Privacy Renaissance: Blockchain’s Next Era

VeradiVerdict - Issue #341

Since Bitcoin’s invention, the blockchain industry’s ethos has been anchored in transparency as an open, immutable ledger that is visible to everyone; trust through verification rather than institutional reputation. This transparency enables decentralized systems to function with integrity and accountability.

But as blockchain technology matures and its applications broaden, transparency alone is no longer sufficient. A new reality is taking shape: privacy is essential for mainstream adoption, and the demand is accelerating across cultural, institutional, and technological fronts. At Pantera we’ve believed in this thesis since day 1, having invested in ZCash back in 2015 as one of the first attempts at bringing privacy to an immutable ledger.

We believe that we’re entering a privacy renaissance, one that blends the ideals of open blockchains with the practical needs of global finance. And this moment provides a backdrop for privacy protocols built from first principles around confidentiality like Zama (launching mainnet soon). Zama’s fully homomorphic encryption (FHE) technology is the absolute fortress that the world needs for mainstream adoption and to withstand the threat of quantum computing in the coming years. Blockchain applications are one area of implementation for Zama’s FHE cryptography and can be explored in other verticals like AI (Zama Concrete), cloud computing, and others.

Another portfolio in a similar vein is Starkware, inventor of zk-STARKs and Validium, a hybrid approach to blockchain privacy and scalability. Starkware’s cryptography similarly is quantum resistant and focused on blockchain use cases, especially with the launch of their latest S- Two prover.

The Cultural Shift: Surveillance Fatigue to Digital Sovereignty

The world has undergone a transformation in how individuals think about data. Years of mass surveillance, algorithmic tracking, and data breaches have made privacy one of the defining cultural themes of the decade. Users now understand that metadata, not just messages or transactions, can reveal intimate details about identity, wealth, location, and relationships. Privacy paired with user ownership of personal sensitive data is the new norm that we’re betting on at Pantera with investments in Zama, Starkware, Transcrypts, and World.

As the public becomes increasingly privacy-conscious, blockchains cannot ignore that digital money must offer confidentiality, not constant legibility. In this environment, privacy is no longer a niche preference. It is part of a broader push toward digital sovereignty.

The Institutional Shift: Transparency Without Privacy Fails at Scale

Institutions are continuing to enter the blockchain ecosystem. Banks, remittance platforms, payment processors, corporates, and fintechs are running pilots and preparing for real volumes across tokenized assets, cross-border settlement, and multi-jurisdiction payment rails.

Yet these institutions cannot operate on fully transparent public ledgers. Corporate cash flows, supplier networks, FX exposures, contract terms, and client transactions cannot be visible to competitors or the public. Enterprises need confidentiality with optional transparency, not full exposure.

This is where earlier pioneers like Zcash laid the groundwork. When Pantera Capital invested in Zcash in 2015, we recognized early that privacy was not merely an ideological preference; it was a requirement for real economic activity. Zcash’s crucial insight was that privacy cannot be bolted onto a system later, especially using zero-knowledge. It must be woven into the core protocol; otherwise it becomes too difficult, fragile, or inefficient to use.

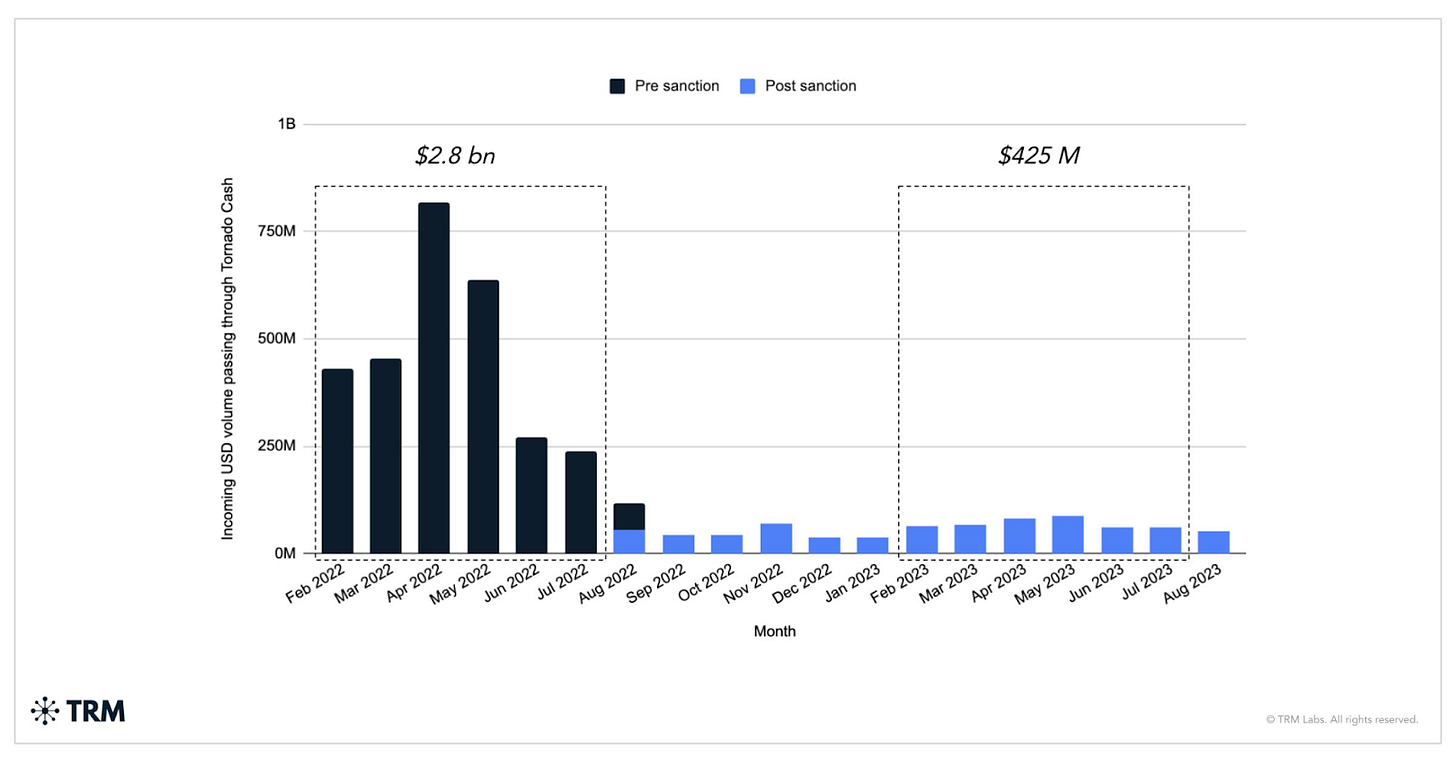

Launched in 2016 as a fork of Bitcoin, Zcash introduced zk-SNARKs that allowed users to shield transaction details while preserving full verifiability. Tornado Cash also represents an important chapter in the evolution of on-chain privacy. The protocol saw meaningful user activity as individuals sought ways to break transactional linkages on public chains.

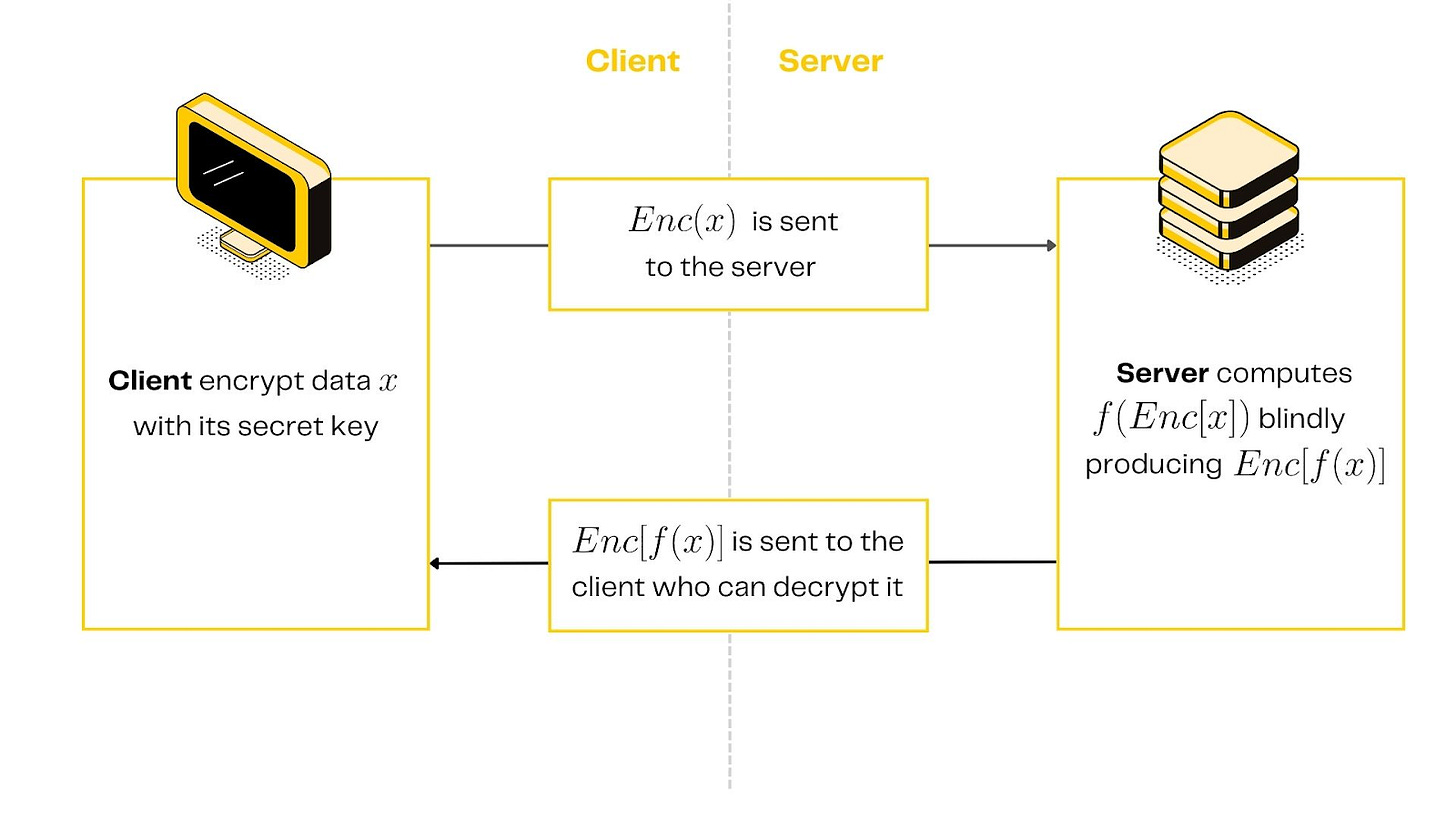

However, its model of strong privacy without mechanisms for selective disclosure ultimately led to high-profile legal actions by government authorities, forcing the project to effectively pause despite being autonomous code. This outcome highlights a critical lesson: privacy cannot come at the expense of auditability or compliance pathways. It is precisely why technologies like Zama’s fully homomorphic encryption are so fundamental. FHE enables computations on encrypted data while preserving the ability to verify and disclose information selectively, something mixers like Tornado Cash were never designed to offer.

The significance of FHE can be understood when you evaluate the landscape and resources put into building FHE frameworks from technology leaders, including Apple, Microsoft, and others. Their investment in this space signals a clear consensus: scalable, compliant, end-to-end encryption is the future of digital privacy, both for consumers and institutions.

Privacy Is Accelerating Now

The numbers reflect this shift. Privacy-focused crypto assets have seen rising interest from both users and investors. But the true shift is not driven by retail speculation. It is driven by use cases where privacy and transparency must coexist:

Cross-border payments increasingly rely on blockchains, but businesses and banks cannot expose every payment path.

Tokenized real-world assets require confidentiality around holdings and investor identity.

Global supply-chain finance demands that counterparties verify events (shipments, invoices, settlements) without revealing trade secrets.

Enterprise-grade transaction rails need a model where auditors and regulators have visibility, but the public does not.

At the same time, retail users are increasingly uncomfortable with surveillance-heavy chains where transaction DAGs can be reconstructed with simple tools. Privacy is becoming part of the consumer expectation for digital money.

In short, the market is aligning around a simple truth: blockchains that cannot offer confidentiality will be structurally limited in institutional adoption.

Canton, Zama, Starkware and the New Privacy Architecture

As the privacy renaissance unfolds, a new generation of protocols is emerging to meet institutional needs.

Blockchains like Canton highlight the growing enterprise demand for private transaction execution on shared settlement layers. These systems allow participants to transact privately while benefiting from synchronized global states and shared infrastructure. Canton is a strong signal that enterprises want blockchain benefits without public exposure.

Yet the most transformative leap in private computations may come from Zama, which occupies a fundamentally different and arguably more scalable position in the privacy tech stack.

Zama is pioneering a confidentiality layer using fully homomorphic encryption (FHE), enabling computation on encrypted data. This allows entire smart contracts (inputs, state, and outputs) to remain encrypted while still verifiable on public blockchains. Unlike privacy-first L1s, Zama works across existing ecosystems, particularly the EVM. This means developers and institutions don’t have to adopt a new chain; they can adopt privacy where they already build.

Zama’s architecture represents the next evolution of blockchain privacy: not simply hiding transactions but enabling private smart contracts at scale. This unlocks new classes of applications (private DeFi, encrypted order books, confidential RWA issuance, institutional-grade settlement flows and clearing, and secure multiparty business logic) all without sacrificing decentralization. Some of these applications unlock sooner rather than later.

Privacy assets are gaining attention. Institutions are actively assessing confidentiality layers. Developers want privacy-preserving computation without the latency or complexity of off-chain systems. And regulators are beginning to articulate frameworks that distinguish legitimate confidentiality tools from illicit obfuscation.

Looking Forward

The story of privacy in blockchain is no longer a debate between transparency and secrecy. It is the realization that both are necessary for the next era of decentralized finance. The convergence of cultural attitudes, institutional requirements, and cryptographic breakthroughs is reshaping how blockchains will evolve over the next decade.

Zcash demonstrated the necessity of privacy from a protocol perspective. Protocols like Canton indicate institutional appetite for confidential rails. And Zama is building the infrastructure that could unify these demands into a universal, scalable privacy layer across chains.

Pantera’s early investment in Zcash stemmed from a simple belief: privacy is not optional. Nearly a decade later, that thesis has never been more relevant. The next wave of adoption, from tokenized assets to cross-border payments to enterprise settlement, depends on making blockchain work securely, seamlessly, and privately.

As privacy becomes a defining theme of this market cycle, the protocols that deliver practical, scalable, and compliant confidentiality will define the future landscape. Among them, Zama stands out as one of the most promising and timely leaders in the rising privacy supercycle.

- Paul Veradittakit

Important Disclosures – Certain Sections of This Letter Discuss Pantera’s Advisory Services and Others Discuss Market Commentary. Certain sections of this letter discuss the investment advisory business of Pantera Capital Partners LP and its affiliates (”Pantera”), while other sections of the letter consist solely of general market commentary and do not relate to Pantera’s investment advisory business. Pantera has inserted footnotes throughout the letter to identify these differences. This section provides educational content and general market commentary. Except for specifically-marked sections of this letter, no statements included herein relate to Pantera’s investment advisory services, nor does any content herein reflect or contain any offer of new or additional investment advisory services. This letter is for information purposes only and does not constitute, and should not be construed as, an offer to sell or buy or the solicitation of an offer to sell or buy or subscribe for any securities. Opinions and other statements contained herein do not constitute any form of investment, legal, tax, financial, or other advice or recommendation.

Business

61% of Institutions Plan Crypto Allocation Boost Into Q4, Says Sygnum

Portfolio diversification serves as the primary investment driver for 1,000 respondents surveyed across 43 countries with interest in tokenized RWA jumping from 6% to 26%, YOY.

Major crypto exchange picks Texas for new HQ, citing pro-business rules

Coinbase will move its business registration out of Delaware after a stockholder majority voted to reincorporate in Texas, joining the exit of this state as part of the Dexit movement.

Circle quarterly profit beats estimates on stablecoin growth

Posted adjusted earnings of 36 cents per share beat estimates of 22 cents; total revenue, which includes reserve income, went up 66% to reach $739.8 million.

Regulation

EU Pushes to Centralize Oversight of Region’s Crypto Businesses

As part of a greater initiative to centralize the European Union’s market supervision, France and certain EU institutions are advocating for this plan while other member states disagree.

Wall St regulator to consider crypto token classification, chair says

SEC Chair Paul Atkins announced that the agency would soon consider creating a digital asset classification system to help delineate when they would be securities.

Major Overhaul in US Crypto Regulation: CFTC May Fully Take Over the Spot Market

Congress is reviewing a bill that would formally grant CFTC primary regulatory authority for the digital asset spot market and establish a form of collaboration with the SEC.

New Products and Deals

BlackRock’s $2.5 billion tokenized money market fund gets boost with Binance tie-up

Binance will now accept BUIDL as collateral while BlackRock will issue a new share class of BUIDL on the Binance-launched BNB blockchain that is now mostly decentralized.

Public Acquires CryptoIRA Business from Alto

Long-term investing app Public acquired Alto’s CryptoIRA self-directed IRA platform that opens up private market opportunities to trade cryptos within their individual retirement portfolios.

21shares launches two US crypto index ETFs

These ETFs track cryptocurrencies basket prices for U.S. investors, including Ethereum, Solana, and Dogecoin. 21Shares launched these funds in collaboration with Teucrium Trading.

This Week at Pantera

Crypto Markets, Privacy, And Payments

Up-to-the-minute news in Pantera’s 11/12/2025 Blockchain Letter includes Cosmo Jiang’s acumen into the crypto market, how Zcash is poised at the center of crypto’s privacy revival, upcoming events, and much more.

Rollup TV

Face-to-face with the leaders in digital assets, Pantera Capital joins Flare Networks, Rialo, and the Blockchain Association as they share deep industry insights.

Introducing the DAT Dashboard

Digital Asset Treasury companies can dive into market and asset-level overviews; in-depth DATCo profiles; and pro forma metrics and analytics.

Let’s Meet Up

I am in Los Angeles the week of November 24th, feel free to DM me for a chat!

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early-stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have any projects that need funding, feel free to DM me on twitter.

Love this!