Institutional DeFi

VeradiVerdict - Issue #229

Fordefi, a fintech company building an MPC (multi-party computation) wallet and security platform for institutions, recently raised an $18M seed round led by Lightspeed Venture Partners with participation from Pantera, Jump Crypto, and Electric Capital, among others.

Popular traditional finance firms such as Goldman Sachs, Fidelity, and BlackRock have been increasingly entering the crypto sector due to heightened interest from their client base. Fidelity is delving into the sphere by allowing users to trade crypto, and Goldman Sachs announced that they’re launching a crypto data service and is also rumored to be on the market for buying crypto firms. BlackRock teamed up in August with Coinbase to enable its clients to purchase crypto in a streamlined way.

The growth of traditional finance entering the sphere throughout a year in which the industry experienced one of the worst crypto downturns we’ve seen is indicative of the sector’s resilience despite volatile markets. User demand for crypto is still quite high, and many choose to invest through a more centralized service, rather than interacting directly with crypto markets on-chain.

Alongside the growth of institutions entering DeFi, there has also been an increase in demand for crypto security throughout 2022. As an increasing amount of blockchain projects emerged and hackers became more sophisticated, there was more room for exploits – particularly in DeFi. For institutional investors, a core challenge to avoid security risk is managing users’ keys in a responsible way. Fordefi’s stack – including their security platform, MPC wallet, and web3 gateway – allows institutional investors to access the world of DeFi in a safe way on behalf of their users.

Fordefi’s core mission is to empower institutional funds – a sector that has previously had issues getting involved in crypto in a safe way – to securely transact across DeFi. At a base level, traditional finance institutions are generally incompatible with crypto. Therefore, there arises a necessity for financial layers designed to improve interoperability between the two. With these layers, liquidity improves, efficiency across transactions improves, and more individuals are able to get exposure to crypto via institutional investors. Fordefi provides this layer – complete with multiparty computation, personalized workflow, and multifactor authentication – for a range of institutional investors.

Fordefi stack. Source: Fordefi

Fordefi’s stack

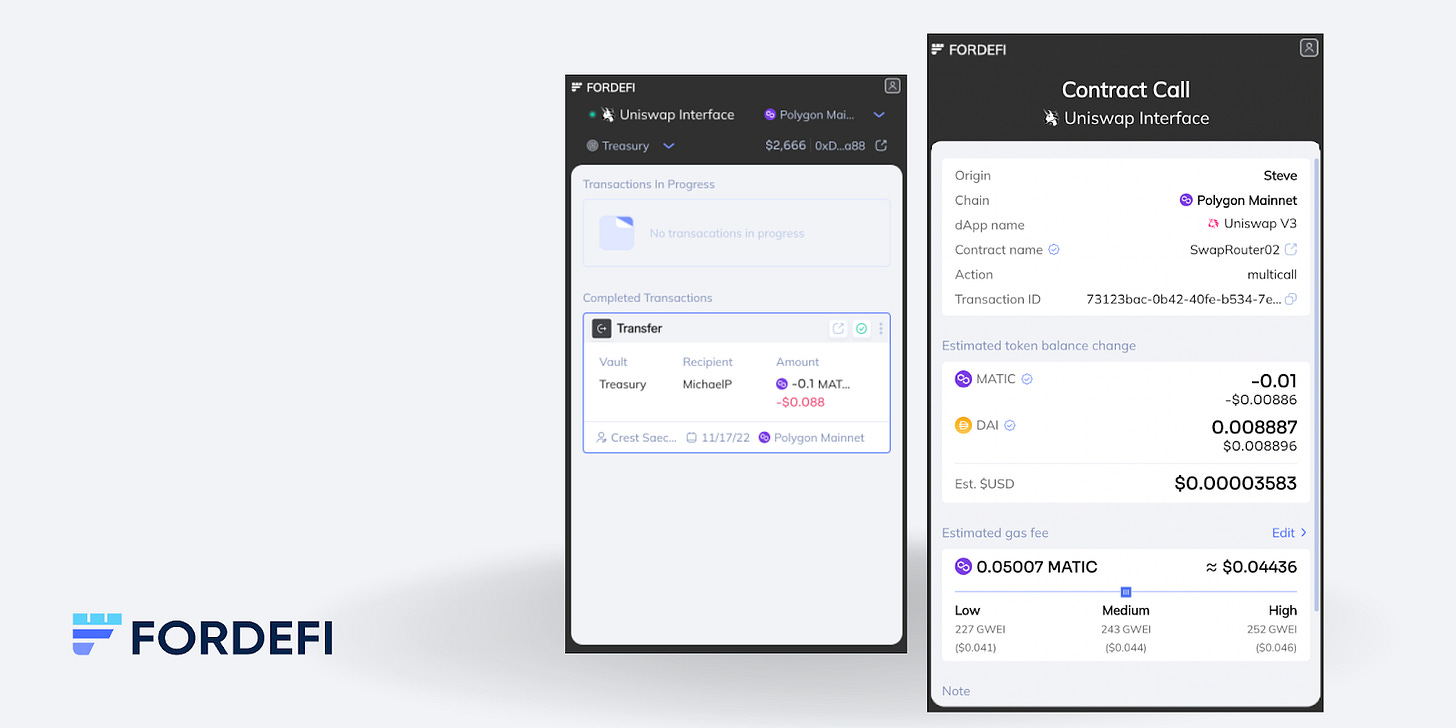

Fordefi’s platform is designed to offer institutional investors (crypto and tradfi) both security for their users and visibility into exactly what they’re doing on-chain. The first tool the company offers is a transaction simulator, which shows explicit details of each tx including run-time effects, balance changes, token approvals, and more. Fordefi also verifies smart contracts, dApps, and token addresses in txs so that mistakes aren’t made when transferring money to or from an on-chain contract address. Josh Schwartz, Fordefi’s co-founder, describes the company as a “category creator in the middle,” since they are providing both secure and efficient institutional software – something the sector has lacked for a while now.

An example tx on Fordefi’s platform. Source: Fordefi

Building at the infrastructure level means Fordefi is much more immune to crypto winters since they’re providing a platform for investment rather than directly investing themselves. This insulation, combined with general B2B stickiness, will allow the company to be resilient through crypto downturns.

Fordefi’s team

Fordefi’s founders are crypto veterans Josh Schwartz, Dima Kogan, and Michael Volfman (VP R&D). Schwartz serves as Fordefi’s CEO and has prior experience as COO at Curv, a crypto security provider which was acquired by Paypal in 2021. He was also previously VP of Sales at BitGo and Global Head of New Business Development at Bloomberg Tradebook. Kogan, Fordefi’s CTO, was a PhD student in the Applied Cryptography group at Stanford and was advised by Stanford’s renowned cryptography researcher and professor, Dan Boneh. Volfman leads R&D at Fordefi, and was previously VP R&D at Toka, a security platform for governments. He also previously co-founded an AI-powered tutoring tool called Mr. Miyagi. Together, the three co-founders bring impressive technical skills, business expertise, and creativity to Fordefi that will allow the platform to flourish as institutional adoption of crypto grows. The team is now 40 individuals across engineering, product, business, and research.

Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

Biggest Crypto CEO Exits of 2022

Many major industry executives resigned or were removed as the bear market set in and contagion took hold.

Ethereum’s 2022 in Review: The Merge, MEV and Mayhem

Ethereum’s year was marked by reductions to energy costs and improved scalability, but it was also racked by hacks and “censorship.”

BUSINESS

Coinbase Customers Block Attempts to Move Lawsuit to Arbitration

Coinbase has made significant efforts to keep several different cases limited to arbitration and out of federal courts in recent months.

FBI Investigating 3Commas Data Breach

This week, an anonymous person leaked 100,000 API keys connected to the crypto trading service.

REGULATION

China to Roll Out State-Backed Exchange for Digital Collectibles

The state-backed marketplace will serve as a secondary trading platform for what China refers to as digital collectibles.

Turkey Pushes Ahead With Digital Lira

The country’s central bank has completed the first tests of its CBDC.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Step Aside, Ethereum: Blockchain Project Stacks Wants to Bring Smart Contracts to Bitcoin

The project claims its Bitcoin sidechain can unlock “hundreds of billions of dollars” in DeFi on bitcoin.

Pega Pool Aims to Make Bitcoin Mining Eco-Friendly With Carbon Offsets

With Bitcoin mining’s fossil fuel use on the rise, the Bitcoin mining pool is on a mission to reduce the industry’s carbon footprint.

LETS MEET UP

PEER Summit, Salt Lake City, Jan 6-8

Walks and coffee meetings in San Francisco throughout the year!

Happy New Year to all of you and thank you for the continuous support!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Thanks for reading VeradiVerdict! Subscribe for free to receive new posts and support my work.