Gaming Guilds 2.0

VeradiVerdict - Issue #178

Play-to-earn, a type of blockchain-based gaming where players earn money based on their in-game activities, has certainly been one of the most significant industry themes of the year. Axie Infinity, at its peak, generated over $15M in revenue per day, illustrating the power of play-to-earn gaming experiences. Many other games, from Star Atlas to Genopets, have since been announced, emphasizing that this trend of vibrant in-game economies is here to stay.

To maximize performance—and earnings—in many of these play-to-earn games, players sometimes are required to make an initial asset investment to commence their play-to-earn journey. As an example, in the Axie Infinity model, users must own a team of three “Axies” to begin battling, which can cost hundreds of dollars. This problem motivated the creation of gaming guilds. Guilds lend out in-game assets—such as those Axies—to their network of “scholars,” allowing them to play the game and taking a proportion of their earnings in return. Many of the largest guilds, such as Yield Guild Games or Merit Circle, have thousands of scholars and are both valued in the billions.

In November, we invested into the $6M seed round of GuildFi, a new gaming guild that hopes to level up today’s guild landscape. We participated alongside DeFiance Capital, Hashed, Coinbase Ventures, Alameda Research, and other crypto-native strategic partners.

Building a “Guild 2.0”

Many of today’s guilds are, at their core, simply asset managers. They decide which games to invest in (currencies and in-game NFT assets), lend those to their network of scholars, and earn a yield on their scholars’ activity. While many guilds offer other benefits to their scholars—such as proprietary software that increases their earnings on Axie Infinity—asset lending remains their core value proposition. We’ll call these a type of “Guild 1.0.”

GuildFi, instead of building yet another asset-lending guild, has its eyes set on being the infrastructure layer that connects these guilds together: a “Guild 2.0.”

Source: GuildFi

To understand what this means, let’s unpack the three main pieces of GuildFi.

1. GuildFi guild. Similar to other traditional guilds, GuildFi has a scholarship program that connects players—particularly those in Thailand—with scarce in-game resources. While the majority of their player base (and revenue) is attached to Axie Infinity, GuildFi has made an effort to make bets on up-and-coming play-to-earn games from across the ecosystem to offer to their scholars. Some recent investments include Pegaxy (P2E horse racing), Syn City (mafia-based metaverse), Elpis Battle (turn-based RPG game), Summoners Arena (blockchain version of Summoners Era), Sipher (casual fighting and exploration), and Nyan Heroes (third-person play-to-earn shooter game).

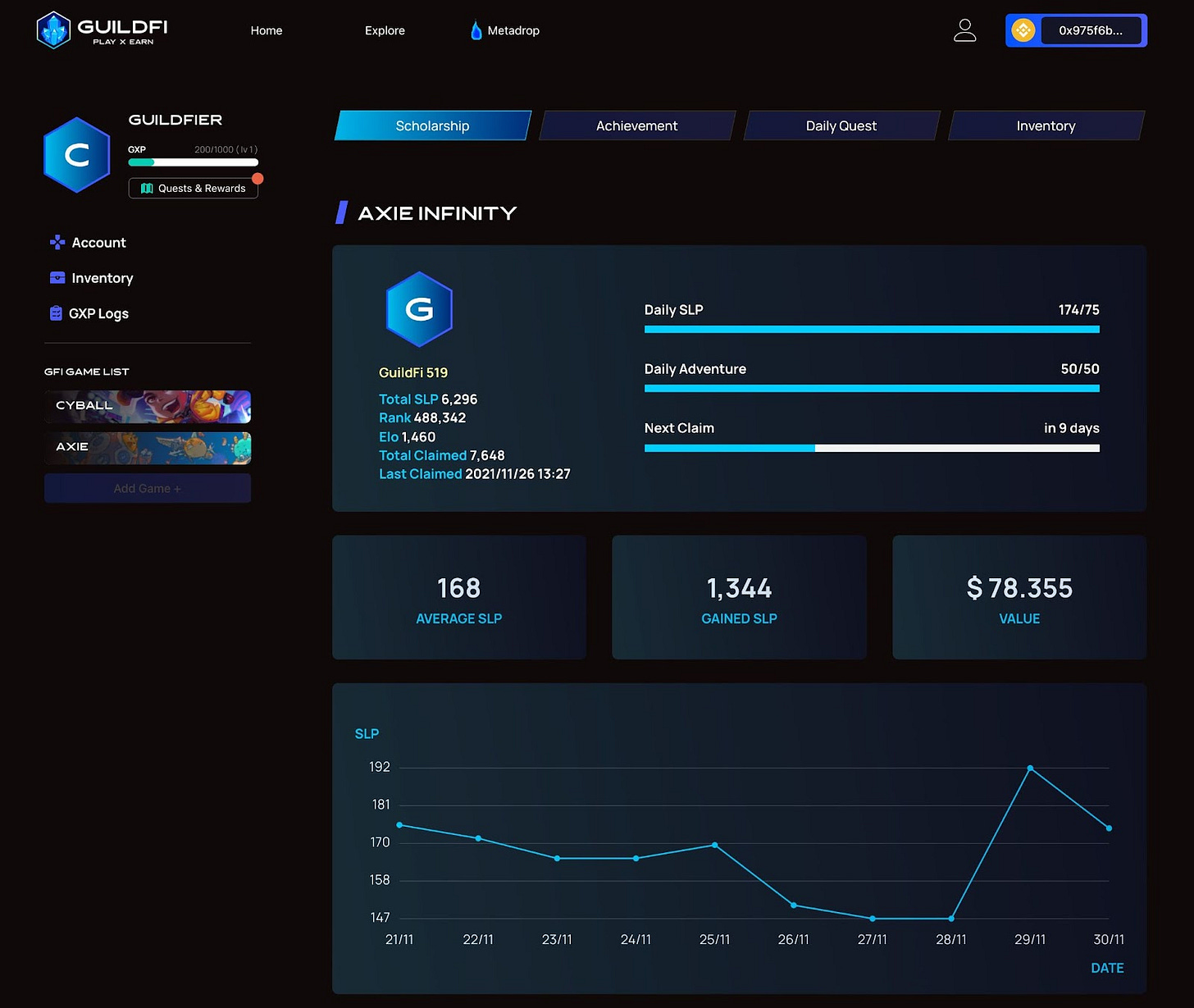

Source: GuildFi

2. Tools. The real piece that differentiates GuildFi is its software suite. Instead of being simply a guild, GuildFi is a guild platform. For example, "ezHub," GuildFi's flagship tool that currently features a set of Axie-specific tools such as scholarship management, card explorer, PvP simulation, and more. They also have a dashboard for players to find, compare, and join guilds for particular games. GuildFi is building player-empowering features such as a self-claim functionality that allows scholars to claim their earnings whenever they want. Through the “Game Discovery'' marketplace, players are introduced to new play-to-earn opportunities, similar to Steam. The Metadrop Launchpad allows games to distribute NFTs to their players and generate momentum around their project—their first Triple IGO Launch of Cyball’s NFT set a new record for volume on Binance NFT.

Source: GuildFi

There is a multitude of exciting features yet to be released, but this early suite of tools—for both the scholar and guild manager—has already begun to alter the way present-day guilds operate.

Source: GuildFi

3. Treasury. GuildFi’s so-called “Treasury Zone” is their investment vehicle with three different strategies. The Venture Fund invests in early-stage games and projects in the ecosystem, offering them a distribution channel to early players in exchange for prized in-game assets. This venture model has been tested by Yield Guild Games, Merit Circle, and other guilds to extraordinary early success. The Growth Fund will be a lower-risk strategy focused on yields from DeFi protocols and staking rewards. The final piece, the Development Fund, will reward GuildFi’s core contributors and incentivize community activity. In aggregate, these three strategies have the objective of growing GuildFi’s overall “pie” of assets that they can use to accelerate the gaming ecosystem. So far, as already the largest Treasury in their sector, GuildFi is on target for that goal.

Milestones in 2021

GuildFi has only been live for a few months, but their traction in 2021 has been remarkable.

Source: FTX Galaxie Cup

Here are a few notable achievements:

Over 3,100 scholars and 30 coaches in the GuildFi guild. A waitlist of over 20,000 players.

The global winner of FTX’s Axie Infinity Pro Tournament.

Strong community, with over 45,000 members of the Discord server.

150,000+ GuildFi IDs were created.

1,000,000+ “quests” were claimed from the Quest & Rewards program.

Over 10 unique games in the “Game Discovery” mode.

The GuildFi team has demonstrated its ability to ship new features and rapidly scale the platform’s reach. It will be exciting to watch their vision of a “Guild 2.0” come to life as we head into 2022.

$GF, GuildFi’s native token

Earlier this month, GuildFi launched its token to the community, $GF. The team raised nearly $140M from the token’s public sale, which will be provided to the protocol’s “Treasury Zone” (explained above) and be deployed into exciting metaverse-related investment opportunities. The token, at current prices, has a circulating market capitalization of $115M and a fully-diluted valuation of $2.6B.

The token has three main value accrual mechanics. The first is related to the guild’s ownership of assets (tokens, NFTs, and equity in companies) across the gaming ecosystem. In their words:

Source: GuildFi (Medium)

Secondly, holding $GF entitles users to particular perks, such as early access to games, NFT drops, and revenue-sharing from GuildFi’s products.

Third, as GuildFi progressively decentralizes into a DAO, $GF will also be the native governance token that determines the future direction of the project. $GF holders will be pivotal in proposing and voting on protocol-wide changes to the DAO.

In the short term, there’s also a staking program where 60M $GF will be distributed to early stakers. To learn more about how to stake your GF tokens, read this piece from the team.

The bottom-line: In less than a year, play-to-earn gaming guilds have gone from an abstract idea to a multi-billion dollar industry. In addition to their fast-growing scholarship program, we like GuildFi's approach in building the software tools necessary to better coordinate the experience of guild managers and players. We believe this “Guild 2.0” experience is a huge opportunity, and we’ve been impressed by GuildFi’s early success in building the play-to-earn interface of the future.

- Paul Veradittakit

DIGESTS

What Blockchain Projects Can Do for Social Good

There’s a natural intersection between impact investing and blockchain technology. Some blockchain startups are focused on making a positive social impact.

A Crypto Whisperer on How Regulators Toss Retail Into the Deep End

Industry commentator Maya Zehavi shares her views on capital controls, overregulation and crypto’s broken promises.

NEWS

Grayscale Adds Flexa’s AMP to DeFi Fund, Removes BNT, UMA in Quarterly Rebalancing

The world’s largest digital currency asset manager announced the updated Fund Component weightings for its products on Tuesday.

Regulatory Uncertainty a Recurring Theme at London’s Token2049

The crypto community needs to do a better job of lobbying and educating politicians, said Galaxy Digital chief Mike Novogratz.

REGULATIONS

European Markets Regulator Seeks Feedback on Regulation of Tokenized Securities

ESMA wants to explore whether existing regulatory standards need to be amended to be effective to accommodate securities traded using distributed ledger technology (DLT).

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Binance Invests $12M in Liquidity Platform WOO Network

The strategic investment follows WOO’s $30 million Series A in November.

Samsung Announces 3 TVs for 2022 With NFT Trading Capability

Three models for 2022 feature an “intuitive, integrated platform for discovering, purchasing and trading digital artwork.”

LETS MEET UP

Coffee meetings or walks in San Francisco

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.