Options on Solana

VeradiVerdict - Issue #191

PsyOptions seeks to be the de facto on-chain financial services platform for Decentralized Finance. The core team contributes to blockchain based software alongside other globally distributed individuals and entities through the Psy Finance DAO. The team has built out an array of product offerings, such as yield generating option vaults and under collateralized, cash settled, European style options - all built on open-source software. The project won first place in the first ever Solana x Serum DeFi Hackathon in 2021.

PsyOptions’ first product was their American-style options protocol.

Users create a new options market by specifying an expiration date, the underlying asset, the amount of the underlying asset held in the option, a quote asset, and a quote price. Importantly, PsyOptions makes no assumptions about what the underlying asset can be, meaning that any SPL token (including NFTs!) is fair game.

Users mint options by putting up 100% of the underlying amount for their desired options as collateral in PsyOptions’ Underlying Asset Pool. In exchange, the user receives an OptionToken, which represents the actual option, and a WriterToken, whose holder can claim the quote amount once the option. The OptionToken can be then traded on any exchange supporting SPL tokens.

Users can exercise an option represented by an OptionToken by paying the quote amount to PsyOptions’ Quote Asset Pool. Once an option is exercised, the holder of the WriterToken (generally whoever minted the option) can then claim the quote amount from the pool. If the option is not exercised by its expiration date, the holder of the WriterToken can recover the underlying asset amount from the protocol as well.

PsyOptions is also currently developing a European-style options protocol, which offers cash-settled, under-collateralized options to end users. Through the ecosystem of ‘Psy’ products, users will be able to buy call spreads, butterflies, condors, and more options trading strategies on both European- and American-style options.

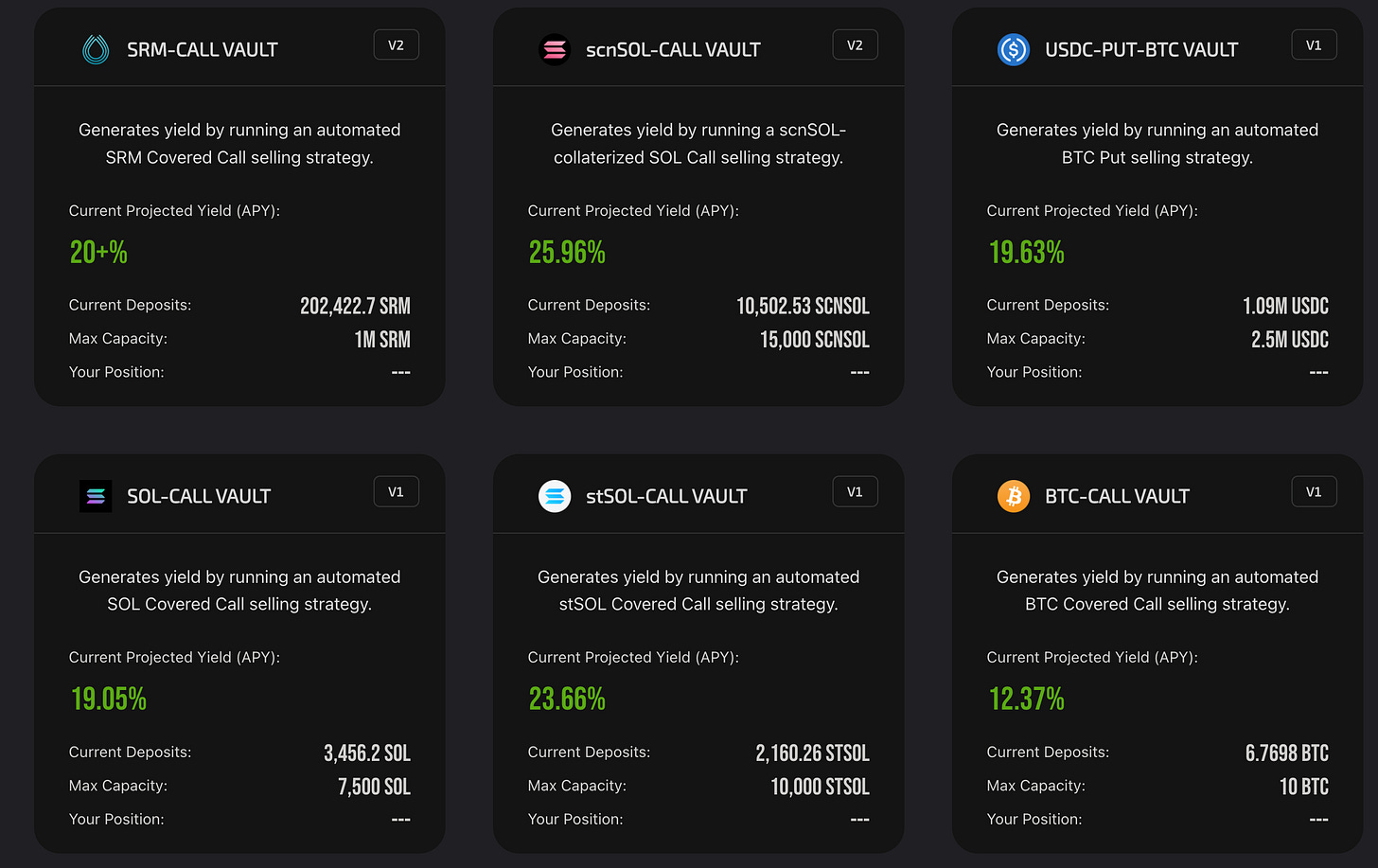

PsyOptions also recently acquired the decentralized options vault Tap Finance and rebranded the platform as PsyFinance. This was the first ever Solana protocol-to-protocol acquisition. Users of the platform can simply deposit their assets into one of PsyFinance’s options vaults; each vault executes an automated trading strategy on PsyOptions to earn stable, non-inflationary yields on Solana of even more than 20% APY. PsyFinance is also developing additional features around liquidity mining on options, which will drive users’ yields even higher.

PsyOptions and PsyFinance are both governed by the PsyDAO, whose membership is gated by the $PSY governance token. In January 2022, PsyOptions held an IEO for $PSY on FTX and Gate, which were both oversubscribed by more than 20-fold. The IEO on FTX was the largest in the exchange’s history.

Ultimately, PsyOptions and PsyFinance bring the diversity of financial products of TradFi to the trustlessness and composability of DeFi –– a remarkable first step in making ‘Psy’ protocols one of the most robust and feature-complete financial services platforms for both DeFi projects and end users alike.

What is PsyOptions?

PsyOptions seeks to be the de facto on-chain financial services platform for Decentralized Finance. The core team contributes to blockchain based software alongside other globally distributed individuals and entities through the Psy Finance DAO. The team has built out an array of product offerings, such as yield generating option vaults and under collateralized, cash settled, European style options - all built on open-source software. The project, which won first place in the Solana x Serum DeFi Hackathon, emerged as a mechanism to automate yield-generating, options trading strategies, enhancing the financial products of TradFi with the openness and trustlessness of DeFi.

How do options work?

To understand what PsyOptions brings to the Solana ecosystem and DeFi at large, it’s important to first understand what options are and what are the different types of options. Generally, an option is a financial contract that gives its owner the right to trade some amount of an underlying asset at a predetermined price. This predetermined price is called a strike price and may differ from the actual price of the underlying asset at the time that the option might be exercised, which, in some cases, means that the owner can earn some kind of profit by exercising their options at the right time. Call options give their owners the right to buy the asset at the strike price, while put options give their owners the right to sell the asset at the strike price. You can read more about options and options trading strategies here.

Importantly, there are two types of options markets: American- and European-styles. The key difference between the two is when the option can be exercised. All options contracts must include some ‘expiration date,’ which sets the timeframe for when the options can be exercised. In the American-style, the owner can exercise anytime up till the expiration date, while in the European-style, the owner can exercise only on the expiration date. American-style options have the advantage of being more flexible, giving owners more freedom in their financial strategies, while European-style options have the advantage of being easier to price and more capital efficient, as there is only one day during which the owner can exercise.

What does PsyOptions offer its users?

PsyOptions’ flagship product is their American-style options protocol. Users can create a new options market by specifying an expiration date, the underlying asset and amount of that asset that a single option will hold, the quote asset (which is the denomination in which the option is priced), and a strike price. PsyOptions makes no assumptions about what the underlying asset must be, meaning that as long as it can be represented as an SPL token, an options market can be created for it. That means things like NFTs, tokenized property, tokenized stocks, and more are all fair game.

Once an options market has been initialized, users can then mint options. All options in the protocol are fully collateralized, meaning that in order for a user to mint an option, they must put up 100% of the underlying amount for that option. In finance lingo, fully collateralized options are called covered calls (the call option) or secured puts (the put option). The collateral assets are stored in the option market’s Underlying Access Pool. Once a user has put up the collateral necessary to mint their option, they receive two tokens from the protocol: an OptionToken, which is the actual token representing the option contract, and a WriterToken, which gives its holder the right to claim the quote amount (the amount paid by the person exercising the option) once the option is exercised.

To exercise an option, the holder of an OptionToken can pay the quote amount (the strike price multiplied by the number of underlying assets they are purchasing) to the protocol, which is then deposited in the Quote Asset Pool. The holder of the WriterToken (generally, the user who created the option) can then claim the quote amount from the Quote Asset Pool.

If an option expires before it is exercised, the holder of the WriterToken can burn that token to retrieve the underlying amount from the Underlying Asset Pool. Alternatively, if a user would like to close their option position before the option expires, they must hold and burn both the WriterToken and the OptionToken to retrieve the underlying amount from the Underlying Asset Pool.

PsyOptions also offers a European-style options protocol, and is working on an under-collateralized options protocol which is still under active development. Under this framework, the expiration of options is handled automatically, and users do not have to fully collateralize their options when minting them, allowing for greater capital efficiency. The team is also building out a new protocol called PsyMarkets for end users to engage with European-style options; users will be able to buy spreads, condors, butterflies, and other options strategies on assets of their choice.

How can DeFi protocols leverage PsyOptions?

PsyOptions enables DeFi protocols to reimagine their approach to governance tokens, liquidity mining, and building out a community. It’s becoming increasingly common for DeFi protocols to conduct “airdrops” to incentivize early usage, where they give governance tokens to early users for free as a way to reward their early commitment to the project. Oftentimes however, these airdrop recipients sell these tokens as soon as they get them as a way to make a quick profit. This can be quite troublesome for the airdropping protocol, as they’ve essentially gifted valuable governance tokens to individuals with unaligned interests, which can affect the token’s price negatively, and thereby the protocol’s capital resources.

With PsyOptions, instead of airdropping governance tokens to early users, DeFi protocols can now airdrop call options for those tokens to early users. Then, if an airdrop recipient wishes to dump the governance token, they must first exercise their option by paying the quote amount to the protocol before they are able to sell the actual token. This, in a sense, hedges the risk of conducting an airdrop, as the protocol still earns some profit even if users dump their token. Jungle DeFi recently conducted an airdrop for options on their $JFI governance token; 102k of these call options have already been exercised, driving the token price above $2 and netting the Jungle Foundation more than $200k.

What is PsyFinance?

PsyOptions recently acquired Tap Finance, a decentralized options vault (DOV) protocol on Solana, and rebranded the protocol as PsyFinance. Notably, this was the first intra-ecosystem acquisition in Solana history! PsyFinance automates various option strategies on PsyOptions to generate sustainable yields on single token assets. This abstracts away much of the complexity and manual effort required for profitable options trading, allowing users to reap the rewards of well-designed options strategies without having to be an options expert.

PsyFinance offers options vaults on several different assets, including USDC, SOL, ETH, BTC, and more. Each vault executes a specific trading strategy on its asset, such as put selling or covered calls, and also automatically compounds its yield to maximize financial gains. Users simply have to deposit their assets into a vault that matches their outlook on the market to earn stable, non-inflationary yields on Solana as high as 30% APY. Additionally, with PsyOptions’ recent support for European-style options, PsyFinance’s options trading strategies can produce even higher yields, as this style of options tends to be more capital efficient. The European vaults also run on top of Serum, allowing any user in the Solana ecosystem to purchase the options flow from the vaults. PsyFinance will also soon add features around liquidity mining on options, enabling users to further maximize their yields from their automated strategies.

How are the protocols governed?

Both PsyOptions and PsyFinance are governed by the Psy DAO, whose membership is gated by the $PSY governance token. The Psy DAO generally follows the COMP governance model to guardrail how $PSY holders can propose and vote on protocol changes. Members of the DAO with at least 0.1% of $PSY delegated to their wallet address can propose governance actions, such as adding support for a new asset or changing the interest rate model for a particular options market. These proposals must be executable code. Once a governance action has been proposed, DAO members have 3 days to review and vote on the proposal. Proposals are implemented if a majority of voters and at least 2% of the total $PSY token supply support the proposal.

The maximum supply of $PSY is 1 billion tokens, and there are currently 62 million tokens in circulation. You can read more about the token distribution across the Psy community here. In January of this year, PsyOptions held an initial exchange offering (IEO) for $PSY on FTX and Gate. Both IEOs were oversubscribed by more than 20-fold, and the IEO on FTX was the most oversubscribed in the exchange’s history, demonstrating the tremendous excitement that the community has for PsyOptions and a robust options protocol for Solana.

Final Thoughts

In sum, PsyOptions immensely expands the scope of financial derivatives on Solana through its extremely versatile options protocol. With PsyOptions, DeFi protocols can create American-style or European-style options markets for their governance tokens, revolutionizing the ways they approach token airdrops, treasury management, and more. End users can also passively earn high, sustainable yields of more than 20% APY by depositing their assets into PsyFinance’s decentralized option vaults and profiting from automatically executed trading strategies. Moreover, with PsyOptions’ emerging products around European-style options and options liquidity mining, PsyFinance users can earn even higher yields with less upfront capital investment. Ultimately, PsyOptions and PsyFinance bring the diversity of financial products of TradFi to the trustlessness and composability of DeFi –– a remarkable first step in making ‘Psy’ protocols one of the most robust and feature-complete financial services platforms for both DeFi projects and end users alike.

- Paul Veradittakit

DIGESTS

Lawmakers Keep Mentioning Privacy in CBDC Discussions

How lawmakers approach privacy with central bank digital currencies differ, but the fact remains they're very frequently now raising the issue.

NEWS

Orange DAO Selects NEAR Foundation as Web3 Startup Partner

NEAR Foundation is excited to announce that Orange DAO, a crypto collective created by Y Combinator alumni for backing Web3 startups, has selected NEAR as its preferred layer 1 blockchain.

Coinbase’s NFT Strategy Questioned by Mizuho Analyst

Dan Dolev is skeptical about the exchange getting into the NFT business at this time, citing a decline in NFT internet searches.

IN THE TWEETS

REGULATION

Digital Euro May Get Easier AML Rules Than Bitcoin, EU Commissioner Says

Mairead McGuinness promised a role for banks in distributing the CBDC, as a consultation presages legislation earlier next year.

NEW PRODUCTS AND HOT DEALS

Boba Network raises $45 million at a $1.5 billion valuation

Boba Network, an Ethereum Layer 2 scaling project that utilizes optimistic rollups, has raised $45 million in Series A funding at a $1.5 billion valuation.

Lightning Labs Raises $70M to Bring Stablecoins to Bitcoin

The Taproot-powered “Taro” protocol aims to bring low-fee stablecoin and asset transfers to the Bitcoin Lightning Network.

HSBC Starts Metaverse Fund for Private Banking Clients in Asia

The Metaverse Discretionary Strategy portfolio aims to capture opportunities arising from the next iteration of the internet, the bank said.

LETS MEET UP

Los Angeles, April 20-22

Crypto Bahamas, Bahamas, April 26-29

Miami, May 2

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.