FTX Update & Co-Ownership

VeradiVerdict - Issue #222

FTX

I wanted to briefly address the FTX situation as it’s been a huge development in our industry this week. The tweet from FTX CEO Sam Bankman Fried this morning is a short summary from him on what went down but essentially FTX is known to most as a way to access cryptocurrencies for consumers but took too much leverage and is in a dire financial situation. Customer funds are a priority and it looks like they will need to raise funds or potentially face bankruptcy.

I feel for those, consumer and institutions, that have their assets locked in FTX right now. There will probably be rippling effects that bleed into other assets associate with FTX, investments that they made, and other commercial relationships that they had. The company has hired top talent and had invested into some amazing companies so those are valuable assets for the industry and we should support those.

While this setback is a blow economically, it’s also a blow on the trust and regulatory side of things for crypto. FTX was a budding consumer brand with celebrities such as Tom Brady, Steph Curry, and others. SBF was a major political donor and advocate on the formation of crypto regulations. What’s needed going forward for centralized platforms is more transparency and governance. SBF mentioned it in his tweets and Binance recently promised a proof of reserves but today release wallets addresses showing $69B of crypto reserves. On the flipside, decentralized finance continues to provide the transparency and runs without fail.

On the Pantera side, we had insignificant exposure on the FTX platform and got exposure to FTX as a shareholder primarily through the acquisition of our portfolio company Blockfolio. The price of FTT has been volatile but trending way down while the value of FTX equity is largely dependent on both infusion of capital and also community trust but Sequoia has already recently marked it to zero. The most important topic for Pantera was making sure our portfolio companies would be fine, and after checking in, 95% had little to no issues. Of those that had issues, it was involving having treasury with FTX and we are helping them through options. We have even seen some of our portfolio companies leaning towards transparency through emails/tweets that they are fine. That’s helpful for their communities.

I appreciate those that have reached out to see how I am doing personally and I’m fine. Being in the industry now for 8.5 years, I’ve seen a lot, but things like this remind me of why we are striving to bring decentralization, transparency, and the re-invention of finance to the world. For this to play out, we will need both centralized and decentralized platform to co-exist and regulatory clarity would help there.

No doubt it’s been a rough few days so I urge you all to reach out to 3 people you know you are or might be affected from the FTX situation, the crypto markets, or the overall markets and see how they are doing!

The FTX situation is continuing to evolve so feel free to reach out for updates.

- Paul Veradittakit

ANTIC

Antic is a pluggable layer that allows groups to purchase products and experiences together in a seamless and user-native way. The company came out of stealth in late September and raised an exciting $7M seed round from Pantera, Seven Seven Six, Sheva Capital, Sound Ventures, Shrug, Rainfall, and Dapper Labs, along with many angels.

Why co-ownership?

Antic is creating a new economic entity: “the group customer.” Co-ownership isn’t yet mainstream, but emerging ownership designs paired with a growing emphasis on community is accelerating its popularity.

Web3 assets are generally top of mind when it comes to co-ownership – but non-cryptonative companies can benefit greatly from these structures as well. By integrating the option to “buy together” on a platform, a substantial amount of revenue is unlocked and the barrier to entry for asset ownership and experiences decreases dramatically. Further, a shared ownership model creates community around the object or experience being co-owned since each person has a stake in it. We’ve seen Fractional (now Tessera) do this well with shared ownership of singular NFTs, but there are many untapped marketplaces in both web2 and web3 that could benefit from providing users the option to purchase together rather than buy alone.

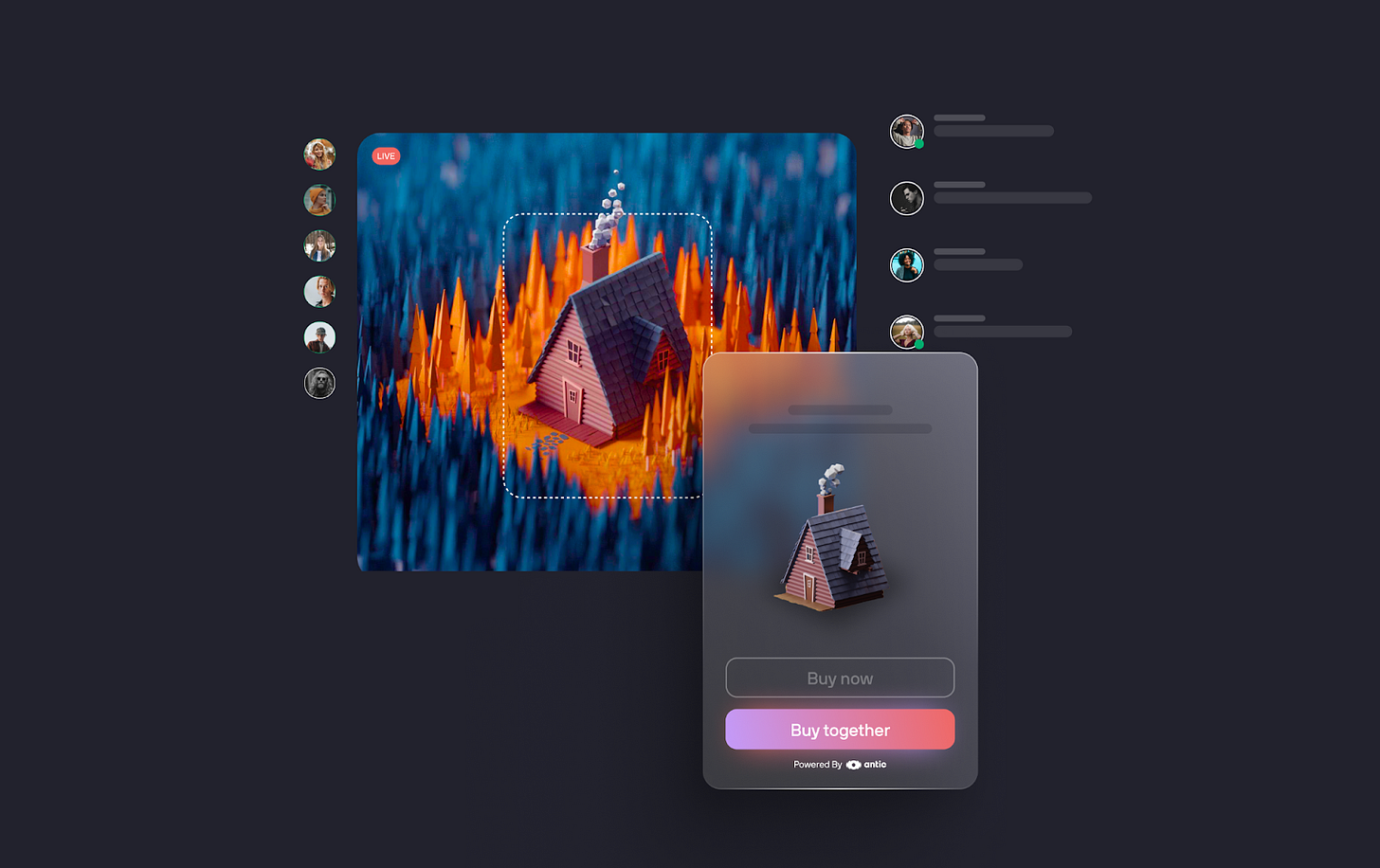

Antic offers a seamless “buy together” integration. Source: Antic

Since their launch in late September, Antic has seen interest from companies spanning web3, gaming, collectibles, and entertainment. Many brands are so eager to integrate Antic’s “buy together” button since it allows sites to attract a higher number of customers, generate more revenue, and create a unique social unlock.

Antic’s co-ownership mission has three core categories:

Co-ownership over digital assets (for both cryptonatives and non cryptonatives)

Co-ownership over intellectual property (IP)

Crowdfunding and other capital pooling / execution mechanisms

The company’s main focus is on creating a B2B2C checkout mechanism for customers that will make buying any kind of asset simple and collaborative. Part of their user-focused mission is to abstract away much of the blockchain-native interfacing and center the user experience around seamless checkout. On virtually any platform that sells assets, Antic’s infrastructure can be integrated to allow for co-ownership. Blockchain technology supports programmable coordination in a way that traditional tech stacks can’t, and Antic is leveraging it to reduce friction in these group purchases.

Antic has applications ranging from gaming, to entertainment, to e-commerce, and more. Source: Antic

Antic’s Architecture

Antic operates under the assumption that users prefer to buy with individuals with whom they share pre-existing trust, rather than a trustless format that’s common in many decentralized protocols today. By leveraging existing relationships, Antic can provide value to a wider market and subsequently help businesses grow their user bases.

Antic’s infrastructure is built on Ethereum and Polygon (EVM compatible) and is pluggable to many different types of on-chain and off-chain applications. For web2 giants such as Netflix, Antic can offer embedded co-ownership mechanisms into their platform as a subscription payment option for users. For web3-native platforms, such as NFT marketplaces, users can be offered the option to include others in their purchase of an asset. There’s also interesting applications for the gaming sector: web3 games can now add group in-game purchases to their platforms. Gaming is already an incredibly community-driven sector, and adding co-ownership will further unlock value on existing platforms. Platforms involving IP also benefit from the shared ownership model: by fairly distributing credit and allowing audiences to co-own IP, value creation and reach expands substantially. Users can even invest in financial assets together with different ownership weights for different contributors.

Antic has interesting applications for fintech and ecommerce businesses. Source: Antic

Forbes notes that attempts at co-ownership mechanisms are currently mostly concentrated in the crypto sphere (shared virtual property ownership, fractionalized NFTs, treasury DAOs, etc). However, many non-crypto consumer-facing products and experiences lack the option of buying together, yet users still find a way to “share” in an unorganized way (e.g. someone logging into their friend’s Netflix account every time they want to stream, or buying baseball cards together and Venmoing each other after).

Using Antic is therefore differentiated when compared with exclusively on-chain mechanisms such as participating in a treasury DAO. With a treasury DAO, in most instances users must deposit the money first and then the asset to be purchased is decided upon later. In many other protocols, shared ownership involves the hassle of extra tokenization processes in order to distribute the asset among users. Antic’s core protocol prints multisigs based on a pre-decided purpose, enabling a set of predetermined users to seamlessly participate in the purchase. Companies can then easily integrate Antic’s API into their platform to support shared ownership. Another benefit of co-ownership is that for on-chain purchases, gas fees are lowered since they’re split between each of the parties involved.

Smart contract auditing for Antic was recently done by Quantstamp.

Co-ownership capabilities are easy to implement with Antic’s API. Source: Antic

Antic’s Team

Tal Dadia serves as founder and CEO at Antic, and brings experience from JP Morgan as their VP of Blockchain Products and Engineering. Prior to that, he was a blockchain research engineer at COTI Group, and has held numerous roles in business development and back-end engineering. He also comes from an academic research background in decentralized governance and cryptographic identities. Tal is joined by Adi Elimelech, VP of R&D, who has over 14 years of startup experience and works on driving product-led growth at Antic. The team has now expanded to 14 people and is growing rapidly, especially on the engineering and product side.

Antic’s Future

Antic plans to expand their EVM-based infrastructure to blockchains Solana and Flow next. Antic is also adding more and more companies to their closed beta and is currently in partnership talks with companies spanning entertainment, art, gaming, collectibles, and payments to bring their tech to a wider market. By abstracting away the blockchain piece and allowing users to co-own nearly anything, Antic will bring buying together to the mainstream and make more coordinated and flexible purchasing options the standard for both web2 and web3 platforms.

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

LETS MEET UP

Los Angeles, November 21-25

New York City, November 28 - December 2

Puerto Rico, December 13

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Thanks for reading VeradiVerdict! Subscribe for free to receive new posts and support my work.

Great piece Paul!

Just to clarify, was there anything that SBF did that was -- strictly speaking -- illegal? Not sure how regulatory frameworks wrt exchanges taking excessive leverage are

Hi Paul . I am an Investor and interested in Portfolio Investment Management. How can I receive your link or code to the fund ? My contact can he informed after your acceptance of this information . Thank you