Eigenlayer

VeradiVerdict - Issue #251

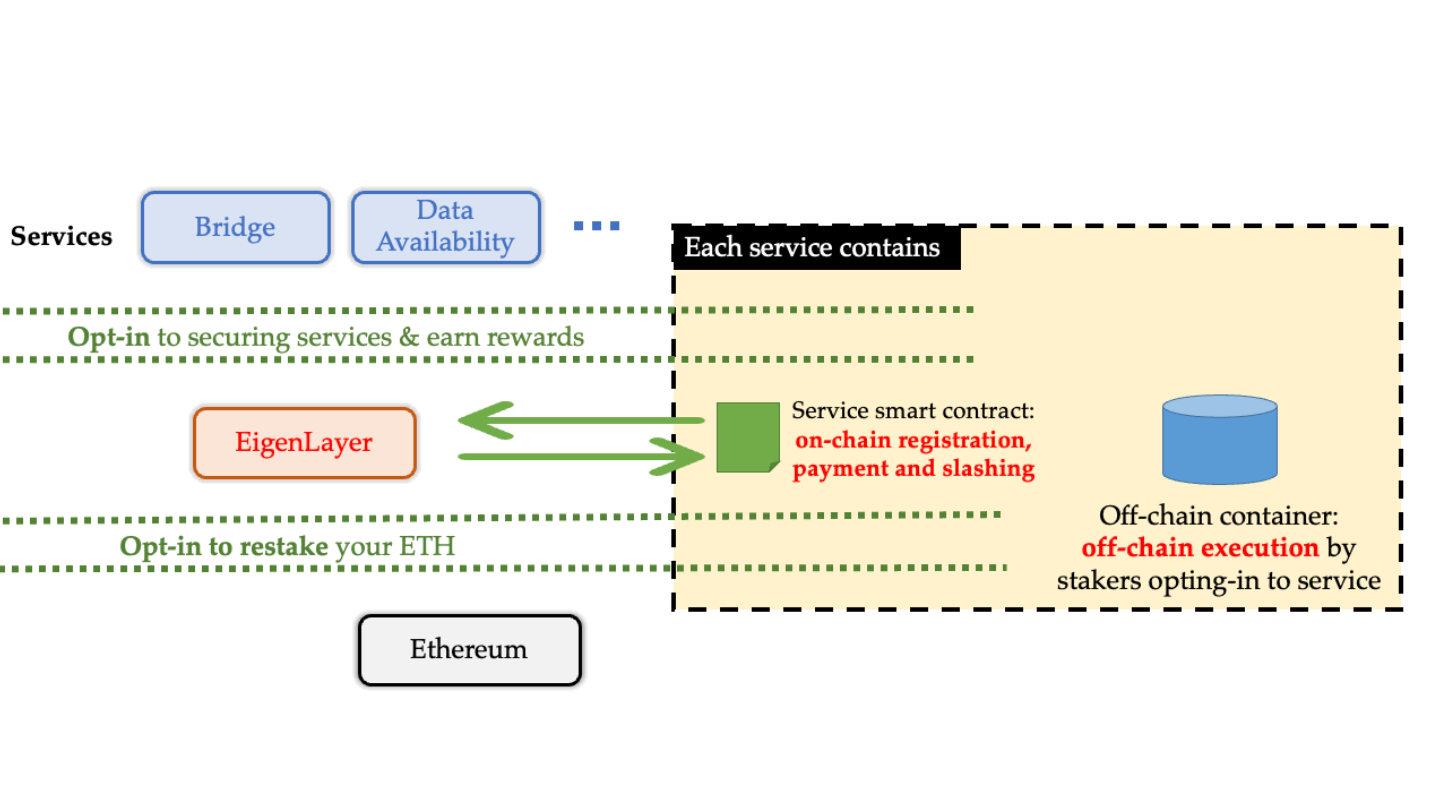

EigenLayer is building a novel mechanism called restaking that allows protocols to leverage Ethereum’s security instead of having to build their own validation mechanism. Restaking allows already-staked ETH to be distributed as a new layer of cryptoeconomic security on protocols. Historically, many projects built outside of the EVM have been forced to bootstrap their own validator set, a complex and costly endeavor. These projects include data availability layers, VMs, oracles, bridges, and more (EigenLayer whitepaper). Though much needed in the space, these modules often involve less innovation than other projects since it’s so difficult to bootstrap a validator set. Restaking drives the industry forward by removing the barrier to entry for these projects to be created, and allows them to do it in a much more secure and efficient way. Further, validators earn protocol fees and rewards for providing security for these new projects, allowing for validators and the modules they secure to benefit.

Validators themselves are able to opt-in to which projects they want to provide security for based on their risk tolerance. EigenLayer calls this mechanism free market governance: a mutually beneficial relationship for validators and new modules since validators earn rewards and new modules get access to the level of security that Ethereum has.

EigenLayer has built two types of restaking mechanisms:

Native restaking: pointing withdrawal credentials of already-staked ETH to EigenLayer’s smart contracts.

Liquid restaking: transferring liquid staking derivatives into EigenLayer’s smart contracts. This is available for tokens like stETH, rETH, cbETH, and LsETH.

EigenLayer restaking protocol mechanisms. Source: EigenLayer docs

EigenLayer uses “restaking points” to measure a user’s total EigenLayer restaking activity that is based on the amount of ETH staked over time. As time goes on, modules may look to restaking points when choosing validators as a way to prioritize long-term committed restakers.

There are a few key protocol features on EigenLayer’s platform:

Custom decentralization: As the amount of ETH restakers grows, EigenLayer will allow native stakers to opt in to securing services that specifically want high decentralization. EigenLayer recommends that services that highly value decentralization should keep off-chain software container requirements light.

Custom slashing: Validators can get slashed if certain conditions aren’t met while restaking. With taking this risk, however, validators gain additional protocol fees and rewards from securing new modules. Whether the validator gets slashed is up to the slashing contract deployed by each service, which EigenLayer verifies to ensure the staker behaved maliciously before being slashed.

Operator delegation: Some stakers may want to delegate operations to operators which can run actively validated service software modules for them. Stakers must trust the operator, but this comes with the benefit of being able to not have to run software containers of services themselves.

With EigenLayer, trust and L1 value accrual are greatly improved and the process of developing a trust network is made much easier. Source: EigenLayer whitepaper

Though EigenLayer is new, some projects have already started utilizing their novel mechanisms to improve security and interoperability – an example of this is Omni Network.

Omni Network

Omni is building out an Ethereum interoperability layer by leveraging EigenLayer’s stack to enable rollups to efficiently communicate with each other. Omni noted that “Nearly half of all the funds lost in DeFi hacks have originated from vulnerabilities in interoperability protocols.” This issue shows the clear need for robust and secure interoperability systems within web3 protocols. Right now, the industry is plagued by high costs and slow confirmation times on layer 1 blockchains. Rollups offer a solution to these issues, but are currently extremely siloed and fragmented. Omni, as the founders put it, is being built as a unification later “to create a new way forward for Ethereum’s modular future.”

Omni’s network leverages validators who restake $ETH which then form the secure foundation of the network, creating a new security standard across modular blockchains. Omni plans to open-source this technology so it can be leveraged and customized by other chains to ensure robust interoperability. The protocol combines restaking with Tendermint PoS consensus to agree upon the state of rollups in an extremely fast way, and therefore acts as a rollup settlement layer. Tendermint ensures Omni’s speed, while the restaking mechanism provides Omni with more robust levels of security. Because Omni’s execution layer is EVM compatible, developers can build natively cross-rollup applications – a huge step for interoperability. Further, developers can work in Solidity and leverage built-in functionality to access state, messages, and applications from other rollups. By deriving security from Ethereum/EigenLayer while also using Tendermint for cross-rollup functionality, Omni is poised to be the future of interoperability on Ethereum and beyond.

https://twitter.com/OmniFDN/status/1650867761126539266?s=20

Omni has already partnered with leading rollups including Arbitrum, Polygon zkEVM, Starkware, Scroll, and Linea.

Pantera recently participated in Omni’s $18M funding round including Two Sigma Ventures, Jump Crypto, Hashed, The Spartan Group, and others.

Closing thoughts

Interoperability and security are two of the largest problems facing Ethereum as it scales. With highly technical and innovative protocols like EigenLayer and Omni, however, the industry is being driven forward at a much more rapid pace. We’re excited to support inventive and groundbreaking projects like Omni to help rollup interoperability mature and improve – for the security and growth of the entire crypto ecosystem.

- Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

AI Can Generate a Trading Edge in Crypto Markets

Large language models like ChatGPT could supercharge sentiment analysis, a key aspect of trading.

What Happens to Bitcoin and Ethereum If the US Defaults on Its Debt?

The U.S. has never defaulted before. Interestingly, Bitcoin and Ethereum have seen more losses than stocks after a warning from Janet Yellen.

LETS MEET UP

New York City, July 12-14

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.