DEX For The People

VeradiVerdict - Issue #157

Clipper is a new decentralized exchange (DEX) designed specifically for retail investors. The project is backed by Polychain Capital, 0x Labs, 1inch, the DeFi Alliance, Robert Leshner, Naval Ravikant, and more.

Most modern crypto exchanges aim to maximize the total value locked (TVL) of the protocol, which is a rough proxy for its liquidity. Higher TVLs mean that traders can execute large trades with lower slippage, but also means that all traders (retail investors and whales alike) must pay higher transaction fees to incentivize such large amounts of liquidity.

Retail investors actually hurt from this race for more liquidity, as they have to pay higher transaction fees with little of the benefits of reduced slippage. For small trades, slippage in a medium-size liquidity pool is effectively the same as trades in a massive liquidity pool. These transaction fees add up, hurting retail traders who are effectively subsidizing whales.

Clipper is a new decentralized exchange (DEX) designed specifically for retail investors. The protocol is designed to give traders the best prices on small trades (~10k USD), and currently supports trades between stablecoins (DAI, USDC, USDT) and wBTC orETH.

Clipper’s key insight is that more liquidity can hurt retail investors. For small trades, having lower transaction fees outweighs having slightly higher slippage in terms of finding the best trade price. Clipper optimizes the tradeoff between transaction fees and slippage by:

Capping liquidity pools at a maximum value of 20M USD, meaning that traders have to pay lower transaction fees (~20bps) to incentivize liquidity

Increasing capital efficiency by consolidating liquidity into one multi-asset pool rather than many two-asset pools, which further lowers required fees.

Using a unique AMM variant which mathematically has less slippage than the classic constant product market maker

Running efficient on-chain computations to maintain the protocol, minimizing gas fees

Updating the price of assets via external oracles instead of relying exclusively on arbitrageurs, reducing impermanent loss

The project was launched by Shipyard Software, a team dedicated to building DEXes for various specific use cases, with deep experience in NFTs, online marketplaces, and AMM theory. Clipper is governed by a DAO, which is currently a multisig including Shipyard Software and Polychain Capital, among others. As the project matures, Clipper intends to be governed by the community through a native token.

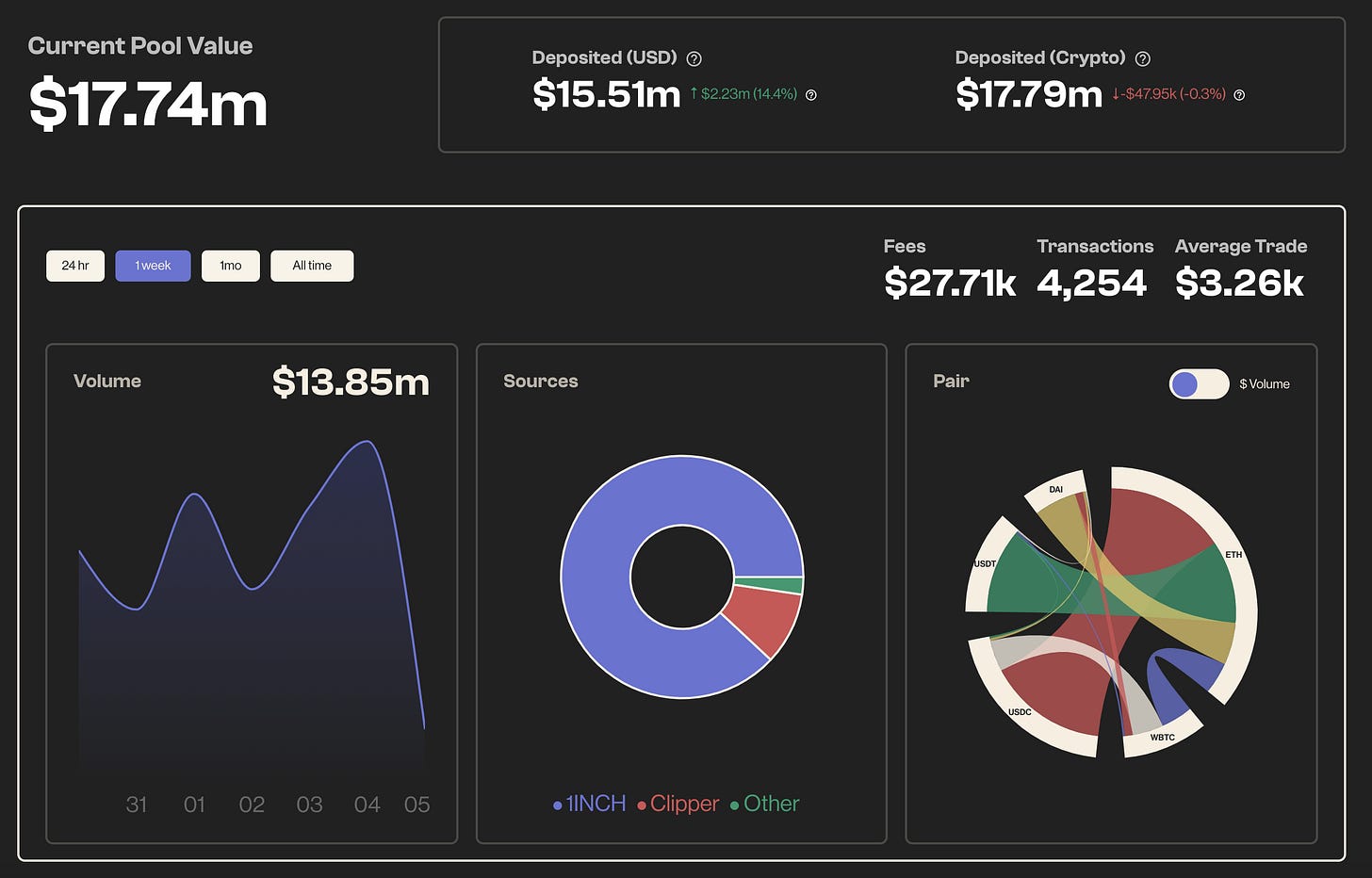

The protocol is currently operating in beta with a 17M USD liquidity pool and has been integrated with the DEX aggregator 1inch Network. In the future, Clipper intends to expand its set of liquidity providers to be open to the community, launch a governance token, integrate with other DEX aggregators, and expand to other chains like Polygon and Layer 2 protocols.

Ultimately, Clipper presents a promising vision for a DEX specifically crafted for the experience of retail traders, further stimulating mainstream adoption of crypto and pushing the space closer toward the vision of DeFi for all.

The Blind Spot of Liquidity

Most crypto exchanges today compete on the battleground of “liquidity” –– an oft-overused term that refers to how efficiently and easily an investor can trade between assets. For decentralized exchanges (DEXs), most of which use the automated market maker (AMM) model, a proxy for liquidity is often the total value locked (TVL) in the protocol. DEXs with a higher TVL have more capital in their liquidity pools, meaning that investors can execute large trades with more convenience and efficiency.

To maintain large TVLs, DEXs have to charge high transaction fees on trades to incentivize liquidity providers to supply capital. Centralized exchanges (CEXs), like Coinbase and Gemini, similarly charge high transaction fees to extract profit from trades as a core component of their business model. These high transaction fees driven by liquidity disproportionately hurt retail traders, who are effectively subsidizing whales for no direct benefit.

By optimizing for a diverse set of investors, today’s crypto exchanges effectively under-optimize for retail traders, who don’t have the capital to make high liquidity worth its cost. To support further mainstream adoption of crypto, it’s critical that the ecosystem come up with novel, exciting, and tailored ways to engage retail investors looking to enter the space.

A DEX for Retail Traders

Clipper is a decentralized exchange designed specifically for retail traders. The project’s guiding principle is to give traders the best possible price on small trades (~10k USD), encouraging more retail activity in the space. The protocol, built on Ethereum, supports trades of wBTC, ETH, DAI, USDC, and USDT.

How does Clipper work?

Clipper’s key insight is that more liquidity can actually hurt retail traders. The primary appeal of having more liquidity is that it reduces slippage, which is when traders must settle for a worse price than the market-rate due to the size of their trade. However, for retail investors executing small trades, this effect is trivial; the slippage for small trades (<10k USD) is effectively the same in both smaller (~10M USD) and larger (~1B USD) liquidity pools. Thus, retail investors pay higher transaction fees for little direct benefit.

For small trades in a small pool, lower transaction fees outweigh slightly higher slippage. Clipper carefully achieves the optimal balance of transaction fees and slippage via the following features:

Capping liquidity pools at a maximum value of 20M USD. With a smaller liquidity pool, the protocol has to pay less to incentivize liquidity providers, ultimately keeping transaction fees low ( 20 basis points or less) for everyday traders.

An AMM designed to minimize slippage. Clipper’s AMM variant has mathematically less slippage than the Constant Product Market Maker, which is the default AMM model used by most DEXs. Moreover, instead of maintaining a liquidity pool for each asset pair, Clipper maintains a single consolidated liquidity pool for any number of assets, which enhances capital efficiency and lowers slippage relative to the pool size.

Inexpensive computations on-chain to reduce gas fees. The protocol uses a novel closed-form invariant for optimization, which is simple to compute on-chain and thus requires less gas fees. Trading with Clipper should take roughly 100k units of gas, on par with most leading DEXs today.

Mitigating impermanent loss with external oracles.Impermanent loss occurs when the price of an LPs’ tokens change relative to when they were deposited in the liquidity pool. Impermanent loss also hurts everyday traders because they must often pay higher transaction fees to offset the losses and attract sufficient liquidity. To mitigate this, Clipper updates asset prices in its liquidity pools by considering external market prices from an oracle, instead of exclusively relying on arbitrageurs to correct the price.

In tandem, these four features optimize the slippage/transaction fee tradeoff for retail traders, giving them the best possible price on their trades.

Who’s behind the project?

Clipper is the first major release by Shipyard Software, a team building a suite of DEXs targeting various classes of crypto investors and specific use cases. The Shipyard team has deep experience in online marketplaces, NFTs, and academic research into automated market making. It includes Mark Lurie and Abe Othman; they met over 15 years ago as freshmen at Harvard and have a long working relationship.

How is it governed?

The protocol is governed by a decentralized autonomous organization (DAO), currently composed of a multi-sig wallet with Shipyard, Polychain and other members of the community as the signers. As Clipper matures, the protocol intends to launch a governance token, which the community can use to vote on governance proposals.

What’s next for the protocol?

Clipper is currently in its beta phase, with $17M USD in assets and has already integrated with 1inch Network. Two weeks from launch, it is doing $14M/week in volume, comprising almost 5,000 transactions from 1,800 traders (over 2x Curve’s traders).

In the second half of this year, the project plans to open liquidity provisioning to the community. If you are interested, you can apply to be an LP here. The project will also be integrated into 0x to stimulate trading activity, and once prices and yields are stabilized, will launch on Layer 2 protocols and other chains. Eventually, it expects to launch a governance token to further decentralize governance to its users.

Final Thoughts

As crypto becomes more mainstream, more and more retail investors are flocking to the space to take advantage of its frictionless investing and insane returns. To capture these users, it’s critical to build the financial infrastructure to support their use cases and capital constraints.

Clipper’s DEX is an inspiring example of how DeFi can benefit from rejecting the popular “one-size-fits-all” approach and honing in on a specific set of users. By optimizing the tradeoff between slippage and transaction fees, effectively optimizing the AMM model for smaller trades, Clipper is positioned to offer the best prices on trades to retail investors, making it easier than ever for them to engage with the crypto ecosystem. In designing for these users, Clipper helps pave the path towards the vision of DeFi for all.

- Paul V

DIGESTS

Bitcoin Stuck Below $40K, Eyes Short-Term Oversold Bounce

Bitcoin buyers could maintain support above $36K.

NEWS

Blockchain Developer Toolkit Alchemy Adds High-Profile Angels to $80M Series B

The blockchain infrastructure company has grown over 10x since it announced the series B in April.

diamondhands's NFT

Today, BitClout takes the NFT space to the next level by creating a whole new category: Social NFTs.

Yat thinks emoji ‘identities’ can be a thing, and it has $20M in sales to back it up

On the surface, Yat is a platform that lets you buy a URL with emojis in it

REGULATIONS

Gensler sets SEC sights on DeFi, crypto lending and more in expansive speech on regulation

SEC chairman Gary Gensler spoke about crypto regulation during an event appearance on Tuesday.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Premier NFT Market MakersPlace Raises $30 Million From Former Sotheby's CEO, Eminem And Bessemer

In 2020, Ryoma Ito, the cofounder and CMO of MakersPlace, a startup that mints and sells non-fungible tokens (NFTs), approached Christie’s, the centuries’ old auction house, with an idea.

Sense Finance Raises $5.2m to add a new dimension to DeFi

The financing was led by Dragonfly, with participation from Bain Capital Ventures, Nascent, Variant, Robot Ventures, and theLAO, among others.

LETS MEET UP

Austin, August 24-25

Mexico City, Aug 30-Sept 1

Los Angeles, Sept 16-17

Mainnet 2021, New York City, Sept 20-22

Coffee meetings or walks in San Francisco

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.