Staking Tools

VeradiVerdict - Issue #167

Pantera Capital recently led the $4M seed round of Stader Labs, an India-based staking DeFi protocol.

In addition to Pantera, a number of top-notch investors such as Coinbase Ventures, True Ventures, Jump Capital, Huobi Ventures, Terraform Labs, Solana Foundation, and Near Foundation also participated in the round.

As the protocol revs up for its mainnet launch in a few weeks, I thought it’d be an appropriate time to explain what Stader Labs does, how it fits into the broader staking ecosystem, and what makes us at Pantera so excited about what they’re building.

What does staking look like today?

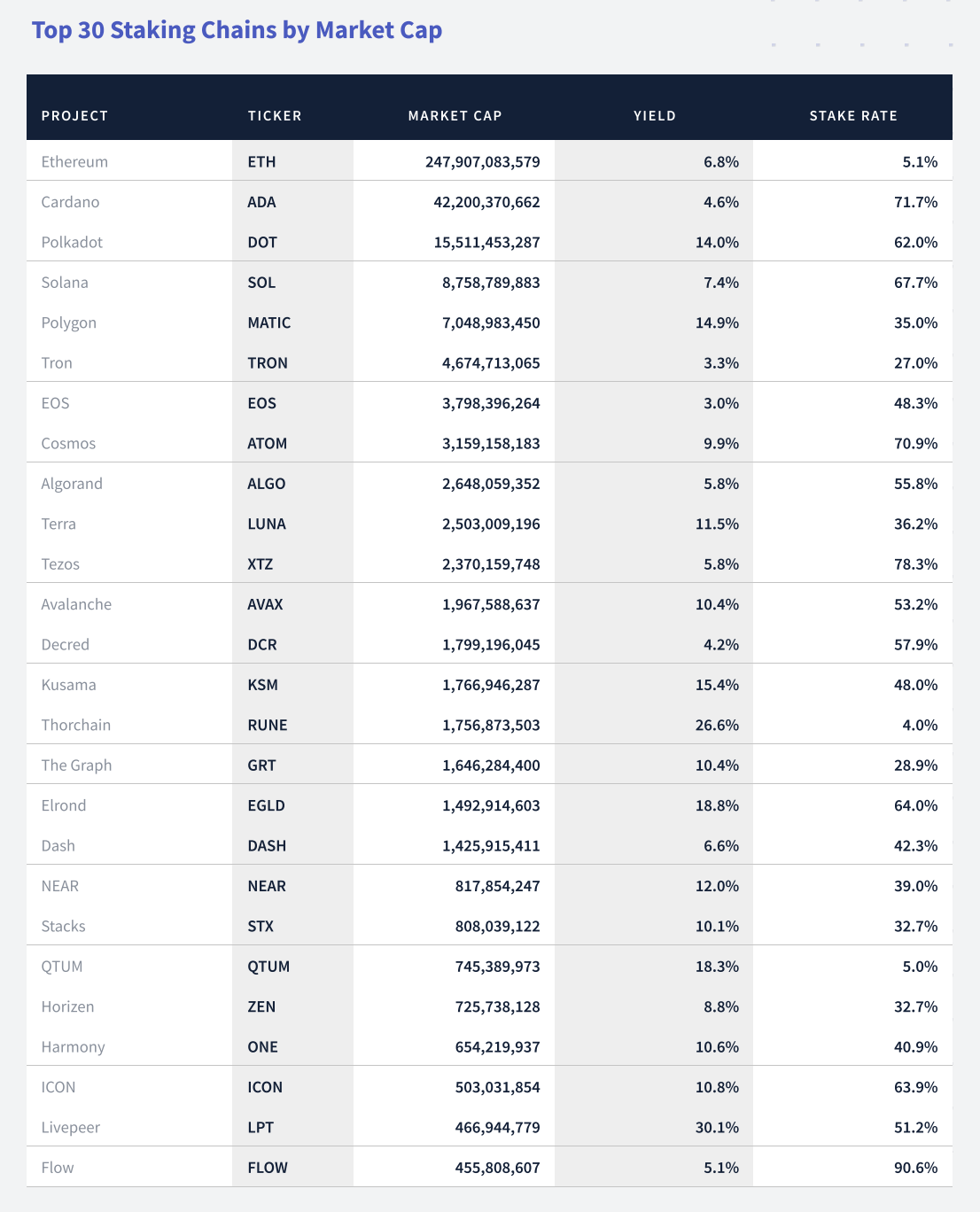

It’s an important moment for proof-of-stake blockchains. Ethereum, the dominant layer-1 for smart contracts, is in the midst of its transition to Ethereum 2.0, which involves a switch from its current proof-of-work consensus mechanism. Polkadot, Solana, Cosmos, Terra, and a number of other notable proof-of-stake layer-1s have experienced skyrocketing market capitalizations, increased community excitement, and early adoption from developers.

Similar to the multi-billion-dollar mining industry that Bitcoin’s proof-of-work system has birthed, we expect these proof-of-stake networks to unlock similar rewards for participants (“validators” or “stakers”) securing these blockchains. These blockchains already have a cumulative market capitalization of over $350B, with over $10B in staking rewards expected to be paid out in 2021 alone.

Source: Staked (Q2 2021)

While a number of staking products exist for institutional clients, such as Staked, the process is typically quite intimidating for retail investors. They must:

Identify validators to delegate their tokens to, based on their fee structures, past performance, reliability, and other factors. This information is oftentimes limited, leaving consumers in the dark.

Continuously monitor the performance of their validators, deciding whether or not to diversify further, move funds out of particular validators, change their allocations, and more.

Determine how to optimally deploy staking rewards, from re-staking them, earning yield elsewhere, or selling on a secondary market.

It’s not hard to see how, especially in the fast-changing world of crypto, wearing all of these hats can quickly become burdensome for many ecosystem participants.

As a result, most retail stakers leave money on the table or expose themselves to unnecessary risk. On Terra, for example, only 20% of delegators stake with three or more validators, which costs them potential airdrops and incurs a higher risk of being “slashed” (or penalized).

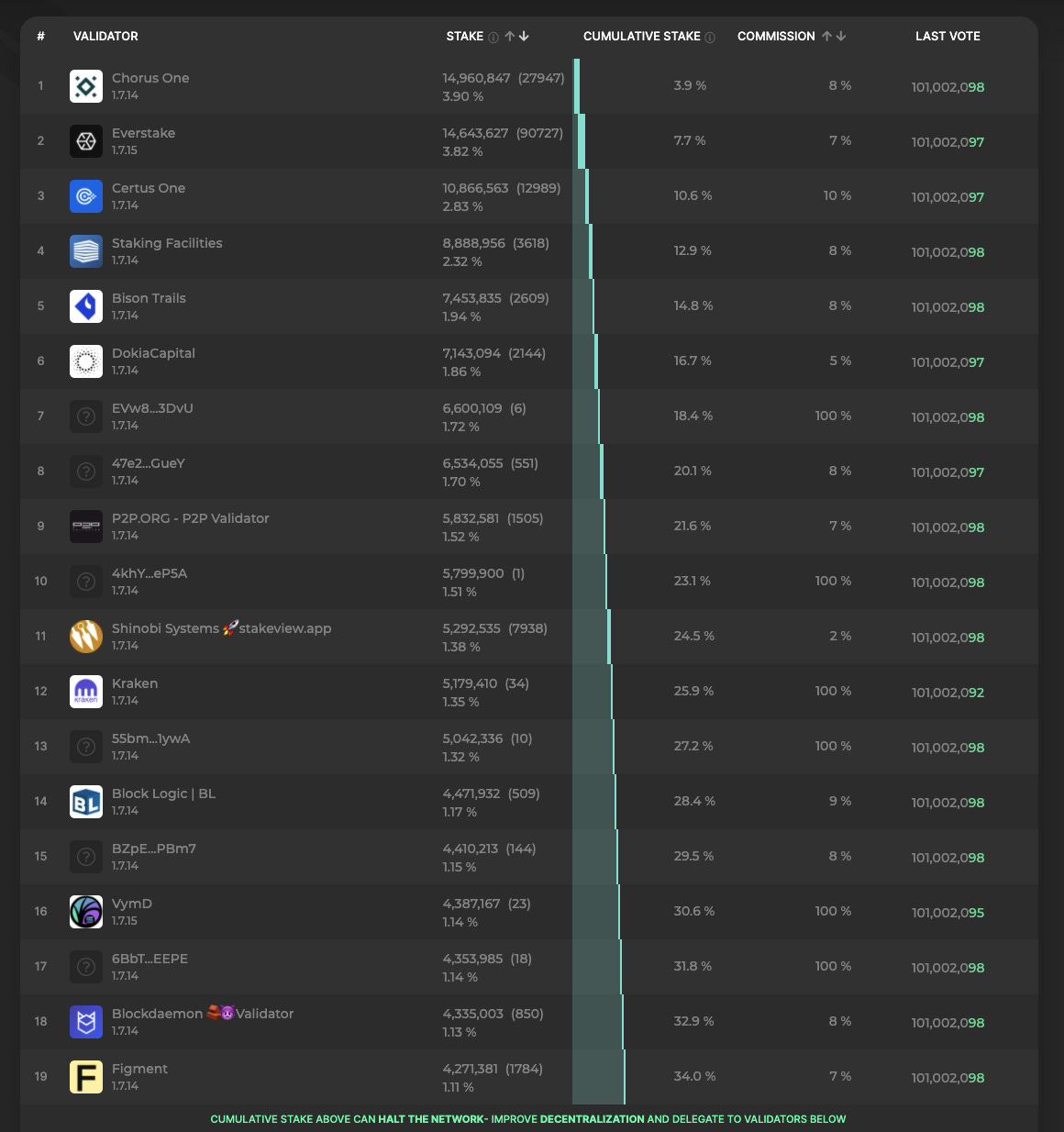

In short, the “smart money” has access to the best staking strategies from their resource advantages and 24/7 monitoring. The same is not true for smaller stakers, though.

This asymmetry also has a negative impact on the decentralization of these networks. Since retail crypto-holders typically stake with reputable, large validators—and typically put all of their eggs in very few baskets—the result is mega-validators with outsized influence on the network. The top 30 validators of Terra, as an illustration, are responsible for over 70% of the staked supply. A similar dynamic has played out for other blockchains. While alarmism isn’t necessarily justified, we should be finding ways to reduce this risk of collusion.

Source: Solana Beach

What is Stader and how does it begin to solve these problems?

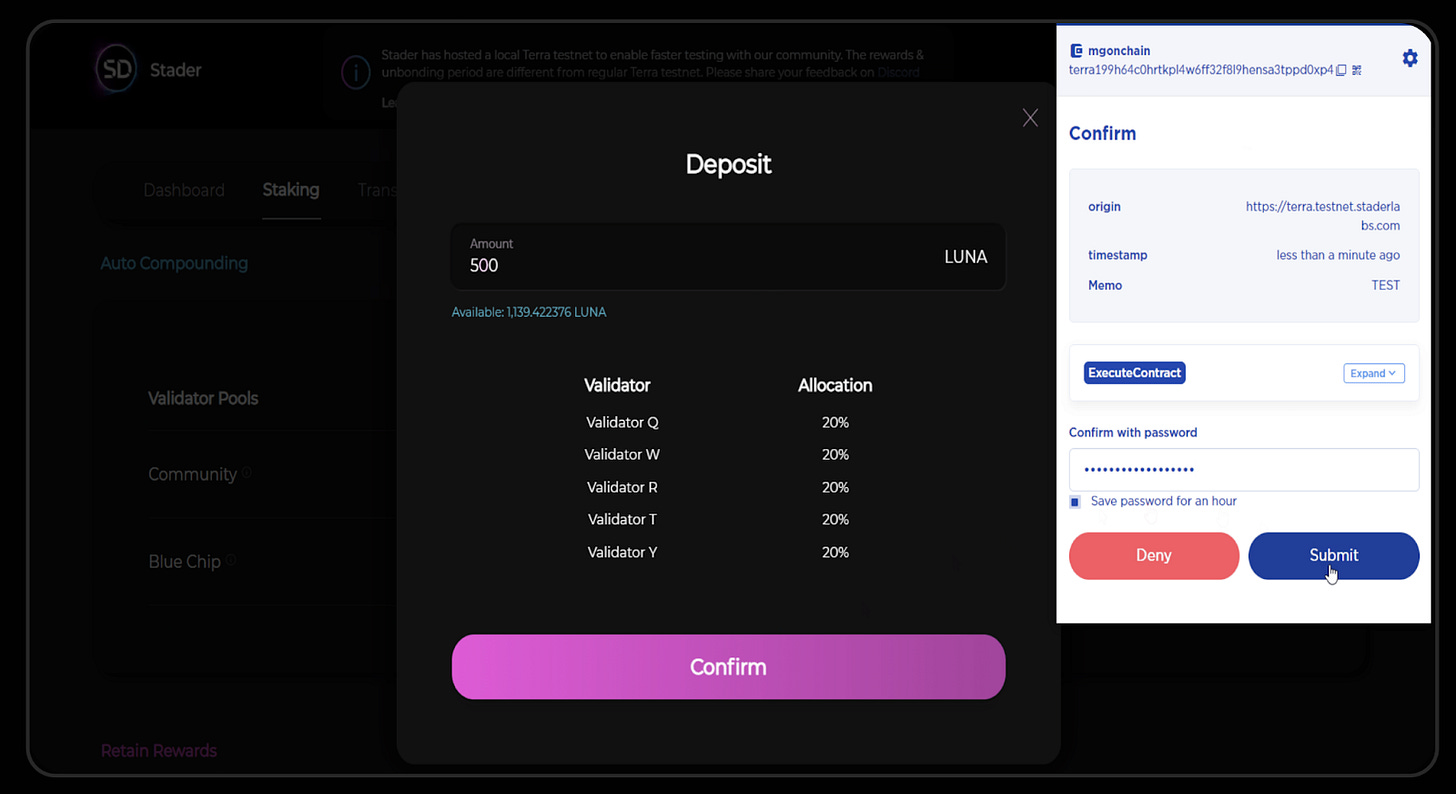

Stader is a DeFi protocol designed to bring staking rewards to the masses. It allows users to easily deploy tokens into sophisticated staking strategies with a single click.

In particular, Stader has a few key features:

Various staking structured finance products (“pools”) with different groups of validators, risk tolerances, and strategies. This allows users to identify pools that they find appealing based on their investment philosophy, similar to purchasing a staking “index fund.”

Liquid staking, eliminating the lock-up periods that some delegates require.

An optional auto-compounding feature so that users don’t have to manually re-stake their earnings.

Simple airdrop-claiming functionality. Particularly for Terra, this ensures that users don’t leave valuable airdrops of Mirror, Anchor, and other tokens on the table.

Source: Stader

These features allow delegates to maximize their staking rewards while alleviating many of the headaches associated with the process today. In addition, the protocol encourages increased diversification across validator nodes, which works to strengthen the decentralization of the overall network.

Source: Stader

After iterating on feedback from over 500 beta testers, Stader is gearing up for its mainnet launch in a few weeks. The team is starting by tackling the Terra ecosystem, where billions of dollars of LUNA are staked, yet consumer staking infrastructure remains primitive at best. They’re also actively pursuing integrations with many of Terra’s most popular DeFi protocols, most notable being Anchor and Mirror.

But Stader certainly isn’t limited to Terra: many of their features are attractive for stakers on a number of other proof-of-stake blockchains. The team is currently building an MVP of the product on Solana, which will be launched soon. Expansion to other notable proof-of-work chains—particularly Ethereum, Polkadot, Polygon, and NEAR—is also on their medium-term roadmap.

Later this year, Stader is also planning on launching the protocol’s native token, which will be used for a number of in-protocol activities. While precise tokenomics are forthcoming, the token will accrue value from its governance utility and percentage of the protocol’s revenue.

Where does Stader go from here?

While Stader’s current yearn.finance-like product is something the ecosystem is lacking, they have ambitious long-term plans for leveling up the staking industry.

First on the list is building a robust “staking API” that third parties can easily use. This will allow institutions, wallets, DeFi protocols, and virtually any other participant of the decentralized universe to have instantaneous access to various staking services. Stader hopes to be the staking middleware that allows dApp developers, professional investors, and everyone in between to get access to stress-free staking rewards.

Stader also aspires to build launchpads with staking rewards while giving stakers on each of the blockchains exclusive access to new project tokens. New projects in DeFi, NFTs, gaming, and more could benefit from raising funds from true believers (long-term stakers) of the ecosystem. Since over $10B worth of staking rewards are paid out every year, launchpads with staking rewards could be a new way to raise capital, spurring massive activity across the blockchains.

As gaming continues to intertwine with the blockchain (a trend I’ve explored recently), Stader could even allow game developers to incorporate staking into their games. PoolTogether, a simple no-loss savings game, uses yield farming on a shared pool of funds to randomly distribute the interest payment to a winner. A similar logic can be applied with staking. It’s not difficult to imagine players staking assets as an alternative to in-game purchases, or even centering an entire game around the rewards. Stader could be the infrastructure of choice for game developers to not worry about the mechanics of staking funds.

In addition to lending, investing, and saving, there’s now another economic activity for crypto-holders: staking. As staking becomes increasingly common and controls an ever-larger share of the ecosystem’s funds, there will be a pressing need for immediate, efficient, and sophisticated delegation services for the masses.

Stader is on track to fulfill this challenging—but hugely important—objective.

- Paul V

DIGESTS

Some NFTs Are Probably Illegal. Does the SEC Care?

Commissioner Hester Peirce has words of advice for NFT makers and platforms.

Why ARK’s Cathie Wood Isn’t Buying Into the Bitcoin Futures ETF

ARK is big on Bitcoin and crypto-adjacent stocks, but Wood isn’t ready to invest in ProShare’s hot new Bitcoin futures ETF.

NEWS

Bitcoin Company Bakkt Begins Trading on New York Stock Exchange

Bakkt, the digital asset platform, makes its debut today as a public company on the New York Stock Exchange under the ticker BKKT.

Bitcoin Price Hits New All-Time High Amid Futures ETF Trading

The price of Bitcoin has broken an all-time high today amid the launch of Bitcoin futures ETF trading yesterday.

REGULATIONS

Prominent Silicon Valley VC firm Andreessen Horowitz embarks on major crypto policy push in Washington

Executives from venture capital firm Andreessen Horowitz plan to meet with leaders on the Hill and in the White House in Washington this week.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Animoca Brands Raises $65M From Ubisoft, Others for NFT Gaming Push

With an eye on the growing metaverse, the crypto gaming investor and publisher has more than doubled its valuation.

Cboe Acquires ErisX in Return to Crypto Derivatives Market

The move gives Cboe, which was the first U.S. company to launch bitcoin futures in 2017 before later shuttering the product, a new set of crypto derivatives offerings through ErisX’s bitcoin and ether futures products, as well as spot crypto trading.

LETS MEET UP

New York City, NFT.NYC, Nov 1-4

Lisbon, Solana Breakpoint, Nov 7-10

Los Angeles, Nov 22-26

Coffee meetings or walks in San Francisco

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.