DVT

VeradiVerdict - Issue #240

Building towards a sustainable and secure future

The shift from Proof of Work to Proof of Stake marked a significant milestone for Ethereum and brought a range of benefits for users of the platform. One of the key benefits was a significant reduction in the network's carbon footprint. This was a welcome development, given the growing concern about the environmental impact of crypto. However, the transition to PoS also presents some significant challenges. One of the most pressing issues is the need to ensure resilient, scalable, and secure validation of transactions. This is crucial to maintaining the integrity of the Ethereum network and preventing fraud or other malicious activity. Additionally, contributing to the network as a validator can be expensive and require significant technical expertise, limiting the number of individuals who can participate in the validation processes. This creates a centralization risk in the network, which can negatively impact long-term viability.

Enter Obol Labs

Obol Labs is a specialized research team that focuses on developing proof-of-stake infrastructure for public blockchain networks and offers solutions to tackle these challenges. The central objective of Obol is to enhance the resiliency, scale, and security of the consensus layer of Ethereum. Today, Obol is focused on scaling the Ethereum mainnet by building and shepherding the adoption of Distributed Validator Technology, or DVT.

What is DVT

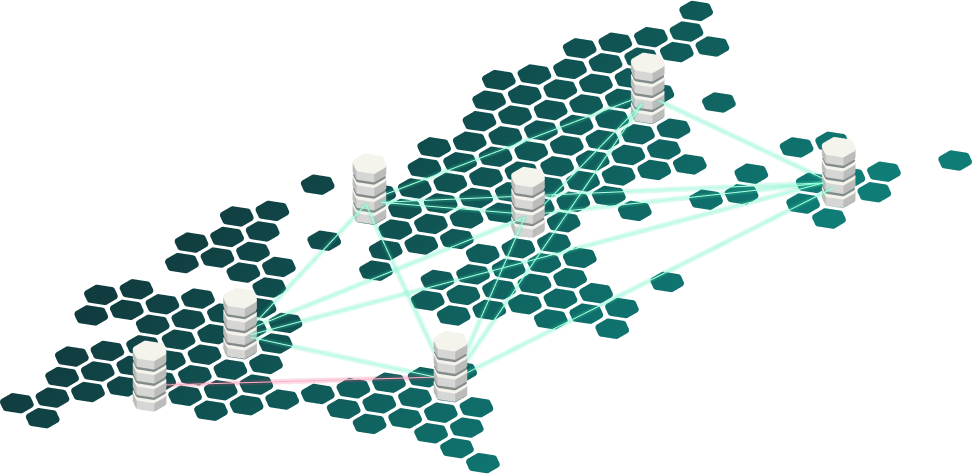

DVT enables Ethereum Proof-of-Stake validators to operate across multiple nodes or machines, called distributed validators, collaborating in real-time to validate transactions. DVT addresses critical problems faced by single-node validators, including machine failures, connectivity issues, slashing risks, hotkey compromises, and high cost to entry. This improves validator resiliency by creating redundancy within a single network validator, such that when a node or machine(s) goes down, the other nodes in the cluster will keep the validator operating (Active-Active Redundancy). This also lowers infrastructure costs by reducing the risk of nodes going offline, allowing more validators to be run on fewer machines (a major profitability blocker for the large validator operators). DVT makes staking more accessible and robust for validators of all sizes. For small validators, DVT reduces the bonding requirement for each node in a cluster, allowing multiple operators to come together to meet the total 32 ETH requirement to operate a validator. Ultimately, DVT leads to greater stake decentralization and improves validator participation, creating a more stable, secure, and credibly neutral Ethereum for the world to build on.

The Obol Network

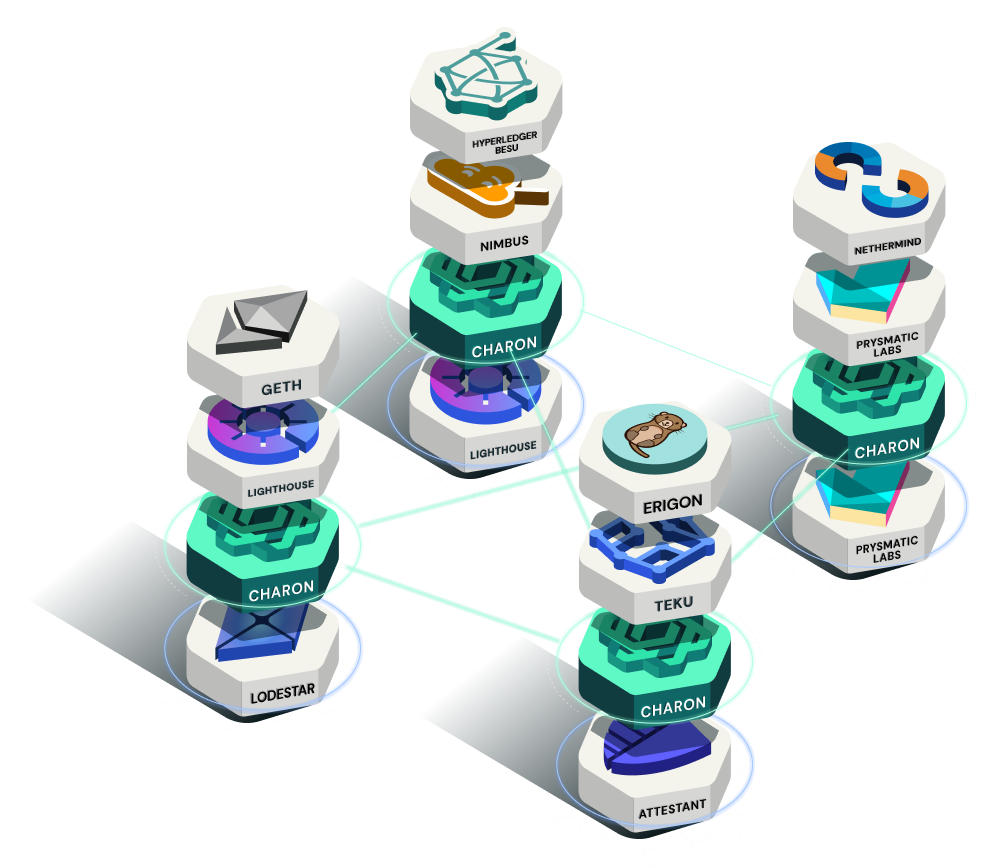

Obol Labs is facilitating the adoption of DVT through the Obol Network, a collection of open-source tools to enable trust-minimized staking. These tools consist of the Distributed Validator Launchpad, Charon, Obol Splitters, and Obol Testnets.

The Distributed Validator Launchpad is a user-friendly interface that facilitates the bootstrapping of Distributed Validators. Charon, on the other hand, is a middleware client that allows validators to run in a fault-tolerant and distributed manner. Obol Splitters comprises a collection of solidity smart contracts that enable the immutable splitting of rewards. Lastly, Obol Testnets is a continually evolving set of public incentivized testnets, designed to allow operators of any size to test their deployment before deploying on the Ethereum mainnet.

With Obol, users can quickly and easily participate in validator pools and enable decentralized applications that are further resistant to censorship and third-party control. By unlocking new avenues for users to participate in the validation process and enabling decentralized networks, Obol is unlocking the potential of the Ethereum network and making it more accessible to a wider range of users.

Improving Validator Resiliency

Obol Network's DVT and decentralized platform specifically reduce risks associated with the Ethereum network's validators, such as "slashing" and yield losses due to downtime.

"Slashing" is a penalty that validators incur if they validate conflicting transactions or fail to perform their duties properly. Today, one of the biggest slashing risks occurs when operators have an active-passive setup, having a failover node on standby in case a primary node goes offline. This means that the validator private key is stored in two locations, so in the event there’s an error that causes both active and passive nodes to be active, the same validator private key is signing, which causes a slashing event to occur. DVT reduces the risk of slashing by allowing operators to come together to form a single distributed validator. In this case, each operator only has a portion of the single private key, called a key share. As long as enough nodes are active to meet the needed threshold of key shares, the full private key can be created to sign the transaction. This means that there is no potential for the private key to ever exist in multiple nodes, eliminating the potential for a slashing event.

In addition, Obol's DVT protocol is designed to minimize the risk of yield losses due to validator downtime by creating an active-active redundancy. Even if a portion of the nodes in a distributed validator cluster goes down, the entire validator can still operate. This ensures much higher resiliency to validator downtime.

Ensuring Validator Key Security

DVT can also help to reduce the risk of key compromise and Byzantine risks in the Ethereum network. Since each node only has a portion of the validator's private key, it is extremely difficult for a private key to be stolen as multiple nodes in the same cluster must be compromised. Additionally, each node of a distributed validator cluster can also be run by a different operator, reducing the impact that each individual operator has on the validator or network in case they go offline or become malicious.

Increasing Validator Participation

Another key benefit of DVT is that it is highly customizable and flexible. Because validators can form networks that are tailored to their individual needs, DVT can be adapted to meet the specific requirements of different validators and organizations. Additionally, DVT lowers the bonding requirements for smaller validators while improving overall performance. This means that as the Ethereum network grows and evolves, DVT can be utilized to increase the number of validators that are securing the network, ensuring that the network remains efficient and resilient over time.

The Team

Obol Network has a strong leadership team at the helm, with Collin Myers serving as the CEO and Founder. Myers brings a wealth of experience to the table, having previously built the Activate project and held senior positions at ConsenSys. In addition, Collin has spent the past 4 years collaborating with the Ethereum Foundation on the specification, economics, and rollout of POS Ethereum (aka Eth2). He founded Obol Labs in 2021, after working on DVT in collaboration with the EF since 2019, as a means to ensure Ethereum's credible neutrality and remains the world's most decentralized blockchain network. Leading the technical team as CTO and co-founder is Oisín Kyne, a computer science graduate with over a decade of experience in the technology sector. Kyne has excelled in the blockchain and innovation space, having served as one of University College Dublin's five student innovators and helped stand up Accenture's Centre for Innovation in Dublin. Prior to joining Collin on Obol, Oisin built and deployed one of the largest Ethereum validator deployments in network history, while working at Blockdaemon. With their combined expertise and experience, Myers and Kyne are well-positioned to lead Obol Network toward its vision of revolutionizing the staking process on the Ethereum blockchain and beyond.

Conclusion

With its recent $12.5M Series A fundraising round, Obol Network is well-positioned to continue driving innovation and growth within the blockchain ecosystem. Co-led by Pantera Capital and Archetype, and with participation from top players such as Coinbase Ventures and BlockTower, the round demonstrates strong support and belief in Obol's vision. Obol's innovative distributed validator technology has the potential to revolutionize the way that validators and developers interact with the Ethereum blockchain. By enabling greater resiliency, security, and scalability, Obol is helping to unlock the full potential of Ethereum and drive the growth of Web3. With its commitment to decentralization and innovation, we believe that Obol is poised to be a key player in the ongoing evolution of the blockchain ecosystem.

Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

What Happens if Ether Is a Security?

A recent suit filed by the New York Attorney General could have far-ranging complications for crypto exchanges that list ether.

Why Was Signature Bank Really Shut Down?

Deliberate attack on the digital asset industry or run-of-the-mill regulatory action? Depends who you want to believe.

BUSINESS

Biggest USDC burn on record just occurred, net redemptions since Friday reach $4.5 billion

In the same period, around $1.7 billion was minted, taking net redemptions to $4.5 billion.

Meta Will End Support for NFTs on Instagram, Facebook

Meta’s Stephane Kasriel said on Twitter the decision is prompted by a desire “to focus on other ways to support creators, people, and businesses.”

REGULATION

Plaintiff Beats Anon Hackers Served Court Papers via NFT

The court demanded that hackers return nearly $1 million worth of stolen USDT—but how will the money be recovered is unclear.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Web3 Service Unstoppable Domains and Polygon Labs Roll Out .polygon Domains

The new tool will allow users to expand their digital identity across over 750 decentralized applications, games and metaverses on the Polygon network.

Accounting Platform Cryptio Partners With Protocol Labs to Help Filecoin Miners Go Public

Filecoin miners will be able to generate accounting reports needed to pass their public company accounting oversight board financial audits.

LETS MEET UP

Pantera Summit, San Francisco, April 3

NFT.NYC, New York City, April 10-14

Vancouver, April 24-28

Dubai Fintech Summit, May 8-9

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Thanks for reading VeradiVerdict! Subscribe for free to receive new posts and support my work.