi on Polkadot

This is where Acala comes in. Acala is a stablecoin platform that powers decentralized finance across different blockchains, by building on top of Polkadot. As a quick refresher, Polkadot is a newly launched decentralized protocol that interfaces across different blockchains, making cross-chain development and transactions significantly easier.

Acala leverages Polkadot’s capabilities for interoperability and offers a generalized set of protocols to help build cross-chain DeFi applications. The core of Acala’s protocol is its multi-asset backed stablecoin Acala Dollar (aUSD), which is a stablecoin pegged to USD that can be sent across different blockchains. To get aUSD, users interface with Acala’s Honzon Protocol, which is a decentralized system of collateralized debt positions (CDPs), which are essentially smart contracts that can back a certain asset with another asset. Users can supply Polkadot assets, or assets from any chain connected to Polkadot (including BTC and ETH) to open a CDP. They can then borrow back a certain amount of aUSD assets which they can use for various purposes on any chain connected to Polkadot. Users can’t withdraw the assets in their CDP until they return the borrowed aUSD.

Acala also allows users to convert their DOT token (a token that users must stake on Polkadot to connect their blockchain to the Polkadot network) to liquidity to be used for liquidity mining. They offer the Homa protocol which creates a staking pool that can tokenize staked assets (like DOT) as a liquid asset (which they call L-DOT or liquid DOT) that they can use in other areas. L-DOT can be used across all chains and is completely liquid; it can also be exchanged for DOT at any time. L-DOTs kind of act like a “receipt” or “proof” that a user owns an asset they say they do. This opens up a plethora of applications, because it enables developers to treat staked assets as liquid.

The protocol already has a full service center with a decentralized exchange where users can borrow and lend aUSD, earn interest on their assets, trade various tokens, and carry out other typical DeFi actions. The live testnet demonstrates what core DeFi functionality could look like on cross-chain applications. The protocol isn’t necessarily the end vision for non-Ethereum DeFi, but rather a set of primitives that power more sophisticated, robust applications in the space.

The ACA token performs three main functions:

It serves as a voting right on governance issues like risk parameters, liquidation ratio, etc.

In case of a crash that results in under-collateralized CDPs, ACA will be diluted and sold to recapitalize (much like how MKR is a safety net for MakerDAO)

Revenue sources are transaction fees and protocol fees. Transaction fees are payments in any of these accepted tokens (DOT, BTC, aUSD, etc). Protocol fees depend on the protocol, right now mostly in aUSD. These fees eventually settle in ACA thanks to the decentralized exchange as a unified liquidity provider.

Much of the token share will be reserved for founders and private investors and some ACA will also be distributed as grants and bonuses for helping develop the ecosystem. ACAs will also be distributed as a reward for IPO participants and network contributors. Per the whitepaper, the protocol plans to distribute ~7% of ACA in a public token sale.

How has the protocol been doing so far?

Acala is already the most active chain on top of Polkadot –– it has 14,500 accounts, 142,000 transactions, and 52 million USD locked in its test-net as of writing. One key byproduct of Acala’s launch is that it legitimizes Polkadot as an infrastructure for various DeFi applications, potentially inspiring more DeFi protocols on non-Ethereum chains.

Who’s on the team?

The Acala Foundation is headed by Ruitao Su, Bette Chen, Fuyao Jiang, and Bryan Chen –– all seasoned veterans of the DeFi space. Prior to Acala, Ruitao, Bette and Bryan also founded Laminar, an open finance platform for margin trading on Ethereum. Ruitao also has significant experience in token economic models, including the decentralized Sovereign Wealth Fund (dSWF), and token generation strategies. Bryan is a Polkadot Ambassador who previously contributed to the Substrate codebase, and taught a Gavin Wood-endorsed course on Substrate. Fuyao previously founded Polkawallet, a mobile wallet for Polkadot, and has helped contribute significantly to the protocol’s growth and outreach.

Final Thoughts

Not only does Acala present a model for DeFi on a non-Ethereum chain, but Acala presents a model for DeFi across any blockchain. By leveraging the technical innovations of interoperability protocols like Polkadot, Acala both legitimizes the need for cross-chain infrastructure and opens up an entirely new sector of DeFi that is agnostic to blockchain or can communicate across different blockchains.

Acala provides a useful, generalizable set of primitives that serve as the first step to bringing a sophisticated DeFi experience across different blockchains. Its key technological developments, including a protocol that can turn staked assets into liquidity, one of the first of its kind, will unlock an entirely new class of DeFi applications and hopefully will outdo the immense growth we’ve seen with DeFi on Ethereum.

- Paul V

DIGESTS

Compound Passes Proposal to Cut COMP Farming Rewards by 20%

Compound – the leading US lending protocol – has passed a proposal to cut COMP liquidity incentives by 20%.

The Case for $500K Bitcoin

Below, we will make the case that bitcoin [1,2,3] is ultimately the only long-term protection against inflation.

NEWS

Hayden Adams details how Uniswap aims to fend off the DEX competition

Uniswap has seen explosive growth since the start of the summer, and last month accounted for 58% of total DEX volumes.

Wonder Tool yETH Promises to Supercharge DeFi Yields

Ethereum users itching for ever-higher yields are saying "yETH please" to a new Yearn Finance product that they say is a gamechanger.

REGULATIONS

Self-Help Firm That Mostly Took Bitcoin as Payment Mostly Just Helped Itself, SEC Charges

Mindset 24 Global LLC was, according to federal prosecutors, a “textbook” pyramid scheme with a million-dollar crypto twist.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Polkadot-Based Acala Raises $7M as DeFi Grabs Land on Another Blockchain

Decentralized finance (DeFi) continues to expand beyond Ethereum with the help of top-tier investors.

Zapper Closes $1.5M Seed Round

We’re happy to announce a $1.5M seed round to expand DeFi accessibility led by Framework Ventures and Libertus Capital with participation from MetaCartel Ventures, Coinfund, The LAO, CoinGecko, and Zee Prime Capital.

LETS MEET UP

Walks at the park or Zoom coffee meetings

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Hello Paul and thanks for sharing such interesting information and gems. I knew about this newsletter thanks to Luca De Giglio and since then I look forward to read every new issue. Daniele