DeFi Index

VeradiVerdict - Issue #121

Last week, I talked about Ethereum and the factors that make it a compelling investment asset. One of the strongest factors is surrounding the traction and use-cases of decentralized finance. A common question I’ve gotten over the past few months is how do I get exposure to decentralized finance?

The Pantera Liquid Token Fund provides exposure to Bitcoin, Ethereum, and a variety of decentralized finance tokens, and it’s actively managed. If you want to gain exposure without investing into a fund manager, an index is an alternative way to go.

Through a partnership between DeFi Pulse (top DeFi stats website) and Set Protocol (the technical infrastructure underneath), the DeFi Pulse Index is a great way to invest in a DeFi index in a single token (DPI). I thought DPI was a unique gift that could be used for white elephant parties during the holidays or just a suggestion for an investor to get exposure to crypto beyond Bitcoin and Ethereum.

If you bought DPI during the holidays, you would currently be up 142%, as decentralized finance tokens have done well.

DPI consists of 10 of the most popular DeFi tokens, capitalization-weighted index, available on Ethereum. The index is weighted based on the value of each token’s circulating supply.

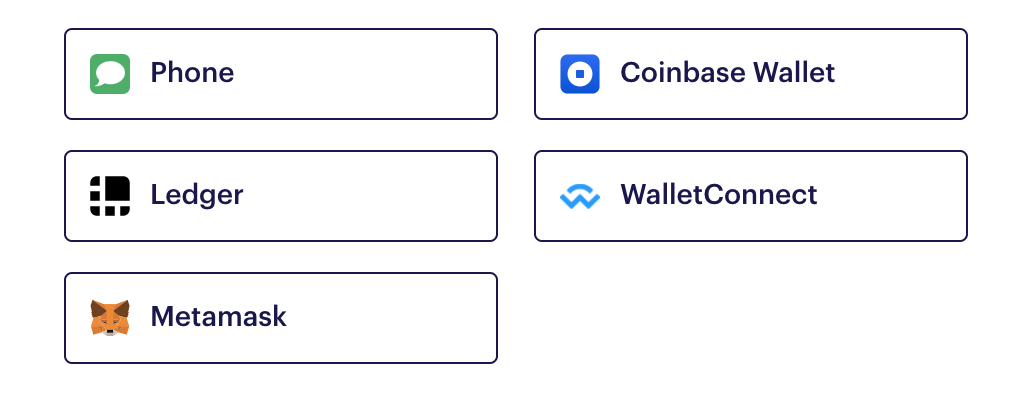

You can read more about the methodology of the index and buy it directly from their website. You would need a web3 wallet such as these below:

If you want to buy DPI through using your bank account, you can buy DPI through mobile app wallets such as Argent and Dharma.

I’ve always thought that the best way to learn is to have a little bit of skin in the game and therefore I encourage reading about and playing around with the products that are tied to the tokens within the DeFi Pulse Index. You would then be knowledgable on the DeFi “blue chips” and understand why industry folks are so excited.

- Paul V

DIGESTS

What is Balancer? How to Use This Automated Market Maker (2021)

Balancer is a DeFi platform known as an automated market maker (AMM) that can be used for swapping ERC-20 assets easily.

Market Update: 22 Jan 2020

QCP Market Update

NEWS

Grayscale May Have Laid Groundwork for 5 More Potential Crypto Trusts

Trusts for Chainlink, Basic Attention Token, Decentraland, Livepeer and Tezos were all recently registered in Delaware.

Harvard, Yale, Brown Endowments Have Been Buying Bitcoin for at Least a Year: Sources

University endowments that backed blockchain VCs in 2018 have started buying crypto directly from Coinbase.

Crypto Miner Marathon Patent Group Buys $150M in Bitcoin

The Nasdaq-listed mining company wants to become a "pure-play bitcoin investment option" for Wall Street.

REGULATIONS

CFTC Attorney Who Let Regulators Trade Crypto Joins Private Law Firm

Daniel Davis oversaw the CFTC’s legal division, including administrative actions.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Galaxy, Coinbase Bet $25M on DeFi Using Terra Stablecoins

The stablecoin for e-commerce creator has already proven people will use its volatility-free tokens in decentralized finance (DeFi) to buy synthetic stocks, and plans to attract blockchain denizens to even more use cases.

DeFi Exchange Startup dYdX Raises $10 Million in Series B

With at least some of its costs already covered, dYdX plans to use the $10 million raised to list additional assets, introduce new features, attract users in China and other Asian markets, build up its team, and “hand over more control to our users.”

Blockchain payment firm Wyre receives $5 million investment from Stellar Development Foundation

Today, the Stellar Development Foundation announced Tuesday that it invested $5 million in Wyre. The SDF told The Block that the funding effort was a Series B2 funding round, with the foundation leading for $5 million. Draper Associates and Great Oaks Venture Capital invested an additional $2.5 million.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.