ETH -> RAI

VeradiVerdict - Issue #125

Pantera recently led a $4M fundraising round into Reflexer Labs, a decentralized, stable and non-pegged currency made for the digital economy.

What are stablecoins?

Stablecoins, in the broadest sense, are volatility-resistant tokens on public blockchains, typically with their values pegged to widely-accepted fiat currencies. Precision about what exactly qualifies as a stablecoin is nuanced and will become more important as regulatory interest picks up, but this working definition captures the gist of it.

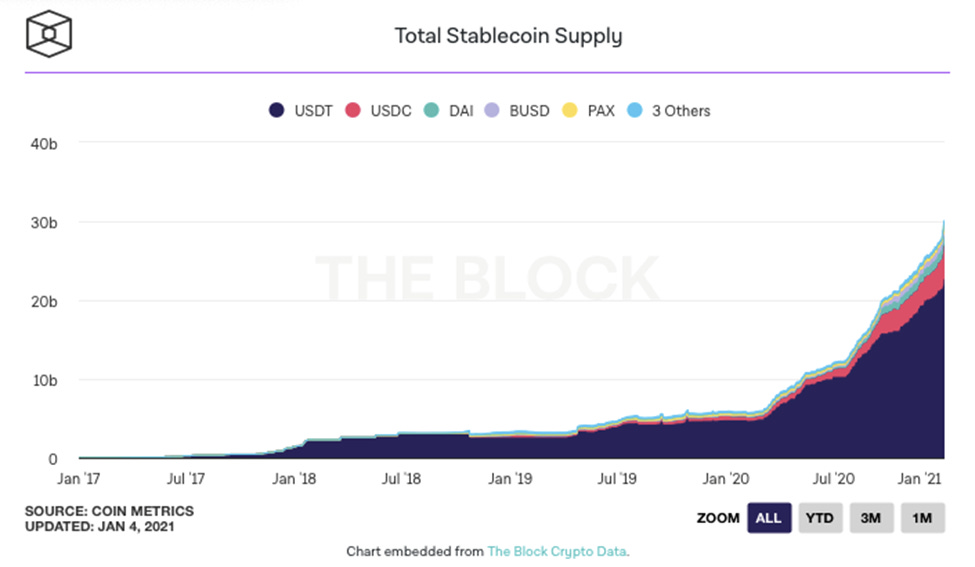

These low-volatility currencies are hugely important to the crypto ecosystem: they leverage the benefits of public blockchains—immutable, decentralized, secure—while offering a bridge to the “old world” of central banking and fiat. Stablecoins, for this reason, played a massive role in last year’s “DeFi Summer” and the continued surge in decentralized finance. Large institutions, too, are starting to get on board; cross-border payments, in particular, have been a powerful use case for stablecoins.

As of now, there are two “buckets” for stablecoins: fiat-backed and algorithmic.

Fiat-backed stablecoins are issued by institutions who underwrite each token with an object of value. For example, USDC and Tether, the two highest-used stablecoins, have a 1:1 relationship with the US dollar: each token is, in theory, redeemable for one USD. This logic applies to other fiat currencies (see: TrustToken’s array of fiat stablecoins) and non-currency collateral (see: Venezuela’s Petro backed by oil).

Despite being the dominant form of stablecoin, fiat-backed tokens have a big downside: trust. First, trust that the issuing party chooses not to freeze your assets, remains solvent, complies with complex regulatory schemes, and actually has the collateral reserves they claim to have (a source of prolonged controversy for Tether). Second, and arguably more importantly, is that you still are subject to the whims of the Fed’s (or another central bank’s) monetary policy. The coin is only as “stable” as the financial regime that manages it: crypto-USD is still USD.

Algorithmic stablecoins, on the other hand, don’t rely on reserves to back their coins. Instead, mathematically-engineered forces help stabilize the currency around whatever “peg” the token designers choose. A number of different approaches have been tested, all varying in complexity; I’ll spare you the intricacies here, but if you’re interested, check out this newsletter’s post from January.

What is DAI and how does it work?

DAI is the most widely-used algorithmic stablecoin currently in circulation, with a peg of $1 USD. It is native to the Maker protocol, a decentralized autonomous organization (DAO) that facilitates peer-to-peer lending (with governance token MKR), and was released in late 2017.

To explain how DAI works, you must also understand the Maker lending platform. DAI are minted when users lock up their ETH (and now other supported assets) in a smart contract on Maker as collateral. Like most DeFi platforms, Maker requires that loans be over-collateralized; in other words, you must lock more ETH than the DAI minted—a 150% collateralization rate, to be exact. This DAI is subject to a stability fee, similar to an interest rate a bank would charge, but typically much lower. When a user wishes to unlock their collateralized ETH, they inject DAI (including interest payments, paid in MKR) back into the protocol, which is then burned.

If that all sounded pretty mystifying, you’re not alone. The DAI mechanism is a true mathematical and economic accomplishment, so if you’re interested in learning more, this explainer video and the whitepaper are great places to start.

DAI stabilizes, to put it extremely simply, through changes in the stability fee, similar to how the Fed can change money supply through interest rates. When the market price is above $1, the stability fee is lowered to increase the supply of loans and bring the price back down; the reverse is true for when DAI is below $1.

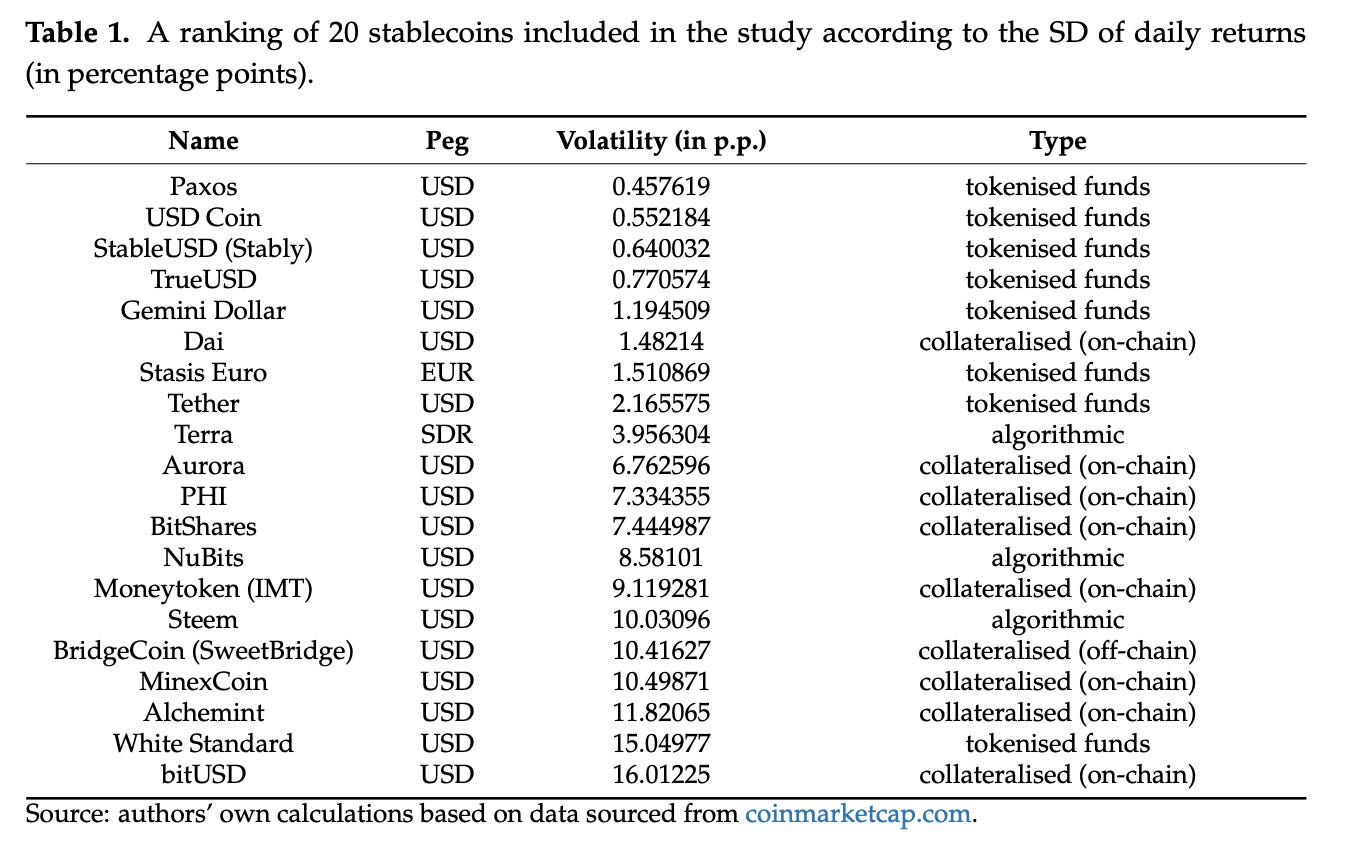

How well has it performed? A recent study in the Journal of Risk and Financial Management ranked it as the least volatile collateralized stablecoin, rivaling many fiat-backed ones—quite the achievement for a new technology.

What are the downsides to DAI?

With all good things, though, there are downsides. For DAI, four major ones have been raised:

Fiat peg. By virtue of being “soft-pegged” to the USD, DAI owners are forced to have some degree of trust in the dollar. Given unprecedented expansions in the money supply, fears over inflation, and companies adding Bitcoin to their balance sheets as a hedge, it may be time to question the “stability” of a USD-pegged coin.

MCD. By shifting to Multi-Collateral DAI (MCD) instead of just supporting ETH, MakerDAO has opened the door to counter-party risk for offchain assets that some holders may be uncomfortable with.

Custodians. Maker’s organizational structure introduces the risk of malicious collusion. Ameen Soleimani imagines an unlikely, but terrifying scenario:

Case in point, MakerDAO currently has at least four custodians, each of whom can, at will, steal 100% of the ETH collateral deposited in MakerDAO, also print a gajillion DAI, and then use that DAI to steal 100% of the ETH liquidity offered for the ETH/DAI pair across all decentralized exchanges (e.g. Uniswap) and lending protocols (e.g. Compound). The custodians, the Maker Foundation, a16z, PolyChain, and Dragonfly, could execute this entire heist in a single atomic Ethereum transaction, before anyone has a chance to respond.

Negative interest rates. There’s a risk of a “runaway peg” that has difficulty finding support. Soleimani again:

One of the limitations of MakerDAO as a result of the 1 DAI = $1 peg is the difficulty of imposing negative interest rates. When the price of DAI rises above $1, MakerDAO doesn’t have a way of making the stability fee negative in order to reverse the incentives and pay borrowers to take out more DAI debt, which would help restore the peg. Instead Maker relies on arbitrage opportunities between different forms of collateral to satisfy excess DAI demand.

What is RAI, and how is it different?

RAI is a new algorithmic stablecoin from Reflexer Labs that attempts to resolve these issues. It’s founded by Ameen Soleimani and Stefan Ionescu and recently closed a $4M fundraising round, co-lead by Pantera.

It launched last week on the Ethereum mainnet after having been in testing for several months. How did it perform, you may ask?

Let’s look under the hood of how RAI works. It’s similar to DAI in many respects—in fact, it’s a hard fork of their Multi-Collateral DAI (MCD) system, which means it benefits from battle-tested code—yet has implemented a few significant changes.

One big difference is that RAI is completely separate from the “fiat world.” The Defiant puts it well:

It’s not pegged to fiat, it’s not backed by fiat, and it’s designed to run completely by computer programs. If it had a physical bill it would carry the inscription, “in code we trust.”

This is pretty significant, and RAI is a pioneer in this respect.

While it may be uncomfortable to have a “floating peg,” Reflexer optimizes for volatility-minimization. There is an arbitrarily set initial target price ($3.14 at launch) and whenever the market price differs from the target, an interest rate (“redemption rate”) is algorithmically adjusted to oppose the price change. While the price may be pushed back down to where it was originally, it could also settle at a new equilibrium. For RAI, this is a success—the goal is not to have a price that never fluctuates, but instead a price that resists fluctuation, which demands a different mechanism from other stablecoins.

The protocol uses a similar lending system as Maker does, except it only accepts ETH deposits to mint RAI, resolving the counter-party risk identified above. The changes in the redemption rate encourage people to either mint or burn their RAI, stabilizing the price by altering the coin supply.

Importantly, RAI also allows for negative interest rates, unlike DAI. While RAI is still in its infancy and has yet to sustain a large shock to ETH prices, the founders believe that RAI would be more resilient to a “Black Thursday”-type event than many other algorithmic stablecoins, without forfeiting decentralization.

How exactly is it stabilized?

The core of RAI—and what makes it so exciting—is how it uses a PID Controller, an idea from “Control Theory,” to stabilize the underlying asset.

A PID Controller, as explained in RAI’s whitepaper, has been used in over “95% of industrial applications and a wide range of biological systems.” At its core, it’s a way of stabilizing systems that uses a feedback loop to smooth erratic changes—one of its first applications was automatic steering for ships. While it hasn’t been explicitly applied to finance, researchers have found that many central banks approximate PID Controllers already, perhaps unintentionally. RAI makes this link clear.

Is RAI a true "stablecoin"?

No, at least not really. The RAI team says:

RAI, on the other hand, is not pegged to anything. The system behind RAI only cares about the market price getting as close as possible to the redemption price. The redemption price will almost always float (thus, it won't be pegged) in order to compel system participants to bring the market price toward it.

This may still be hard to grasp, but think of RAI not as an approximation of an external currency (like a dollar-pegged stablecoin) but instead as a currency as its own that is optimized for low-volatility. It has its own monetary policy and governance model, which means that when its price changes, that’s a feature, not a bug of the system. Looking at price changes in the RAI/USD trading pair is the same as saying the USD is surging uncontrollably in value compared to the Zimbabwean dollar; they’re two completely different systems, which, for some users, is an asset, not a liability.

Some call it a “gentlecoin,” a term I really hope doesn’t catch on but, regrettably, does a good job of describing the different class of token that RAI falls into.

What value does RAI add to the crypto ecosystem?

RAI’s release is an important moment for the community both symbolically and pragmatically.

A core tenet of the new “cryptoeconomy” has been the shift away from the central banking establishment. While Bitcoin and other stores of value have provided an alternative to fiat, volatility has always been crypto’s Achilles heel. For risk-averse community members, fiat-backed stablecoins have been a “safe haven” for high-volatility events in the markets and for long-term financial contracts. RAI, though, now offers an alternative, one that doesn’t rely on, use the language of, or particularly care about the world of fiat. For community members who don’t want to sacrifice their anti-fiat philosophy in the name of risk management, RAI is a compelling option: an anti-volatility coin that doesn’t rely on fiat for its stability.

Pragmatically, though, the team sees two immediate use cases. First, RAI could be an asset for investors who want exposure to ETH without having to hold the base asset. Due to the floating peg of RAI, and the fact that all of the protocol’s collateral is underwritten in ETH, RAI ends up tracking the movement of ETH, albeit with less volatile price swings. This could be an attractive component of a diversified portfolio for a certain type of investor.

Second, RAI could be the next “ETH standard” for collateral in DeFi projects. In particular, synthetic asset platforms (e.g., UMA, Synthetix) could view RAI as a less volatile alternative to other forms of collateral. Particularly for “Black Thursday” scenarios—such as this week’s correction causing the second-highest number of liquidations on record—protocols may be searching for alternatives to ETH and other cryptoassets.

Where do we go from here?

It’s been an exciting first week on the Ethereum mainnet, already with $250m worth of ETH locked and over 30M RAI issued. Check out more live data here.

While this has been a short summary of RAI’s philosophy and mechanics, there’s a lot more to learn! If you’re interested in getting involved, check out their docs and join their Discord. If you’d like to mint RAI by locking your ETH, the protocol is already providing leverage to hundreds of users.

In short, RAI is a new type of cryptoasset: an anti-volatility coin that doesn’t rely on fiat for its stability. It is the first of its class, but likely won’t be the last, and we’re thrilled to see where it goes.

- Paul V

DIGESTS

The Furry Lisa, CryptoArt, & The New Economy Of Digital Creativity

Over the last year I became the proud owner of The Furry Lisa, among several other one-of-a-kind digital creations often referred to as “crypto art” or “NFTs”

Investing in Optimism

Ethereum has proven itself to be an extremely popular computing platform, with both developer and user demand growing dramatically.

DeFi’s Future is in Real World Assets

Over collateralizing is not sustainable. Future DeFi projects need to start planning for the future.

NEWS

Bill Gates Says He’s ‘Neutral’ on Bitcoin

Gates has previously criticized cryptocurrencies and said he'd short bitcoin "if there was an easy way to do it."

Polkadot’s roadmap for full launch fuels rally to all-time highs

There is now a clear path to finally using Polkadot, but issues with the testnet suggest there may be delays.

REGULATIONS

US Central Bank Explains ‘Preconditions’ for a Digital Dollar

The U.S. central bank is grappling with how to proceed on a potential "digital dollar" project.

NY AG’s $850M Probe of Bitfinex, Tether Ends in an $18.5M Settlement

In a closely watched case with wide-ranging implications for the crypto market, Tether has admitted no wrongdoing and will provide reports on USDT’s reserve composition for two years.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Libra Co-Creator’s VC Firm Co-Leads $12M Round in ‘Decentralized GitHub’

“Web 3 developers should be building on open protocols,” NFX General Partner Morgan Beller said of Radicle, a platform for crypto-native code collaboration.

LETS MEET UP

Walks at the park or Zoom coffee meetings!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. The firm invests in equity, pre-auction ICOs, and cryptocurrencies on the secondary markets. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.