Pantera Proof of Work

VeradiVerdict - Issue #305

Proof of Work: How We Show Up for Founders

As a crypto VC for 10+ years, we’ve been lucky to work with 200+ of the best & brightest founders in the world at Pantera Capital, from the early stages and through every market cycle.

But how do we earn our opportunity for the next 10 years?

Our simple answer: Show Your Work.

About 2 years ago, we launched Proof of Work: an internal system to hold ourselves accountable to founders on:

how do we show up for founders?

where do founders need our help?

are we getting it done for founders?

We built out new systems and processes to track our engagement with our portfolio teams. Introductions we made to potential customers, partners, investors, or hires. Workshops on marketing, regulation, and token launch strategies. Amplifying new product launches and protocol upgrades.

We tracked as much as we could (and still missed a lot!). Now we’re ready to share some of what we’ve learned and built.

The Data

Here’s a look at v1 of the data behind our Proof of Work 👇

Introductions Made: 1,702

Business Development / Customers: 624 (37%)

Fundraising: 392 (23%)

Hiring / Recruiting: 171 (10%)

Legal / Regulatory: 166 (10%)

Banking / Treasury Mgmt: 125 (7%)

Security / Audits: 98 (6%)

Marketing / PR: 69 (4%)

Liquidity / Trading: 37 (2%)

Other (Governance, Tax, etc): 19 (1%)

Portfolio Asks Completed (excludes intros): 723

Marketing / Amplification: 217 (30%)

Business Development: 204 (28%)

Legal / Regulatory: 110 (15%)

Talent: 70 (10%)

Banking / Treasury: 41 (6%)

Liquidity / Trading: 31 (4%)

Security / Audits: 30 (4%)

Other (Research Lab, etc): 30 (4%)

Portfolio Interactions / Hosted Events: 785

Founder Meetings (Virtual): 649

Founder Meetings (In-person): 71

Founder Dinners: 15

Co-working Sessions: 11

Happy Hour: 20

Workshops / Webinars: 10

Pantera House: 6

Summits: 3

Total Attendees: ~6,255

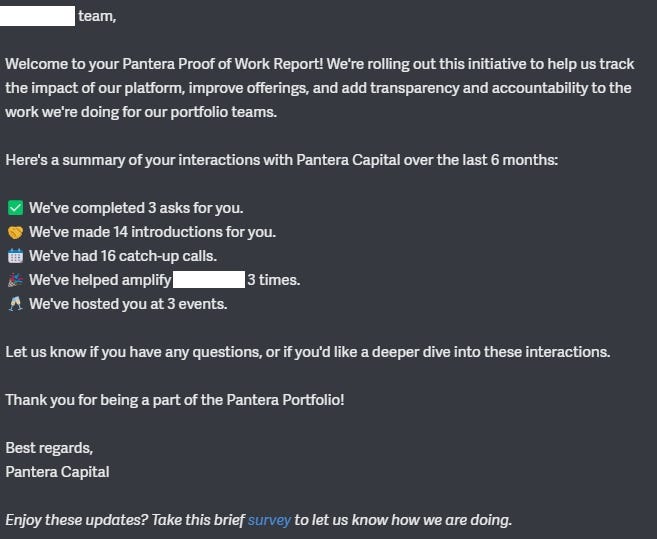

The Proof of Work Report

We’ve started to test out a reporting system to provide custom Proof of Work summaries to our founders.

Here are a couple of samples.

What do you think we should add? 💬

Showing Up in Crisis

Proof of Work also provides us with a neat historical record of the crypto industry in crisis.

March 2023: When Silicon Valley Bank, Signature Bank, and Silvergate Bank wound down in the same month, every crypto founder was left in a tough situation. They were suddenly cut off from company funds - the money they needed to pay employees, vendors, server costs, etc. It wasn’t the first time that a portfolio company was treated this way by their banking partners, but this time was different. We tapped into every banking relationship we had built over the years to open new accounts for companies and help make sure those paychecks were delivered on time.

What did this look like in our Proof of Work system? An all-time high in Banking introductions made for our portfolio teams by ~2,000%.

November 2022: The collapse of FTX kicked off a series of bankruptcies and liquidations that rolled through the crypto industry for months.

In the 12 months that followed the end of FTX, we recorded a 300-500% increase in calls and meetings with portfolio founders, year over year. We spent that time strategizing about runway, surviving the bear market, and looking around the corner for the next ball to drop.

Looking back now, it was “the bad day that lasted a year”

https://twitter.com/FranklinBi/status/1590785667197333504

The Pantera Hotline

We tell our founders that we’re standing by to pick up the phone if they need us. Some fun facts about how founders reach us:

38.6% of asks come from Telegram (bullish for TON?)

37.4% of asks come from catch-up calls

18.4 % of asks come from email

5.6% from in-person meetings

Any scaling solutions out there for this? 🤯

Raising the Bar

We’re always improving & raising the bar for ourselves as crypto VCs. Planned for Proof of Work v2:

Tracking rate % (still under-counting by ~20-30% imo)

New metrics for Research Lab initiatives

More automation (AI tools!)

Public dashboard (maybe?)

Any other ideas?

We’re building Proof of Work for our founders.

At the end of the day, they chose us. That’s why it’s important that we show up.

Our Proof of Work is also a testament to the Pantera team’s constant work & dedication. We’re grateful for every star on our team.

Now it’s time to get back to work 💼 💪

- Paul Veradittakit

DIGESTS

New Binance CEO Sees No Need for IPO as He Plots 100-Year Strategy for Crypto Exchange

Richard Teng, who replaced founder Changpeng "CZ" Zhao in November, is playing the long game.

Can Crypto Sway the U.S. Election?

With the political environment so finely poised, candidates would be wise to attract crypto voters, says Nonco’s Jeffrey Howard.

BUSINESS

U.S. Leading Economic Indicators Continue to Fall, No Longer Signal Recession

The U.S. recession fears were partly responsible for the early August slide in stocks and cryptocurrencies.

FutureNet Co-Founder Arrested in Montenegro Over Alleged $21 Million Fraud

Roman Zimian, who founded the alleged "large-scale international pyramid scheme" FutureNet, had previously escaped from house arrest in Italy.

REGULATION

Former FTX Executive Salame Seeks to Overturn Conviction Alleging Breach of Deal on Partner’s Probe

Lawyers for Salame argue the Government “failed to abide by its word” by resuming its investigation into his partner, Michelle Bond.

Kamala Harris Advisor Says VP Open to Crypto: Bloomberg

A senior campaign advisor cited the need for rules for “that sort of industry,” but the statement was hailed as a breakthrough.

NEW PRODUCTS AND HOT DEALS

Story Protocol Raises $80 Million in Bid to Shake Up IP Ownership in the AI Era

Blockchain can replace “a medieval, antiquated system,” PIP Labs cofounder Jason Zhao told Decrypt ahead of its testnet launch.

Bitcoin Miner Bitfarms to Buy Rival Stronghold Digital for $175M in Stock, Debt

The deal comes weeks after Riot Platforms dropped a bid to buy Bitfarms, choosing to try and overhaul the company's board before pursuing a takoever again.

LETS MEET UP

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have an projects that need funding, feel free to DM me on twitter.