The NEAR Protocol recently launched the Rainbow Bridge, its bridge with Ethereum. Users can now easily transfer ERC-20 tokens between the two blockchains, unlocking new channels of liquidity and pools of users for dApps on NEAR. Rainbow also allows contracts on both chains to read and cryptographically verify information from the other chain, powering composability of dApps across chains. In the future, the NEAR team plans to expand the Bridge to other chains, support other types of tokens (like ERC-721 NFTs), and offer full synchronization of dApp state across blockchains.

The Rainbow Bridge is powered by a NEAR light-client on Ethereum, which efficiently tracks and verifies the state of the Ethereum blockchain in a NEAR smart contract, and an Ethereum light-client on NEAR, which efficiently tracks and verifies the state of the NEAR protocol in an Ethereum smart contract. To transfer assets between chains, users deposit their assets in a “locker” smart contract, whose state is then verified by the corresponding light client on the other chain. Once verified, users can then mint an equivalent amount of wrapped assets on the other chain, guaranteeing a 1:1 ratio between the original and wrapped asset.

Most existing cross-chain bridges rely on centralized validation schemes, like Proof-of-Authority (PoA), where known, authorized validators are responsible for verifying the state of the underlying blockchains. This means the bridge is only as trustworthy as the validators, compromising the stronger security guarantees of the individual chains. The Rainbow Bridge replaces PoA with an efficient cryptographic mechanism to verify chain-state within each light client, meaning the bridge maintains the security guarantees of the underlying chains and is truly trustless and permissionless.

Users with Ethereum-native assets can now leverage NEAR’s significantly lower transaction speeds and transaction fees. For the broader NEAR ecosystem, the Bridge unlocks the trove of liquidity on Ethereum, fueling the growth of DeFi protocols on NEAR with users and activity.

As DeFi protocols launch on newer blockchains with better scalability and efficiency guarantees, the crypto community will need robust mechanisms to synchronize state and transfer assets across the universe of chains. Rainbow offers a promising model for how fully trustless bridges can power a new generation of DeFi platforms and dApps on NEAR and beyond.

What is the Rainbow Bridge?

The NEAR Protocol, an open-source blockchain focused on scalability and efficiency, recently rolled out its bridge with Ethereum, called the Rainbow Bridge. The Rainbow Bridge allows the seamless transfer of ERC-20 tokens (the standard behind DAI, USDC, LINK, and more) between the NEAR and Ethereum blockchains. This mechanism enables users to trade Ethereum-native assets on NEAR dApps, unlocking new channels of liquidity and users for the NEAR ecosystem. The Bridge is completely trustless and permissionless, meaning that any user can deploy a new bridge, help maintain an existing bridge, or use an existing bridge to transfer assets without needing approval from anyone.

As of now, users can transfer a myriad of tokens from Ethereum to NEAR, including stablecoins, wrapped assets, DEX tokens, lending tokens, and more. The Bridge also allows either chain to read and cryptographically prove information stored on the other chain, meaning users can do things like vote in a DAO on NEAR using their ETH balance as a stake, without having to physically transfer their ETH balance. For developers, the Bridge also supports the ability to schedule calls with callbacks on the other chain, allowing smart contracts to intelligently interface with information on both chains.

Eventually, the Bridge plans to support interoperability with more chains, complete application state-syncing across multiple chains, and even transfers of other token types, like ERC-721, enabling use cases around DeFi, NFTs and more.

How does it work?

At a high-level, the Rainbow Bridge is powered by two key components: a NEAR light-client on Ethereum and an Ethereum light-client on NEAR. A light-client is essentially a smart contract that tracks the state of a given blockchain and verifies it in a trustless way, without requiring any heavy computations. An Ethereum light-client on NEAR, for example, tracks the state of the Ethereum blockchain in a NEAR smart contract, meaning that NEAR applications can easily access and cryptographically verify the state of Ethereum and read data like contract balances, transaction history, etc. Similarly, a NEAR light-client on Ethereum tracks the state of NEAR in an Ethereum blockchain, allowing Ethereum applications to read various information from the state of NEAR.

Each of the light clients is linked to the blockchain it tracks via a relay, which forwards new block headers from the blockchain to the light client. These block headers can then be used to verify the state of the blockchain cheaply within the light client, enabling applications to trust the light client’s replica of the chain state. Each client is also coupled with a Prover contract that can verify specific events or contract execution results on the blockchain that the client tracks.

Fig 1. Light clients powering the Rainbow Bridge (NEAR Blog)

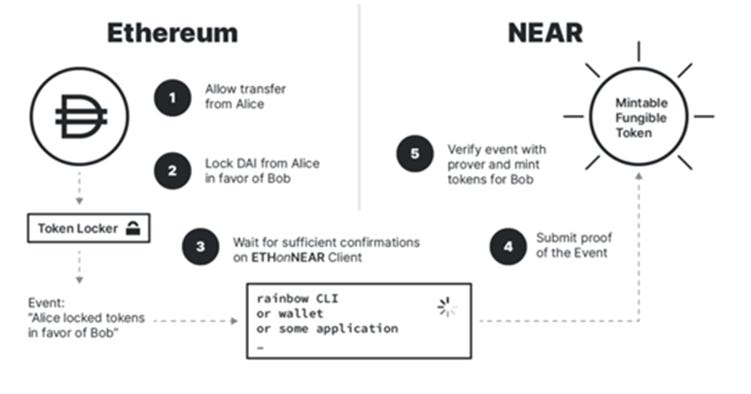

To transfer assets between chains, a user would first deposit their assets into a locker contract on the chain that the asset is native to. The locker contract essentially prohibits these assets from being used on the native chain after they have been transferred to the other chain, preventing attacks like double-spending. Users can then mint an equivalent amount of wrapped assets via a minting contract on the other chain, which they can then freely trade and use on the other chain. The light clients essentially verify that users have locked the appropriate assets on the original chain, securing the 1:1 relationship between the original and wrapped assets.

As a more concrete example, if a user wanted to transfer 10 DAI to NEAR, they would first deposit the assets in a TokenLocker contract on Ethereum and then mint 10 nDAI (the wrapped version of DAI on NEAR) using a MintableFungibleToken contract on NEAR. To reverse the transfer, they can simply burn the 10 nDAI on the MintableFungibleToken contract and unlock their native DAI from the TokenLocker contract on Ethereum.

Fig 2. ERC-20 token transfer via locking and minting on the Rainbow Bridge (NEAR Blog)

You can get started with transferring assets between Ethereum and NEAR using the Rainbow Bridge here, following this guide. Ethereum users without a NEAR account can claim an account from this NEAR faucet.

How is this different from other bridges?

Most other cross-chain bridges use a validation scheme called Proof-of-Authority (PoA), which essentially assigns block validation to known, authorized validators. PoA relays and verifies the state of one chain to another to allow for minting/unlocking of wrapped assets. The security of this approach, however, is predicated on the security of the validators. If the known validators behave maliciously or fail to correctly verify the state of chains, these bridges become prone to double-spending attacks and more.

NEAR’s Rainbow Bridge replaces the PoA model with light clients that can efficiently verify the state of the chain, removing the need for authorized validators. This increases the security of the bridge to the security of the two underlying chains, because the entire system is trustless and verifies state using each blockchain’s native validation processes. Users can easily transfer assets between both chains, without having to worry about trusting a new set of validators and a new verification procedure. This enables true trustless, secure interoperability and encourages a new generation of decentralized, networked blockchains.

What are some of the Bridge’s use cases?

The Rainbow Bridge enables users to access the best of both the NEAR and Ethereum blockchains. Users with plenty of Ethereum-native assets can now leverage NEAR’s incredible scalability and transaction efficiency, including its lightning-fast speeds (1-2 second transaction time vs. several minutes on Eth) and negligible fees (under $0.01 per transaction vs. $13 on average for Eth).

For the NEAR ecosystem, the Rainbow Bridge also unlocks the treasure trove of liquidity sitting on Ethereum. Since users can spend their ERC-20 assets on NEAR dApps, there’s likely to be huge interest in a new generation of DeFi lending protocols, exchanges, liquidity pools, and more––all hosted on NEAR. These protocols can also leverage NEAR’s competitive guarantees around scalability and efficiency to offer higher rewards and better user experiences than their Ethereum counterparts, which are bottlenecked by slow transaction times and ridiculous gas fees. Such applications could potentially attract significant mainstream interest as well, since cleaner UX and competitive rewards matter more to everyday users than the underlying blockchain technology. Users have already begun to spend wrapped ERC-20 assets on several NEAR dApps, including Pulse (a decentralized prediction market), Ref.Finance (an AMM for swapping bridged tokens), and Paras (a trading platform for digital NFT cards).

As the Rainbow Bridge evolves, the potential use cases expand to asset transfers across other chains (including Celo, Solana, Polkadot, etc.), different classes of tokens (including ERC-721 NFTs), and a new model of multi-chain dApps that isn’t restricted or partial to any one specific blockchain.

Final Thoughts

As the scope and scale of crypto grows, DeFi protocols are likely to expand to a new generation of blockchains (like NEAR) that offer significant performance improvements and broader functionality than their predecessors (like Ethereum). Especially given the recent saturation of the Ethereum network, resulting in slow transaction times and insane gas fees, protocols are seeking better, more user-friendly solutions to build out core financial functions.

The Rainbow Bridge offers a promising model for true trustless and permissionless blockchain interoperability. By design, the Bridge maintains the security properties of the underlying blockchains, allowing for the seamless, secure transfer of assets and synchronization of state across various chains. By unlocking new liquidity channels to stimulate engagement, the Rainbow Bridge can power a new wave of DeFi protocols on NEAR and beyond, designed to tackle the inefficiencies of Ethereum and offer more cost-effective, user-friendly financial tools.

- Paul V

DIGESTS

M&A Using Crypto? Here’s How to Make It Work

Given the rise in prices, it won't be long before we see M&A transactions in crypto, says one lawyer. Here's how to think through the issues.

NEWS

Latin American e-commerce giant MercadoLibre discloses treasury bitcoin buy

MercadoLibre, the Latin American e-commerce and fintech company, said in a Wednesday regulatory filing that it now holds bitcoin on its balance sheet.

Galaxy Digital to Buy BitGo for About $1.2B in Stock, Cash

The acquisition comes as Galaxy Digital plans a U.S. listing later this year.

REGULATIONS

US Federal Reserve Proposes Guidelines for ‘Novel’ Banks That Want Access to Fed Payments

The guidelines would have a direct bearing on Wyoming special purpose depository institutions that want access to Fed payments, said U.S. Sen. Cynthia Lummis.

New York Bill Would Freeze Bitcoin Miners Pending Environmental Review

The new legislation seeks to counter an industry that critics blast as detrimental to New York’s decarbonization goals.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Coinbase to acquire leading institutional data analytics platform, skew

Acquisition allows Coinbase to provide real-time actionable data analytics to institutions and traders.

Paradigm, 3LAU Back $7.6M Raise for ‘NFT Social Network’ Showtime

Crypto investment firm Paradigm and DJ 3LAU are involved in a $7.6 million funding round for non-fungible token (NFT) social network Showtime.

With backers like Tiger Global, LatAm crypto exchange Bitso raises $250M at a $2.2B valuation

Bitso, a regulated crypto exchange in Latin America, announced today it has raised $250 million in a Series C round of funding that values the company at $2.2 billion.

LETS MEET UP

Bitcoin 2021, Miami, June 3-6

Puerto Rico, June 7-9

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.