Onchain Order Book + AMM = ?

VeradiVerdict - Issue #270

The world of DeFi is about to witness a transformative moment as SynFutures prepares to introduce its latest innovation, SynFutures V3. Let’s dive into what users of the permissionless perpetual contract (“perp”) DEX can expect from V3, focusing on the new Oyster AMM and its potential to revolutionize the DeFi derivatives landscape.

Key Takeaways

SynFutures is a perp DEX that creates an open and trustless derivatives market by enabling permissionless trading on any asset with a price feed. The latest iteration of the protocol represents a significant milestone in the DeFi space.

The new version of the protocol features Oyster AMM, an innovative automated market maker model aimed at delivering the highest capital efficiency of any derivatives DEX.

Oyster AMM combines the strengths of onchain order book and AMM models while allowing 30-second arbitrary asset listings of perps and futures with only a single token; it enables a significant “capital efficiency boost” and broadens SynFutures’ audience of traders and liquidity providers.

Introduction

SynFutures is a perp DEX that employs a business model reminiscent of Amazon, democratizing the derivatives market and supporting an endless array of longtail assets. This approach grants users the power to effortlessly engage in asset trading and list customized futures and perps contracts in a matter of seconds. By cultivating a free market and maximizing the variety of tradable assets, SynFutures is lowering the barrier to entry and creating a more equitable derivatives market. Anyone can list and trade anything, anytime.

Since launching in 2021, SynFutures has emerged as a leading perp DEX, processing over $21 billion in volume with nearly 100,000 traders and 270 trading pairs listed to date. The protocol is backed by Pantera Capital, Susquehanna International Group (SIG), Polychain Capital, Standard Crypto, Dragonfly Capital, Framework Ventures, and HashKey Capital, among others.

Oyster Automated Market Maker (AMM)

While V2 marked a significant milestone in the project's evolution, V3 signifies a substantial leap in the overarching product roadmap. At the core of this transformation lies Oyster AMM, a refined automated market maker model designed to build upon the foundations established by its predecessors.

Oyster AMM is designed to harmoniously blend the simplicity of automated market making with the efficiency of order book models, creating a seamless experience for newcomers and seasoned professionals.

Key Features of Oyster AMM (outlined in the SynFutures V3 whitepaper):

Single-Token Concentrated Liquidity for Derivatives: Oyster AMM facilitates liquidity concentration within specific price ranges and incorporates leverage to boost capital efficiency. Unlike prevalent spot market-focused liquidity models, it introduces a margin management and liquidation framework tailored for derivatives, using just a single token to streamline the trading ecosystem.

A Fully Onchain Order Book: While AMMs democratize market access, they demand significant liquidity for equivalent price impact compared to order book models. To address this, SynFutures V3 introduces an onchain order book model in addition to its CL AMM, ensuring transparency, trustlessness, and anti-censorship, eliminating dependence on centralized administrators.

A Single Model for Unified Liquidity: Oyster AMM integrates concentrated liquidity and order book into a single model, offering unified liquidity tailored to active traders and passive liquidity providers. This cohesive approach ensures efficient atomic transactions and avoids non-synchronization issues in dual-process execution systems.

Stabilization Mechanism for User Protection: The Oyster AMM introduces advanced financial risk management mechanisms to enhance user protection and price stability. These mechanisms include a dynamic penalty fee system discouraging price manipulation and balancing the LP's risk-reward profile.

Trading on V3

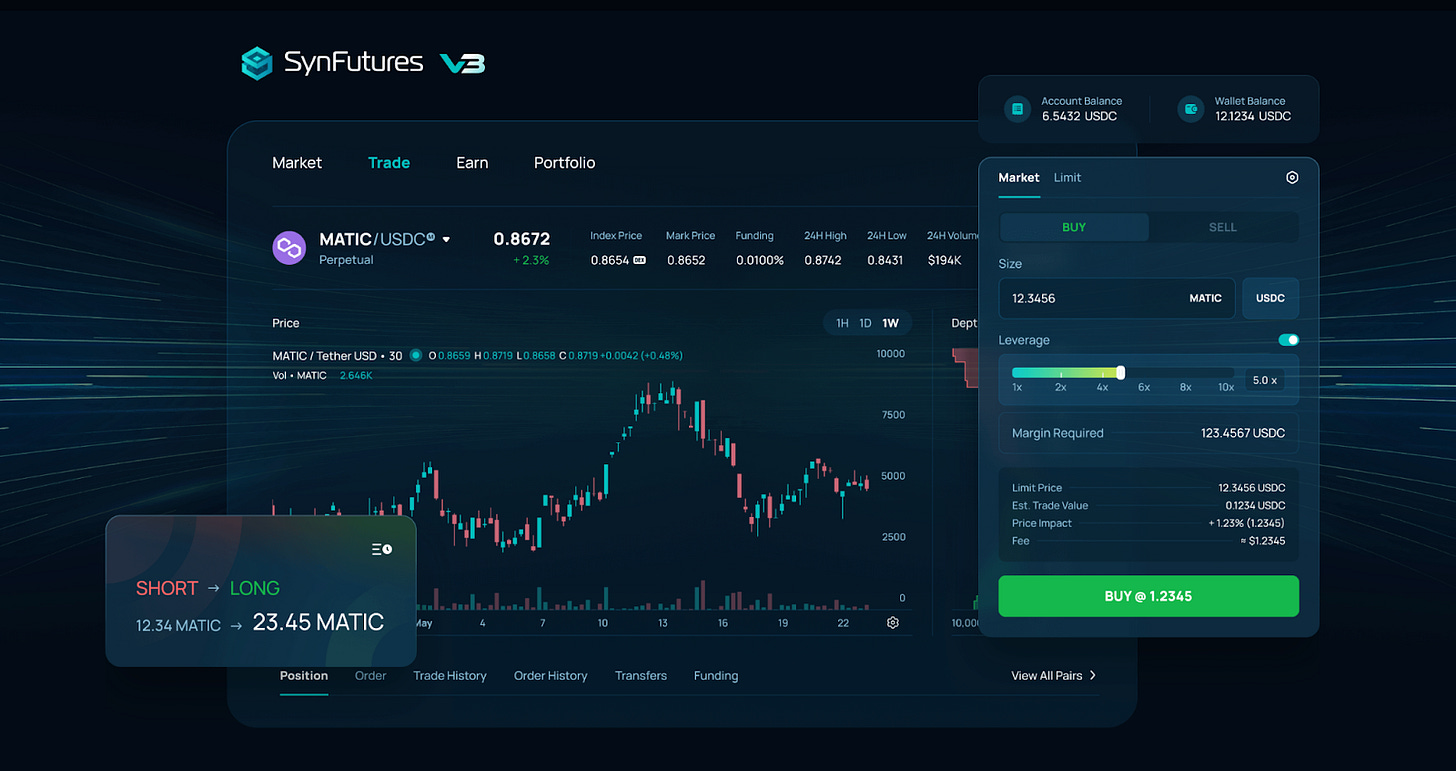

While V3 introduces a brand new AMM model, the one-click trading experience users have come to enjoy is still as seamless as ever. V3 is currently in public testnet, allowing anyone to experience the new AMM risk free. After connecting their wallets and minting mock assets, users can begin trading with up to 100x leverage. Under ‘Portfolio,’ traders can manage their positions and view their trading and order history.

SynFutures V3 trading dAPP interface

In conjunction with V3's launch, SynFutures has undergone a website revamp to reflect the latest developments and expanded offerings.

SynFutures V3’s Significance and Implications

Following the successful public testnet phase, the next milestone on the horizon is the mainnet beta launch, anticipated to occur by year-end on multiple chains. SynFutures is also actively working with market makers to prepare for the mainnet launch. Reach out to the SynFutures team for more information.

SynFutures V3, alongside the enigmatic Oyster AMM, stands poised to reshape the perp DEX landscape. The symbolism of the oyster extends to encompass limitless possibilities, and with SynFutures V3, individuals are invited to embark on an exciting journey wherein the realm of decentralized derivatives truly becomes their oyster.

- Paul Veraditakit

DIGESTS

Crypto World Cautiously Hopeful as California Acts in Absence of U.S. Feds

The BitLicense axis between New York and California may draw in other jurisdictions as the states solidify their position as the only regulatory option for crypto businesses in the U.S.

BUSINESS

Crypties 2023 Nominees Revealed: Vote for Crypto's Top Projects and Creators

Claim your free Crypties voting pass and cast your ballot to help choose this year’s most exciting crypto and emerging tech creators.

UK's $252B in Crypto Activity Dominated by DEX Trading, NFT Swapping: Chainalysis

Platforms like OpenSea, Sorare, and Uniswap are the top choices among British crypto users, according to a new Chainalysis report.

REGULATION

U.S. Treasury Targets Gaza Crypto Business in Sanctions to Squeeze Hamas

The Treasury Department issued a list of sanctions that included a business providing money transfers and digital assets exchange services in Gaza.

DLT Securities Rules Are Here to Stay, EU Official Says

New European laws took effect in April, but fears over its limited scale may have inhibited take-up.

NEW PRODUCTS AND HOT DEALS

Protocol Village: Binance Invests in Modular Rollup Network Initia

The latest in blockchain tech upgrades, funding announcements and deals. For the week of Oct. 9-16, with live updates throughout.

Bitcoin Magazine Owner Backs First Ordinals Fund, Which Bought $85K Rock

The "Unbroken Chain" fund, as it is known, plans to raise $5 million from its limited partners and will trade in various Ordinals types, including BRC-20 tokens – sometimes positioned as NFTs on Bitcoin.

LETS MEET UP

Los Angeles, November 21-28

New York City, December 8

Puerto Rico, December 11-12

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.