VeradiVerdict - A New Synthetic Non-Correlated Commodity Money Launches - Issue #42

Hi, I am Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. The firm invests in equity, pre-sales/IEO rounds, and active trading of cryptocurrencies on the secondary markets. I focus on early investments and want to share my thoughts and what’s going on in the industry in this weekly newsletter. If you ever come across, or have an interesting project that you would like to share, please reply to this e-mail!

View this issue on my Medium blog here.

If you aren’t subscribed already, you can click here to subscribe.

Please fill out a NEW survey by clicking here

Editorials

Pantera Capital invested into Ampleforth with top investors such as True Ventures, Founder Collective, FBG Capital, and angel investors such as Brian Armstrong, Alok Vasudev, and Mike Karnjanaprakorn. Ampleforth is not a stablecoin but a new type of synthetic commodity money that is non-correlated with other crypto assets and warrants further explanation below:

TL;DR

• Synthetic commodity money is an economic classification for monies that are absolutely scarce (like natural commodity-monies) and have no non-monetary use (like fiat). This new classification was discovered by George Selgin at the Cato Institute while investigating the use of Bitcoin for monetary reform as a base-money alternative to gold and fiat. But the new asset class also lends itself to many important applications in trading and asset management. Bitcoin is considered a synthetic commodity money.

• Thus far synthetic commodity monies have had low exposure to traditional asset groups, making them attractive for portfolio construction. However, the problem with most synthetic commodities today is that they are highly correlated with one another and tend to follow the price action of Bitcoin. High correlations within the cryptocurrency markets prohibit diversification and pretty much guarantee that economic problems associated with Bitcoin will affect all cryptocurrencies.

• Ampleforth presents a new protocol that responds to market changes by changing the supply of their token based on real-time nominal exchange rate info instead of the price (which most other cryptocurrencies do). This fundamentally makes their economic model different from other cryptocurrencies.

• The supply-based trading strategy de-correlates the AMPL token from the performance of Bitcoin, creating optionality and opening up numerous applications in diversifying portfolios. Moreover, the nature of the economic model is counter cyclical and free from the deflationary problems of fixed supply assets like gold, Bitcoin, and the majority of current-generation cryptocurrencies, making it an even better replacement for central bank money.

• People are incredibly interested in Ampleforth; their IEO on Bitfinex on 6/13 sold out to $5 million in just 11 seconds. There’s huge demand for something like this.

• Ampleforth presents a very promising option for diversifying portfolios and getting away from the problems of traditional price-based trading strategies.

What are synthetic commodities, and what’s the current issue with them?

Synthetic commodity monies are exactly what the name suggests––monies that are commodities because they are scarce and synthetic because they are designed by human systems and aren’t raw materials like gold and silver, which have immediate non-monetary use. Synthetic commodities are incredibly valuable because (1) they are free from market distortions that arise from innovations in raw material extraction or non-monetary use, (2) their monetary qualities make them tradable the way that we trade fiat currency or traditional assets like stocks, both of which largely drive the US economy, and (3) they are free from politics and outside tampering like natural commodity-monies.

Cryptocurrencies are synthetic commodities because they are scarce (as defined by algorithmic protocols that regulate the trade and propagation of cryptocurrencies) and don’t have immediate non-monetary use (like fiat, they are a vehicle for trading but you wouldn’t use cryptocurrency as a raw input the way you would use gold).

Since the inception of Bitcoin in 2009, there have been dozens of other cryptocurrencies (and synthetic commodities) that have spun off, representing financial value on an electronic, data-driven ledger of some sort. Surprisingly, despite the myriad of apparent choices in synthetic commodities or cryptocurrencies available, the performance of these commodities has been highly correlated with one another––and they all largely follow Bitcoin’s demand pattern. Put simply, the price and value of most synthetic commodities highly depend on the price, value, and supply of Bitcoin, leading to somewhat of a homogenous system of synthetic commodities.

In essence, there exist a variety of synthetic commodities, but they tend towards the same overarching trend which limits the true potential of diversification.

So, how do you approach diversification and de-correlating from the performance of Bitcoin?

That’s where Ampleforth comes in. The entire ethos of Ampleforth is a paradigm shift from price-based trading strategies to supply-based trading strategies. Most cryptocurrencies operate singularly or mostly on the platform of determining and adjusting their value using their own price and the price of other cryptocurrencies on the market; this is a pretty traditional economic concept, where price adjusts in response to shifts in supply and demand (perceived value).

Ampleforth makes a critical change in their protocol, where instead of using price to respond to changes in the market, they adjust supply instead. Ampleforth polls a set of reliable oracles every 24 hours to get real-time information on nominal exchange rates between various cryptocurrencies and uses that to establish what they call a price-supply equilibrium. In essence, they ensure that the price of their cryptocurrency persists and is consistent by adjusting supply to reflect changes in value.

I’m still confused. An example, maybe?

Let’s walk through the example that Ampleforth gives in their whitepaper.

Say you start with 1 AMPL which is currently worth $1. All of a sudden, the demand for AMPL doubles and now your 1 AMPL token is in theory worth $2 if you adopt a price-based trading strategy. However, the AMPL protocol immediately recognizes this shift in demand and resets your account to have 2 AMPL, each worth $1.

Your total value has increased, preserving the effect of the shift in demand, but the market responds by adjusting price and not supply. This critically de-correlates Ampleforth from other cryptocurrencies, because the theoretical shift in price from $1 to $2 is correlated with the performance of Bitcoin. Ampleforth instead persists their price and adjusts supply, effectively de-correlating Ampleforth from Bitcoin.

Essentially, if the exchange rate of Ampleforth to other targets rises, the protocol expands supply. If the opposite is true, the protocol contracts supply. There’s a lot more to exactly how the protocol achieves supply (smoothing, market expansion coefficients, etc.) but most of the fundamental information is captured in that simple rule.

So, basically the price of Ampleforth is stable? So it’s a stablecoin?

Not quite. Stablecoins are designed to remove volatility from economic markets (that’s why they exist––to remove volatility for investors who think basic cryptocurrency is a bit too risky) and are generally used for base trading-pair tokens on exchanges.

Ampleforth’s protocol still allows for volatility, and as in the above example, we saw how though the price of Ampleforth persists, the total value of the account definitely changed. Ampleforth tokens can gain and lose value. Additionally, given the expected volatility of Ampleforth, it’s highly unlikely that exchanges will use it for base trading-pairs––they’ll still used dollar-backed stablecoins or regular fiat.

What are the biggest benefits behind Ampleforth then?

Again, the biggest differentiator between Ampleforth and virtually all other cryptocurrencies is that Ampleforth propagates market information through changes in supply, not price. This makes the currency inherently fair and independent; to be more specific:

1. Changes in value affect every party in the same way. Propagating market information through changes in price has the potential to disproportionately benefit certain groups––think of it as the same way that inflation disproportionately helps those who already have a pretty hefty supply of the currency. Supply-propagation means that everyone’s value increases equally––both nominally and truly.

2. Ampleforth is entirely governed by the supply-propagation protocol, and relies on no discretionary decisions from external regulators, balance sheets, etc. This makes it inherently fair.

3. Ampleforth moves differently from other price-based cryptocurrencies. The economics of this are a bit too complicated to deeply dive into (their white paper does a great job of explaining it thoroughly), but essentially, price-based strategies vary somewhat harmonically and are relatively symmetric across a certain time interval. Supply-based strategies increase with time asymptotically. The math behind this isn’t super key to understanding; what’s important is that price-based strategies and supply-based strategies have different economic models for how value propagates. This inherently makes Ampleforth different from other cryptocurrencies, creating important applications in diversification.

4. In a purely economic school of thought, AMPLs don’t suffer the same drawbacks of deflation and also scale pretty easily because it is an outside commodity that doesn’t rely on collateralized debt. This mean that Ampleforth functions pretty well as a commodity in an economy.

In terms of use cases, the three that Ampleforth suggests are:

1. Near-term diversification in cryptocurrency portfolios. Since Ampleforth is de-correlated from Bitcoin, it truly offers a different currency to include in a portfolio that doesn’t vary with the broader trend of the portfolio, but rather operates under an entirely different framework.

2. Medium-term use as reserve collateral in banks like Maker DAO. Because the price of Ampleforth is stable, it functions well as reserve collateral for stablecoin-oriented accounts.

3. Long-term replacement of central-bank money. AMPL functions very similarly to Bitcoin as a replacement currency, but it’s more macro-economically friendly for the reasons described above. This makes it strongly preferable––and even more different––from centralized holdings of currency.

Are people interested in it?

Ampleforth had their Initial Exchange Offering (IEO, basically where they launch the sale of their token on an exchange) on Tokinex on June 13. Within 11 seconds, the supply of tokens sold out and the protocol raised a ground-breaking $5 million. People are definitely extremely interested to see how Ampleforth functions in a real market––and how it can help them.

Final Thoughts

Ampleforth brings an incredible degree of disruption to the way that we conceive cryptocurrencies. It completely changes the model from a price-based trading strategy to a supply-based strategy that guarantees fairer and more independence from the performance of other cryptocurrencies like Bitcoin.

The independence of Ampleforth leads to a lot of important applications in diversifying portfolios and creating a replacement for centralized-bank currency that isn’t subject to the woes of deflation and truly benefits everyone fairly. It’s patently clear that there’s huge demand for something like this; the $5 million, 11-second IEO speaks for itself. Ampleforth presents an incredibly promising view for a future with supply-based cryptocurrencies, guaranteeing a more diverse, fair, and independent market.

Digests

The Discovery Testnet Developer Release is Live! – Enigma

We are extremely pleased to finally announce the Testnet Developer Release of our Discovery network!

A 330% Rally Puts Focus on Litecoin, Top 2019 Crypto Gainer - Bloomberg

This year’s top-performing cryptocurrency is up more than threefold and you’ve likely never heard of it.

The Monetary Experiment: Algorand

We explore the monetary experiment of Algorand, a new cryptocurrency invented by Turing Award winner Silvio Micali. Arrington XRP Capital will be participating in the Algorand economy by running a relay node and bidding in the Algorand Foundation’s dutch auctions.

In the Tweets

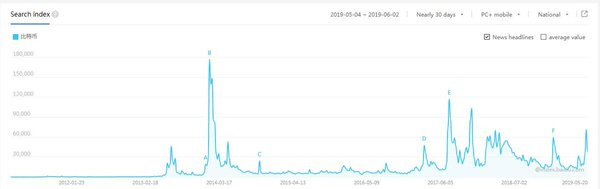

There's been a lot of talk about how China has been the driver behind Bitcoin's move up since the first week of May. So I decided to look into bitcoin Baidu trends (China's Google). China's bitcoin popularity has definitively been on the rise. 👇 https://t.co/kQ38WJfGjp

4:49 PM - 3 Jun 2019

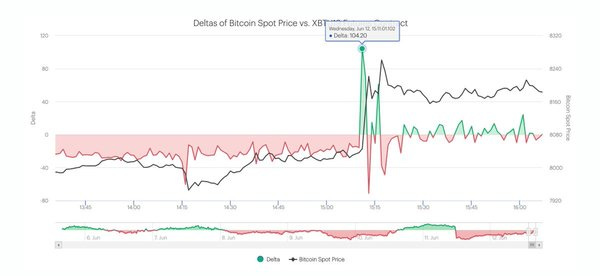

Once again, #bitcoin futures forecast story for the spot price.

Check the timestamps of the contango spike (15:11 UTC)

And the spot price at the same time (15:11 UTC $8045.80)

Followed by a jump in price (15:12 UTC $8142.40)

And again a jump in price (15:13 UTC $8221.18) https://t.co/xoRaAqhJ9J

9:21 AM - 12 Jun 2019

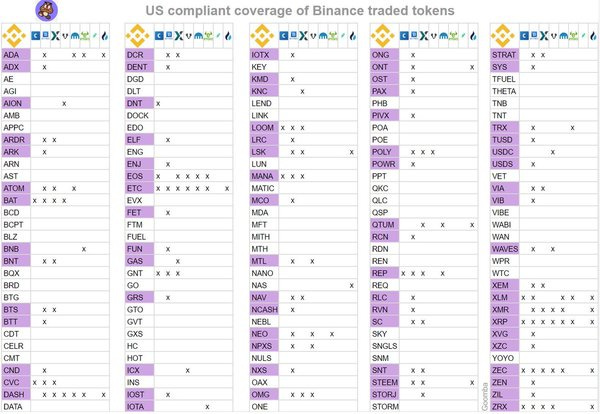

Here is the breakdown of what coins will still be available (as things stand) to US customers through US compliant exchanges once @binance stop US based trading in September https://t.co/OSawHb9GX6

5:58 AM - 14 Jun 2019

News

Facebook’s cryptocurrency partners revealed—we obtained the entire list of inaugural backers - The Block

Dozens of companies are set to be a part of the governing association of Facebook’s cryptocurrency. Here’s a map of the members set to be made public on Tuesday.

Jack Dorsey says now is our chance to build a global currency for the internet

Quartz spoke with the Twitter and Square founder about bitcoin, the end of cash, and more.

BitTorrent Creator Bram Cohen Takes Over as CEO at Chia Network | CoinDesk

BitTorrent creator Bram Cohen has taken over as CEO of his current company, Chia Network, CoinDesk has learned. Co-founder Ryan Singer has stepped away from the company to focus on family priorities.

Regulations

U.S. customers to be blocked from trading on Binance.com - The Block

Binance has announced that it will stop serving US individual and corporate customers on Binance.com in September

SEC vs. Kik: The Lawyers Speak | CoinDesk

The SEC has filed a complaint against Kik, claiming the company’s initial coin offering was a breach of federal securities law.

FINRA Fines Ex-Merrill Lynch Investment Adviser Over Crypto Mining Sideline - CoinDesk

U.S. self-regulatory organization, the Financial Industry Regulatory Authority (FINRA), has fined and suspended an investment adviser over undeclared cryptocurrency mining activities.

New Products and Hot Deals

Ampleforth raises $5 million in IEO - The Block

Ampleforth, the first token to be offered on Ethfinex and Bitfinex’s IEO platform Tokinex, reached $5 million in 11 seconds during its initial exchange offering.

Facebook’s New Cryptocurrency, Libra, Gets Big Backers - WSJ

Facebook has signed up more than a dozen companies including Visa, Mastercard, PayPal and Uber to back the cryptocurrency it plans to unveil next week.

Napster Founder's IoT Startup to Go Crypto With $15 Million Series C - CoinDesk

An internet-of-things (IoT) startup founded in 2013 is adding tokens to its business model with the backing of two of crypto’s best-known funders.

Fidelity, Tenaya Capital Fund Crypto-Security Firm Fireblocks - CoinDesk

Fireblocks, a platform for securing digital assets in transit, announced today $16 million in Series A funding from investment heavyweights including Cyberstarts, Tenaya Capital, and Eight Roads — the proprietary investment arm of Fidelity International.

Decentralized video infrastructure platform Livepeer raises $8m series A – TechCrunch

The company announced today that it has raised an $8 million Series A venture capital round led by Northzone.

Meet with Me

Las Vegas, July 12

Los Angeles, July 19

Berlin, Web3 Summit, August 19-21

Additional Info

👋 Working on building new technologies? I’d love to hear about it, shoot me an email

🙏 I’d appreciate it if you forwarded this email to someone who would might benefit from it

💡If you have any content you want to share on this newsletter, please send it to me and we can make it happen

Please click here to help me improve this newsletter and your experience by filling out this NEW survey!