With global macro and fed rates bringing investors to take some risk off right now, the crypto market has sold off a bit and we may be at the start of a bear market. While it seems like there is a coupling of the stock market with the crypto market, it took only 71 days during the last bear market for the uncoupling to occur and crypto to begin rising when investors put risk back on. I’m not sure if this is the bear market but if it is, we’ve been here before.

I thought it would be interesting to reflect back on what I wrote during the last bear market about why this is the best time to invest. You can read it but here are the summary bullet points:

The bear market is great as companies are focused on building and entrepreneurs are in it for the right reasons

Top talent has come into and continues to come into the space

This is a great time to invest because of favorable valuations. Structures include equity, equity-token hybrid, and discounted SAFTs

Investors are going to find great value and long-term successful companies during this time

I believe that all of those points are accurate. The liquid cryptocurrencies are really discounted right now while private market valuations tend to lag. During the bull market, most deals tended to be token deals while during the bear market, we will see mostly equity deals, as there will be fewer token projects launching tokens due to lower investor demand for riskier assets. If token projects do list, they will continue to look towards established platforms like exchanges, Coinlist, and Republic to reach retail.

A innovative channel for investing during the last bear market was around secondaries. Early employees, early investors, and tourist VCs look to take some risk off the table and discounted shares can be purchased. Even discounted SAFTs that are still vesting are in play. It takes the hunter to do well here.

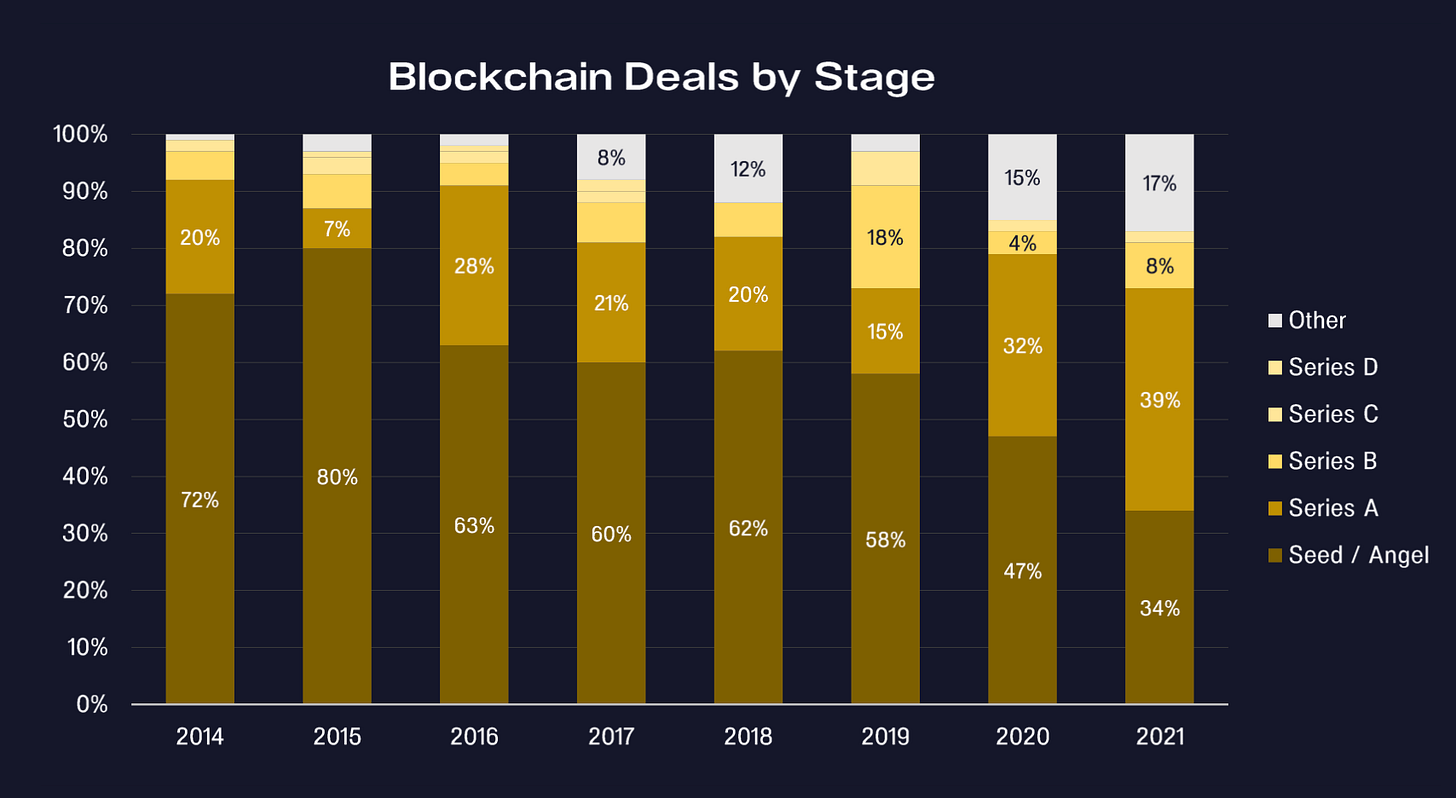

Lastly, there have an increase in growth deals over the last two years, and thus we can see quite a bit of M&A and consolidation during this period.

Some tips for entrepreneurs:

Raise capital or operate lean/extend runway for at least 24 months

Focus on monetization and business model earlier rather than later, creating exit value

Reduce excessive spending; in crypto, you spend less during a bear market on marketing and push more into the next bull market

Review service agreements and either cut or re-negotiate

Larger companies should be active in looking for acquisition targets

In conclusion, our best performing companies so far came out of the last bear market so be patient, mission-driven, and resilient; there’s light at the end of the tunnel.

DIGESTS

The Collapse of UST and LUNA Was Devastating, but There Is Still Hope for Crypto

When a prominent stablecoin and the token that backs it failed, the broader ecosystem certainly was dealt a blow, but ultimately it is surviving.

NEWS

Nearly 5,505 ETH, or $10M of the $625M Ronin Exploit, Is on the Move

Funds connected to the Ronin exploiter address are making their way through Tornado Cash, blockchain data shows.

Galaxy CEO Mike Novogratz Preaches ‘Humility’ Expresses Confidence In Crypto’s Future Despite LUNA/TerraUSD Crash

In his first public comments since the dramatic collapse of dollar-pegged stablecoin TerraUSD (UST) and its companion token LUNA, previous major backer Galaxy Digital CEO Mike Novogratz is using the loss as an expensive lesson and reminder of crypto’s riskiness and volatility.

IN THE TWEETS

REGULATION

US Appeals Court Orders SEC to Bring Enforcement Actions to Jury Trials

The 5th Circuit Court of Appeals found that the targets of SEC enforcement actions had their constitutional rights violated by the use of in-house judges.

Biden Administration Wants Crypto Exchanges to Separate Customer and Corporate Funds

Federal officials saw Coinbase’s admission about customers’ vulnerability in a bankruptcy and will call for congressional action to segregate clients’ funds, source says.

NEW PRODUCTS AND HOT DEALS

Crypto Wallet BitKeep Raises $15M at $100M Valuation

Dragonfly Capital led the round, which will fund a cross-chain DAO for wallet users.

LETS MEET UP

Los Angeles, May 18-20

Los Angeles, June 3-7

Consensus 2022, Austin, June 8-14

NFT.NYC, New York City, June 20-24

London, July 14-19

EthCC, Paris, July 19-22

Walks and coffee meetings in San Francisco throughout the year!

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.

No time like bear market to stop getting distracted by price volatility and to focus on building.