Rarimo is an interoperability protocol making assets, identities, and dApps multi-chain. One of the key features distinguishing them from all other interoperability bridges is their focus on decentralized identities and social. By making metadata retrievable, and by replicating credentials, Rarimo enables Soulbound Tokens (SBTs), NFTs, and other components of on-chain identity to seamlessly travel across chains. Accordingly, we believe that they are well-positioned to bring interoperability to decentralized social layers.

Rarimo has also pioneered new use cases for cross-chain digital assets transfers, such as NFT checkouts, which allow users to buy NFTs using any cryptocurrency, regardless of the blockchain it’s held on. They eliminate excess transaction fees and time-consuming manual steps from an endless range of use cases, and instead offer users single-click, single-fee solutions. Pantera recently led a $10M round in Rarify Labs, one of Rarimo’s service providers, along with Protocol Labs, Circle, Eniac, Slow, Hyper, and Greycroft.

Problem space

As more layer 1s and 2s continue to enter the space, fragmentation is becoming an increasingly urgent issue. Users need to be able to access their assets and identities from across different ecosystems.

While in the case of digital assets, pre-existing solutions do exist, they often offer a poor user experience or have limited functionality. Users are generally required to pay multiple transaction fees, provide multiple signatures, execute multiple manual steps, and in some cases, shoulder a vulnerability to hacks. When solutions do offer an improved user experience it generally comes at the cost of providing universal support. Typically, they support only a narrow range of use cases and are often only focused exclusively on the transfer of ERC-20 tokens. This infrastructural bias makes it extremely challenging to expand to other ecosystems.

Meanwhile, users of decentralized social layers are currently unable to transfer their identity artifacts from one blockchain to another let alone in a seamless, cost-efficient manner.

Architecture and how Rarimo works

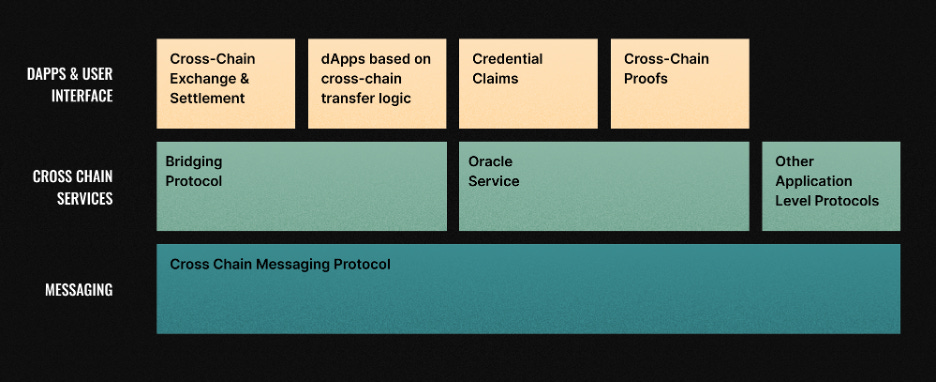

Rarimo’s multilayer architecture. Source: Rarimo

Their highly composable multi-layer architecture is what allows Rarimo to support such an expansive range of use cases. It consists of three components: the Base Layer which operates as a generalized messaging protocol and includes an independent and decentralized blockchain; the Cross-chain Layer which includes bridging and oracle services; and the Application Layer which leverages the two underlying layers to provide support for specific projects.

The protocol was designed to provide the low transfer costs of centralized solutions, but the security of decentralized ones. Rarimo creates proofs using a Threshold Signature Scheme that reduces network costs while also supporting a large number of independent validators. On top of this, Rarimo bundles transactions. This allows multiple flows to be executed at once, and therefore saves users from having to pay multiple transaction fees.

As well as improving the experience for users, Rarimo’s design makes development faster and easier for builders whose dApps leverage multi-chain liquidity and access. The Application Layer means developers can effortlessly expand existing dApps from one chain to many without having to build notable amounts of custom, use-case specific logic.

Currently, Rarimo supports Ethereum, Solana, Binance, Near, Avalanche, and Polygon. Rarimo’s testnet is currently accepting developer applications.

Rarimo x Circle

Most recently, Rarimo partnered with Circle, a Pantera portfolio company, to integrate Circle’s Cross-Chain Transfer Protocol (CCTP). This allows USDC to flow natively across chains for NFT payments.

Right now, users who hold USDC on one chain and want to buy NFTs listed on another face an extremely complex process. They are forced to manually exchange their tokens on a DEX, accruing multiple transaction fees along the way. With the Rarimo x CCTP integration however, they will be able to make cross-chain NFT purchases with USDC with only a single click, and paying only a single transaction fee.

Developers can also utilize the Rarimo-CCTP integration to enable paying in USDC while minting NFTs on different chains.

Rarimo Use Cases

Rarimo’s additional interoperability use cases include:

● Access: cross-chain proof of identity including SBTs, multi-chain DAO voting and governance, and multi-channel state replication

● Liquidity: cross-chain NFT purchases, proof of ownership / reputation for lending, NFT fractionalization, optimized NFT pooling / staking, and bulk transferring NFTs between chains

● Compatibility: scaling assets multi-chain for metaverses, cross-chain NFT drops, brand asset migration by end users, and layer 1 to layer 2 (or vice versa) asset swaps

Team

Rarimo is maintained by the decentralized Rarimo Foundation. Service provider, Rarify Labs, was founded by Lasha Antadze, Revaz Tsivtsivadze, and Vlad Dubinin in late 2021. Revaz has previous experience in APIs and fintech products including Shutterstock and Mastercard. Lasha and Vlad are the previous co-founders of Shelf Network, a platform for cross-border decentralized auctions, and Vlad is also the co-founder of Distributed Lab, one of the largest Blockchain research and development centers.

We believe that Rarimo is well-positioned to solve the imminent issue of fragmentation to become a leader in the interoperability space. They are set apart by their modular, multi-layer architecture which enables hyper-secure and user-friendly multi-chain transactions. We at Pantera are thrilled to back Rarify Labs as they continue to develop solutions for the secure transfer of data, identity, and digital assets across web3.

- Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

Hong Kong Is Vying To Be The Next Crypto Hub

Hong Kong has historically provided fertile soil to grow financial institutions. Can it also make magic for crypto firms?

BUSINESS

Intel Discontinues Bitcoin-Mining Blockscale Chips, No Future Gens Announced

Came in late, leaving too early.

Crypto Wallet Firm Trezor Adds Privacy-Enhancing 'CoinJoin' Feature to Bitcoin Transactions

The popular Bitcoin privacy-preserving technique is now available on Trezor hardware wallets.

REGULATION

Prosecutors Seek Seven-Year Prison Sentence for Reggie Fowler in Crypto Shadow Bank Case

The former footballer pleaded guilty to bank and wire fraud charges over operating Crypto Capital Corp., the shadow bank that lost Bitfinex's millions.

EU’s Crypto Licensing Regime Set for Approval as Lawmakers Signal Support

Ahead of a vote Thursday, legislators from the European Parliament’s largest political groupings indicated they will support the landmark MiCA law.

NEW PRODUCTS AND HOT DEALS

Crypto Wealth Manager Onramp Taps CoinDesk Indices to Create Customized Portfolios

The partnership will provide advisers with a wider range of options for shaping successful portfolios.

Square Enix Teams With Elixir to Bring Web3 Games to Mainstream Audiences

The Final Fantasy developer is continuing its push into Web3 via the Elixir launcher, which already offers an Epic Games Store integration.

LETS MEET UP

Vancouver, April 24-28

Dubai Fintech Summit, May 7-9

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.