HSDT, Solana Company - Building the Preeminent Solana Treasury

VeradiVerdict - Issue #339

Summary

This month Pantera Capital launched Solana Company (Nasdaq: HSDT), a Solana-backed Digital Asset Treasury that closed over $500 million in private placement with the potential to raise over $1.25 billion aggregate gross proceeds.

$HSDT Solana Company’s mission is to maximize SOL per share and provide access to one of the most commercially viable blockchains for capital markets.

Solana is positioned to become the premier destination for consumer applications and decentralized finance, powered by its highly scalable infrastructure, ultra-low transaction fees, and ease of accessibility to anyone with an internet connection.

It’s been an exciting month at Pantera. I’ve been on the road, speaking with our LPs and founders. What comes up the most in these conversations is the topic of DATs or Digital Asset Treasury Companies.

Pantera Capital has been at the forefront of establishing the digital asset treasury (DAT) category. We’ve anchored some of the earliest launches in the US including DeFi Development Corp. (DFDV) and Cantor Equity Partners (CEP), serving as anchor investor in BitMine (BMNR)—now the world’s largest Ethereum DAT—and most recently leading the formation of Solana Company (Nasdaq: HSDT), the preeminent SOL treasury.

Our thesis is straightforward: DATs can generate yield to grow net asset value per share, delivering superior returns compared to holding tokens directly or through ETFs, especially when investing near 1.0x NAV where you benefit from asymmetric risk/reward. After reviewing over 150 pitches and deploying capital across over 20 DATs, we’ve refined our diligence process and deepened our conviction that the best DATs will evolve into large-scale, strategic capital allocators across the digital asset ecosystem. Like any emerging category, this will mature and evolve—but ultimately, DATs provide investors from retail to institutions with accessible public market exposure to the leading blockchain infrastructure our industry is building.

The latest on Solana Company (Nasdaq: HSDT)

September 15: Pantera Capital and Summer Capital raised more than $500 million in funding to launch HSDT, a Solana Digital Asset Treasury. Read here.

September 22: HSDT then executed on our capital markets strategy by purchasing 760,190 SOL a week post-launch. Read here.

September 29: HSDT announced corporate name change to Solana Company and Letter of Intent with Solana Foundation. Read here.

In this issue, we will dive into the DAT thesis and our high conviction for Solana.

Revisiting the DAT Thesis

In our most recent Blockchain letter, Cosmo Jiang said, “DATs can generate yield to grow net asset value per share, resulting in more underlying token ownership over time than just holding spot”. This thesis has been proven by companies like BitMine Immersion, which grew ETH per share by 330% in its first month while accumulating 1.15 million ETH worth $4.9 billion.

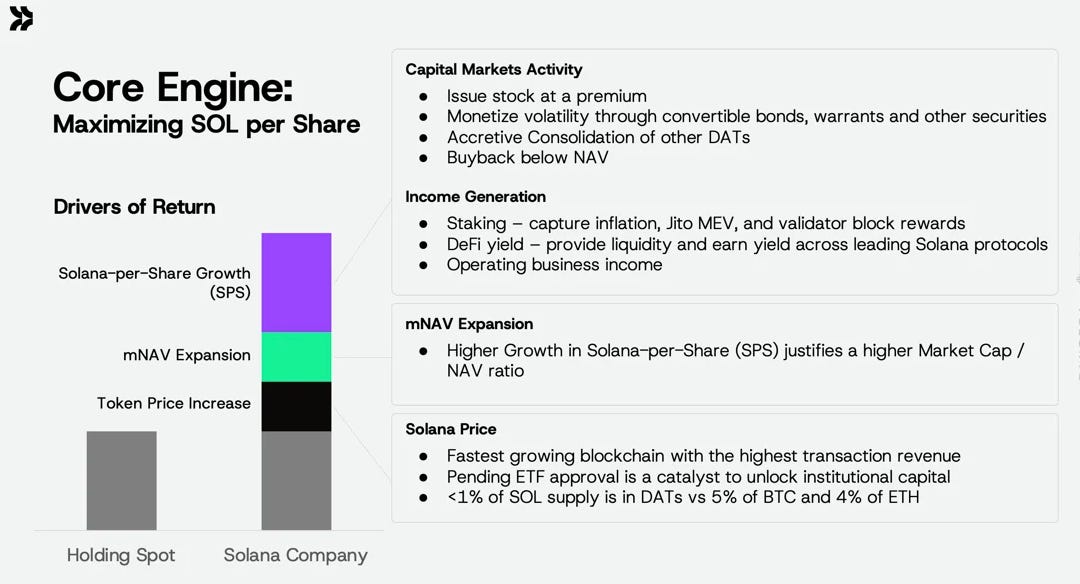

As seen in my previous blog, “A New Frontier for Digital Assets”, there are three factors contributing to an increase in share price: growth in underlying per share, mNAV expansion and token price increase.

There are two main ways HSDT maximizes SOL per share: capital markets activity and income generation. Through capital market activities, HSDT can issue stock at a premium, monetize volatility through convertible bonds and buyback shares below NAV. Through income generation activities, Hellius can stake the SOL it holds and generate DeFi yield. Solana typically generates ~7% staking yield. For most investors, staking directly is complex, but HSDT is designed to capture that yield on their behalf — turning SOL’s built-in productivity into incremental value for shareholders.

mNAV expands when there is a high growth of underlying per share, further propelling its share price. Lastly, SOL’s strong performance also increases the value of HSDT shares.

Why Solana

Strong Fundamentals

We believe Solana is positioned to become the premier destination for consumer applications and decentralized finance, powered by its highly scalable infrastructure, ultra-low transaction fees, and ease of accessibility to anyone with an internet connection.

“Solana is cheaper, faster and more accessible than traditional financial rails.”

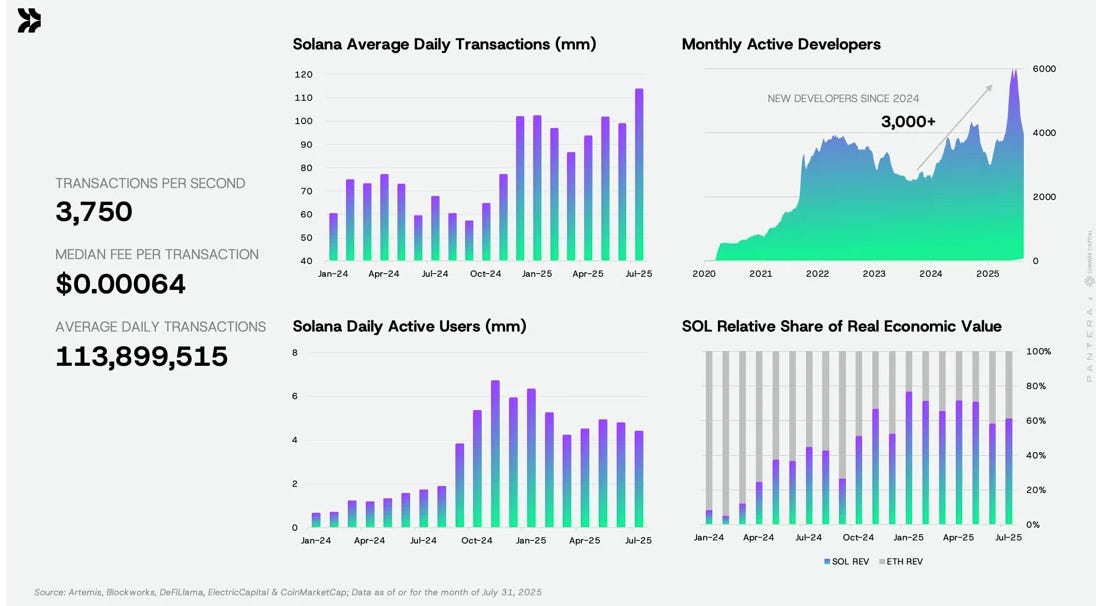

Solana is the fastest blockchain with 3,500+ transactions per second, <400ms finality, consistent uptime, and <$0.01 transaction fees that enable high volume activities. Solana is the most widely adopted blockchain with 7,500+ new developers onboarded in 2024 and 3.8mm + average daily active wallets processing 23bn+ transactions year-to-date.

Solana is also a financially productive asset with asymmetric upside. It offers 7% native staking yield with a deflationary fee burning mechanism while representing 5% of BTC market cap and 21% of ETH market cap. Solana has gained institutional credibility through utilization by blue-chip financial institutions including tokenized funds by BlackRock, Apollo, and Franklin Templeton, as well as payment rails adoption by PayPal and Stripe.

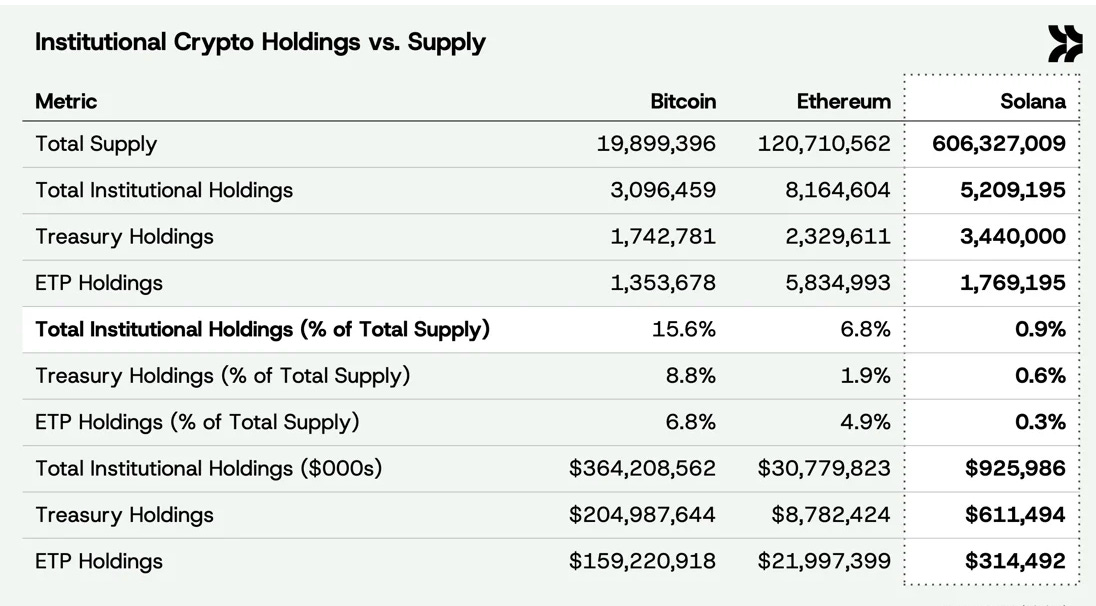

Solana is underallocated by Institutions

Institutional allocation data tells a compelling story - asymmetric opportunity. Solana sits at a mere 0.9% institutional penetration of total supply, dramatically trailing Bitcoin’s commanding 15.6% and Ethereum’s established 6.8%. This disparity becomes even sharper when examining corporate treasury allocations, where Solana captures just 0.6% versus Bitcoin’s massive 8.8% and Ethereum’s 1.9%. The absolute numbers are staggering: Solana’s $926 million in total institutional holdings represents a rounding error compared to Bitcoin’s $364 billion war chest and Ethereum’s $31 billion allocation. What we’re witnessing is a classic catch-up trade in the making - institutional capital recognizing Solana’s technical superiority and ecosystem momentum while the allocation gap remains wide open. As institutions begin connecting the dots between performance metrics and portfolio allocation, this underweight positioning creates one of crypto’s most compelling asymmetric bets.

Looking Forward

We’re still in the first inning for DATs, and it’ll take time for this category to mature. Not all DATs are created equal—what differentiates one from another is the management team behind it. That’s why with Solana Company (HSDT), we’re committed to building the preeminent SOL treasury to maximize SOL per share and provide access to one of the most commercially viable blockchains for capital markets. Beyond HSDT, Pantera continues to deepen its Solana ecosystem investments in infrastructure and applications like Raiku and Metaplex, while partnering with the Solana Foundation and Solana Labs on strategic initiatives. We believe in Solana’s strong fundamentals as the execution layer to upgrade our global financial system.

To learn more about HSDT, Solana Company here or on Twitter here.

- Paul Veradittakit

Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (”Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

Business

Ripple and Securitize Enable RLUSD Smart Contract Functionality for BlackRock’s BUIDL and VanEck’s VBILL Tokenized Funds

Ripple, the leading provider of digital asset infrastructure for financial institutions, and Securitize, the leading platform for tokenizing real-world assets, today announced a smart contract that would allow holders of BlackRock’s BUIDL and VanEck’s VBILL to exchange their shares to Ripple for Ripple USD (RLUSD).

PayPal launches new P2P payment links

PayPal launches new P2P payment links with upcoming crypto integration (Bitcoin, Ethereum, PYUSD) in the U.S.

Circle Beats USDH to the Punch with USDC Launch on HyperEVM

Circle launched USDC on Hyperliquid’s HyperEVM layer 1 blockchain on September 16, shortly after a $4.6M HYPE purchase by a Circle-linked wallet.

Regulation

SEC approves generic listing standards for crypto ETFs

The U.S. SEC’s approval of generic listing standards for crypto ETFs is expected to accelerate new ETF launches, with BlackRock and Grayscale leading high-volume debuts and industry experts viewing this as a catalyst for broader institutional adoption

New Products and Hot Deals

Raiku closed a $13.5MM raise, led by PanteraCapital, with Jump, Lightspeed, Big Brain and more visionary partners.

Raiku recently closed a $13.5 million funding round led by Pantera Capital. Other participants in the round include Jump, Lightspeed, Big Brain, and additional visionary partners.

Kraken introduced "Kraken Launch," a platform for participating in ICOs

Kraken introduced "Kraken Launch," a platform for participating in ICOs and early token sales directly through Kraken accounts, in partnership with Legion.

Kazakhstan Launches National Stablecoin

Kazakhstan is planning to launch “Evo,” a new stablecoin pegged to its national currency, Tenge. Solana, Mastercard, and several local organizations are supporting the project.

This Week at Pantera

Pantera's Dan Morehead on How Solana Became Crypto’s Most Attractive Asset

Pantera Capital Founder Managing Partner Dan Morehead discusses the growth of the crypto industry, Solana becoming the most attractive asset and how Congress’s stance on the industry has changed over the years.

Solana’s had better performance than bitcoin over the last four years, says Pantera’s Dan Morehead

Dan Morehead, Pantera Capital founder and managing partner, joins ‘Squawk Box’ to discuss the launch of a solana digital asset treasury company, ethereum vs. solana, future of crypto, and more.

Let’s Meet Up

I am in New York City the week of October 6th, feel free to DM me for a chat!

ABOUT ME

Hi, I’m Paul Veradittakit, , a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early-stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have any projects that need funding, feel free to DM me on twitter.