Background

Since the creation of Bitcoin, we have witnessed the "L1 Wars," which have spurred the development of cutting-edge technologies to address the blockchain trilemma. The demand for highly scalable solutions has persisted, as no single solution has been able to meet the industry's demands while ensuring top-level security. This led to the creation of Sui and Aptos, leveraging the architecture from Facebook's abandoned Diem and Novi projects.

Aptos

Aptos Labs, led by Mo Shaikh and Avery Ching (executives from Diem/Novi), created the Aptos blockchain with the goal of reinvigorating Diem's technology and competing with established market leaders like Ethereum and Bitcoin. Aptos aims to provide a flexible, scalable, and secure infrastructure. It utilizes Diem's architecture alongside cutting-edge techniques to ensure high throughput, low latency, and verifiable state synchronization.

Sui

Sui, built by Mysten Labs and managed by former Facebook executives Evan Cheng and Sam Blackshear, was developed to address the limitations hindering current crypto networks from meeting the demands of at-scale usage. Unlike Aptos, Sui is not a Diem derivation but was built from the ground up, embracing inherent scalability and rapid settlement. Sui aims to offer high throughput, low latency, and affordable computing resources necessary to power applications for billions of users.

Move: The Scalability Language

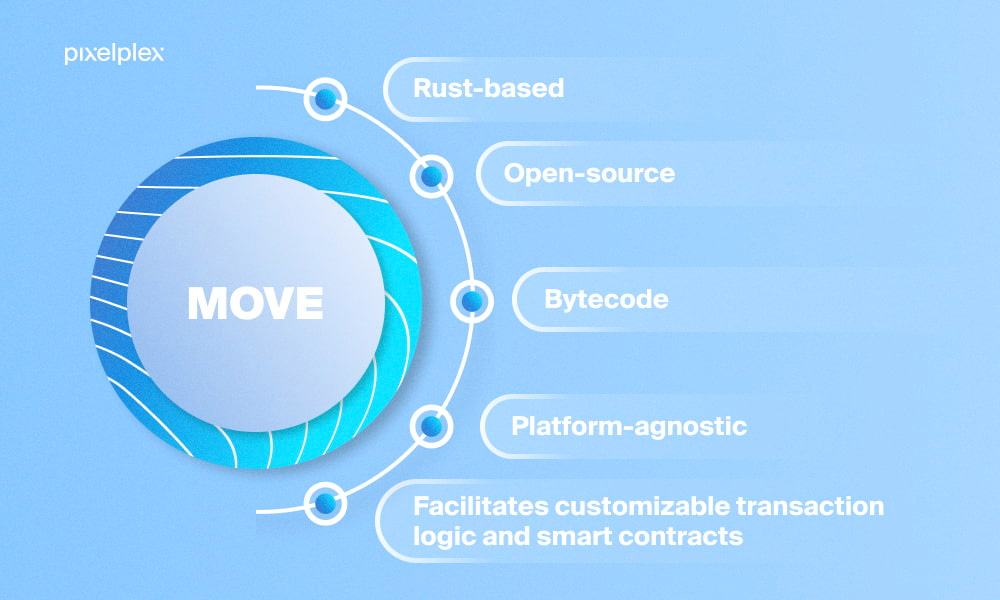

Both blockchains employ Move, a Rust-based programming language that allows for parallel processing. The Move ecosystem includes a compiler, a virtual machine, and other developer tools. Aptos uses the language's core implementation, although Sui has made a few minor changes to better fit its' architecture.

Background

Move is a bytecode language used to design custom transactions and smart contracts. What sets Move apart from other languages, like Solidity, is its resource management capabilities and emphasis on scarcity and access control over digital assets. Scarcity limits asset formation to reduce the risk of double spending, while access control determines ownership and asset access. Move's resource management is based on the mathematical idea of linear logic, treating assets as absolute resources that are lost forever once used up. This resource specificity allows for secure transfers between program storage places without implicit removal or copying, hence the name "Move."

Sui’s Move changes

Although Aptos’s Move mostly replicates Diem's white paper, Sui adds an object-oriented storage system to keep track of everything, including addresses and transactions.

Sui's property classification into objects is defined as follows.

Shared object: It is mutable, has no clear owner, and can be used without authorization in the transactions of several parties.

Owned object: Own a unique owner and can only be altered by that user.

Read-only object: Has no sole owner, cannot be altered after publication and is available for use in transactions by all users.

The classification of these assets into distinct domains reduces processing and transaction times, providing scalability in NFTs, gaming products, etc. This is also a primary basis behind Sui's role in the NFT/games industry.

Consensus Foundation for Sui/Aptos

Consensus is a procedure that enables blockchain nodes (validators) to concur on the reliability of transactions and blocks. Both Aptos and Sui are built on the widely recognized concept of Byzantine Fault Tolerance (BFT). The consensus mechanism's central tenet is that the network may continue to operate normally even if up to 1/3 of the validators become malicious or fail.

Byzantine Fault Tolerance (BFT)

The basic concept underlying BFT is as follows:

A network is made up of validators, who together have N votes that are used to decide whether to approve a new block.

N usually has a value of 3F+1 and must withstand a certain number of validators with F votes. This implies that up to F validators may be malicious, slow, disconnected, etc.

In each round, a leader is selected in a random and observable manner.

In Each cycle, a leader proposes a new block, and the remaining validators vote on it.

They can come to an agreement on consistent choices as long as 2F+1 votes are held by trustworthy validators.

Task Parallelization Techniques:

Aptos’ Block-STM

Aptos achieves transaction parallelization through Block-STM, an enhancement of the high-performance HotStuff algorithm inspired by Software Transactional Memory. Block-STM identifies transaction relationships and enables parallel execution. If a transaction fails validation but has dependencies, it can be re-executed; otherwise, it is discarded. Once disputes are resolved using a lazy commitment method, all transactions in a block are committed to the blockchain simultaneously. This approach conserves time and resources as transactions no longer need to be processed sequentially.

Sui’s Narwhal and Tusk

For complex processes, Sui employs the Narwhal & Tusk consensus technique for parallelization in its execution layer. Narwhal is a mempool module that assures the availability of data submitted to consensus. Narwhal's design uses a Directed Acyclic Graph (DAG), in which its numerous components are connected by networks rather than chains (similar to distributed ledgers). It may also be used independently (without Tusk) with other consensus engines, including HotStuff or Cosmos' Ignite.

Summary of the life cycle:

A sender (which functions similarly to a leader node) advertises a transaction to all Sui validators.

The sender receives votes from Sui validators. Weights are assigned in proportion to the validators' interests in Sui under Delegated Proof of Stake setups.

Votes that satisfy the conditions for Byzantine-resistant-majority are gathered by the sender to create a certificate. Validators must reach a consensus through Byzantine Agreement used to sequence the certificate in order (present in the diagram above).

After processing each certificate in turn, the sender sends the certificates back to the validators one last time to finalize the transaction.

Sui's transactions are connected as a networked graph rather than a series of sequentially crammed transactions in a blockchain. This DAG-based data paradigm, along with breaking transactions into smaller pieces and leveraging their inherent properties, increases scalability. Sui's asynchronous architecture provides security against denial-of-service attacks, and Tusk, a high-performance BFT consensus procedure, ensures transaction sequencing. Together, Narwhal and Tusk enable each validator to handle more transactions within a given timeframe.

Product Performance:

Aptos: 160k TPS

Aptos boasts a processing speed of up to 160,000 transactions per second (TPS). This achievement is made possible by four key technical advancements: parallel transaction execution, state sync, lazy commit, and collaborative scheduling.

Parallel Transaction Execution - the processing of transactions in parallel and the redoing of dependent processes.

State Sync - Chain data may be synced and validated by reliable non-validators.

Collaborative Scheduling - Allows the resource allocation for transactions to be optimized during the scheduling phase to speed up processing.

Lazy Commit - The idea of committing transactions in bulk after the Block-STM procedure is complete.

Sui: 120k & "infinite" TPS

An eight-core Macbook pro is able to handle over 120k TPS on the Sui blockchain.

This depends greatly on the sort of transaction since simple transactions don't call for a broad consensus and allow horizontal expansion. Sui's performance is potentially 'infinite' at its maximum size. As the network demand develops, Sui nodes can continue adding workers to complete additional transactions.

Use Case:

Both Aptos and Sui cater to a wide range of use cases across various industries and applications.

Aptos Blockchain's versatile architecture makes it suitable for applications in different sectors. Its primary goal is to decentralize the cloud infrastructure powering Web 2.0 applications, facilitating the widespread adoption of Web 3.0. With scalability, security, and low fees, Aptos Blockchain is well-suited for applications in finance, supply chain management, decentralized finance (DeFi), gaming, identity management, and more. The platform's focus on addressing real-world problems positions it as an attractive option for developers and businesses seeking robust and scalable blockchain solutions.

Sui Blockchain, as a permissionless Layer 1 blockchain, offers immediate settlement, fast throughput, and low latency, making it applicable to various industries and use cases. Its emphasis on energy efficiency and decentralization positions Sui as an ideal choice for applications in finance, Internet of Things (IoT), gaming, social media, content sharing, and other latency-sensitive domains. Sui's commitment to supporting latency-sensitive decentralized applications establishes it as a strong contender in the blockchain ecosystem.

Traction:

Aptos has secured substantial funding from prominent venture capital firms, totaling approximately $400 million. Investors include Andreessen Horowitz, FTX Ventures, Jump Crypto, a16z, Tiger Global, and Multicoin Capital, among others. This robust financial support highlights investors' confidence in the Aptos project and its potential for growth and success. The involvement of reputable firms not only provides financial backing but also opens doors to potential collaborations and partnerships, further strengthening Aptos' position in the market.

Sui has also experienced strong support from major investors, such as Lightspeed Venture Partners, Andreessen Horowitz, and Redpoint. In its latest funding round, the Series B, Sui raised an impressive $300 million, bringing its total funding to $336 million when combined with the $36 million raised in the Series A. The substantial funding and high valuation of over $2 billion underline the market interest and confidence in the Sui project. The involvement of reputable investors paves the way for strategic alliances and partnerships, contributing to Sui's growth and ecosystem development.

Additionally, both Aptos and Sui have cultivated vibrant and active communities of developers, enthusiasts, and users. These communities actively contribute to the ecosystem through application development, engagement in discussions, and sharing of ideas. The community-driven nature of both platforms fosters innovation, collaboration, and adoption, creating a robust ecosystem around Aptos and Sui.

Closing Thoughts

While it remains to be seen which solution will emerge as the dominant market winner, both Aptos and Sui have made significant strides in their development, greatly advancing the current state of blockchain design. Aptos has gained traction by being comparatively first to market and attracting substantial attention, while Sui has benefitted from its innovative and security-focused approach. One thing is certain: with their enormous potential to improve the scalability and security of crypto networks, Move-based technologies are poised to leave a lasting impact on the industry.

- Paul Veradittakit

DIGESTS

Binance’s New General Counsel On the Cutting Edge of Crypto Regulation

Each day brings “a legal question which there’s no precedent for,” says top lawyer Eleanor Hughes, as Binance works to build trust in the industry.

Coinbase Is the Real Winner in the Bitcoin ETF Race—Here’s Why

Coinbase has been tapped by BlackRock and others to help launch a Bitcoin ETF, and its stock price has felt the bump. But the company still faces significant risks.

BUSINESS

Bitcoin Holds Steady After Federal Reserve Raises Rates to 22-Year High

The Federal Reserve today said it would continue to hike interest rates—but Bitcoin and Ethereum did not immediately move.

REGULATION

House Financial Services Committee Votes in Favor of Crypto, Blockchain Bills

The votes mark the first time crypto-specific bills were advanced on their own merits and not as part of broader legislation.

Feds Want Sam Bankman-Fried Jailed Until Trial Over Alleged Witness Tampering

Federal prosecutors accused Bankman-Fried of trying to discredit a witness in talking to the New York Times.

NEW PRODUCTS AND HOT DEALS

Private Banking Firm With $14B Assets Starts First Crypto Fund of Spain

The fund will be accessible to professional investors only and will be audited by PwC.

Reddit Launches More Polygon NFTs—After Already Minting 18 Million Avatars

Cool Cats and Aku are in the mix for the new Collectible Avatars NFT drop, with prices ranging from a couple bucks to $200 apiece.

LETS MEET UP

Science of Blockchain Conference, Stanford University, August 28-30

Starknet Summit 2023, San Francisco, August 31

TOKEN2049, Singapore, September 11-13

Mainnet 2023, New York City, September 18-22

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.