GameFi Lending

VeradiVerdict - Issue #201

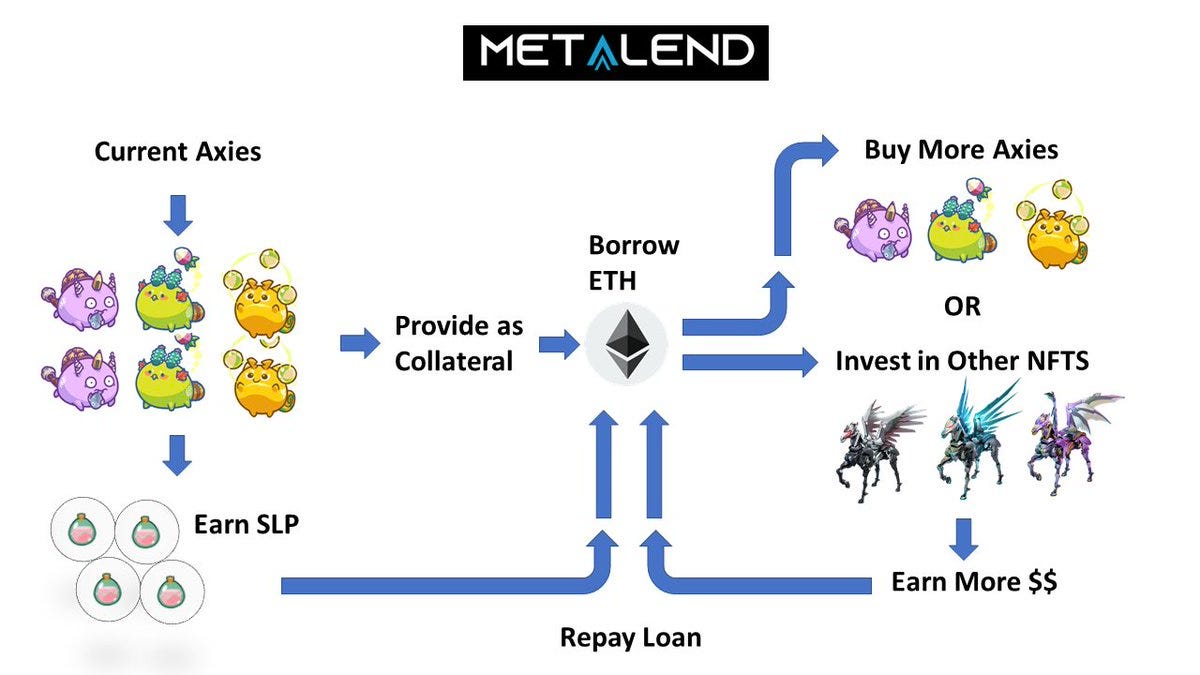

MetaLend is a DeFi platform that empowers users to keep playing and earning with their collateralized NFTs. Borrowers can use the protocol to take out loans against their NFTs and still maintain partial access to their assets and claim any yield from them. Pantera is delighted to have led MetaLend’s $5M seed round as they empower NFT owners and build out use cases around web3 gaming assets.

Many play-to-earn NFT owners purchase assets which lack lucrative financing and are generally only used in-game. To address this issue, MetaLend, a new DeFi company, built out a platform for NFTs to generate yield even if they’re being used as collateral. Users are able to appraise their assets and borrow up to 30% of their value in ETH against the NFTs. MetaLend’s protocol essentially provides liquidity from lenders seeking to earn interest. APY varies by currency loaned, and is set by utilization of the liquidity, with higher utilization corresponding to higher APYs. MetaLend currently supports Axie Infinity because of the substantial amount of liquidity and more stable price prediction, but plans to expand to Sandbox Land and others in the coming months. According to MetaLend, the Axie NFT market better enables the team to track prices and liquidity of their collateral. In addition, $SLP (Smooth Love Potion, the in-game digital currency of the Axie Infinity game) allows MetaLend to track USD yield of collateralized NFTs and $AXS (Axie’s token) enables them to track game popularity and engagement.

Snapshot of net APY, supply balance, and interest earned. Source: MetaLend.

According to MetaLend, “gaming is now responsible for half of all blockchain usage and the ‘Metaverse’ is estimated to be worth $1 Trillion – yet no financing exists for asset owners.” In November 2021, there were over 1M active gaming wallets out of nearly 2.8M total active wallets composed of DeFi, gaming, NFTs, and other categories. This proves the strength of the play-to-earn ecosystem and the demand for tooling to improve the efficiency of gaming NFTs. In MetaLend, month-over-month growth in collateralized NFTs grew over 60% in June, active borrowers grew by over 77%, and game accounts grew by 80%. The platform also saw total value locked, lenders, and scholar/game accounts grow.

Yield-generating collateral on MetaLend. Source: MetaLend.

Mechanism

The protocol allows borrowers to take out loans (in the form of ERC-20 tokens) against ERC-721 (NFT) assets, which then earn yield. MetaLend ensures that “borrowers still have partial access to their ERC-721 assets and have full rights to any yield that is generated by that asset.” With the borrowed tokens, users can either buy more yield-generating Axies invest in other NFTs. This creates a positive feedback loop that helps the liquidity and stability of the protocol.

MetaLend asset yield. Source: Attack On Axie on Twitter

The current max loan-to-value ratio – the ratio of the value of the loan taken out to the value of the NFT used as collateral – is 30%. If a borrower’s collateral value drops and the max LTV threshold is reached, the protocol’s smart contracts will begin to liquidate the NFT (at a 10% liquidation discount) in order to pay back the loan. The value of the ERC-721 token is determined by an appraisal engine run off-chain which re-appraises the assets hourly. The engine is run by a machine learning algorithm that analyzes transactions of similar NFTs to the one being appraised. For Axies, these traits include Axie class, breed count, body parts/cards, purity, last sold time, and last sold price.

Community

MetaLend has already built an impressive Discord community with over 1,000 members. Many of MetaLend’s users are similar in that they want to put their NFTs to work and are passionate about the NFT communities they’re a part of. Building a community around MetaLend is essentially bringing these like-minded individuals together to generate yield and further build out NFT use cases.

Team

MetaLend is led by co-founders Sudjeev Singh and Nikhil Bhardwaj. Singh led the marketplace product teams at Bird and ZipRecruiter, and Bhardwaj was the right-hand man to the Ring CTO, where he helped run the core engineering team. MetaLend has two blockchain developers on the team with extensive experience between them; one was a senior data engineer at Riot Games and the other built on Axie Trading Bot and was the #1 rated Solidity/ETH responder on StackOverflow. TJ, the team’s data and machine learning developer, was an engineer at Palantir and went to Carnegie Mellon for math and CS.

What’s next

MetaLend is planning on building out the protocol to support other GameFi NFTs besides Axie Infinity, with the first being Sandbox Land. Supporting different collections will help attract more users and grow revenue and diversification. To explore which options to enable, MetaLend is aggregating NFT data that analyzes a collection’s volatility, liquidity, yield, and longevity. The team also continues to onboard engineers and contractors as they expand. In addition, MetaLend is building out their own payout automation system internally for Axie borrowers to claim and payout their earnings to scholars. Since the protocol generates revenue from interest payments on loans, they’re able to price their payout system well below the market average (0.5%). By expanding financial tooling for lenders and borrowers and enabling every step in the process on their platform, MetaLend will become the go-to solution for GameFi business managers.

Because of the lack of performative financial tools for NFT owners, MetaLend is a great solution for users to accrue value on their play-to-earn NFTs. Pantera is excited to partner with MetaLend as they build effective financing tools for NFT owners and encourage growth in the play-to-earn ecosystem.

- Paul Veradittakit

Pantera Hosting After Dark Party in NYC

Join us for the best NFT NYC after party on 6/21 (Tues) at 9pm - midnight ET with music by Chantel Jeffries, gaming, open bar, delicious food at NYC's largest gaming lounge.

Register for the event HERE

DIGESTS

In Conversation With the Federal Reserve Chief Innovation Officer

I spoke to Fed Chief Innovation Officer Sunayna Tuteja about the central bank’s innovation team during Consensus 2022.

NEWS

Coinbase Lays Off Around 1,100 Employees

The exchange is reducing its workforce by roughly 18%. CEO Brian Armstrong admits the company "grew too quickly."

BitMEX’s Delo Will Not Face Prison After Guilty Plea

Ben Delo pleaded guilty to charges of violating the Bank Secrecy Act earlier this year.

MetaMask, Phantom and Other Browser Wallets Patch Security Vulnerability

There is no evidence the vulnerability was ever exploited by attackers, meaning no user funds are believed to have been impacted.

REGULATION

Crypto Lending Platforms 'Should Be Regulated': Former CFTC Chairman

“A lot of people have losses who didn't understand the risks they were taking,” Timothy Massad said on CoinDesk TV’s “First Mover.”

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Team behind Words with Friends raises $46 million for new gaming venture on Polygon

The round was led by Paradigm with additional support from Griffin Gaming Partners, Polygon, and Sabrina Hahn

Nansen Seeks to Reshape Crypto Messaging With Blockchain-Compatible App

Nansen’s app will initially be available for subscribers and certain NFT holders.

LETS MEET UP

NFT.NYC, New York City, June 20-24

London, July 14-18

EthCC, Paris, July 19-22

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.