State of Prediction Markets

Summary

Prediction markets aren’t new—they’re finally decentralized. Humans have always put money behind forecasts, but crypto turns this ancient behavior into permissionless, transparent, global markets where prices aggregate real-time collective intelligence instead of opinion polls.

Infrastructure + regulation unlocked the market. CFTC clarity, TradFi partnerships, and multi-chain scalability have pushed prediction markets from niche experiments to a $3.9B weekly volume category, with platforms embedding directly into brokerages, media, and consumer apps.

Uncertainty is becoming a financial asset class. As prediction markets evolve into core hedging, data, and forecasting infrastructure, value will accrue to platforms that combine liquidity, integrity, and distribution to price real-world outcomes at global scale.

For more than a thousand years, humans have sought ways to harness collective wisdom to bet on the future. Ancient Greeks received personalized tokens to slip down a tube system to vote while juries in that culture expressed their verdicts through choosing either a solid stone or one with a hole in the middle. Side bets surely took place at the kapeleia, the ancient tavern of the day.

In the 17th-century Amsterdam stock exchange merchants wagered on cargo ship arrivals and, in the 19th-century, political betting parlors dominated American elections until banned in the 1940s. Then there’s the Chicago Board of Trade’s commodity futures. So, we’ve long understood that putting money behind predictions creates powerful information signals.

Today’s crypto-powered prediction markets are the digital rebirth of this ancient practice—but with a critical difference: they’re permissionless, transparent, and global.

The Information Markets Revolution: What Makes Crypto Prediction Markets Different

Traditional prediction markets required trusted intermediaries to hold stakes, verify outcomes, and distribute winnings. Crypto eliminates these middlemen through blockchain technology. When you place a bet on Polymarket on mostly geopolitical, macroeconomic, and cultural market issues—whether it’s “Will the Fed cut rates in January?” or “Who wins Best Picture at the 2026 Oscars?”—your stake is held in a smart contract, results are verified transparently, and payouts happen automatically using USDC. No bank account required, no geographic restrictions, and no intermediary taking a cut or deciding who gets to play.

Another giant in the industry, Kalshi, focuses 90% of its subject matter on sports with topics like “PGA Famers Insurance Open Winner” and “College Basketball Kent State vs. Akron.” Another rising predictions market, Novig, focuses solely on sports.

The Convergence Moment: Why Now?

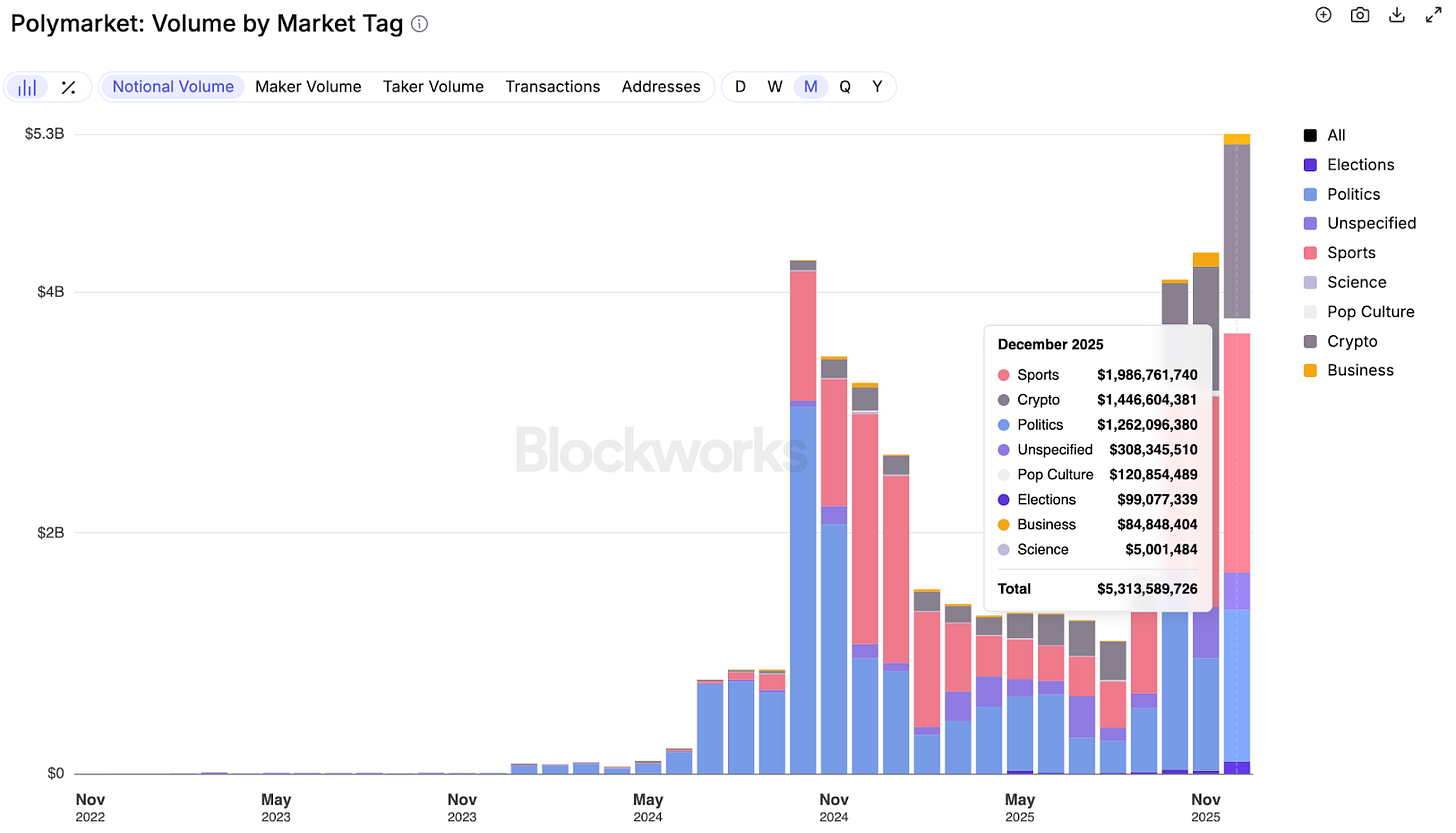

With a seven-day trading volume of $3.9 billion, prediction markets are taking off, and here are a few reasons: regulatory maturation, TradFi integration catalysts, and infrastructure breakthroughs.

Most notably on the regulatory side, CFTC approvals enabled operations in the United States. For example, in July 2025, Polymarket acquired the CFTC-licensed derivatives exchange QCX, LLC and clearinghouse QC Clearing LLC. This allows traders to engage with prediction market contracts on Polymarket with confidence and clarity. Kalshi’s $1 billion December raise at an $11 billion valuation also demonstrates institutional confidence. Overall, regulatory clarity is unlocking institutional capital and retail access through established brokerages.

Along with the Intercontinental Exchange’s (ICE) 2 billion investment into Polymarket, ICE will also become a global distributor of Polymarket event driven data, highlighting the comingTradFi integration into prediction markets.

Partnerships deepen the integration. Polymarkets’s multi-year collaboration with TKO Group Holdings causes the predictions market platform to become the official and exclusive partner of UFC and Zuffa Boxing. This allows for a direct blending of prediction market technology with live fan experiences.

Kalshi is partnering with both CNN and CNBC in 2026 with viewers able to see real-time probabilities in news tickers. Both Polymarket and Kalshi have struck deals with Google. Companies entering the space through partnerships and native apps include Robinhood, Fanatics, and Coinbase. The three billion event contracts traded on Robinhood prediction markets in November 2025 (+20% MoM) demonstrating retail adoption at scale.

Technical advances have allowed infrastructure breakthroughs to occur. These include multi-chain expansions with Polygon, Solana, Base, and Gnosis Chain; AI oracle integrations for instant permissionless settlements; and hybrid AMM/order book models reducing friction while improving liquidity. Contrast that to the struggles of Augur, a platform that debuted when tech and regulation wasn’t ready.

Market Dynamics: Leaders and Challengers

Although Polymarket has served as the dominant platform, it will likely continue to be challenged by competitors, offering users diverse options. In fact, in 2025, a dozen organizations either submitted applications to become or became designated contract markets (DCMs), which is an increase of 500% over the previous year. Additionally, other companies want to partner with DCMs as future commission merchants to offer prediction market services.

As a quick comparison between Polymarket and Opinion:

Polymarket metrics over 30 days, ending on December 3, 2025 include:

Open interest: $247.1 million

Total notional volume: $4.39 billion

82% market share of category TVL

Historical zero fees model driving user adoption

Opinion metrics over 30 days, ending on December 3, 2025 include how its:

TVL surged +110% in 30 days (from $30 million to $63 million)

Estimated $4 billion monthly volume indicating potential market share disruption

Performance has demonstrated a product-market fit on emerging L2 infrastructure

Network effects and winner-takes-most dynamics are attracting growth capital as these platforms offer scalable diversification from traditional derivatives and betting products. Monetization strategies go beyond fees and include data licensing such as real-time probabilities to news outlets, financial terminals, and more; API integrations with social platforms and applications; and, for some companies, like Robinhood, the opportunity to cross-sell core financial services.

The User Behavior Shift

Traders are migrating to prediction markets where more structured speculation exists with markets serving as hedging instruments and alpha sources for DeFi portfolios. As real-time probabilities outperform traditional polling in political/economic forecasting, this migration will likely also extend into other related event market contracts.

Although initially in the news spotlight because of political predictions, Polymarket isn’t limited to this category. Markets with the largest open interest include:

Non-election politics: $55 million

Crypto: $52 million

Business: $36 million

Elections: $22 million

Pop culture: $20 million

Sports: $20 million

Total: $242 million

Newer entries include Crypto.com’s partnership with Hollywood.com to launch an entertainment-based prediction market with a focus on films, television shows, theater productions, actors, musicians, and award winners. Limitless offers short-term prediction markets, focusing on crypto and stock prices; it’s an X/Twitter project backed by Coinbase and 1confirmation.

Controversies, Challenges, and Emerging Solutions

Prediction markets wrestle with certain pain points, including centralization risks, manipulation in traditional oracle models, and settlement delays in manual reporting systems.

Regulatory gray zones still exist, including sports betting classification debates. Kalshi, for example, received a November 2025 ruling from a Nevada judge that labeled Kalshi as a gaming platform that was not exempt from state gambling regulations. Kalshi’s stance is that the platform is a federally regulated financial exchange that uses legal derivative contracts with event contract swaps rather than bets. After the ruling, Kalshi began the appeals process. Something similar is also happening in Massachusetts.

Regardless of the case outcomes, issues still needing to be addressed include age-gating and additional responsible gambling concerns. Cross-border regulatory arbitrage may also serve as a headwind factor.

Market manipulation risks that need to be managed include whale influence on low-liquidity markets, wash trading and price manipulation in decentralized settings, and trade-offs between permissionless transactions and market integrity.

We are seeing market formats evolve, including the introduction of perpetual prediction markets for continuous outcomes, combinatorial markets handling complex multi-variable events, and bonding curve mechanisms for dynamic liquidity. Opportunities exist with prediction market probabilities as oracle inputs for DeFi protocols; tokenized positions enabling secondary trading and leverage; and integration with yield strategies and portfolio hedging.

Emerging solutions focus on AI-powered instant settlement for permissionless markets, exchange-integrated oracles that reduce front running, and appchains with embedded consensus for oracle integrity.

Forward-Looking Perspectives

From our vantage point, we see a few catalysts for broader adoption in the near term, including CFTC-approved U.S. platform launches via established brokerages, social platform integration such as through embedded prediction APIs in tweets, and neobank-embedded markets blending finance and speculation.

Additionally, as prediction markets evolve into a standalone financial market category, we’ll likely see the verticalization of prediction markets for the larger sub-market categories (i.e. sports, business, etc.). For instance, sports-focused prediction markets like Novig are focused on building hyper tailored markets and user experiences for sports bettors. As prediction markets become a more normalized consumer behavior, these verticalized prediction markets will likely offer better experiences for users than one-size fits all platforms.

Over the next one to three years, privacy-focused prediction markets may leverage zero-knowledge proofs while governance applications like futarchy and outcome-based decision making may develop.

There could be some roadblocks ahead, including potential regulatory crackdowns limiting global access or product scope, user fatigue if markets fail to deliver accuracy improvements, and competition from traditional platforms adopting blockchain rails.

As further integration does occur, we see a number of positive societal implications:crowd intelligence for resource allocation and policy decisions, decentralized forecasting as public good infrastructure, and a shift from polling to participatory probability markets in media/governance.

The question isn’t whether prediction markets will scale, but how many prediction markets we’ll have and which models will capture the multi-trillion dollar opportunity of pricing real-world uncertainty on-chain as these predictions supplement human intelligence and forecasting.

Business

BitGo Debuts With $2.59 Billion Valuation as Crypto IPO Window Reopens

BitGo received approval from a top U.S. regulator, in December, to convert its state trust bank charter to a national one, allowing the firm to operate nationwide. An expert quoted in the article called BitGo’s IPO the “first major bellwether of the market’s appetite for crypto listings in 2026.”

UBS Explores Crypto Investing for Select Private Banking Clients

This private Swiss bank would initially permit select clients to buy and sell Bitcoin and Ether and then potentially expand the service to Asia-Pacific and United States markets. The lender’s rising crypto focus is occurring, in part, because of increasing digital asset demand by wealthy clients.

Latam Insights: Brazil Opens Crypto to Banks, Colombian Pension-Fund Manager Reveals Bitcoin Fund

Brazil is streamlining processes for banking institutions and brokers to enter the digital asset industry while a Columbian pension fund manager, Proteccion, plans to launch a Bitcoin investment product. Proteccion wants to take advantage of the country’s significant interest in crypto.

Regulation

SEC to Dismiss Winklevoss’ Gemini Crypto Lending Lawsuit

The company has reached a settlement with the New York Department of Financial Services. Customers will get 100% of their crypto assets back.

Binance Seeks EU MiCA License With Greek Subsidiary

The largest crypto exchange in the world now has a Greek presence and is seeking a license. The license would permit the exchange to operate anywhere in the European Union. Binance’s focus on Greece included an awareness of its strong regulatory environment and economy that’s growing faster than the EU average.

Vietnam: Applications for Cryptocurrency Market Licenses Will Begin to Be Accepted on January 20th

About ten banks and securities companies have shared plans to provide crypto exchange services once licensed via the State Security Commission’s regulatory authority.

New Products and Deals

Solana Foundation Partners With Hanwha to Grow Korea’s Crypto Market

As Hanwha Asset Management accelerates its South Korean digital asset strategy, the two parties signed a memorandum of understanding. Goals include strengthening Solana’s local ecosystem and boosting institutional-ready blockchain products.

ARK Invest Files for CoinDesk 20 Crypto Index ETFs

This move serves as the company’s first push into broad crypto exposure with ETFs that would track the daily CoinDesk 20 index performance. One fund would pair Bitcoin with major altcoins while the second fund would pair long index futures with short Bitcoin futures.

Ethereum Foundation Forms Post-Quantum Security Team, Adds $1 Million Research Prize

The foundation is supporting the drive to harden a key hash function, adding a $1 million Poseidon Prize to last year’s $1 million Proximity Prize for broader cryptographic research.

Pantera News

Pantera Wrapped - A Look Back at 2025

2025 was another reminder that crypto never moves in straight lines. Amid historic tailwinds and meaningful progress on U.S. regulatory clarity, markets surged to all time highs, narratives evolved, and momentum periodically reset. While the year ultimately ended below its highs, it marked the reset the industry needed to build toward true escape velocity.

Pantera Blockchain Letter: Market Outlook for 2026

Cosmo Jiang notes how “2025 was not a fundamentals-driven year for returns in the crypto markets. It was a year where macro, positioning, flows and market structure effects were the dominant drivers – particularly for assets outside of Bitcoin. Looking at a timeline of the year’s major macro and policy inflection points helps capture why the tape felt so discontinuous.”

For more than a decade, Pantera has supported BitGo as they scaled from early multi-signature wallets to developing comprehensive solutions for institutional investors. The milestone of BitGo’s IPO reflects the maturation of modern finance as digital assets integrate into global markets.

Let’s Meet Up

Hong Kong, February 10th-11th

Singapore, February 12th

New York City, February 26th

Los Angeles, March 13th

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early-stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

If you have any projects that need funding, feel free to DM me on twitter.

I think there's an opportunity for scaling prediction markets globally, in a way where its allowed by countries that claim that its gambling.

I would love feedback on useorni.xyz, also in app form :)

I'm on all platforms as anndrrson