Future is Bright

VeradiVerdict - Issue #114

Globe is a new crypto derivatives exchange unlocking fair, frictionless global markets both existent and possible

An institutional grade platform, it uniquely connects traders and institutions, east and west, initially offering highly in demand perpetual futures with free leverage of up to 100x, allowing for long or short positions on their innovative implied volatility future (XBTVIX), bitcoin, ethereum, and decentralized finance (DeFi) tokens. Globe intends to expand to offer richer crypto index perpetuals, linear/alternatively margined perpetuals, spot, yield products, options, vanilla futures, and other novel derivative classes covering untapped alphas that crypto is gradually unwrapping spanning real estate, equities/equity derivatives, energy/hashrates and more. Globe will reveal more at a regular pace after launch.

Founded by two former traders and digital asset technologists, Globe most recently raised a $3 million seed funding round and plans to launch its trading platform in the coming weeks. Globe’s matching and risk engine Thor, along with its other products helps traders manage wealth. Thor would “rival Nasdaq in terms of latency and throughput”, according to CEO James West, making it the first microsecond latency perpetual futures exchange.

Competitive Landscape and Market Opportunity

Globe arrives in the wake of substantial amounts of price discovery moving away from traditional crypto exchanges like Binance and BitMEX and onto private ones like the CME and LMAX. Globe is suddenly placed to bridge these two worlds for a new wave of traders.

It is also a time of heightened interest in DeFi and crypto assets from existing liquidity providers, and regulatory crackdowns on older exchanges like BitMEX.

Growing demand has led to DeFi hypergrowth, with total value locked up in all DeFi projects reaching an all-time high of $13.6 billion in November.

Source: DeFi Pulse

Recent Bitcoin booms have also caused a surge in futures trading volume across major exchanges. Bitcoin hit an all-time high of almost $20,000 in December, with increasing demand bringing its year-to-date gain to 177%.

Growth in open interest – the value of outstanding contracts yet to be settled – signals that more money is flowing in the crypto derivatives market. Recently, open interest on aggregated futures contracts reached a record-high $7.4 billion at derivatives exchanges.

Source: Skew

While BitMEX used to be the leader of the Bitcoin futures market, product stagnation, recent regulatory challenges and heightened volatility have propelled Binance Futures ahead as the leading futures exchange. In November, Binance Futures processed over $450 billion in volume, its highest monthly volume since its launch in September 2019 – a rise in demand partly driven by the regulatory probe against BitMEX. In October, the U.S Commodity Futures Trading Commission (CFTC) and Department of Justice (DOJ) charged BitMEX owners with illegally operating an unregulated platform and violating anti-money laundering violations.

Alongside the DOJ charges, developing international regulations and compliance standards will have widespread impact on the crypto futures market. In Hong Kong, the global dominant market for crypto futures trading, the Securities and Futures Commission (SFC) recently proposed greater regulation of crypto exchanges and assets, and requirements for all crypto businesses to comply with anti-money laundering rules. Since Hong Kong is home to leading crypto exchanges and enterprises, including BitMEX, Bitfinex, FTX, Huobi, and Bybit, the proposals could have ripple effects across the global cryptocurrency market, and increase demand for safe, secure, and compliant trading platforms.

Trading on Globe

Globe gives users access to up to 100x leverage for free, expanding users’ ability to control a large contract value with a relatively small amount of capital, and have a larger profit potential. Leverage is set automatically to help protect traders from risk and inverse market conditions.

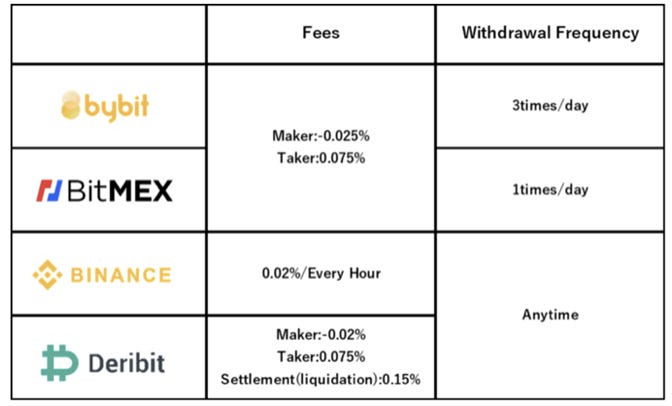

Globe classifies all trades as either a maker trade or a taker trade, depending on whether the trade adds to market liquidity (maker) or reduces it (taker). If a trader’s order matches an outstanding bid or ask, they are considered a taker. If the order is not immediately matched, it sits on the order book waiting to be filled, and users (makers) receive a rebate. Globe fees match those of the fastest growing crypto derivatives exchanges.

Similar to BitMEX and Globe, Bybit also offers up to 100x leverage for its Bitcoin perpetual swap contracts. BitMEX offers futures contracts for several altcoins, including Litecoin, Bitcoin Cash, and Cardano, but only has perpetual swap contracts for Bitcoin and Ether, while Bybit offers perpetual swap contracts for Ripple and EOS, in addition to Bitcoin and Ether.

Source: Bybit

Team

Globe was founded in 2018 by Y Combinator alumni James West and Shaun Ng, who operate as CEO and CTO respectively. West formerly led a quantitative trading team at a London hedge fund and continues to publish academic research on cryptocurrency markets with Globe Research. He earned a PhD in Biostatistics from University College London, and studied algebraic geometry at the University of Cambridge. Prior to co-founding Globe, Ng was a freelance crypto and blockchain developer and trader. He earned a Master’s in Astrophysics from the University of Cambridge and has published original research on gravitational waves.

Why is Globe compelling?

In the wake of regulatory probes and expanding regulation, the importance of CFTC-compliant, insured, and safe platforms like Globe is clear. Globe is compliant with the Bank Secrecy Act and AML rules with U.S. banking partners, and stores all Bitcoin in cold, multi-signature wallets, which are stored offline and cannot be stolen by hackers. The wallets also require authorization from 2 or more of its owners to process transactions, adding another layer of security. 99% of cold wallet deposits are insured, protecting traders’ accounts from dropping below zero.

Globe is here to drive innovation, on a generationally advanced solution arriving at a time of key market opportunity. With the recent downfall of BitMEX and growing institutional participation in crypto markets, the launch of Globe’s platform provides a solution building the integrity of crypto derivatives and digital asset markets for all.

- Paul V

DIGESTS

Hayden Adams: King of the DeFi Degens

Hayden Adams took a $65,000 grant and turned it into a $2 billion protocol; no other developer has come close to that.

NEWS

Someone Sent $166 Million in Bitcoin for Just $1.25 in Fees

Someone paid $1.25 to send $166 million of Bitcoin.

Visa Partners With Ethereum Digital-Dollar Startup That Raised $271 Million

Credit card giant Visa today announced it is connecting its global payments network of 60 million merchants to the U.S. Dollar Coin (USDC) developed by Circle Internet Financial on the ethereum blockchain.

REGULATIONS

Bitwise lists its crypto index fund on OTC markets, shares tradeable via brokerage accounts

BITW tracks the Bitwise 10 Large Cap Crypto Index and therefore it will give investors exposure to the ten largest crypto-assets.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Apple Co-Founder Wozniak’s New Venture Lists Token to Help Fund Energy Efficiency Projects

Apple co-founder Steve Wozniak has launched Efforce, a company that facilitates investments in energy efficiency projects via cryptocurrency and blockchain technology.

Balaji Srinivasan, Gitcoin co-founder back $750K seed round for decentralized notification system on Ethereum

The team behind a decentralized notification protocol Ethereum Push Notification Service (EPNS) has raised $750,000 at a valuation of $5 million, the startup announced on Tuesday.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.