The Oracle Problem

VeradiVerdict - Issue #113

Recently, Pantera Capital invested into API3 with Placeholder, Accomplice, CoinFund, Digital Currency Group, and Hashed. API3 is our bet to best solve the oracle problem and provide data for decentralized applications.

Summary

The classic oracle problem of blockchain revolves around how blockchain protocols can ingest data from third-party sources in a reliable, trusted way. Since dApps and smart contracts are highly networked and automatic, corrupt or invalid data ingestions can create huge consequences for users when they do occur.

API3 is a solution that promotes the development of “decentralized APIs” (dAPIs), which actually are actually the aggregation contract on-chain. dAPIs are governed by the DAO.third-party service providers operate their own oracle that can write data directly to a blockchain. These oracles are governed by the API3 decentralized autonomous organization (DAO).

Third-party services leverage API3’s Airnode, which is essentially an “oracle wrapper” for web APIs that makes it simple and easy for third-party service providers to host and operate their own oracles. This also allows API providers to reap the benefits of operating oracles, including more API traffic and blockchain rewards from hosting the oracle.

API3 also enables a kind of “data insurance” for data consumers, where the DAO pays out any claims of invalid or corrupted data ingestion. This financially incentivizes the DAO to maintain high standards for data quality and validity.

API3’s biggest competitor in this space is ChainLink, which essentially operates oracles on behalf of third-party API providers, requiring no extra work from these providers. While this approach is functional, it poses risks if the middlemen oracle node operators are malicious and it also precludes API services from being fully compensated for how their data is being used on the blockchain.

Airnode is managed by the API provider. Membership in the DAO is based on ownership of the API3 token, which gives the owner the right to vote on parameters like staking rewards, insurance collateral, and allocation of DAO funds. 20 million API3 tokens (20% of the entire supply) were distributed on Mesa DEX from this Monday to 12/14, with a maximum price of $2.00. On the first day of sale, 14 million of the 20 million tokens were purchased, indicating a huge demand for the service. However, API3 did face a sales attack on Mesa DEX that allowed the attacker to buy the low price end of the offered tokens.

Ultimately, API3 presents a powerful approach to increasing trustless interoperability between blockchains and third-party services. By partnering with API providers to enable them to operate serverless first-party oracle nodes, API3 formulates a deep, native connection between APIs and the blockchain, and will hopefully contribute to an explosion of oracles for blockchains to be able to ingest trustless, decentralized third-party data.

The Oracle Problem

The rapid development of decentralized applications (dApps), powered by various blockchains, demands better tools, abstractions, and primitives for interfacing with existing software and technology services. Several decentralized applications could significantly benefit from connecting with existing APIs, data plants, and cloud compute providers, but are limited in their capabilities to do so due to fundamental differences between these services and blockchain protocols. This is the classic “oracle problem” of the blockchain space –– how do we validate and safely import trustable data onto the blockchain from third party providers?

One of the biggest concerns of the oracle problem is a dApp’s behavior when invalid or corrupted data is imported to a blockchain. Since most dApps operate via automatic smart contracts, code could automatically execute using the invalid data, which can lead to disastrous downstream consequences. Particularly since the blockchain is well-suited for various financial services like lending and trading, these corrupt data imports could pose a significant threat to user’s assets, identity, and more. There is a pressing need for a reliable way to import external data from a third-party provider, while ensuring the safe operation of the underlying blockchain.

How do dApp developers solve this?

API3 is a new service that builds “decentralized APIs,” specifically designed for interfacing decentralized blockchain applications with third-party services.

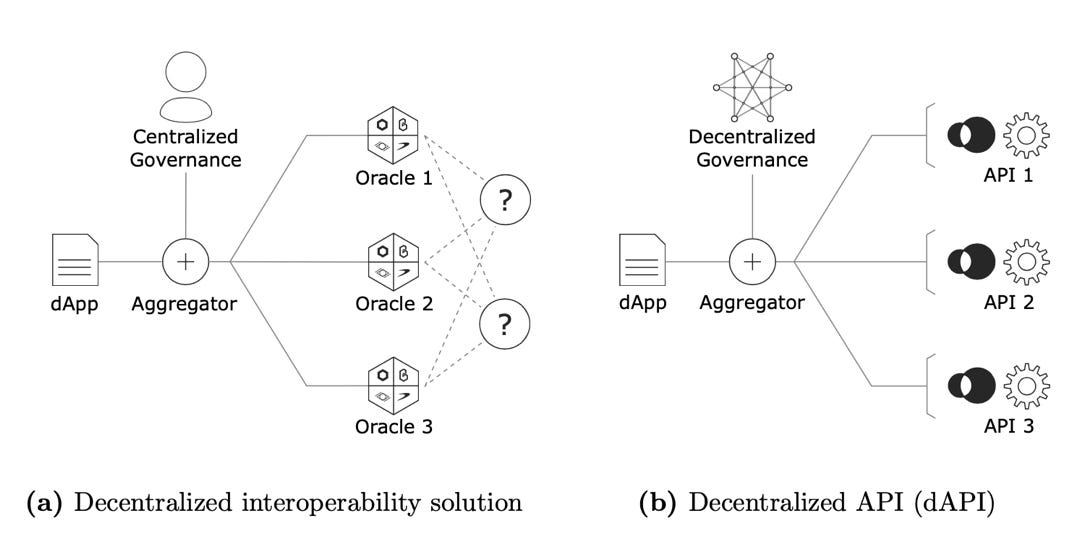

API3 frames the oracle problem as “the problem of decentralized applications not being able to receive services from traditional API providers in a decentralized way.” Most previous solutions in the space take the approach of “decentralized operability,” where various oracles (essentially various middlemen building wrappers around APIs that convert the data into a format that the blockchain can ingest) feed data into an aggregator, which is governed by a centralized third party, that then medianizes the inputs from the nodes to arrive at a single value that is used to execute a function in the consumer contract (dApp). The centralized operator poses a huge risk to the integrity of the network, because they have the potential to corrupt the data or incorrectly validate it, which can lead to corrupted data being written to the blockchain.

Fig 1. Decentralized interoperability versus decentralized APIs (API3 White Paper)

In contrast, API3 pursues a decentralized API approach. Here, several APIs feed their data to an aggregator directly without third party middlemen.

How do decentralized APIs (dAPIs) work?

API3 developed Airnode on Ethereum. Airnode is off-chain and feeds data to an aggregator contract on Ethereum using Ethereum nodes. The aggregation contract is the dAPI that consumer contracts call. Airnode is essentially an oracle node that can be run and operated by existing API providers, with almost no friction. One of the classic challenges of the decentralized API approach is that traditional API providers are often extremely unfamiliar with blockchain architectures, and it requires a ton of lift for them to be able to operate oracle nodes. Airnode is essentially a wrapper on a traditional Web API, allowing the data to be written to a blockchain.

This approach of having API providers operate their own oracles allows API providers to much more easily service blockchain applications, and manage metadata like traffic, credits used, etc. which are critical for monetization and reliability. ChainLink’s top node operators earned up to $100,000 in recent DeFi crazes; extending those rewards directly to API providers and third-party services could open up an entire new market for API providers. The API3 team plans to work with several API providers to begin rolling out services to existing blockchain applications. dApps can request the build of a decentralized API here.

Additionally, API3 offers data consumers with the option to enable on-chain insurance, where in the case of an oracle or API malfunction, data consumers are compensated for their losses (should be quantifiable to qualify as claims); the exact mechanisms are to be determined by the API3 DAO. This approach incentivizes those in the API3 governing body to maintain high standards for data and integration quality, and also provides a deterministic fallback in the case of a technology failure.

How does this compare with existing approaches?

The biggest other player in this space is ChainLink, which takes the paradigm of decentralized interoperability as described above. ChainLink’s key advantage is that it allows blockchain applications to interface with third-party services, without requiring any additional effort from these third-party services.

Nonetheless, the fundamental problem with the ChainLink approach is that there are several vulnerabilities when centralized middlemen are responsible for data conversion and validation. In the short-term, while developers are incentivized to build quickly and break things, the middlemen approach works out just fine; as these applications become more and more mature however, there is a stronger emphasis on high standards for data quality and reliability. API3’s approach requires some leverage from third-party providers, but makes things as simple as possible with their Airnode wrapper. If you want to scale available data, you have two realistic choices: 1) Get API providers to run their own nodes 2) steal. Third party systems opt for 2 while API3 with the Airnode opts for 1.

How is decentralized governance implemented for dAPIs?

dAPIs are fully governed by a decentralized autonomous organization (DAO) or dAPI service providers, data consumers, and folks familiar with the blockchain and API integrations space. These DAOs will govern parameters like staking rewards, collateral for dAPI insurance, and broad governance for the DAO, which has the power to invest funds in certain projects (like building or hosting a new decentralized integration, etc.).

Membership in the API3 DAO is determined by ownership of the API3 token. The public token sale for API3 began this Monday on the Mesa DEX and will continue till December 14th. 20 million tokens will be for sale, which constitutes 20% of the total token supply of 100 million API3 tokens. 30% of the remaining tokens will be allocated for API3’s founders, 35% will be allocated to ecosystem builders, and 15% will be allocated to investors.

Fig. 2: API3 token allocations (API3 Blog)

The sale began with a price of $0.30 per token and is currently hovering at $1.28 at time of writing. The final price is capped at $2.00. More information about the token distribution, including the vesting structure and bonding curves, can be found on API3’s blog. Here’s a guide into how to take part in the distribution.

In the first day of sale, roughly 14 million of the tokens have been purchased, and the DAO has raised roughly $14M in USDC via the sale. However, the distribution did face an attack on Mesa’s Gnosis protocol in which the attackers were able to purchase the first four price tiers of tokens at a flat rate of $0.57. The attackers were not able to “steal” any tokens per se, since they purchased at a price higher than the tiered prices, but the attack did affect the token’s price appreciation, and most users purchased API3 at a price of $1.06 instead of the expected price after the first batch of $0.98. The API3 team is working closely with Mesa to understand the mechanism behind the attack and to determine amends and next steps.

Final Thoughts

As developers come up with more exciting and diverse use cases for blockchain protocols, dApps will need better, trusted ways to interface with existing third-party data providers and stores. Existing solutions, while functional, make fundamental architectural assumptions that could compromise the data being ingested into a blockchain, essentially invalidating the trust that dApp users have in underlying services. Corrupted data writes can lead to immense downstream catastrophes, due to the highly networked and automated nature of dApps and smart contracts.

API3’s solution of enabling third-party services to operate their own oracle, Airnode, enables blockchain interoperability with third-party services in a decentralized fashion. The API3 DAO governs the operation of dAPIs, and is financially incentivized to ensure that high quality, trusted data is being serviced. Given the immense returns that oracle node operators can earn from blockchain-API integrations, it’s likely that more API providers will begin capitalizing on the explosion of DeFi applications by operating their own oracle nodes; Airnodes make this ridiculously easy for them. Ultimately, API3 presents a powerful solution to bridging the compatibility gap between traditional technology services and those implemented on a decentralized blockchain.

- Paul V

DIGESTS

Governance Minimization

"THE BEST GOVERNMENT IS THAT WHICH GOVERNS LEAST"— UNKNOWN

Bitcoin Is Winning the Covid-19 Monetary Revolution

The virtual currency is scarce, sovereign and a great place for the rich to store their wealth.

Cryptoasset Investment Thesis

Blockchain.com presentation

NEWS

The Libra Association Rebrands Itself to 'Diem'

The Libra Association has changed its name and recruited several high-profile experts ahead of Libra’s launch.

Almost 20% of PayPal Users Have Used App to Trade Bitcoin, Mizuho SaysThe virtual currency is scarce, sovereign and a great place for the rich to store their wealth.

Nearly one-fifth of PayPal (PYPL) users have already traded bitcoin using the PayPal app, according to a report published Tuesday by Mizuho Securities and obtained by CoinDesk.

Visa partners with Circle to let card issuers integrate USDC payment capability

Visa announced a partnership today with Circle Internet Financial — one of the firms behind Ethereum-based stablecoin U.S. Dollar Coin (USDC) — to add USDC payment capability into Visa credit cards.

REGULATIONS

Circle Partners with Bolivarian Republic of Venezuela and Airtm to Deliver Aid to Venezuelans Using USDC

Initiative launched with government support marks a global first with use of stablecoins for foreign aid.

IN THE TWEETS

‘

NEW PRODUCTS AND HOT DEALS

1inch Raises $12M to Keep Up With DeFi’s Growing Crop of DEX Aggregators

Decentralized exchange (DEX) aggregator 1inch has closed a $12 million funding round led by Pantera Capital.

Bitcoin Derivatives Firm ErisX Adds Cash-Settled Contracts After Physically Settled Futures Fall Flat

Cryptocurrency derivatives platform ErisX launched cash-settled bounded futures on Tuesday, after seeing little interest from the market for its physically settled futures.

Velo Protocol powering the world’s premiere Federated Credit Exchange Network

This network, powered by the Velo Protocol, enables network participants to freely issue digital credits pegged to any stable currency by staking VELO tokens.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.