NFT: Real or Fake?

VeradiVeradict - Issue #210

Optic is building an AI-enabled NFT verification protocol to provide fraud-related NFT analytics and community NFT discovery. Pantera is thrilled to have recently led Optic’s $11M seed round alongside Kleiner Perkins, Lattice, OpenSea, Circle, Polygon, and others as they help encourage authenticity and transparency across NFT marketplaces and communities.

Often, purchasing an NFT is the first step crypto-curious individuals take before entering the broader web3 ecosystem. It’s a fun and simple way to purchase digital assets while simultaneously supporting artists and becoming a part of a larger community. Unfortunately, many eager individuals new to crypto – as well as existing buyers – are increasingly becoming susceptible to fraud and scams, particularly in NFT markets. Because digital art can be easily (slightly) altered, replicated, and then minted on-chain, it’s sometimes difficult to decipher which pieces are legitimate – especially when the art is listed on a marketplace the buyer trusts. Despite this, excitement is high: during the first quarter of 2021, there were over $2B in NFT sales. Additionally, around half of all NFT sales are under $200, showing that many buyers are willing to deploy a smaller amount of capital to become a part of a community and hopefully turn a profit. However, according to Optic, ~90% of NFTs are traded on OpenSea, but the space is rife with fraud – for example, 80% of lazy mints on OpenSea were scams. This fact deters many buyers from purchasing NFTs (even ones they’re excited about) because of the high probability of fraud on the platform. Optic aims to solve this issue by using an AI engine to monitor newly minted NFTs and compare them to existing legitimate collections on marketplace websites.

As NFT popularity and collections grow, so does fraud susceptibility. Source: Optic

A broad reach and a comprehensive tooling suite

Optic’s AI indexing now covers 3334 NFT collections which make up over 30M assets, and the protocol processes over 5M assets (2TB of data) per day. OpenSea, the world’s largest NFT marketplace, is Optic’s first and largest customer and uses their Marketplace Moderation tool to process huge amounts of data on a daily basis. Their AI algorithm monitors for qualities like color changes, distortions, and clarity in the NFTs they assess. Optic enables much more than monitoring NFT collections – they also offer ecosystem safety APIs for developers to build applications that enforce content creation policies and customer protection policies. These smart contracts give developers access to Optic’s AI for content validation, search, and recommendations. Wallets, games, and social platforms (or any other platform that renders or transacts NFTS) can also access Optic’s infrastructure for authenticity verification and other analytics.

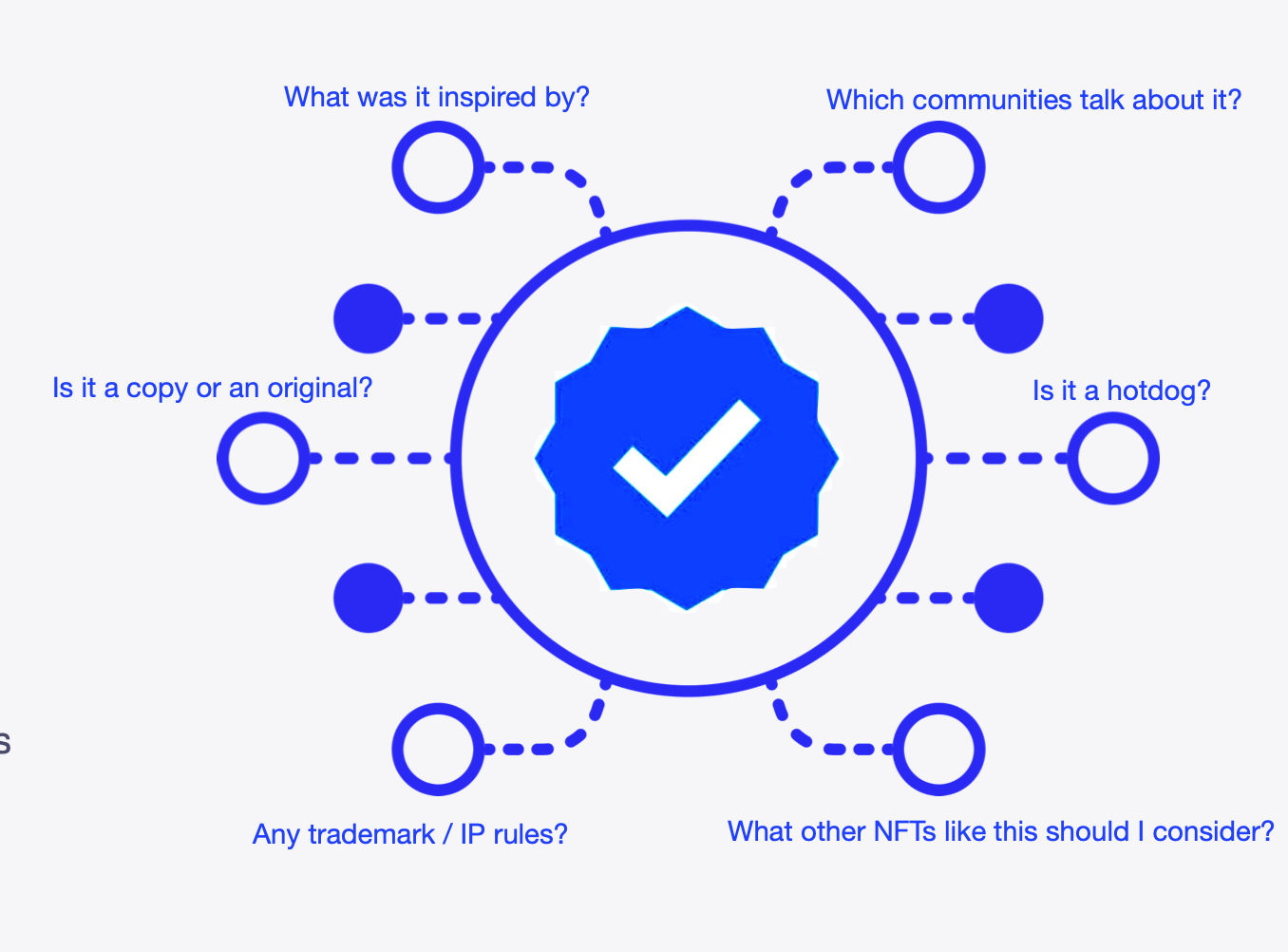

Optic’s AI checks for many metrics that allow developers to use the information however they choose. Source: Optic

Optic also allows marketplaces to customize operations workflow and digest their data to discover trending scams and fraudulent activity via Optic’s API. For creators, Optic offers data on people who have wrongfully claimed others’ work, and notifies artists when someone creates pieces inspired by their existing work.

The NFT community can use Optic’s tools to build their brand, run authenticity checks, discover noteworthy NFTs, and assess collection rarity and value. The team’s founder, Andrey Doronichev, noted that “Optic isn’t an enforcement business. Our goal is to make the information available and transparent to the ecosystem. Artists and marketplaces can decide what to do with it.” With this flexible approach, different communities and art platforms have power over what they do with the data and what level of enforcement is appropriate for them.

Optic’s interface with an AI-enabled comparison analysis of two collections. Source: Optic

A team with deep experience in AI and authenticity

Andrey Doronichev serves as Optic’s CEO and previously worked at Google as Director of Product Management and as a Head of Mobile at Youtube, where he worked on building out the ContentID system (fraud-fighting infrastructure). The team’s CPO is Roman Doronin, who co-founded Eora AI studio, a computer vision, automation, and AI-consulting services firm. Vlad Vinogradov, Optic’s CTO, co-founded Eora AI with Roman and has extensive experience in ML, AI, and computer vision. The team is rapidly expanding on the AI and software development front and now consists of 17 individuals on the core team as well as a strong and growing advisory board.

Beyond exposing fraud

In an industry that struggles with scamming, software like Optic’s will be increasingly necessary to onboard users, build community trust, and enforce authenticity. Optic is currently building out their product suite to offer useful tooling such as detecting particular images inside of other images and detecting fake blue verified collection checkmarks. The team is also adding text metadata analysis to detect fraudulent patterns and are further growing their SDKs to reach a larger set of developers working on protocols where authenticity is relevant. Many additional customers are also in talks with Optic as their analytics become increasingly broad and different use cases are built out on the protocol. In speaking about the advantages of using Optic, Doronichev noted that the industry, at its core, has an “... ecosystem issue, and it has to be addressed.” Though fraud attempts will always be around, we’re confident that Optic’s technology will dramatically help to mitigate this issue via their marketplace tools, developer SDKs, and consumer protection analytics.

- Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This article does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this article are solely those of Paul Veradittakit, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

The Downside of Sanctioning Tornado Cash

OFAC’s blacklisting of an Ethereum smart contract stands to compromise innocent users’ privacy while doing little to stop bad actors.

Move Over, Ethereum – Bitcoin’s Lightning Network Has Apps, Too

Bitcoin’s dominant scaling system continues to grow despite a formidable bear market.

NEWS

Bankrupt Crypto Lender Celsius Gets Cash-Injection Offers, Approval to Sell Mined Bitcoin

The company had said Monday that it might run out of cash by October.

Bank of China unveils new e-CNY smart contract test program for school education

Under the pilot test, parents could enroll their children in after-school vocation programs via smart contracts.

REGULATION

SEC Files Complaint Against Dragonchain for Unregistered Initial Coin Offering

The complaint alleges the blockchain startup failed to register more than $16 million in crypto asset securities.

IRS takes out John Doe summons on crypto prime dealer SFOX to find tax cheat customers

The U.S. tax service has used the same tactic to gain information from Circle, Coinbase and Kraken in recent years, as analysis finds that half of taxes on crypto go unpaid.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Google invested a whopping $1.5B into blockchain companies since September

Other notable corporate investors include BlackRock, Morgan Stanley, Samsung, and Goldman Sachs, according to a report from Blockdata.

VIDEOS

Check out my Youtube channel at www.youtube.com/user/veradittakit/playlists!

LETS MEET UP

Los Angeles, September 1-6

NEARCON, Lisbon, September 11-14

Geneva, Switzerland, September 15-16

Bangkok, Thailand, September 22-23

Pantera Asia Blockchain Summit, Singapore, September 27

TOKEN2049, Singapore, September 28-30

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Optic is a new entrant in a growing market focused on finding NFT / Digital Asset fraud after it's happened ... a sad admission that we can't prevent fraud so we have to find and address it after it's happened. There is a better way and that's prevent fraud in the first place ... what if you a) could protect the original asset b) control access to it c) enforce licensing rights on it and d) record everything that happens to it. You can do this when you store each music, video, art original file on a blockchain - in fact each asset on it's own blockchain.

Great post! The scales in the NFT space are shifting and fraud seems to me to be having a large and growing impact. And of course the fraud is not limited to theft of the content of wallets/accounts etc.