ETH Hits All-Time Highs

VeradiVerdict - Issue #120

Recently Ethereum, the second largest cryptocurrency by market cap, hit an all-time price high of $1,439.

While Bitcoin may have a stronghold on the digital gold narrative, Ethereum currently leads as the platform/blockchain of choice for smart contracts and decentralized applications. If Bitcoin is gold, Ethereum is silver. If Bitcoin is the initial cryptocurrency for investment, Ethereum is right behind as the next choice.

During this current bull run, we’ve seen institutional capital, corporations, and wealth management platforms get exposure to Bitcoin, enabling/motivating retail to soon follow. While institutional capital is still educating and getting into Bitcoin, folks will be taking profits and going into Ethereum, other smart contract platforms, and token projects building decentralized applications along the way.

What makes Ethereum compelling right now?

1) Scalability

Ethereum recently launched the first phase of its upgrade to Ethereum 2.0 with the launch of the beacon chain on December 1, 2020. Ethereum 2.0 hopes to bring scalability and a proof of stake consensus system, where users will be able to vote with their tokens/monetary value to secure the network. So far 2 million ETH has been staked.

In addition, a number of Layer 2 scaling technologies/solutions have emerged with the idea that data can be kept on-chain, while moving execution off-chain to handle faster performance while maintaining security. You can see the landscape of solutions below, who funded them, and which projects they are working with.

2) DeFi Growth

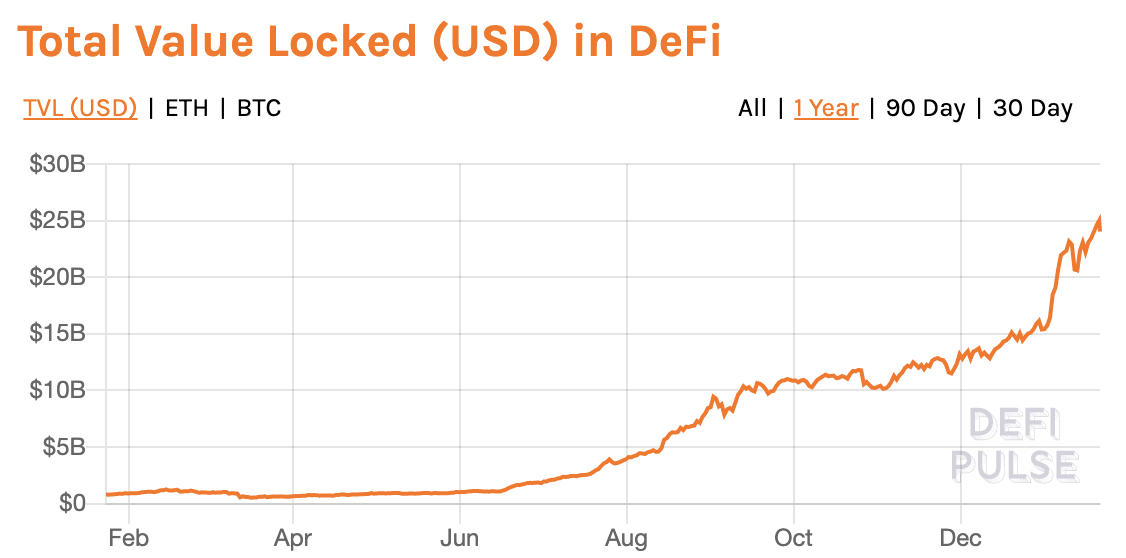

DeFi, or decentralized finance, is when you transact value in a peer-to-peer trustless way over a blockchain. Early in 2020, DeFi has $1 Billion in total value locked within DeFi protocols and recently, DeFi hit $24 Billion in total value locked, a 24x increase in about a year which is astonishing.

Decentralized exchange volumes have reached a high of 16% of all centralized exchanged volumes through platforms like Uniswap, 1inch, Sushiswap, and 0x. Stablecoins have reached up to $24 Billion in issuance as of December 2020. Stablecoins are cryptocurrencies that usually hold a fixed fiat value (primarily dollars) and are used as a store of value or trading asset. Decentralized lending protocols like Aave and Compound have brought innovation around flash loans, liquidity, and governance. Total DeFi users have growth quite well in the last year.

3) Rise of NFTs (non-fungible tokens)

Non-fungible tokens are a type of token that allows for artists to sell unique digital artwork. In December 2020, Beeple, a digital artist, sold a collection of artwork for a combined $3.5 million.

Recently, Justin Roiland released Rick and Morty art pieces and one sold for $290,000.

You can see the growth of crypto art volume and it allows creators to have supplemental income and for new artists to break into the industry and make a name for themselves.

In addition, NFTs aren’t limited to digital artwork and can be applied to unique digital items in gaming or even real-world assets. What becomes even more interesting is when you use the blockchain to track fractionalized ownership of collectibles. Imagine community-owned platforms where users have the decision-making capabilities and better economics. I really expect this sector to do well in 2021.

2021 ETH Prediction

Ethereum starts to get momentum on the institutional side later this year after further progress on both scalability and applications built on ethereum, leading to more record highs.

- Paul V

DIGESTS

The Bit Short: Inside Crypto’s Doomsday Machine

If you own meaningful amounts of cryptocurrency or you’re considering buying some, you’re the reason I wrote this. Please do read to the end.

After Huge Bitcoin Price Rally, Here’s What Billionaire Mark Cuban Thinks Is Next For Bitcoin And Crypto

Now, billionaire investor Mark Cuban, who famously said he'd rather have bananas than bitcoin, has warned crypto traders to watch for a rise in interest rates—but thinks the emerging decentralized finance (DeFi) market could change the game for crypto.

NEWS

Ethereum-based Options Platform Charm Goes Live on Mainnet

Decentralized platform Charm promises users “options markets which are liquid and cheap to trade on.”

BIP-X

BIP-X is an overall roadmap for the future direction of Basis Cash. With BIP-X as the starting point.

Mirror and Mask Network Partner to Bring Synthetic Stock Trading to Twitter

The collaboration will enable Mask users to view and trade mAssets directly on Twitter via the mask web extension and access Terra’s UST stablecoin.

REGULATIONS

Janet Yellen Says Cryptocurrencies Are a ‘Concern’ in Terrorist Financing

The U.S. should examine how it can curtail the use of crypto for illicit financing, the former Fed Chair said.

The US Can Make Bitcoin Mining Greener

With companies like Square announcing environment-focused mining initiatives, the U.S. can take the lead in reducing bitcoin's carbon impact.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Saddle, a new automated market maker for stablecoins, goes live after raising $4.3 million

A new stablecoin-to-stablecoin automated market maker (AMM) called Saddle went live today and announced that it has raised $4.3 million from venture capitalists.

Coinbase to acquire leading blockchain infrastructure platform, Bison Trails

The acquisition will enable Bison Trails to accelerate its mission to provide easy-to-use blockchain infrastructure that strengthens the entire crypto ecosystem.

SBF leads $50M funding round to bring DeFi to Maps.me's 140M users

Leading offline mapping application Maps.me has conducted a $50 million fundraising round to embed decentralized finance tools onto its platform.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.