Omni brings Ethereum-native interoperability to the network’s rollup ecosystem, allowing Ethereum to once again function as a single, unified operating system for decentralized applications.

Introduction

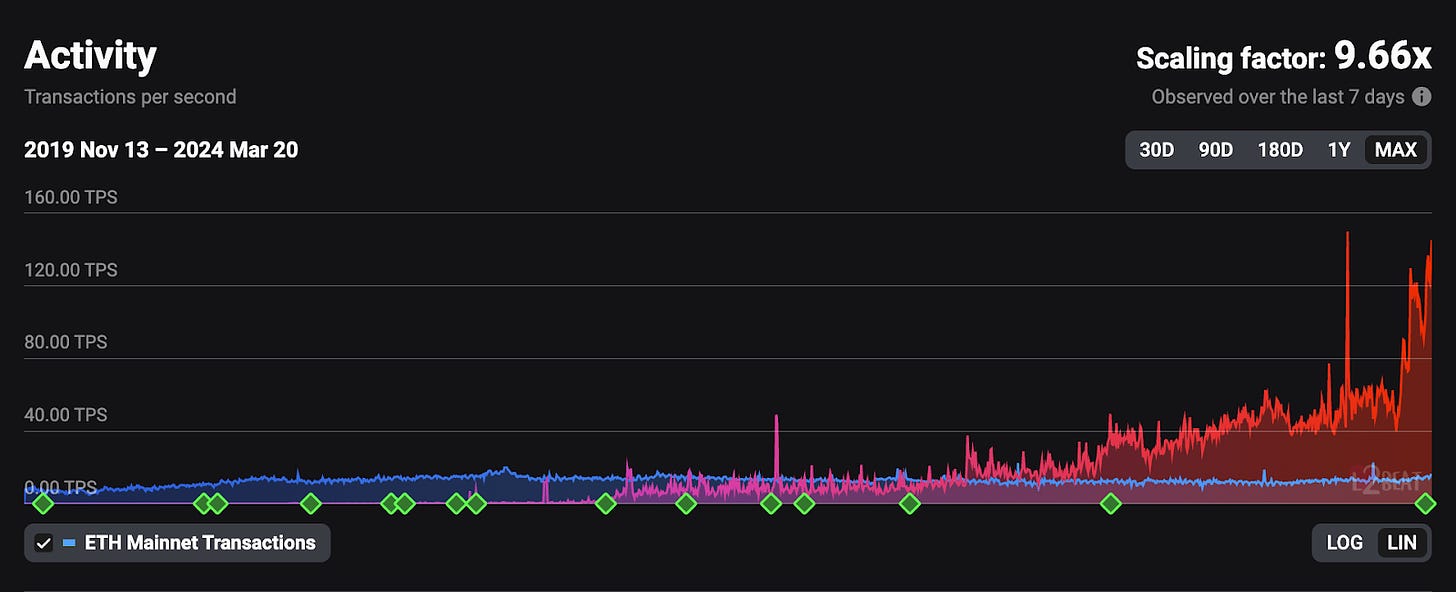

Rollups are the present and future of Ethereum scaling. After a gradual increase in usage from 2021 to 2023, rollup adoption has recently accelerated, providing Ethereum L1 with a nearly 10x increase in transaction throughput.

Source: https://l2beat.com/scaling/activity

Rollups help Ethereum handle more transactions efficiently by processing them off-chain and only storing data or proofs on-chain on Ethereum L1. This method allows rollups to inherit the security of Ethereum L1 while maintaining compatibility with Ethereum’s vast developer tooling and application ecosystem.

However, because rollups scale Ethereum via isolated off-chain environments, they introduce negative externalities that degrade Ethereum’s network effects. Specifically, liquidity, users, and developers are fragmented between disparate ecosystems. The expanding variety of rollup designs and their growing adoption will only exacerbate these issues. Consequently, Ethereum requires a native interoperability protocol that realigns the network with its original vision of being a single, unified operating system for decentralized applications.

Omni’s Key Innovations

Omni is an Ethereum-native interoperability protocol that establishes low latency communications between all Ethereum rollups, allowing Ethereum to function as a cohesive system in the modular age. Built by a team with deep industry experience, Omni is positioned to unify Ethereum’s fragmented rollup ecosystem with the following defining features.

Security

Interoperability protocols have historically struggled with security. The first generation of protocols relied on nothing more than a set of trusted actors verifying and relaying messages between networks. Over the years, these protocols have been the subject of many exploits, cumulatively costing the industry over $1 billion.

A second generation of protocols improved on this design by applying cryptoeconomic security to the network. Under this approach, actors stake the protocol’s native asset to participate in the verification process. This is a step in the right direction, but relying on a native asset makes the protocol’s security guarantees unstable.

Using EigenLayer, Omni introduces a fundamentally new security model for interoperability protocols. Omni secures its validator set using restaked $ETH, allowing the protocol’s security to scale in line with Ethereum L1’s security budget. With more than $100 billion securing the network, Ethereum’s current security budget is an order of magnitude larger than any other PoS network. By leveraging restaked $ETH, a highly liquid, low volatility asset, Omni’s security achieves significantly greater stability than its predecessors. Moreover, by deriving security from Ethereum, Omni aligns its security base with the rollups it connects, facilitating a security model that grows in tandem with Ethereum’s modular ecosystem.

Omni is setting the standard for action among EigenLayer’s Actively Validated Services (AVS). Omni became the first protocol to reach a deal with a liquid restaking (LRT) provider when it agreed to rent $600 million worth of restaked $ETH from EtherFi. Omni’s team struck agreements with multiple other LRT providers to push its day one security budget over $1 billion. This will allow Omni to offer industry-leading security at launch without requiring the protocol to incur excessive costs bootstrapping the network. As the only Actively Validated Service (AVS) operating on testnet, apart from EigenDA, Omni is positioned as the most production-ready AVS on the market.

Sub-Second Verification

One of the key advantages that integrated blockchains like Solana have over modular systems is low latency transactions. Users are becoming accustomed to sub-second transaction times that mirror the user experience of modern cloud-based web applications. For Ethereum to compete with these alternative platforms, cross-rollup message latency must be on par with transaction speeds of integrated systems.

Omni brings this experience to Ethereum rollups using a novel protocol architecture that achieves sub-second cross-rollup message verification. After processing 7.5 million transactions from 550,000 wallets on previous testnets, Omni Labs overhauled the network’s architecture. At the heart of this design is Octane, a new open-source framework for combining the EVM with CometBFT consensus. Octane uses the Ethereum Engine API and ABCI++ to create a clear separation between Omni nodes’ execution and consensus environments, thereby isolating the components that bottleneck performance in existing EVM <> CometBFT frameworks.

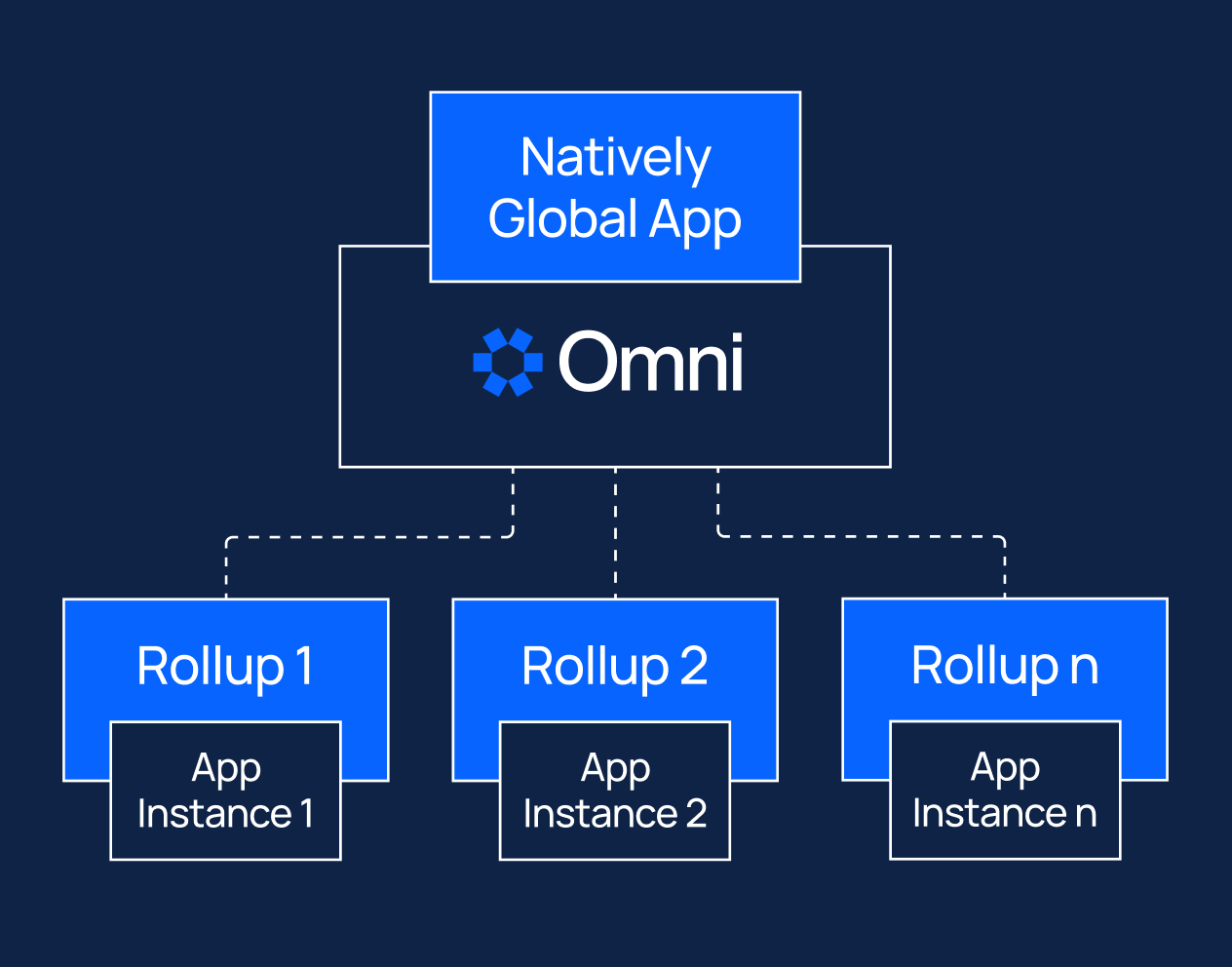

Natively Global Applications (NGAs)

In addition to providing cross-rollup message verification, Omni also offers a dedicated execution environment, the Omni EVM, that allows developers to manage all of their rollup application deployments from a single location. Using the Omni EVM as an orchestration layer, developers can deploy Natively Global Applications (NGAs). NGAs are a new category of applications that dynamically propagate contracts and interfaces to any rollup, allowing them to access all of Ethereum’s liquidity and users by default. Using NGAs, developers can leverage the scalability of Ethereum rollups without the burden of managing distributed state between multiple rollup environments.

As the rollup ecosystem continues to evolve, projects will develop more customized rollup solutions, each tailored for specific functionalities and performance needs, incorporating unique virtual machines, programming languages, and data availability architectures. Omni is intentionally designed to support any rollup architecture, enabling seamless application management through the Omni EVM.

Backwards Compatibility

To accommodate existing rollup applications, Omni is engineered with backwards compatibility in mind. Applications can integrate Omni without modifying their deployed contracts. Instead, applications use modified frontend instructions to assemble cross-rollup messages, allowing Omni to function as a wrapper around existing application deployments. Omni also introduces a universal gas marketplace to deliver cross-rollup messages to destination networks, eliminating the need for users to maintain a collection of different gas tokens.

Team

Omni Labs is composed of an experienced team with vast industry experience. The team is led by CEO Austin King, a Harvard graduate who previously built the Interledger network which processed 10 billion payments and was ultimately sold to Ripple. CTO Tyler Tarsi, also a Harvard graduate, leads the team’s engineering efforts and brings experience building machine learning infrastructure for quantitative trading systems. Prior to building Omni, the duo collaborated on Rift Finance, a DeFi protocol that amassed $50 million in TVL in just two days.

Looking Forward

Omni’s unique approach to Ethereum rollup interoperability will soon be accessible to all users and developers. The Omni Labs team recently deployed its final testnet, Omni Omega. During Q2, Omni will be the first AVS to launch on mainnet, bringing a secure and performant interoperability solution to Ethereum’s fragmented rollup landscape. Just as rollups have been established as core infrastructure for transaction processing, Omni is positioned to become the standard for interoperability within the Ethereum ecosystem.

- Paul Veradittakit

DIGESTS

Crypto Airdrops Are Not Securities, Lawsuit Against SEC Argues

Airdrops involve no investment of money and therefore can’t be securities transactions, asserts the DeFi Education Fund.

BUSINESS

London Stock Exchange Will Start Market for Bitcoin and Ether ETNs May 28

The stock exchange will accept applications for trading bitcoin and ether crypto exchange traded notes from April 8.

Crypto Market Remains Focused on Spot Bitcoin ETF Flows Over Fundamentals: Coinbase

There were $836 million in net outflows between March 18 and March 21, the report said.

REGULATION

Garlinghouse Says SEC to Press Judge for $2B in Fines and Penalties in Ripple Case

The court documents filed in a New York court on Monday are currently under seal.

SEC to Seek $2 Billion From Ripple Labs, Says Chief Legal Officer

Stuart Alderoty made the preemptive announcement on Twitter on Monday ahead of a court hearing.

NEW PRODUCTS AND HOT DEALS

FTX to Sell Shares in Claude AI Developer Anthropic for $884 Million

FTX will unload 29.4 million Anthropic shares to repay creditors.

Solana, Avalanche Post Big Gains as Crypto Market Rebounds

Bitcoin is edging back toward the price discovery zone, and altcoins are poised to follow its lead—despite a subdued response from traders.

LETS MEET UP

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.