Ethereum Turns 10

VeradiVerdict - Issue #336

Summary

Ethereum is establishing its role as the foundational layer for stablecoins, DeFi, and tokenized assets as it enters its second decade.

Digital Asset Treasuries (DATs) are reducing token float and driving institutional demand for ETH, creating structural price support.

Regulatory clarity and Ethereum Foundation reforms are positioning Ethereum for long-term growth as the core infrastructure for on-chain capital markets.

The Origin of Ethereum’s Vision

Before Ethereum, Vitalik Buterin was an early Bitcoiner, working at Bitcoin Magazine. Here, he noticed the need for scripting capabilities for application development within Bitcoin. He embraced this vision and built Ethereum with a general scripting language and shared his blueprint of a computer being run on a decentralized permissionless network. At the time, the idea was ambitious, leaving room for skeptics as there was this young kid without any big tech corporate experience, aiming to create something fundamentally new.

What shifted the gaze for me and many other early investors was that applications were wanting to build on Ethereum instead of Bitcoin and its Layer 2s, conveying that Ethereum is better for application development. One of the first killer apps that validated this sentiment was Augur; a decentralized prediction market. Augur illustrated that Ethereum could enable powerful, permissionless applications built on transparency, automation and financial logic. Ethereum also allowed developers to issue tokens, coordinate governance, and raise capital natively, sparking the ICO boom. At Pantera, we launched one of the first ICO funds and backed some of the earliest DeFi applications such as 0x, holding our place at the forefront of the Ethereum evolution.

A Decade of Ethereum

Marking its 10th anniversary, Ethereum is enjoying a long-awaited moment in the sun. Launched in 2015, Ethereum was the first to introduce programmable smart contracts, building a community of developers that set the stage for DeFi, gaming, NFTs and more. Through the decade, this ecosystem fostered continuous innovation that resulted in hosting the majority of DeFi protocols, and serving as the backbone for stablecoins. The infrastructure supporting stablecoins has matured significantly, with the GENIUS-Act providing regulatory clarity, channeling royalties to Ethereum and boosting its demand. While stablecoins like USDC and USDT exist on many chains, Ethereum remains the dominant home for stablecoin activity accounting for nearly 50% of global stablecoin market cap. Ethereum’s robust ecosystem continues to drive price appreciation, fueled by stablecoin adoption and innovative scaling solutions, with Pantera Capital’s strategic investments amplifying this growth.

Pantera’s Ethereum Ecosystem Investments

Over the past decade, Pantera Capital has invested in Ethereum’s ecosystem, backing transformative projects and founders. We are also one of the very few firms to have invested consistently alongside the very existence of Ethereum itself. Key investments include Circle, which powers USDC, a leading stablecoin with over $60 billion market cap and a driving force behindEthereum’s adoption in DeFi and payments. Arbitrum, a leading Layer 2 solution, has captured 100% of Ethereum’s incremental transaction growth in 2023, processing transactions 40x faster and 20x cheaper, with over 1.89 billion transactions since its launch with cumulative DEX trading volume exceeding over $545 Billion, displaying Ethereum’s scalability. More recently, it has emerged as a key player in migrating the infrastructure of capital, powering Robinhood’s launch of Stock Tokens on Arbitrum and serving as the underlying infrastructure of Robinhood Chain. Ondo, contributing significantly to the billion-dollar tokenized treasury market, launched USDY in 2023, showcasing Ethereum’s pivotal role as the core infrastructure for linking real-world assets, like U.S. Treasuries, to on-chain finance. Morpho significantly improved the lending experience on Ethereum, as it reached nearly $1 billion in deposits just a year after its launch, making it one of the fastest DeFi protocols to hit this milestone. Pantera seeded Bitwise’s spot Ethereum ETF, one of the first to gain approval, creating a new venue for institutional capital inflows. As of 2025, Bitwise manages over $4 billion in assets, leveraging Ethereum’s blockchain to power DeFi and tokenized asset strategies. Finally, BitMine, alongside firms like Bit Digital, has added over 840,000 ETH to corporate treasuries, signaling commitment to Ethereum’s value as a reserve asset.

Institutional Demand, DATs, and Ethereum’s Supply Shift

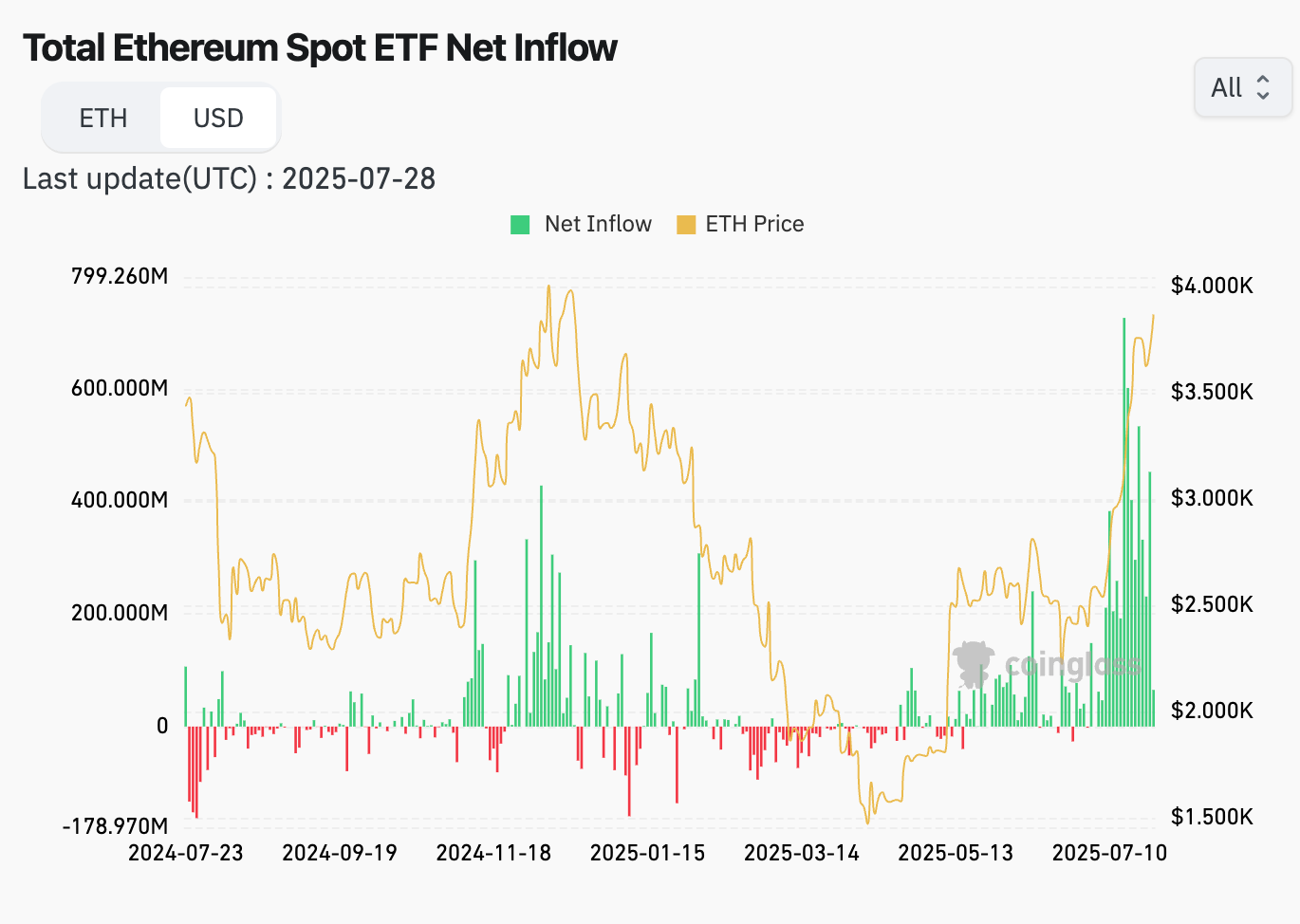

Ethereum surged 53% in July - but this rally wasn’t built on hype. It’s a structural move driven by growing institutional allocations into ETFs and Digital Asset Treasuries (DATs), Ethereum Foundation’s turnaround, coupled with recent regulatory clarity.

Institutions have taken interest in cryptocurrency exposure through ETFs and DATs. U.S. spot ETH ETFs attracted $1.8 billion in inflows last week alone. DATs also began aggressively stacking ETH. SharpLink (SBET) boosted its reserves to 361,000 ETH, while BitMine crossed the $2 billion mark in Ethereum holdings in just 16 days. As MicroStrategy’s Tom Lee highlighted on call with Pantera's Cosmo Jiang, these treasury companies have built-in advantages: cheap capital, equity premiums, staking yields, M&A arbitrage, and operational income that allow every new equity issuance to compound their ETH per share. This unique structure continuously shrinks Ethereum’s free float, providing price support beyond simple demand.

Source: https://www.coinglass.com/eth-etf

DATs are no longer a crypto-native curiosity, serving as an entry point for institutions to dip their toes into crypto and Ethereum, allowing them to gain exposure prior to purchasing spot or transacting on-chain. As I covered in my previous blog “Blockchain Going Public: the Convergence of Public Markets and Digital Assets”, these vehicles concentrate massive buying power, often absorbing more ETH than is issued, driving scarcity, and setting off broader capital rotations into altcoins.

Regulatory Clarity and Ethereum Foundation’s Strategic Turnaround

Regulatory clarity has also transformed historical headwinds to tailwinds. July’s GENIUS Act granted federally chartered status to regulated payment stablecoins. Stablecoins, quietly becoming crypto’s killer app, have already exceeded $250 billion in circulation, with Ethereum settling roughly half of all tokenized dollar transfers globally.

Lastly, Ethereum Foundation's (EF) new leadership and rapid developments are helping the chain evolve rapidly. The turnaround involved a leadership overhaul, Protocol team restructuring, a disciplined treasury policy, and an accelerated technical roadmap to address community criticisms about inefficiency, transparency, and competitiveness. By focusing on L1 scaling, blobspace, UX, and DeFi integration, EF aims to prove Ethereum’s dominance amid growing institutional adoption (e.g., Robinhood’s Stock Tokens on Arbitrum) and competition from blockchains like Solana. While challenges remain, such as retaining talent and managing community expectations, the EF’s strategic shift positions Ethereum to capitalize on the on-chain migration of capital markets, as seen in innovations like Robinhood Chain and Pantera’s ecosystem investments.

Final Thoughts

Stablecoins have finally locked onto dependable rails, reinforced by regulatory clarity from acts like the GENIUS Act, boosting its demand. Digital Asset Treasuries are the engines behind that demand. They vacuum float, boost price, and give institutions a turnkey way to hold crypto. In a market that now prizes structural yield, tokens that have deflationary pressure and linked with real cashflow, will be attractive candidates to be the underlying assets for DATs, further driving Ethereum’s price upward as demand for its blockchain surges.

We are at the cusp of a significant infrastructural shift, one that requires not a silver bullet but a vast array of solutions to numerous confounding issues. At Pantera Capital, we remain committed to investing in those solutions that power the next phase of on-chain capital markets, streamline financial infrastructure, and push the horizon of blockchain innovation. Ethereum stands at the center of this shift as the backbone for stablecoins, the platform of choice for institutions, and a catalyst for the evolving digital asset economy.

- Paul Veradittakit

Business

Why BNB Is Outperforming Altcoins Like XRP, ETH, SOL Today?

BNB surged to a new all-time high of $860 following a wave of U.S.-listed companies announcing major treasury allocations to the token. CEA Industries raised $500M, backed by CZ’s family office, joining Windtree Therapeutics, Liminatus Pharma, and Nano Labs in adopting BNB as a strategic reserve asset.

Anchorage Digital X Ethena Labs

Anchorage Digital and Ethena Labs launched USDtb, the first stablecoin compliant with the U.S. GENIUS Act. Backed 1:1, USDtb’s debut triggered a $4B stablecoin supply surge.

Regulation

Trump Eyes Moving U.S. Economy Further Into Crypto Via Mortgages, 401(k)s

Accelerating efforts to integrate crypto into core U.S. economic systems include a potential executive order allowing 401(k) retirement plans to allocate into digital assets.

Senate Crypto Market Framework Drafts and Ongoing Debates

The Senate Banking Committee introduces a hybrid regulatory model for digital assets, proposing a shared framework where the SEC handles disclosures and the CFTC oversees market activity for a new asset class called “ancillary assets.”

White House Unveiling Crypto Policy Report

The White House administration is working to release a crypto report to outline the administration's views on tokenization, and will lay out regulatory, legislative proposals.

New Products and Hot Deals

Christie’s Debuts Crypto Real Estate Division

The brokerage has spun up a dedicated division that already lists $1 billion in luxury property and recently closed a $65 million Beverly Hills sale entirely in crypto

Stablecoin-Focused Bitcoin Sidechain Plasma Draws $373M in Oversubscribed Token Sale

Stablecoin‑centric Bitcoin sidechain Plasma blew past its $50 million target, raising $373 million and promising $1 billion in on‑chain dollars plus fee‑free transfers at launch.

Everclear Secures Strategic Investment From NEAR Foundation To Scale Cross-Chain Clearing

Cross‑chain clearing protocol Everclear (a Pantera portfolio company) secured strategic funding and tech support from NEAR to speed trust‑less settlement across blockchains.

This Week at Pantera

Blockchain Letter

Pantera’s July note claims that tokenization has crossed “from concept into inevitability” as corporations issue directly on‑chain - setting the stage for an explosion of Digital Asset Treasury (DAT) companies.

Pantera DAT fund II

After the first Digital Asset Treasury fund filled and was fully deployed within a week, Pantera announced a second, larger vehicle to meet investor demand.

Pantera Capital to Invest $250M in Real-World Asset Projects

Ondo Finance is launching a $250 million initiative with Pantera Capital to invest in real-world asset tokenization projects. The program, called Ondo Catalyst, will focus on both equity stakes and token investments.

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early-stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have any projects that need funding, feel free to DM me on twitter.

thanks