From the emergence of “AI x blockchain” use-cases to an increasing role of stablecoins in financial markets, to the maturation of zero-knowledge proofs, I believe the overall space remains resilient despite volatile market conditions.

Coindesk article transcript below:

I will explore some of the spaces which we at Pantera are keeping an eye on.

1. Social and Consumer Use Cases

Whereas Web2 has progressed from social to finance, Web3 is moving from finance to social. From Friend.tech to on-chain loyalty, recently there has been more attention on the social element of Web3, seeking to use tokenization to transform social behavior. As consumer transactions may become more frequent on-chain, we believe stablecoins playing an increasingly important role as an on-ramp and off-ramp settlement solution between DeFi and TradFi use-cases.

Moreover, recent advancements in generative AI potentially promise a far more abstracted, personalized, and simplified user experience. With increased AI-enabled abstraction, we hope that this can reduce the onboarding and educational barrier to Web3, making blockchain data more accessible to those with non-technical backgrounds.

2. ZK-Enabled Modularity and Composability

We believe zero-knowledge proofs (ZKPs) will continue to mature, both with new theoretical advancements in recursive proving and the gradual specialization of companies within the vertical to specific roles, such as co-processing, prove executions, zkDevOps, privacy layers, and so on. With this we are beginning to use ZKPs as a way of establishing a common interface between different layers of a modular tech stack.

Modularity is where different layers of the blockchain stack (consensus, execution, data availability etc.) are operated by different providers. This idea allows for increased composability in the form of lego-like “plug-and-play” blockchain architectures. This means that projects can customize their blockchain tech stack according to the specific demands of a consumer-facing application. Furthermore, increased smart-contract composability using general-purpose languages such as Rust allows for increased developer familiarity, reducing the barriers to entry for Web3 developers.

3. Bitcoin Ecosystem

We believe a third space to potentially look out for within the next year or so is the overall Bitcoin ecosystem, which has seen a flurry of renewed interest ahead of the anticipated 2024 halving. This includes possible SEC approval of ETFs from major TradFi funds, as well as a modularized Bitcoin blockchain that allows for more composable smart contracts.

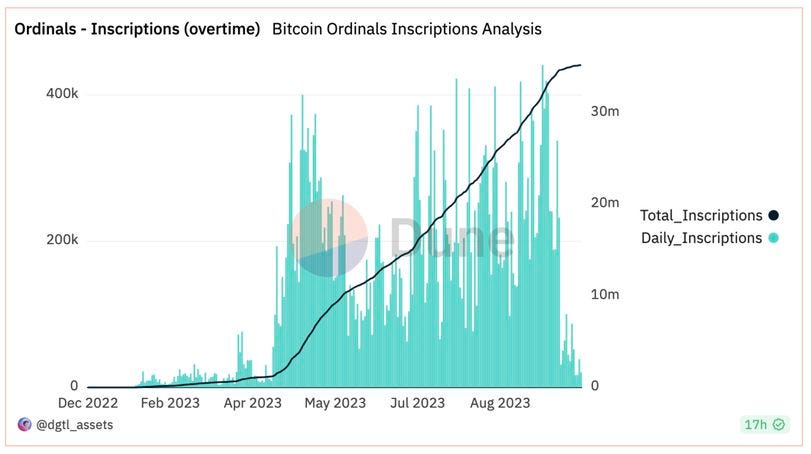

Rise of Ordinals Inscriptions. Source: Dune Analytics. Retrieved Oct 6.

Perhaps one of the most interesting innovations is the rise of Bitcoin digital assets powered by Ordinals-like tech. With this, we may see a bifurcation in the use of NFTs, where Ethereum NFTs may become focused on transaction utility, whereas Bitcoin NFTs, due to the chain’s cultural significance, may evolve into a form of “digital jewelry” and collectibles for art, fashion and media.

- Paul Veraditakit

DIGESTS

A Year After Sam Bankman-Fried's Downfall, Solana and Other FTX Holdings Are Flying High

The FTX founder's downfall began on Nov. 2, 2022 – a year ago Thursday – when CoinDesk published a big scoop. Jurors are poised to begin deliberating his fate on the anniversary of that story, at a time when the SOL tokens FTX owns just got $1 billion more valuable.

Crypto for Advisors: ETH Futures ETFs and What’s Next

Today in Crypto for Advisors Roxanna Islam from VettaFi discusses the current crypto ETF market with a focus on Eth futures performance.

BUSINESS

Elon Musk Blasts NFTs—And Bitcoin Fans Love It

On Joe Rogan’s latest podcast, Elon Musk revived a common criticism of NFTs—so why are Bitcoiners thrilled about it?

Bitget Embroiled in Bitter $10M Dispute With Floki Over TokenFi Memecoin Listing

Floki Inu alleges that Bitget created a $10 million hole by selling tokens that it didn't hold, effectively creating a synthetic short position.

REGULATION

Prediction Market Kalshi Sues U.S. CFTC for Denying Its Contracts for Congressional Elections

The CFTC denied a valid hedging option when it rebuffed a plan to offer event contracts for traders to bet on political outcomes, the company said.

SafeMoon Execs Arrested by DOJ in Fraud Investigation, Charged by SEC

Crypto company SafeMoon's CEO and chief technology officer were arrested, accused of withdrawing more than $200M to buy luxury cars and homes from funds that they told investors were "locked,"

NEW PRODUCTS AND HOT DEALS

Team Behind Celsius Bidder NovaWulf Starts New Firm Called Valinor

Former NovaWulf employees Connor Dougherty and Lily Yarborough are spearheading Valinor, with the continued support and collaboration of two former NovaWulf partners.

PayPal UK Unit Registers as Crypto Service Provider

The Financial Conduct Authority's approval means the payments firm can offer certain crypto services and advertise to local clients.

LETS MEET UP

New York City, November 3

Los Angeles, November 21 - December 1

New York City, December 8

Puerto Rico, December 11-12

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

Hi Paul thanks for sharing. I don't disagree however I am concerned about an anti crypto populist response short to medium term due to the worsening economic sentiment that I believe the Feds may use to ramp up enforcement actions and lawsuits as the deleveraging now spreads to main street from broader tech/Wall st.