Market Making

VeradiVeradict - Issue #122

Market making an an essential component of any token issuer’s launch and has even been a requirement for larger, reputable centralized exchanges for listing. Pantera and Lightspeed recently invested into Wintermute, a leading global algorithmic market maker in digital assets which creates liquid and efficient markets on the world’s best crypto exchanges and trading platforms.

Liquidity, or the amount of liquid (quickly accessible) assets, is a key factor in efficient markets. Brokerages and exchanges need sufficient liquidity and buy-/sell-demand from third parties to allow their clients to trade freely and openly. Crypto protocols, in particular, need massive amounts of liquidity for token collateral, loans, or simply just powering trades.

Market makers (MMs) are financial institutions that buy and sell assets on exchanges and other trading platforms and profit by optimizing their “bid-ask-spread,” which is the difference between the price at which they price the sale of their asset and the price at which they are willing to buy the asset. MMs are a key component in supplying liquidity to some of the world’s biggest markets, including US securities/public equities.

Most MMs in crypto treat crypto as a peripheral business to traditional markets (mainly US equities), focus on hyperspecific markets (like East Asia), or are automatic, and are dependent on incumbent trades from users in order to allocate liquidity effectively. While several have gained prominence, few have been able to offer the general capabilities necessary to power liquidity for a diverse set of exchanges and protocols.

Wintermute is an MM that is natively designed for crypto trading. The founding team, with decades of experience in market making and trading, has architected hundreds of proprietary trading algorithms that help Wintermute hedge risk, generate profits, and supply liquidity to various crypto exchanges and protocols. The MM has already captured significant volume from some of crypto’s leading platforms, like Coinbase, Binance, and more.

Leading MMs like Wintermute can help make crypto markets become even more efficient by working directly with platforms like aggregators, which aggregate liquidity across hundreds of DeFi protocols. By combining the networked nature of aggregators with the liquidity supply of Wintermute, crypto markets can become extremely efficient, capturing the attention of more and more traditional traders and bringing in (and process) much more volume.

As crypto and DeFi continue to explode in popularity and value over the next few months, platforms like Wintermute will be absolutely essential in supplying the necessary liquidity for various DeFi protocols to operate. The company has already claimed the top position on Bitfinex’s list of the top traders on the platform ranked by volume. Through powering efficient markets, Wintermute helps realize DeFi’s vision of offering efficient and consistent access to capital for protocols’ end users.

The Need for Liquidity

Liquidity, or the availability of liquid (quickly accessible) assets, is the bread and butter of efficient markets. In this past week’s madness on Wall Street, unprecedented volatility forced many platforms geared for retail investors, like Robinhood, to restrict the trades of certain assets, because these platforms lacked the necessary liquidity to put up collateral for their clearinghouses and other partners. Ensuring ample liquidity is key for financial platforms and protocols to offer open access to efficient trades for its users. Crypto protocols and exchanges require immense amounts of liquidity to collateralize their tokens, offer various loan products, and power swaps and trades for retail and institutional investors alike.

With the recent explosion of interest in crypto and DeFi, protocols will be in higher demand for liquidity than ever before, and the space may see an influx of capital like never before. It’s therefore critical that the community comes up with novel, innovative ways to allocate capital and liquidity effectively to these protocols, promoting an efficient crypto market and maximizing returns.

What are Market Makers?

In the securities market, the primary agent for supplying liquidity is the market maker (MM). MMs are institutions or platforms that both buys and sells various securities to several exchanges. It may seem unintuitive (and unprofitable) for MMs to both buy and sell the same asset, but MMs optimize a metric called the bid-ask-spread, which is the price by which the sell price (or ask price) exceeds the buy price (or bid price).

For example, an MM working with an exchange might allow that exchange to both buy and sell a certain asset X, with a sell price of $100.05 and a buy price of $100. As the exchange receives buy and sell orders from its clients, the exchange then interfaces with the MM to execute these orders, by buying and selling them. Over time, a well-designed MM profits from the bid-ask-spread; if the MM sells 1000 more shares than they buy, they would earn a profit of (1000)($100.05-100.00) = $50. In bulk, these amount to massive profits.

MMs are key engines of the US public equities market. Some prominent examples include GTS, Citadel Securities, Virtu, and Two Sigma Securities. With trading volumes rising and new tokens popping up across hundreds of exchanges, MMs will be key to ensuring that crypto markets operate efficiently and in the interests of its end-users.

What is Wintermute?

Several existing MMs already have crypto capabilities, including Jump Trading, Amber, Alameda Research, and more. Most of these MMs, however, either offer crypto as a peripheral service to their core product (generally, US public equities) or target specialized markets (such as Asia). Others, like Uniswap, are automatic market makers (AMMs) and can even be decentralized. Still, these AMM solutions are limited by how many incoming trades they get from their users and lack the capability to inject capital quickly when there is a gap in the market.

Wintermute is an algorithmic market maker designed natively for crypto. Since its launch in 2017, the company has built a suite of proprietary trading algorithms in CeFi, DeFi and OTC (over the counter) markets. These algorithms have been extremely successful; last week, Bitfinex listed Wintermute as the top trader on the platform by volume, with a weekly trading volume of almost 2 billion USD, roughly twice more than second place.

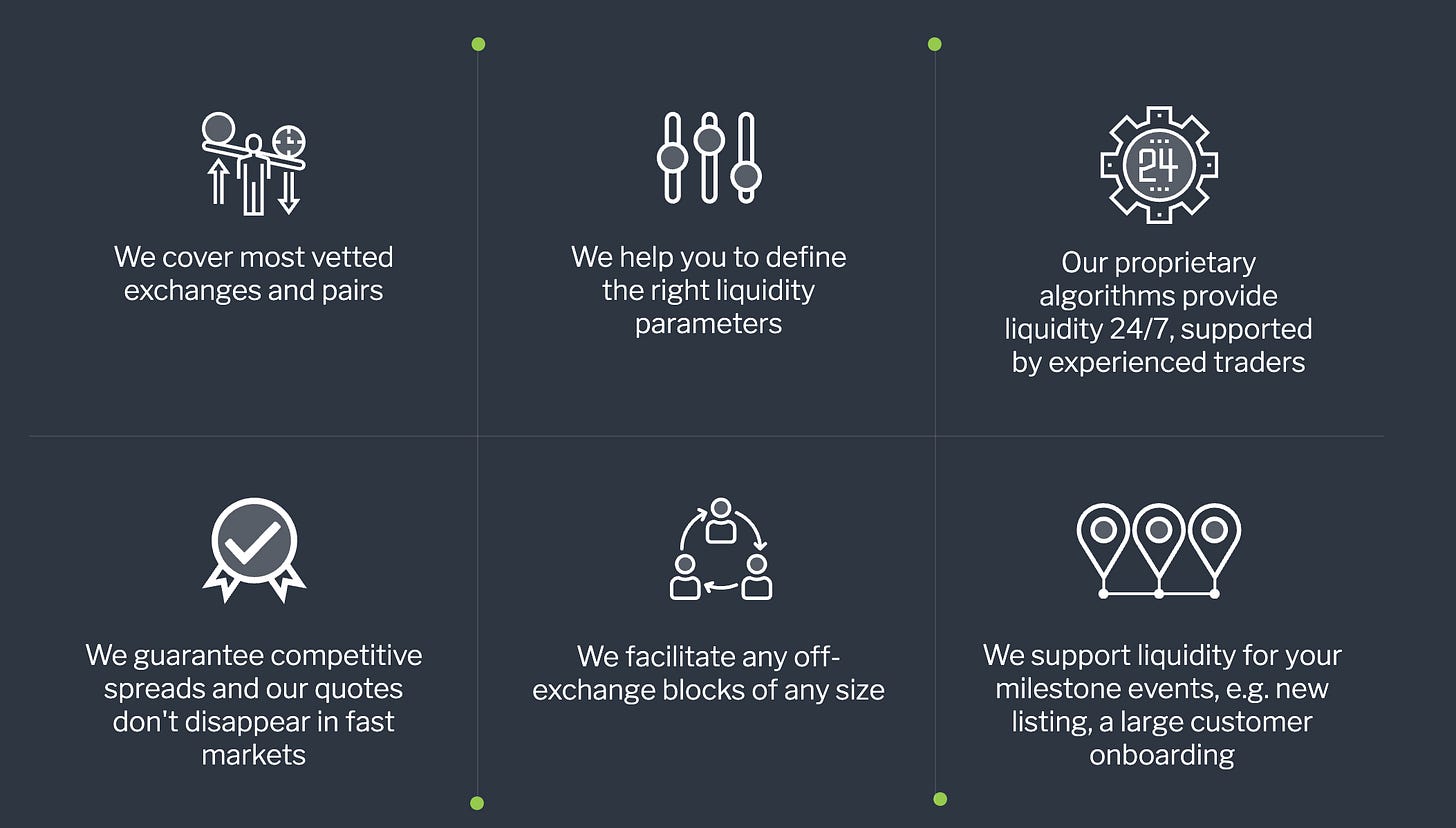

Wintermute’s crypto-native approach makes it an incredibly appealing partner for crypto titans and up-and-coming protocols alike. It works with over 50 exchanges, and some of its most prominent partners include Binance, Coinbase, and Kraken. By partnering with these leading exchanges, Wintermute also positions itself as a leading MM across the entirety of crypto, powering many different assets and users, rather than focusing on a hyperspecialized market. Wintermute is also supporting the world’s best blockchain projects at the time of listing and beyond. They even plan to expand beyond Western markets, particularly into Asia, in the near future. Additionally, since the liquidity provider operates via proprietary trading algorithms, Wintermute is also not dependent on incumbent trades from users to optimize their bid-ask-spreads, allowing them to deploy liquidity much more efficiently and easily.

What does Wintermute mean for the future of crypto trading and DeFi?

Already, Wintermute powers significant volume for the world’s leading exchanges accounting for double-digit market shares on some of key exchanges . As more crypto exchanges and financial platforms pop up, Wintermute will be a key partner in powering these protocols, offering the necessary liquidity to keep crypto markets efficient and appealing for all kinds of users.

Another growing trend in DeFi is that of the aggregator, a sort of meta-protocol that consolidates liquidity across hundreds of decentralized exchanges to increase market efficiency. MMs like Wintermute can supply liquidity directly to these aggregators rather than interfacing directly with different pools, which leads to seamless processing of transactions and incredible levels of efficiency. MMs like Wintermute are a key component in building an efficient crypto market that can support the full promise of financial assets on the blockchain. Wintermute also intends to explore derivatives markets and scale its OTC activities with the launch of RFQ platform for financial institutions), which may help power a new generation of exchanges and protocols for those assets.

Who’s behind the project?

Collectively, the Wintermute team has over 70 years of experience in market making, trading, and managing risk and compliance across complex financial assets. CEO Evgeny Gaevoy previously ran the European ETF business at Optiver, and CTO Valentine Samko formerly worked as a software engineer at proprietary trading firms and banks such as Barclay’s, JP Morgan, and more. With their remarkable market making experience, the team is well-poised to partner with leading exchanges to develop a top-tier MM product.

Final Thoughts

Liquidity is one of the biggest existential challenges for any financial protocol, but particularly those in volatile markets. Crypto is becoming more mainstream by the minute, and exchanges are listing new tokens each day; it’s more critical than ever that the community find robust, efficient ways to ensure that exchanges and other protocols have enough liquidity.

- Paul V

DIGESTS

Introducing Balancer V2: Generalized AMMs

The core tenets of Balancer V2 are security, flexibility, capital efficiency and gas efficiency.

NEWS

1INCH price rallies 30% as its monthly DEX volume nears $6 billion

The total value locked in 1inch is closing in on $1 billion, and the decentralized exchange aggregator has processed nearly $6 billion this month.

Visa Signals Further Crypto Ambitions With API Pilot for Bank Customers to Buy Bitcoin

Visa is working with Anchorage to allow customers at traditional banks to "buy and sell digital assets such as Bitcoin."

Blockfolio launches zero-fee crypto trading on its app

In the future, FTX.US could offer stock trading to US users of Blockfolio. The firm is in the process of acquiring a broker-dealer that would set the foundation for such an offering.

REGULATIONS

ErisX Exchange Asks CFTC to Approve Sports Bet Futures as ‘Risk Hedging’ Tools

If approved, three proposed futures contracts would be tied to the outcome of National Football League games.

China’s Central Bank Is Partnering With SWIFT on a New Joint Venture

It's unclear what the new group's mission will be, though People's Bank of China employees working on its digital currency efforts will be involved.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

DeFi options platform Opyn raises $6.7 million Series A led by Paradigm

Opyn, a decentralized finance platform for options, has raised $6.7 million in a new Series A funding round.

Bitcoin Security Firm Casa Nets $4 Million in Seed Funding

Casa plans to use the funding to expand its team and continue developing its product portfolio, which includes its free-to-use Casa Wallet self-custody Bitcoin app as well as more advanced security services for paying customers.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.