The Merge

VeradiVerdict - Issue #214

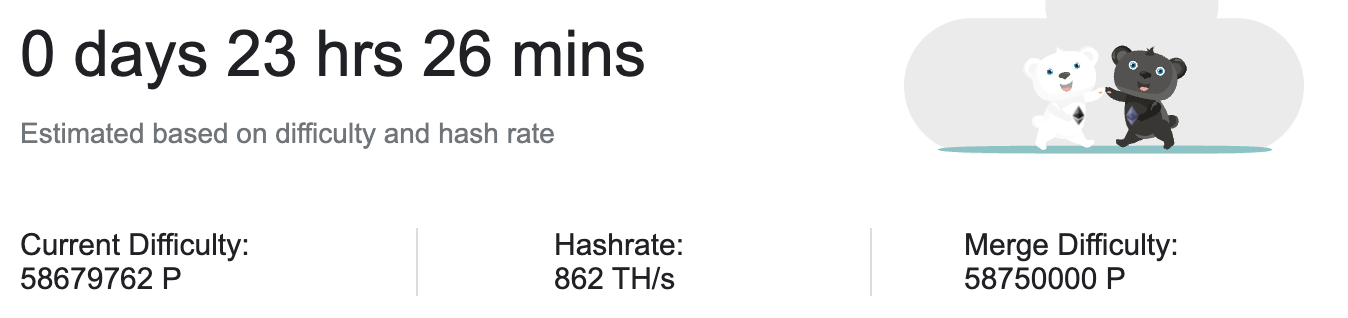

The Merge countdown on Google. Exact timing and details can be seen on bordel.wtf.

The Merge, explained

“The Merge” refers to Ethereum’s long-awaited transition from a proof-of-work (PoW) to proof-of-stake (PoS) consensus mechanism and is expected to take place around September 15. Though Ethereum mainnet has been operating under PoW since July 2015, engineers have been working for years to get ready for a PoS transition. To prepare for The Merge, Ethereum devs have been running shadow forks of existing testnets and Mainnet, and have also merged many PoW testnets to PoS (Ropsten, Goerli, Sepolia). Incredible amounts of research, preparation, and engineering are culminating in this monumental event – but The Merge itself is designed to be a quiet and seamless transition. At the moment of The Merge, Ethereum’s PoW mining will be shut off and a PoS consensus mechanism will take its place with zero network downtime.

With PoS, Ethereum’s energy usage is reduced and the network is better suited to scale. Source: Ethereum

Why now?

Mining is often criticized for being environmentally unfriendly due to its massive energy demands to secure the network. With The Merge, this issue disappears almost completely: Ethereum energy consumption will be reduced by a tremendous ~99.95%.

Ethereum is the leading blockchain and also one of the only major ones that doesn’t use PoS – so why didn’t it happen sooner? For one, just preparing the chain for The Merge through the Bellatrix hard fork and other software upgrades have taken an enormous amount of research and development. Preparing on the engineering side for proper implementation of the upgrade while simultaneously ensuring that there is no network downtime has proven to be a time-intensive endeavor.

The Bellatrix upgrade on September 6. Source: Twitter

Preparing for The Merge

The actual merge, known as the Paris upgrade, has been years in the making. In late 2020, developers created the Beacon Chain – a chain that runs in parallel to Mainnet and operates under PoS – to eventually serve as the block production infrastructure (vs mining). Post-merge, it’ll act as Ethereum mainnet’s consensus layer.

The network will also become better suited for sharding and other scaling upgrades following the Merge. Ethereum’s initial plan was to address sharding pre-Merge, but developers quickly pivoted with the introduction of many popular layer 2’s. Because of the massive traction of L2’s today, developer focus on sharding is now more geared towards network capacity and optimization mechanisms, Ethereum notes. So though plans for sharding are still “rapidly evolving,” the PoS transition is currently the main priority. Many also claim that L2s will indirectly benefit from the Merge because Ethereum and its L2s scale in parallel.

Of course, the Merge isn’t a cure-all for Ethereum: a common critique is that decentralization isn’t exactly improved. Token rewards on a PoS blockchain are proportional to how much a user has staked, so ownership can tend to concentrate in large holders. The equivalent to this in PoW is mining farms with enormous amounts of computing power, which are obviously much more likely to solve computational puzzles than individual miners. PoS may not be perfect, but in terms of efficiency and environmental friendliness, the benefits are undeniable.

Ethereum’s upgrade timeline. Source: Ethereum

What to expect

Prior to The Merge, there is no action required for Ethereum users and holders. Ethereum has detailed necessary steps to take preceding September 15 for dapp and smart contract developers as well as node operators and providers. When The Merge takes place, “no history is lost” – the entire transactional history of Ethereum mainnet will also merge with the Beacon Chain.

For web3 developers, Goerli is expected to be maintained as a testnet supported by the Ethereum Foundation (Ropsten, Rinkeby, and Kovan will be shut down or no longer supported by the Ethereum Foundation). Ethereum also cleared up common misconceptions about The Merge that have been circulating the Internet, including questions regarding transaction time, gas fees, and staking. A few fast facts:

Transaction speed will remain about the same on L1

Gas fees will not be reduced

Staking APR is predicted to reach a ~50% increase post-merge

Additionally, users will not be able to immediately withdraw staked ETH on the Beacon Chain after The Merge. Newly issued ETH will be illiquid for “at least 6-12 months” post-merge, and withdrawals will only be enabled when the Shanghai upgrade is implemented. In the meantime, validators will still have access to liquid fee tips / MEV.

$ETHW airdrop

A group of miners is planning to fork the network to keep a “PoW Ethereum” in existence. The structure of The Merge is designed such that each user will have the same quantity of tokens before and after the switch to PoS. Because of this, all token balances will essentially carry over to the forked chain, enabling users to have an equal amount of $ETHW on EthPoW as they do $ETH on Ethereum. $ETHW is only the native currency of the forked chain and is completely separate from regular $ETH.

For users that want to “play the Merge,” a list of centralized exchanges planning to support ETHW has been published. Bobby Ong of CoinGecko recently tweeted a thread about how users should best position themselves for the airdrop. He recommends that users hold full custody of their ETH on a hardware wallet – if users hold on an exchange, it’s a toss-up on whether that exchange will support the forked tokens.

Full thread here. Source: Twitter

Tokenomics

The Merge has a defining impact on Ethereum’s tokenomics. As mentioned earlier in this post, a substantial amount of ETH will be locked up post-merge – over 14M ETH are currently staked, representing ~11% of the total supply. Furthermore, over 2.6M (and counting) ETH have been burned since the implementation of EIP-1559 last year.

ETH issuance will also decrease since block rewards will drop from 2 ETH to 0.2 ETH for each block mined – a 90% fall. Pre-merge, mining rewards distributed were ~13,000 ETH/day. This will drop to zero after the upgrade, when only ~1,600 ETH/day in staking rewards will remain (and of course, these funds will be initially illiquid).

Since ETH issuance from the execution layer will be eliminated, a net reduction of ~89.4% in annual ETH issuance will occur. Together, these factors result in scarcity that may make ETH a deflationary asset following the Merge.

Closing thoughts

Transitioning to PoS marks a huge accomplishment for the Ethereum community and the DeFi ecosystem as a whole. The Merge is the exciting outcome of years of hard technical work and will result in a more eco-friendly, efficient, and scalable Ethereum. As DeFi becomes more mainstream, one the biggest critiques about Ethereum – its negative environmental impact – is about to be remedied.

- Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

SEC's Gensler Holds Firm That Existing Laws Make Sense for Crypto

I sat down (virtually) with SEC Chair Gary Gensler last week ahead of a speech on digital assets. Here’s the transcript.

BUSINESS

Wall Street Titans' New Crypto Exchange Aims to Seriously Cut Costs for Investors

EDX Markets, backed by major trading and investment firms like Schwab and Citadel Securities, will initially offer only a handful of cryptocurrencies such as bitcoin.

Twitter Shareholders Approve Musk Buyout Offer: Report

Musk has repeatedly tried to back out of the $44 billion takeover deal.

REGULATION

Crypto Crime-Focused Justice Department Leader Leaving: Report

Nicholas Quaid, second-in-command in the criminal division, spent his nearly two-year stint at the DOJ developing the regime around crypto crime legislation and prosecution.

US CPI Report Shows Inflation Hotter Than Expected, Bitcoin Dips 4%

Core inflation, which is more closely watched by traders, rose 0.6 percent in August, a larger increase than in July.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Crypto Options Trading Startup Synquote Raises $2.8M From Initialized, Polygon

The company will look to expand its platform for trading derivatives contracts in tokens that don’t usually have such markets.

Crypto Tech Firm BlockFills to Offer ESG Credits to Miners

The firm said it is working with Isla Verda Capital to sell carbon offsets to miners who get their power from renewable energy sources.

LETS MEET UP

Geneva, Switzerland, September 15-16

Bangkok, Thailand, September 22-23

Pantera Asia Blockchain Summit, Singapore, September 27

TOKEN2049, Singapore, September 28-30

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.