Supercharge Your DAO

VeradiVerdict - Issue #186

Rift Financeis supercharging DAO growth by pairing governance tokens with $ETH and deploying them to DEXs. This process allows DAOs to improve liquidity while retaining ownership over their tokens, and increases and diversifies yield for liquidity providers.

Decentralized autonomous organizations (DAOs), nascent Web3 alternatives to traditional organizations, are currently fascinating the public with their various use cases, incentive structures, and flexibility. DAOs are essentially leaderless self-governing organizations run by smart contracts with a common mission and shared treasury. The purpose of a DAO is to reward participants of the community commensurate with their activity and contribution. These entities have definitively entered the mainstream and have surged in activity in 2022 as the sheer number and unique types of DAOs – along with funds raised – all climbed notably. Currently, there are over 10,000 distinct DAOs in existence, with more than $8B in their treasuries.

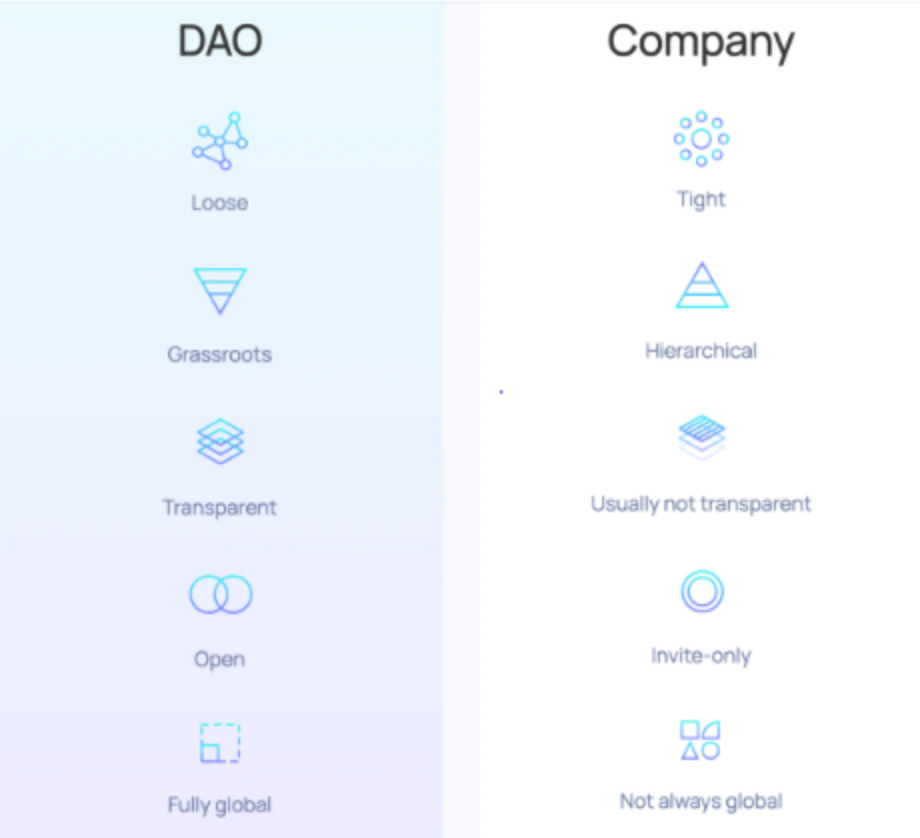

DAO vs Traditional Company (Source: Aragon)

DAOs can take a number of different forms, but they’re usually composed of a group of people working to achieve a goal or grow an organization. Rather than being either a member of a “fun” community (e.g. a tennis league or book club) or a “work community” (e.g. a corporation), people can now do both through DAOs. DAOs essentially relax the division between work and play – they encourage individuals to contribute what they’re best at and what they genuinely enjoy doing. Contribution is voluntary and members usually aren’t punished if they don’t reach a certain level of participation or output, contrary to traditional workplaces. DAOs also allow for asynchronous and remote work, which attracts individuals of varying skill sets throughout different parts of the world. A DAO could be a charity, a venture fund, or simply a community of like-minded individuals. Goals can include acquiring NFTs, raising capital to fund creators in crypto, shared speculation, or achieving shared ownership over any kinds of digital assets. DAOs don’t always achieve their goals, but the sheer number and variety that have emerged over the last year is staggering. ConstitutionDAO, a DAO that attempted (and failed) to win a rare copy of the Constitution that was being auctioned off by Sothetby’s, brought DAOs and their power more into the public eye.

DAO Services (Source: Consensys, Corbin Page)

The underlying concept of a DAO is growing to be more and more resonant with individuals and societies at large. People want to be rewarded adequately for the precious energy they put into an organization, rather than the organization just squeezing productivity out of them. They want to be a part of something new and exciting – something that they can grow with. Rather than being a unit of labor in a society governed by profits, DAOs take a more holistic view of contribution and energy. They effectively allow the member to retain greater autonomy in their role and command more respect from the work ecosystem. As Joe Lubin, the co-founder of Ethereum, puts it: “[DAOs] are just a new technology that enables us to operate collectively with one another, which is what we've been doing for millennia.” Notable DAOs today include:

BitDAO, which has a ~$2.3B treasury and invests in new DeFi projects

Friends with Benefits DAO (FWB), a members-only club that gives you social capital as well as access to exclusive, token-gated events and FWB’s city-based sub-DAOs

Decentraland DAO, a decentralized body that governs more than 90,000 parcels of virtual land

Overview of the DAO Landscape (Source: Cooper Turley)

Incentives are another crucial piece of a DAO achieving its purpose – individuals are usually rewarded via the DAO’s token in exchange for contributing to a given organization. Contributions include voting on governance proposals, interacting with the DAO’s social channels (such as Twitter and Discord), and helping to educate new members. In traditional companies, the ruleset is governed by organizational executives who have asymmetrical input on what decisions the company should make. In DAOs, every member of the community has a say on how the organization grows and evolves, creating a more community-oriented and equitable organization. This power may be adjusted based on how much the individual contributes to the DAO, but regardless, it’s the person’s prerogative to engage or not.

So far, DAOs have replaced some companies, and we believe that this trend will only continue given the current hype and rapid development in Web3. However, running a DAO requires a very technical skillset and comes with a number of complex issues such as governance token liquidity.

We believe DAO-growth supercharger, Rift Finance, is well-positioned to be the choice partner for new and existing DAOs who encounter these difficulties. Given the transformational potential of DAOs and the significant need for token liquidity, Pantera is proud to have led Rift Finance’s latest $18M round.

About Rift Finance

Rift Finance, a DAO infrastructure protocol that simplifies the growth process, provides an efficient and seamless solution for DAOs to achieve sustainable token liquidity. Many DAOs struggle to achieve adequate token liquidity, and many current liquidity structures are harmful to DAOs themselves today – as Rift explains, “they drain DAO treasuries and shrink market caps.” Rift allows DAOs to deploy governance tokens straight from their treasuries to improve liquidity without having to give up ownership. Without adequate liquidity, the DAO’s token won’t be able to easily be converted to another cryptocurrency. Insufficient liquidity therefore inhibits members from joining the DAO (due to high entrance costs), and hinders the ability of the DAO to reward its members in a meaningful way. For existing members, low liquidity means little incentive to participate, which slows the DAO’s growth.

Most of DAO wealth is locked up in the organization’s treasury. Source: Messari’s Crypto Theses for 2022

The Mechanism

Rift’s smart contracts pair the DAO’s governance tokens with Ethereum tokens from retail and institutional depositors, which are then deployed to decentralized exchanges such as Uniswap.

It’s a symbiotic relationship: DAOs are then able to achieve higher liquidity and ETH depositors receive higher, more diversified yield. For LPs, they can lower their risk of impermanent loss through collaboration with DAOs instead of the previously competitive relationship. Impermanent loss is the financial risk associated with liquidity providing – if the token price drops substantially compared to when the user pooled them, they may incur negative returns if the fees generated are low enough. With Rift’s mechanism, DAOs still retain ownership over the tokens deployed from their treasuries, but are enabled a much higher level of liquidity via the token-pairing process. For example, if the Terra DAO deposited LUNA (their token) in the Rift protocol, Rift would source ETH on the other side. Once Rift paired the tokens together, the protocol would deposit them into a decentralized exchange such as Uniswap. With this mechanism, Terra is able to achieve liquidity at no cost. LPs earn double the fees because their position is now composed of the pair of assets deposited, rather than just the one asset. Rift’s protocol operates on redesigned incentive mechanisms and relationships that previously weren’t considered in the blockchain ecosystem.

Private Beta Success

Top DAOs, such as Terra, Fantom, and Injective participated in Rift’s $50M TVL private beta on Ethereum, and quickly proved the strength of their technology. The private beta rapidly reached its $50M TVL cap, with the participating DAOs able to efficiently deploy their tokens to DEXs while maintaining ownership. The CEO of Fantom noted that Rift allowed the organization to “begin controlling 32% of the FTM:ETH liquidity on SushiSwap in a single transaction.” In-line with the hype and attention around DAOs right now, Rift already has a lengthy waitlist for its high yielding structured product, Rift Alloy. Users currently on the waitlist will be rewarded with first access to Alloy and will be able to “diversify their deposits across DAOs in the Rift.” Rift plans to launch across some Layer 1 blockchains soon, with each blockchain kicking off with a “cohort of leading DAOs looking to accelerate their growth potential through sustainable token management.”

Team

Austin King and Tyler Tarsi, Rift’s co-founders, come with a wealth of blockchain experience and expertise. Both are crypto builders who met while studying computer science at Harvard. Tarsi has spent time building proprietary quant algorithms for institutional lending and borrowing desks at hedge funds. King is the founder of Strata Labs, a crypto startup that builds payments infrastructure, which Ripple’s VC firm, Xpring, acquired in 2019. The pair were early and strong to the space, and with their building experience, will prove to be a formidable combination to lead Rift Finance.

What’s next?

While Rift Alloy, the yield-structured product, is currently Rift’s sole product, there’s no doubt that Rift’s team will continue to build out a range of new and exciting services. The DAO ecosystem is sometimes difficult to navigate and innovate in, and we know Rift is the perfect partner to help grow these budding organizations. The team plans to eventually launch the product on multiple blockchains, enabling sustainable and fast growth for DAOs across any chain. For the ecosystem, this means greater economic efficiencies, better capital flows, and supercharged DAO growth. Financial actors are driven by incentives; by redesigning these incentives, Rift will expedite the growth of DAOs and push ahead the Web3 ecosystem as a whole. The incredible potential of DAOs are what’s driving the future – they shouldn’t be limited by something as fundamental as insufficient liquidity.

- Paul Veradittakit

DIGESTS

Why Crypto Networks Should Preserve Russian Propaganda

The internet is the information war’s venue. Social giants Twitter and Facebook may delete Russian misinformation, but there’s a strong case that “fake news” should be preserved.

Announcing Our $1 Billion Raise & Ideas We Are Looking to Fund

We raised $1 billion to fund crypto networks, Web3 protocols, and blockchain-enabled businesses.

NEWS

IMA Financial Plans to Start Selling NFT Insurance in Decentraland

The top-10 U.S. insurance broker is opening its “Web3Labs” research and development facility in the metaverse.

IN THE TWEETS

REGULATION

EU Excludes 7 Russian Banks From SWIFT

The bloc is also studying whether crypto is being used to evade sanctions.

NEW PRODUCTS AND HOT DEALS

Hedge Fund Giant Alan Howard Backs $7.5M Round for ‘Financial NFTs’ Project

Nested’s social trading platform allows investors to earn royalties on their crypto portfolios by representing them as NFTs.

African Crypto Exchange VALR Raises $50M in Series B Led by Pantera Capital

Alameda Research and Coinbase Ventures were also investors in the round, which valued the company at $240 million.

LETS MEET UP

Los Angeles, March 7-11

Singapore, March 14-18

Bangkok, March 21

Crypto Bahamas, Bahamas, April 26-29

Walks in San Francisco

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.