Shapella

VeradiVerdict - Issue #244

Ethereum’s Shanghai/Capella upgrade, which will unlock staked ETH rewards for validators, is scheduled to take place today, April 12.

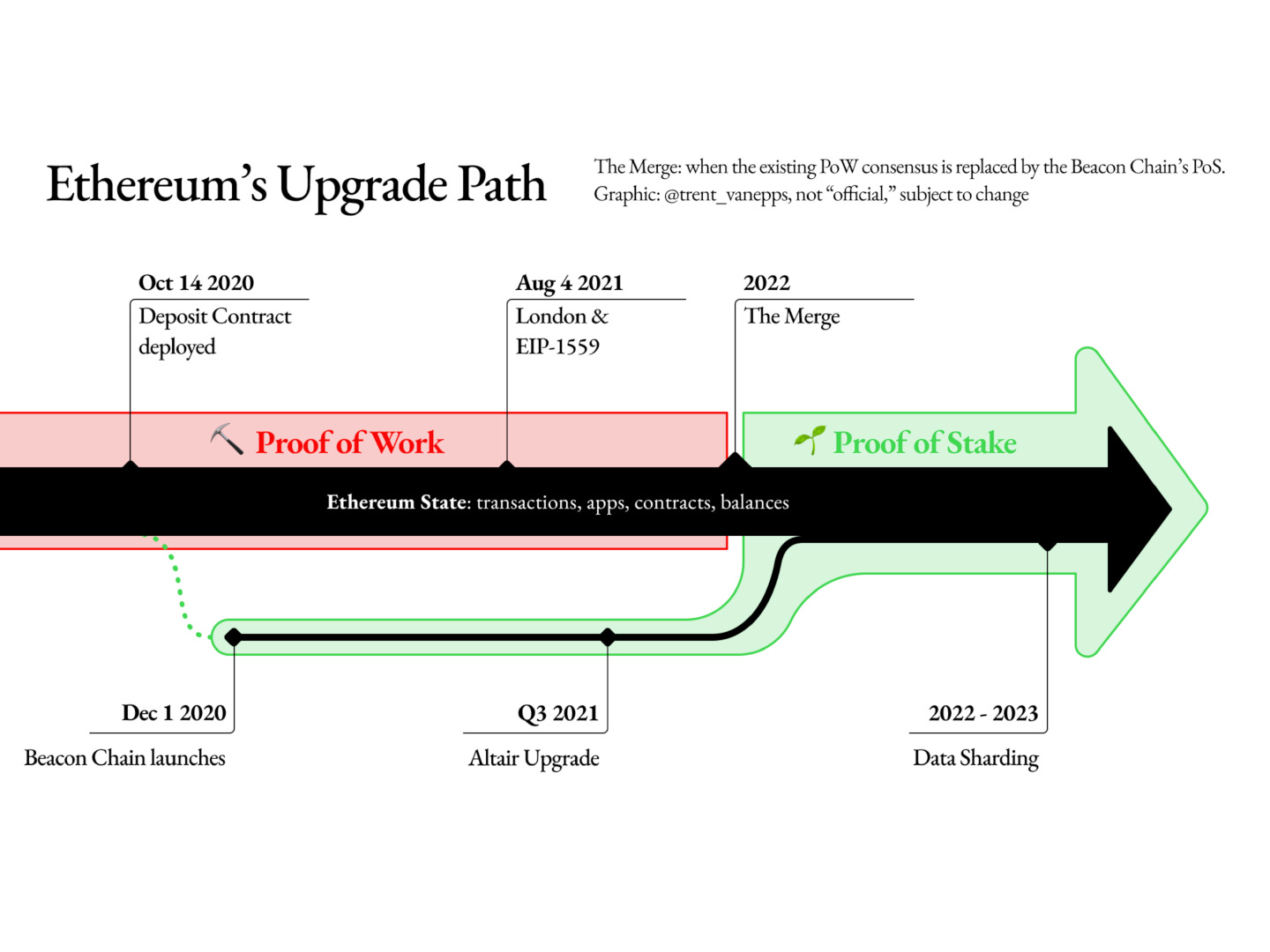

In September 2022, The Merge was implemented to transition the Ethereum network from Proof of Work (PoW) to Proof of Stake (PoS) consensus. Now, Ethereum’s next major technical improvement is the Shanghai upgrade, which will allow users to withdraw their staked ETH from the Beacon Chain. Many users chose to stake amounts of ETH lower than 32ETH (the amount needed for a full validator) and are also now able to unlock their rewards with this upgrade.

Ethereum’s upgrade schedule. Source: Ethereum Foundation

According to the Ethereum Foundation, the Shanghai upgrade enables users to:

Stake their ETH

Earn ETH rewards that will be distributed automatically

Un-stake their ETH to regain full access to their entire balance

Re-stake to sign back up and start earning more rewards

Fundamentally, this upgrade closes “the loop on staking liquidity” and helps Ethereum become a more sustainable and secure chain. In order for the Shanghai upgrade to be implemented, the Capella upgrade – a simultaneous upgrade – must also occur on the Beacon Chain. ConsenSys explains that Capella allows “locked” ETH on Ethereum’s consensus layer (CL) to be withdrawn, which is then applied to an execution layer (EL) level address. The entire upgrade is commonly referred to as Shanghai/Capella since it’s the first upgrade that involves developments to both Ethereum’s execution layer and consensus layer. Further, the upgrade is expected to introduce some technical improvements to the EVM as well.

A dev from the Ethereum Foundation announces that the Shapella (Shanghai + Capella) upgrade was implemented on the Sepolia testnet. Source: Twitter

The Ethereum Foundation also mentions that “reward payments will automatically and regularly be sent to a provided withdrawal address linked to each validator” and that “users can also exit staking entirely, unlocking their full validator balance.” Withdrawal payments are done automatically via a continuous loop on Ethereum’s consensus layer. Proposers “sweep” through validators and check accounts via a set of questions that determine if a withdrawal should be initiated.

A practical way to think of validator withdrawals. Source: Ethereum Foundation

This withdrawal design is gas-free since stakers don’t have to submit a tx to the network to request ETH to be withdrawn. The Ethereum Foundation estimates that 115,200 validator withdrawals can be executed on the network each day. Therefore, the time to process withdrawals can be seen here:

Source: Ethereum Foundation

Other helpful resources:

Answers to frequently asked questions – including on withdrawals, validator preparation, and staking pool / liquid staking derivatives rewards – can be found here from the Ethereum Foundation.

Preparation instructions for current stakers and new stakers can be found here from the Ethereum Foundation.

A video explaining how Ethereum withdrawals work by Finematics can be found here.

- Paul Veradittakit

DISCLAIMER

Pantera Capital Puerto Rico Management, LP and its affiliates (“Pantera”) makes investments in crypto assets and in blockchain-related companies. Pantera and/or its affiliates or personnel may be an investor in, or have relationships or other business arrangements related to, certain instruments, companies and/or projects discussed herein. This document does not contain any advertisement for Pantera’s investment advisory services, or any other services or products, whether provided by Pantera or otherwise. The information and opinions presented in this document are solely those of Paul Veradittakit; they do not represent, and should not be interpreted as representative of, the views of Pantera or any other individual working for Pantera, and do not represent investment, legal, tax, financial, or any other form of, advice or recommendations. Neither Pantera nor Mr. Veradittakit is acting, or purports to act, as an investment adviser or in a fiduciary capacity with respect to any recipient of this paper. Information contained in this document is believed to be reliable, but no representation is made regarding such information’s fairness, correctness, accuracy, reasonableness or completeness. There is no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. Nothing contained herein constitutes any representation or warranty as to future performance of any financial instrument or company. Forward-looking statements should not be relied upon, and performance or outcomes may differ materially from what is contemplated herein. Opinions included here incorporate subjective judgments or may be based on incomplete information. This document does not constitute or contain an offer to sell or a solicitation to buy any securities or a recommendation to enter into any transaction, and no reliance should be placed on this document in making investment decisions.

DIGESTS

MiCA: What Europe’s New Crypto Rules Mean for the Industry

The European Union will soon usher in a suite of new crypto rules called MiCA. But what are they and what does it mean for the industry?

BUSINESS

MicroStrategy's Bitcoin Bet Now in Profit Amid Latest Rally

As the price of Bitcoin recaptures $30,000, MicroStrategy's bold investment in the largest cryptocurrency appears to be paying off.

Bitcoin, Not Ether, Builds Crypto Market Dominance Ahead of Ethereum's Shanghai Upgrade

Bitcoin's dominance rate, its share of the crypto market, has risen to the highest in almost two years, while ether's stagnates.

REGULATION

Montenegro's Central Bank to Develop CBDC Pilot With Ripple

The pilot will see the central bank identify the practical application of a national stablecoin and come up with a design to simulate its circulation.

Employees of South Korean Crypto Exchange Coinone Arrested: Report

They allegedly took money in return for listing certain tokens on the exchange.

NEW PRODUCTS AND HOT DEALS

Shiba Inu's Metaverse Will Partially Open by 2023-End, Developers Say

The metaverse is unlikely to be fully completed on release as it will be an “ongoing project,” developers said.

Proof Launches Exclusive NFT Collection for Moonbirds Holders

The collection will feature 10,000 pieces from 22 artists, including Beeple.

LETS MEET UP

NFT.NYC, New York City, April 10-14

Vancouver, April 24-28

Dubai Fintech Summit, May 8-9

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.