Gameplay Alpha

VeradiVerdict - Issue #180

Earlier this month, Perion, a top gaming guild, announced their $8.6M Series A, which we are proud to have participated in. The round was led by Alameda and Framework, with investments from other strategic partners including ourselves, Jump Crypto, and The Spartan Group.

Our partnership with Perion is a reflection of our deep conviction on the promise of blockchain-based gaming and, more specifically, the compelling nature of gaming guilds. The concept of play-to-earn has already been extensively covered in this newsletter, but to give a brief refresher on the “gaming guild” phenomenon:

To maximize performance—and earnings—in many of these play-to-earn games, players sometimes are required to make an initial asset investment to commence their play-to-earn journey. As an example, in the Axie Infinity model, users must own a team of three “Axies” to begin battling, which can cost hundreds of dollars. This problem motivated the creation of gaming guilds. Guilds lend out in-game assets—such as those Axies—to their network of “scholars,” allowing them to play the game and taking a proportion of their earnings in return. Many of the largest guilds, such as Yield Guild Games or Merit Circle, have thousands of scholars and are both valued in the billions.

In just the past six months, dozens of copycat guilds have sprung up, each with its own tweak of the original model. Our thesis, however, is that the guilds that endure—and grow to become multi-billion dollar platforms—will stretch conventional understandings of what a “guild” is and, in the process, produce an irreplaceable experience for their scholars and users.

We believe Perion, with these qualities, has the potential to be a once-in-a-generation gaming brand.

What sets Perion apart?

Perion has a similar shape to other prominent gaming guilds. The scholarship model, where the guild lends NFT assets to players in exchange for a portion of their rewards, is the core revenue-generating part of the guild. Perion, similar to others, also has a venture arm that makes early-stage investments into a number of blockchain-based games; they’re investors in MetalCore, Syn City, Sipher, Ember Sword, and ZED Run, just to name a few.

However, the real differentiator is the type of players that join Perion: they comprise the upper echelon of players in the play-to-earn ecosystem. Since Perion remains largely focused on Axie Infinity, many of the guild’s players are regularly near the top of the game’s leaderboard. This player advantage has enabled Perion to earn higher yields on their assets, receive high-quality data for generating new strategies, and build a brand as one of the most dominant gaming groups in crypto.

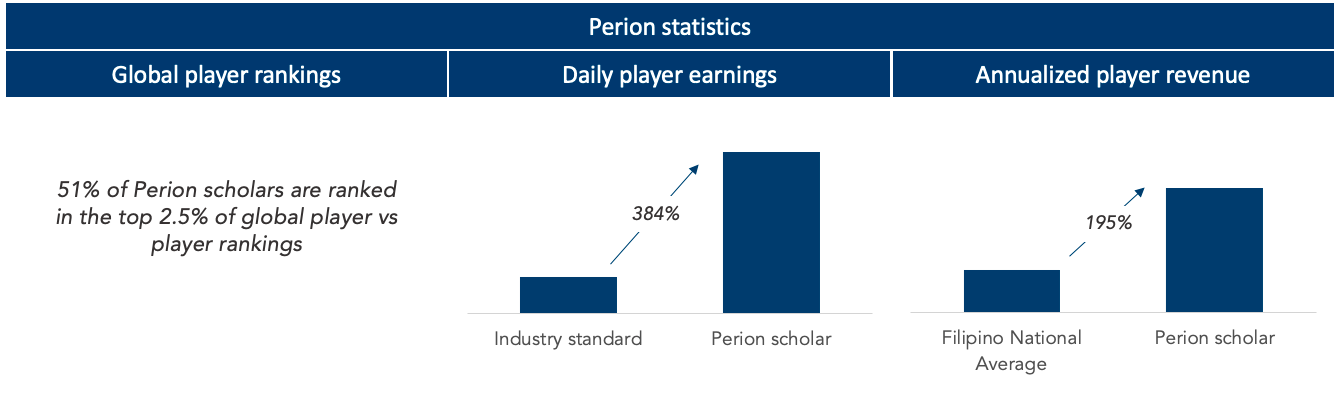

Source: Perion

To fully take advantage of this strong set of competitive players, Perion also invests heavily in analytics and other resources that give their scholars an edge. In their words, “[i]n leveraging its collective strengths in metagame analysis and resource allocation, Perion will seek out supernormal returns and create ideal scenarios for our vast network of dedicated members to participate in the play-to-earn ecosystem.” New scholars to join Perion benefit from this institutional knowledge, a network of other top-notch players, and custom-built tools to perfect the game.

This philosophy is inspired heavily by the people behind Perion. Amos Whitewolf, one of the core team members, worked his way to become the top player in the world playing Axie Infinity, giving him a strong intuition for Axie’s game mechanics and a desire to build a high-performance guild. Mitch Penman-Allen, another core member, previously founded a high-frequency trading firm with complex quantitative trading strategies. These two elements—gameplay mastery and financial sophistication—are in Perion’s DNA.

The model is working

This high-performance, high-yield strategy has paid off handsomely for Perion thus far.

Here are a few statistics:

51% of Perion scholars are ranked in the top 2.5% of Axie Infinity’s global rankings

Average daily earnings are 288 SLP (Axie Infinity’s native token) per day, over 380% higher than the industry standard

25% of Perion scholars are receiving the highest possible allocation of 21 SLP per win

Source: CMCC Global

Perion has a revenue split with their scholars of 50%, over 4x that of most of their competitors. They are able to charge this because of the rare top-tier assets in their treasury and the “gameplay alpha” they offer their network of scholars. A common criticism of other guilds is that price competition over a finite set of players will eventually cause a “race to the bottom” and cut everyone’s profits. Based on the unique needs of this top-tier player category, this criticism rings less true of Perion.

As attention gradually shifts from Axie Infinity to new play-to-earn economies, the question remains whether Perion will continue to be able to deliver high-quality assets, earning-enhancing tools, and other valuable perks to their scholars.

$PERC, Perion’s native token

Source: Perion

Perion’s next milestone is the launch of their token, Perion Credits ($PERC).

The IDO will take place over a seven-day period beginning on January 21st to ensure that all participants have equal pricing, organic price discovery occurs, and early contributors have access to high-yield opportunities for their $PERC. In total, 4% of the total token supply will be unlocked for between e depending on the final price. For more details about the token launch, read this piece.

Source: Perion

Perion, like many other guilds, is in the process of progressively decentralizing into what they call a CoreDAO and a GameDAO. Eventually, many of the decisions around how to allocate capital and the future trajectory of the guild will be decided upon by $PERC token-holders. In addition to the token’s governance power, the team is considering other value accrual mechanics and economic incentives that can be granted to token-holders.

Looking forward

Perion has ambitious plans for 2022 and beyond. These include expanding the scholarship program, maximizing the global reach of Perion’s brand, and investing in more early-stage blockchain games.

However, one of the most interesting elements of Perion, we believe, is their software.

In the past few months, they’ve already built numerous proprietary tools for managing the guild and enhancing their players’ performance. They’ve “developed smart contracts for scholar payments, integrated performance tracking software, developed the first MOBA credential verification system and created automated systems for genetic matching, pricing and breeding of Axies.”

By continuing down this path, Perion could develop the tools that future play-to-earn players use to maximize their earnings and guilds use to streamline their operations. As play-to-earn games grow more complex, Perion could even build financial products on top of these vibrant in-game economies, becoming a leader on the frontier of GameFi.

Based on how large we project guilds and, more generally, play-to-earn gaming to be, Perion is positioning itself well in this massive industry. We’re thrilled to be partnering with them through this exciting time.

- Paul Veradittakit

DIGESTS

Liquidity Mining Is Dead. What Comes Next?

Once DeFi’s top growth hack, a wave of new projects is reconsidering a yield farming staple.

Derivatives Data Shows Softening Crypto Enthusiasm

The wind seems to be out of crypto’s sails for now.

NEWS

Pantera's new venture fund sees $1 billion in total commitments

Pantera, a crypto investment firm, is preparing to raise more than $1 billion for a new venture fund, according to an email distributed on Tuesday.

Gemini Introduces Prime Brokerage Following Second Acquisition in a Week

Gemini Prime aims to attract institutional investors by providing access to multiple crypto exchanges and over-the-counter liquidity sources.

REGULATIONS

NFT Investors Owe Billions in Taxes and IRS Sets Sights on Evaders

Nonfungible token market exploded to $44 billion last year

Uncle Sam is keen to collect, but the tax rules aren’t clear

Bank of Russia Calls for Full Ban on Crypto

Russia's central bank suggests making crypto trading, mining, and usage illegal.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

FalconX Raises $210M Following 30x YoY Revenue Growth; Now Valued at $3.75 Billion

Series C Led by Altimeter Capital, B Capital Group, Sapphire Ventures, and Tiger Global Management, with participation from Amex Ventures and Mirae Asset.

Tom Brady’s NFT Platform Autograph Raises $170M

The funding round was led by Andreessen Horowitz (a16z) and Kleiner Perkins and included the new fund of a16z alum Katie Haun.

OpenSea acquires Dharma Labs and a new CTO

The NFT marketplace buys the nearly five-year-old DeFi protocol but does not share financial terms.

LETS MEET UP

Singapore, March 7-11

Crypto Bahamas, Bahamas, April 26-29

Walks in San Francisco

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.