Optimizing Your Token Distribution 2023

VeradiVerdict - Issue #290

At Pantera Capital, the investment team spends quite a bit of time learning and educating entrepreneurs on insightful strategies across a number of areas. General Partner Lauren Stephanian has created the most comprehensive report in the industry around how to optimize your token distribution so you can read it below and feel free to DM her if you have any comments or questions!

Two years ago, we released Optimizing Your Token Distribution, an analysis of token distribution patterns, to help founders better think through network allocation. Trends in this space shift quickly and, given the renewed market enthusiasm, more founders are starting to draft their token distribution models and launch tokens. This report incorporates the latest data along with updates to our analytical framework to serve as a useful resource to founders.

As a reminder, founders of protocols often raise capital with the intention of releasing tokens to both private investors and their community. These tokens typically involve governance rights, and allow holders - insiders, private investors, and community alike - to participate in a product, service or protocol. Often a protocol has a fixed supply of tokens and therefore teams have to be careful about how they allocate them, optimizing for the greatest set of recipients as well as considering inclusion of their users and partners. Teams will therefore allocate their supply accordingly and create a schema that contextualizes how tokens are earmarked for different user groups.

In the previous version of this exercise in 2022, we explored key trends in token distributions with data pulled from private pitch decks, public medium posts and blogs, and Github READMEs dating back to 2014. Now, two years later, we have been able to improve upon that data set and further explore the latest trends below.

Please note: This report was published as of March 2024 using publicly available information as well as aggregated and anonymized private data points. The authors of this report did not independently verify the accuracy of these distributions today.

Key Trends for Token Buckets

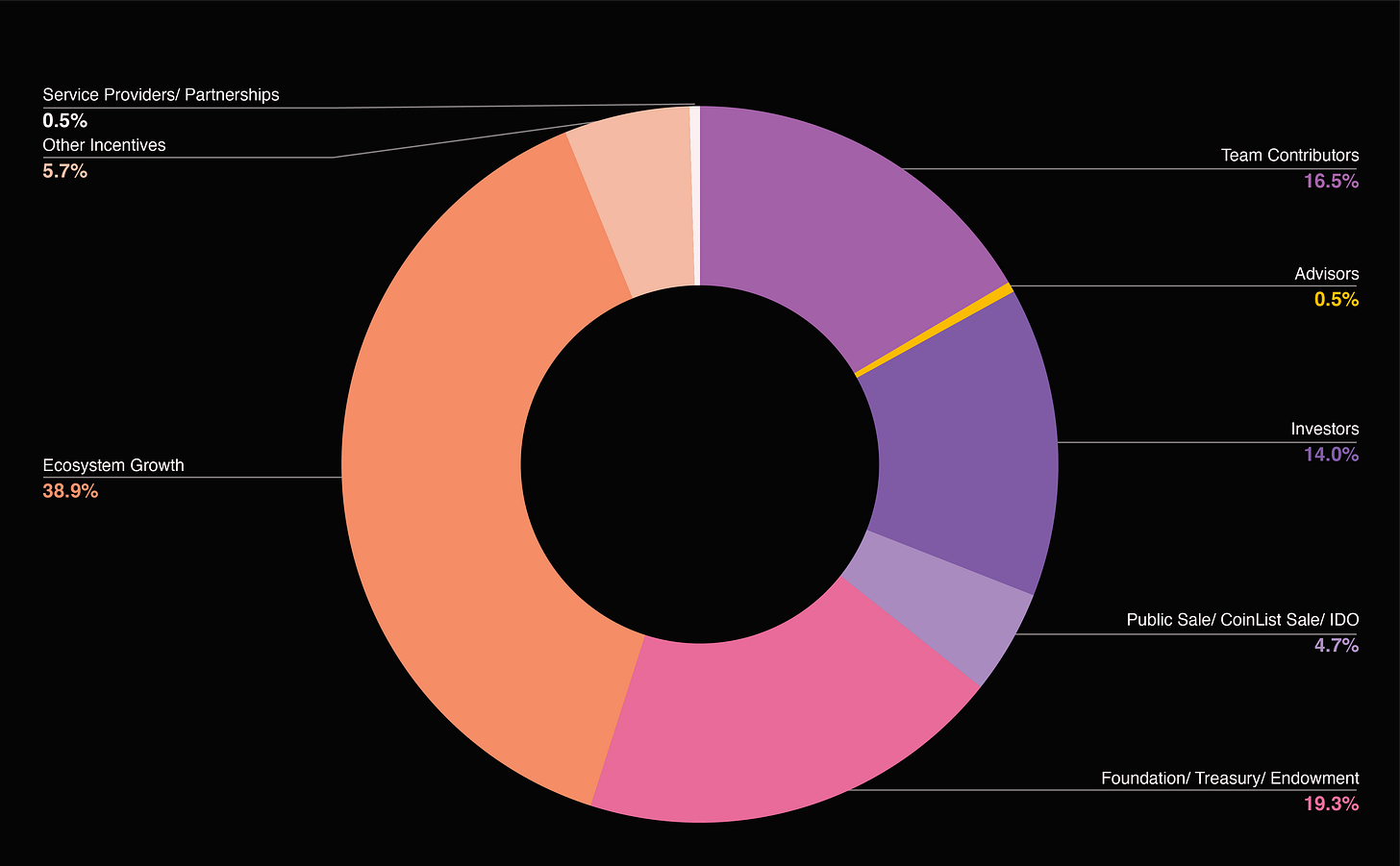

Token distributions can be broken down into 7 main segments:

Core Team

Private Investors

Community Treasury

Ecosystem Incentives

Airdrop

Public Sale

Partnerships and Vendors

We aggregated distributions across 150+ projects and protocols to create a comprehensive analysis of notable trends.

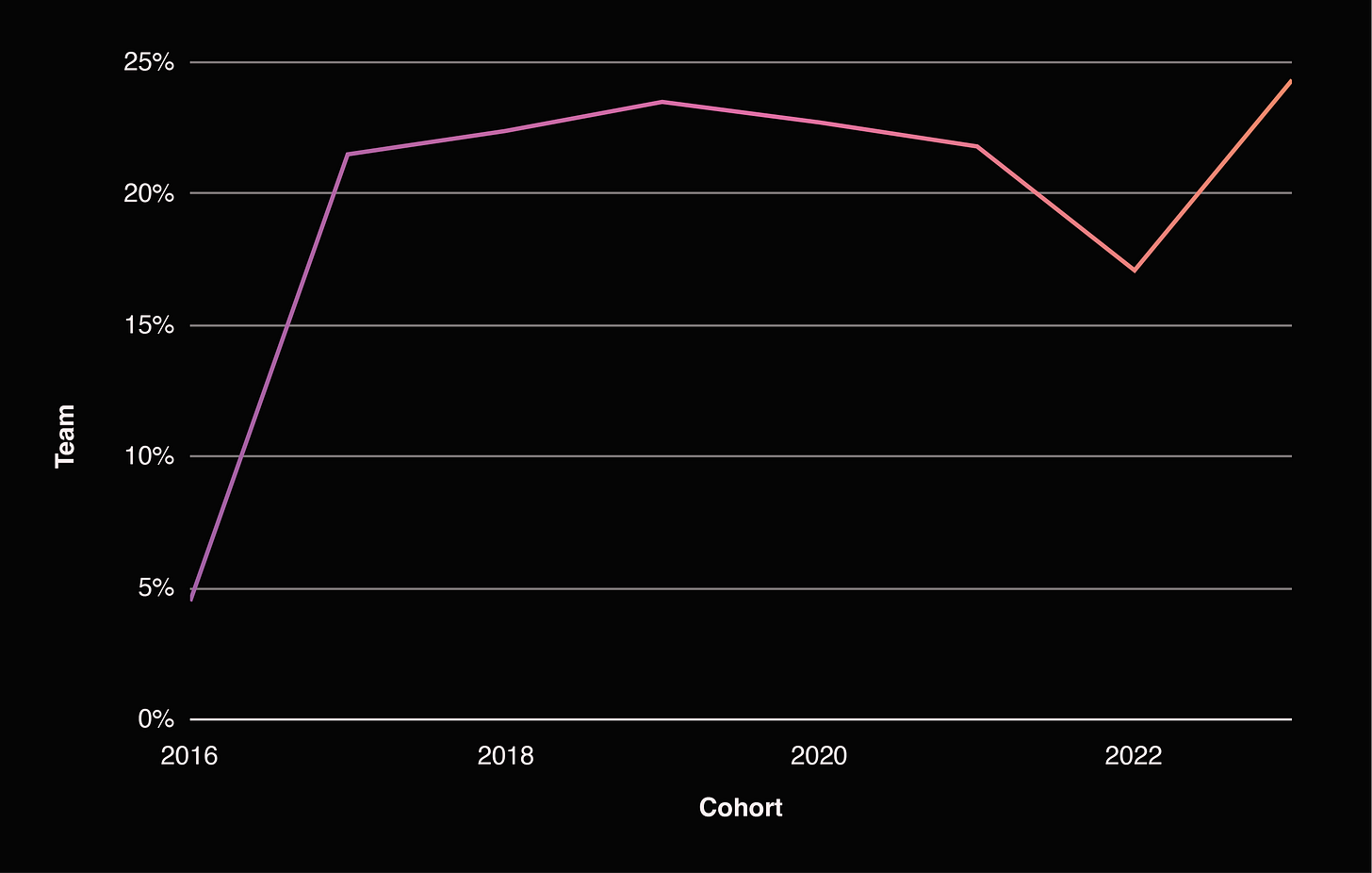

Team

This is the allocation reserved for founders, past and future employees as well as advisors. These tokens are often subject to the longest lockups, typically in line with their investors lockup schedules.

The chart above includes all team allocation, including core contributors, future contributor pools, and advisors. For a closer look at just core team, take a look at the chart below, indicating that core team allocation has actually never been higher.

It’s unsurprising - but still notable - that team allocation does seem to be somewhat correlated with where we are in a particular market cycle. When the aggregated crypto market cap is growing, allocation to team grows, while when market cap shrinks, the team allocation also shrinks.

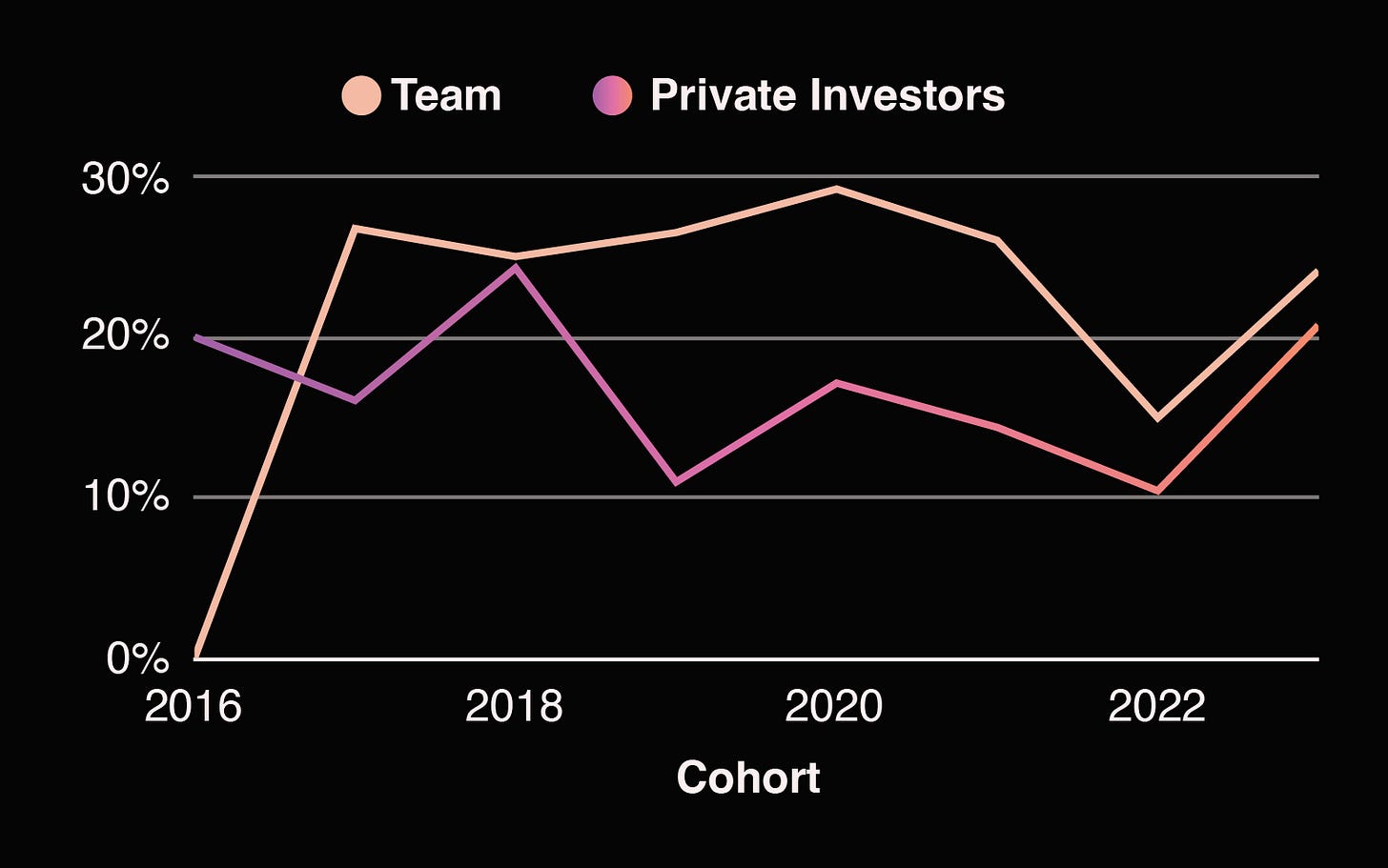

Private Investors

This is the percentage allocated to capital providers who have purchased rights to future tokens or equity that later converts to tokens. These tokens are also subject to lock-ups, generally in line with the core team

Interestingly, while we might have expected the investor allocation to be inversely correlated with team allocation, it’s actually also on the upswing over the past year. It now sits roughly at levels we last saw in 2018.

Initially I thought this could be related to the larger rounds being raised in late 2023 but taking a look at industry raise data this doesn't make as much sense given valuations increased more % wise than raise amounts.

This could be related to founders raising rounds they didn’t expect to need after waiting out this most recent bear market.

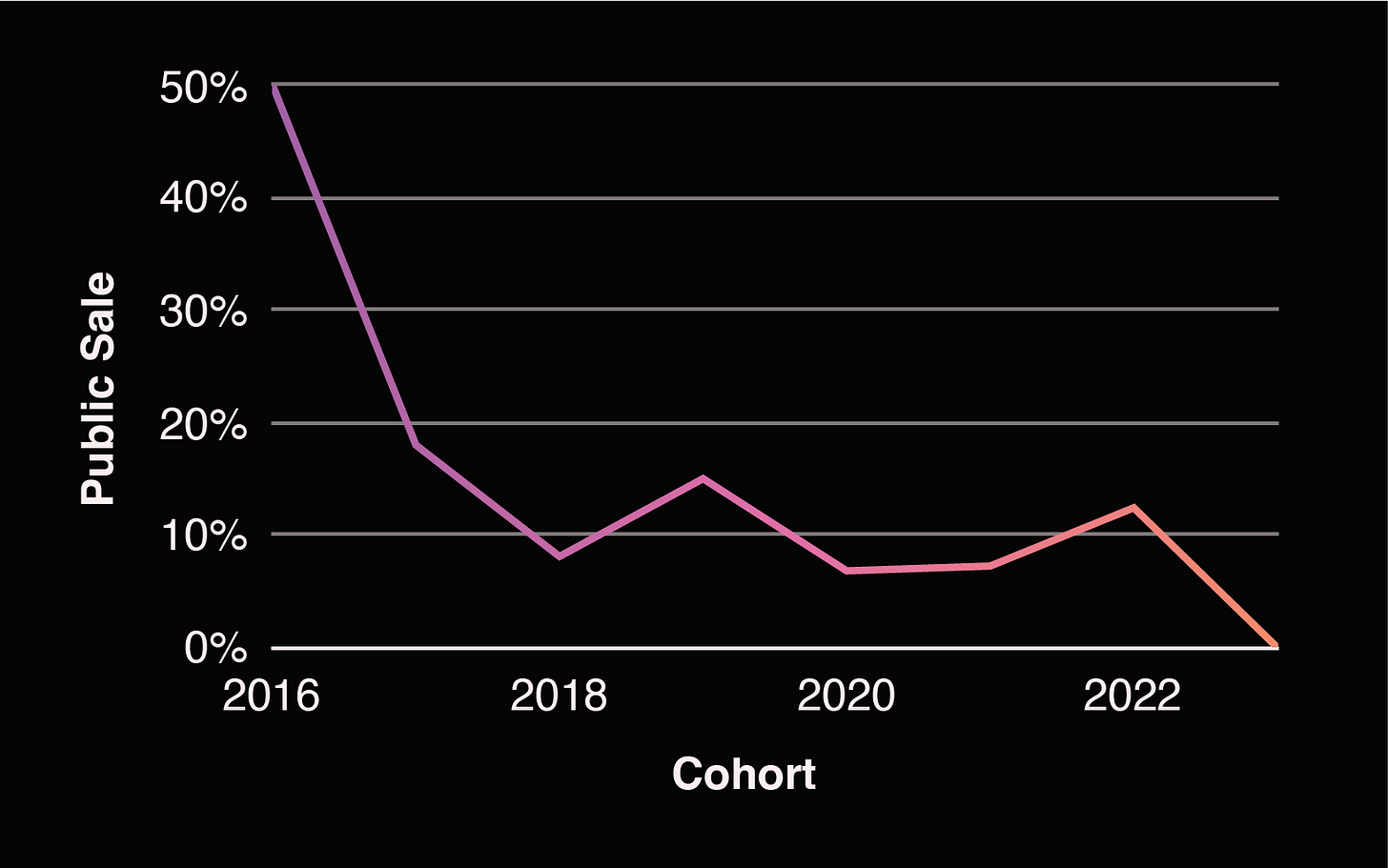

Public Investors

This is the allocation meant for sale to the general public. Formerly referred to as the “ICO” portion of the supply, Public Sale tokens are sold at launch, and liquid at inception.

Perhaps unsurprisingly, due to regulatory risk, public sales are trending to 0.

Airdrops

The absence of token sales to the public begs the question - how do you get tokens into the hands of your community? One potential way is through airdrops.

Treasury

These tokens are retained for future distribution through governance. Treasury tokens are often viewed as the project's “reserve pool” - allocated to different stakeholders through voting proposals.

Treasury allocations have fluctuated over time but peaked in 2022. Trending downwards, we’re likely seeing less allocation potentially due to increases across other categories.

Ecosystem Incentives

These are earmarked for growth programs at launch. Ecosystem Incentives are typically programmed at launch, allowing users to earn from a pre-designated pool of tokens. Incentives have emerged as an alternative to public sales, including growth programs, liquidity mining and yield farming.

Allocation to ecosystem incentives is on the decline but given airdrop percentages have increased so quickly, it’s quite likely that many founders view incentivization as an overall larger bucket, so you could take this decrease as being pretty closely tied to the massive increase in airdrops

Partnerships and Vendors

These include pools for payments for expenses such as legal, rent, third party marketing, etc. The reason for this decline might be simply due to these expenses being uncategorized and lumped together with treasury.

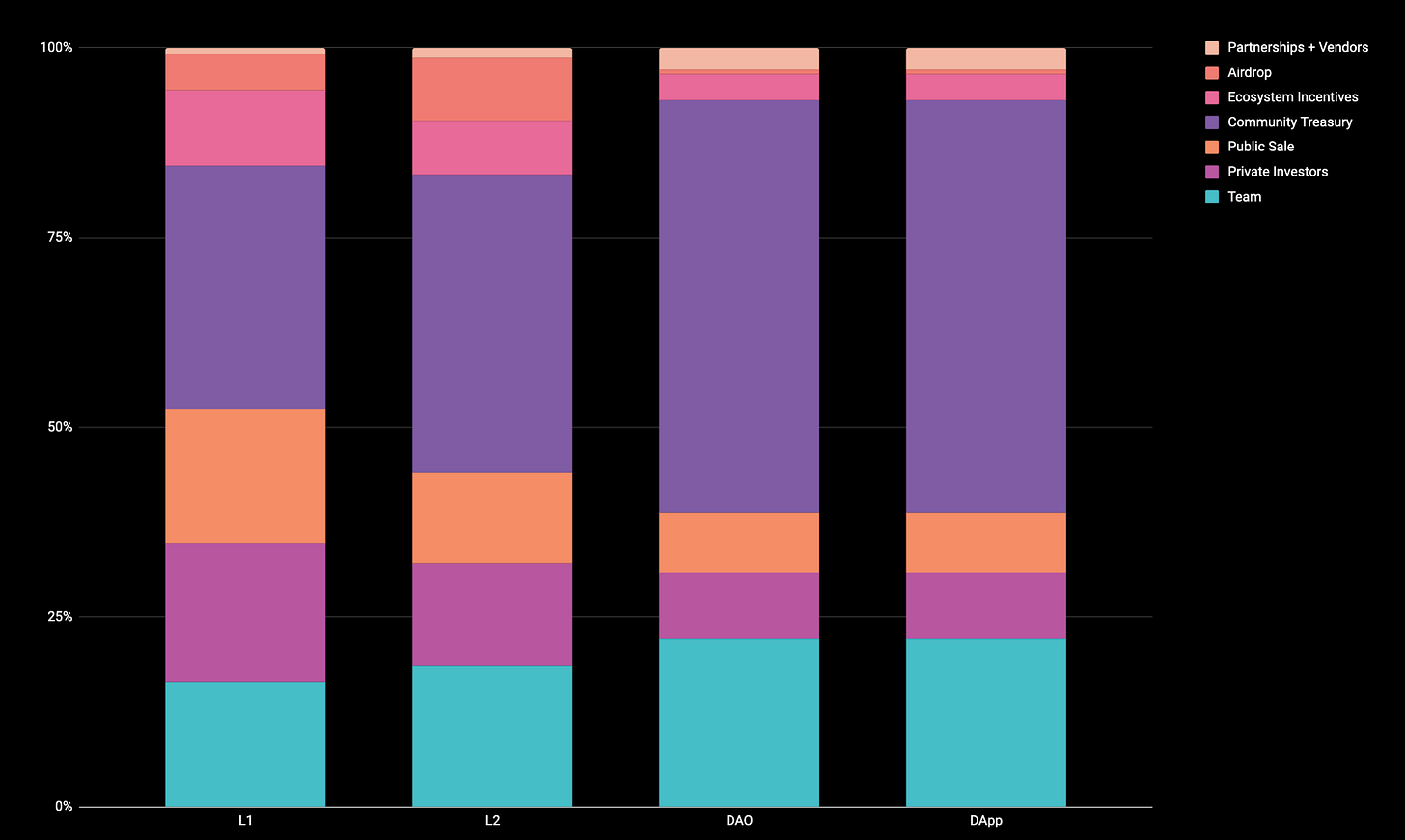

Token distribution by project type

Each type of project will have a unique distribution pattern.

Here’s how they stacked up across the board. Note that these are post-pandemic averages.

Unsurprisingly, DAOs tend to allocate more to their treasury / foundations, whereas L1s prioritize airdrops and - at least before 2023 - public sales. L2s tend to prioritize ecosystem growth incentives, which could have later been decided to be used for airdrops as well. DApps spent the most on their community engagement not necessarily via airdrops, but by other engagement farming such as liquidity incentives and yield farming.

Now, we’ll dive a bit deeper into the breakdowns within each category.

DAOs

Taking a closer look at DAOs by year, we can see some shifts over time distribution. Community treasury remained high throughout the years, while team allocation shrank and allocation to funds grew. Unfortunately we did not have enough data from 2023 to display averages.

DApps

Diving a bit deeper into DApp token distributions, we can see that team allocation has been decreasing slightly over time (after a big drop after 2014), while investor allocation and airdrop allocations have been increasing.

Infra: L1s and L2s

Because they are quite similar, this chart lumps L1 and L2 token distribution together. We can see that over time, public sale allocation dropped off. Community treasury has fluctuated a bit over the years, while investor and team allocation both increased in 2023. A significant portion of token distribution in 2023 is also going to airdrops.

Taking a closer look at the difference between the typical layer 1 and layer 2 token distribution, you can see that L2s tend to reserve less for unallocated ecosystem growth pools and more for public sales (though likely not anymore) and airdrops. L2 teams tended to take less allocation as well.

Interviews

Of course, all of the above charts indicate historical averages over time. This time around, it felt pertinent to share anecdotal data collected from some founders from earlier vintages of token raises to see what they might have regretted about their raises or what they were happy with.

Here’s what they had to say:

Livepeer

Livepeer was founded in 2017, long before DAO governance tools when crypto still very much felt in its infancy.

“I am generally happy with how [our token] was distributed, initially through an algorithmic, decentralized, and open-for-all mechanism we created called the Merklemine, and then on an ongoing basis through inflation that directs token to node operators on the network and other active participants. This has gotten tokens in the hands of those who are directly helping the network, while also allowing access to all and allowing tens of thousands of users to discover Livepeer along the way through the MerkleMine received token.

As to what I would change, if DAO based governance tools were more mature and available [6] years ago when the network launched, it would have been nice to take advantage of them to enable a community governed treasury. This would help with future ecosystem growth by being able to direct the token into the hands of video developers and others who aren't directly rewarded by the network. But at the time, these tools were so immature and complex to build, that it wasn't going to be a top priority - and we didn't want centralized control over the distribution so didn't reserve a large company governed treasury.” - Doug Petkanics, Founder of Livepeer

Well Known dApp Founded in 2018

“I think for [redacted token name], the token distributions themselves ended up working out well, I don't often wake up thinking: if only ... #facepalm

But if I could go back in time I would have placed a greater emphasis on raising from folks who 1) Can actively quant trade, 2) Are Vocal, 3) Are active in governance.

One thing that has played out well for us as founders is we didn't take up an exorbitant piece of the pie— this has allowed us to compensate employees with strong positions in the network and room to spare.” - founder of well known DeFi protocol founded in 2018

What is “Optimal”?

After publishing the previous 2022 version of this post, it was rightly pointed out that average isn’t always what’s optimal. Therefore it’d be interesting to reverse engineer some of the most notable and recent token launches across categories.

Reverse Engineering Top Token Launches

Layer 2

Taking a look at Optimism, they have a large fund specifically dedicated to RPGF, a new trend in incentivizing builders to engage with their platform. A typical amount was given to investors and core contributors, while airdrops were also a big part of the equation.

Layer 1

Celestia is a layer 1 protocol. They’ve dedicated a large portion of their token allocation to investors and a large portion dedicated to their R&D ecosystem. Incentivizations together also make up a very large portion of distribution.

dApp

GMX being a DeFi DApp has a more complex token breakdown, with a large portion going to requirements for the longevity of the DApp, especially as it pertains to keeping the product functioning well - i.e. liquidity reserves, etc.

Summary and Key takeaways

Dynamics in this space have drastically shifted over the past year with this recent bull run.

Teams

In 2023, on average teams were allocated 24% of the total distribution.

On average, team allocation is correlated with the timing of the market and in this market teams will have a lot more leverage.

Team and investor allocations are not necessarily inverse to one another and in fact, both are trending up in this market.

Private Investors

In 2023, on average private investors received 20% of the total distribution.

Community Treasury

In 2023, on average founders allocated 28% of the total distribution to their treasury.

Public Sale

In 2023, public sales saw next to nothing in distribution on average.

Ecosystem Incentives

In 2023, on average founders allocated 8% of the total distribution to ecosystem incentives.

Airdrop

In 2023, on average founders allocated 20% of the total distribution to airdrops.

Airdrops have become an important part of community building and airdrop strategy is important.

What makes a successful token drop involves allocating a large portion to community holders and future incentivization of the core team.

In a bull market, teams have the upper hand as VCs vie to get into the top deals. Founders took a cut in ownership in the last bear market but current ownership percentages are back up to where they were during the last bull market in 2021. One of the difficult problems founders in the crypto space needs to solve is striking the balance between incentivization and core team members semi-retiring upon first vest.

Separately, airdrop popularity has grown exponentially, which has spurred a flurry of engagement - both good and bad - from crypto users that have become more sophisticated with time: users will not only set up wallets on a protocol, but bridge to it, engage in transactions, generate pull requests on a protocol’s GitHub, and more - often to the dismay of builders.

On the Horizon

This space is ever-changing and we’re always seeing innovations in marketing, ecosystem growth, fundraises, and team compensation. Interestingly, it seems as though we’ve given into the reality of engagement farming, but the question is how to lengthen the time of engagement and get users familiar with using your platform.

One evolution of the airdrop framework involves points, which can be used to incentivize activity while providing the founding team with the benefit of full control. Maybe to the detriment of the community this allows founders to incentivize engagement without fully committing to dropping a token at all.

RPGF is also an up and coming topic, and a way to incentivize the building of utilities, i.e. tooling for an ecosystem which makes it easier to access or build. Utilities are extremely important Layer 1s and Layer 2s to have, but they’re typically not venture backable. RPGFs are used to incentivize the building of these utilities and enhance the ecosystem overall, - technically categorized under ecosystem growth. So far, over $300m has been granted to 1k+ entities.

Learn More or Contribute

After publishing the initial version of this post, the most frequent request I received was to open source the data. Unfortunately during the first go-round it was a mix of private and public data which for confidentiality reasons I felt I couldn’t share. However, we now have more than enough public data that we have begun building a repo. If you’d like to view (or contribute!) data, the Github repo is here.

—

Authored by Lauren Stephanian

Note: While the data in this report is not all-encompassing, it is meant to be a resource to build conviction when mapping your token distribution. Many thanks to Alex Svanevik at Nansen, Soona Amhaz at Volt Capital, and Ali Geramian at Anthemis for their helpful suggestions and review. An additional thank you to Nihal Maunder at Pantera Capital for his analysis help and Jonathan Chan at WSGR for kindly providing useful data.

- Paul Veradittakit

DIGESTS

Cathie Wood Attributes Bitcoin's Rise to National Currency Devaluations

Wood called bitcoin an "insurance policy against rogue regimes and horrible fiscal and monetary policies."

Amid Bitcoin ETF Frenzy, When Will BlackRock Flip Grayscale?

The world’s biggest fund manager’s ETF is fast catching up with the biggest crypto fund. It could have more assets under management within a month.

BUSINESS

Meme Coins on Degen Chain Flourish as New Layer 3 Racks up Millions in Volumes

Degen Chain was released last week as a specialized network that sits atop Base, which itself is an Ethereum layer 2.

Crypto Exchange Bitget's Wallet Team Joins Meme Coin Hype, Issues Token That Rises 14,000%

The token's rise comes alongside a wave of trading volume.

REGULATION

U.S. SEC Calls for Comments on Spot ETH ETFs

The Securities and Exchange Commission has opened up comment periods for ETF applications for Grayscale, Fidelity and Bitwise.

Central Bank Group Starts Tokenization Project to Enhance Monetary System

The project seeks to build a "usable" solution to integrate tokenized commercial bank deposits with central bank money using smart contracts and programmability, officials at the Bank for International Settlements said.

NEW PRODUCTS AND HOT DEALS

Wormhole Debuts at $3B Valuation in 617M Token Airdrop

Based on the debut price, the project's W token has a fully diluted value of $16.5 billion.

Coachella Launching Avalanche NFT Quests Game at Music Festival

Coachella concertgoers this year can track their experiences and earn prizes on the blockchain via Avalanche NFTs. Here's how it works.

LETS MEET UP

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have an projects that need funding, feel free to DM me on twitter.