Last month, we announced that Pantera was the first investor in Apollo DAO, a new yield compounding DeFi protocol on the Terra blockchain. We’re thrilled to join a number of other strategic investors—such as Do Kwon, GSR, and others—in providing the capital and guidance necessary to take Apollo DAO to the next level.

Terra’s DeFi ecosystem has flourished in recent months. Anchor Protocol, a high-yield savings product that readers may remember from its April launch, now has over $5B in total value locked (TVL). Mirror, a synthetic stock protocol, has recently surpassed $1.5B in TVL. LUNA, the reserve asset of the Terra ecosystem, has reached a fully diluted market capitalization of over $40B. Just last week, we covered Stader Labs, a new Terra-based protocol building staking infrastructure.

While Ethereum remains the center of DeFi activity, the spectacular growth of developers and value in the Terra ecosystem confirms that it is undoubtedly a successful layer-1 with staying power, although it was almost by accident.

What is Apollo DAO?

Apollo DAO’s self-stated goal is to “bring DeFi to the masses.”

Their first product, very much in line with their mission, is a yield autocompounder on Terra designed to make participating in DeFi more accessible.

To understand why auto-compounding is valuable, let’s imagine you’re a liquidity provider for Mirror. In exchange for providing capital to a pool—let’s say in the form of mTSLA—you receive LP rewards in the form of MIR, the protocol’s native token. But you don’t want MIR, you want more mTSLA! So you’d have to manually swap MIR for mTSLA (slippage, gas fees, frustration, etc.), and then re-supply those new funds into the pool.

Imagine having to manually repeat this process across several different pools on a near-continuous basis. Unless you’re an institutional LP—or a DeFi wizard—you simply don’t have the bandwidth or patience to execute this constant re-balancing.

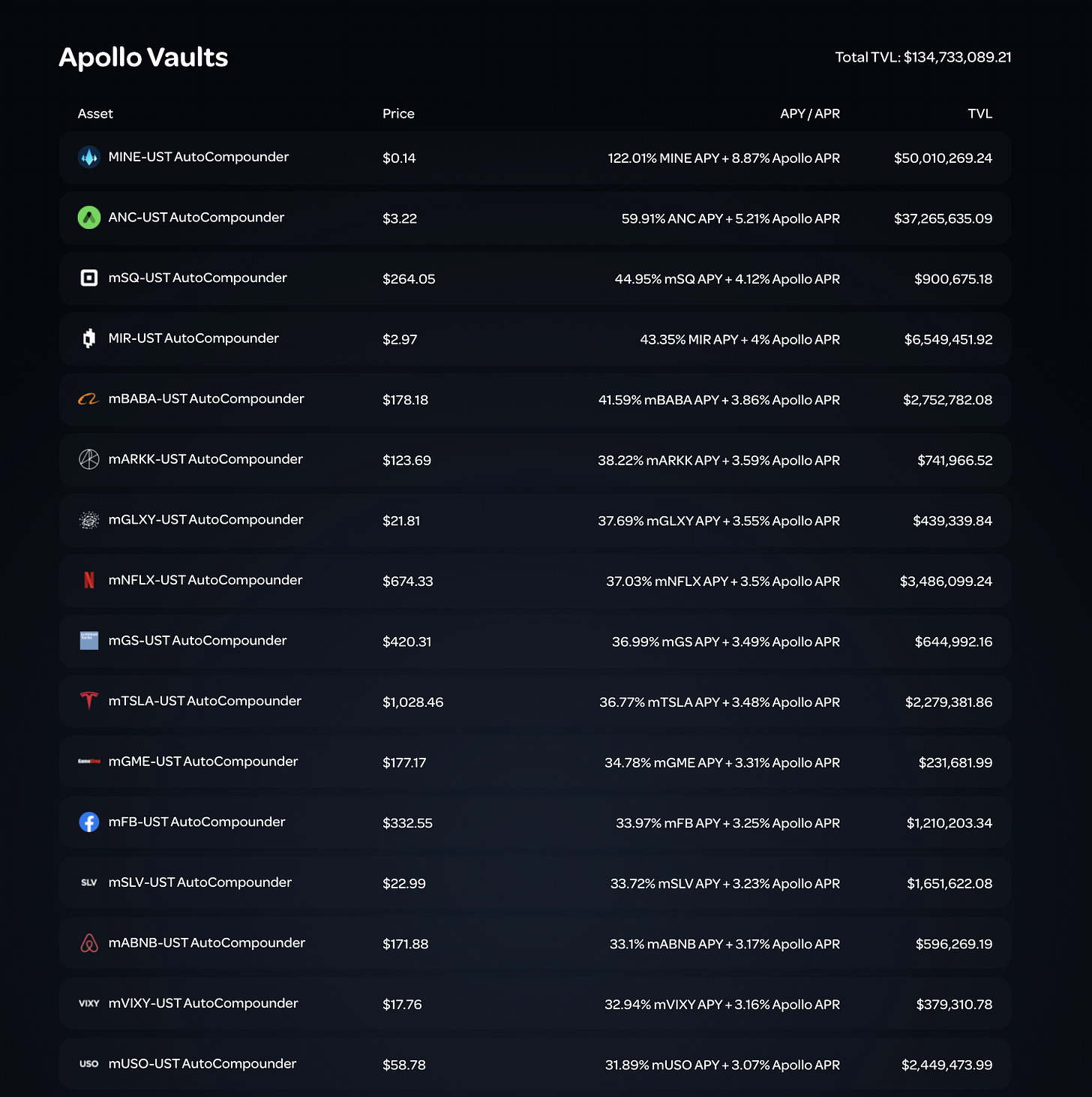

That’s where Apollo DAO’s autocompounding product comes into play. Users can easily examine different yield opportunities and invest in pools directly from Apollo DAO’s front-end. By default, these pools automatically invest yield rewards back into the fund, which alleviates the excessive network fees and headaches from performing it manually.

Source: Apollo DAO

The protocol’s interface is also designed with user-friendliness in mind. Very few DeFi protocols—and even fewer on Terra—are as simultaneously powerful and intuitive as Apollo DAO. The protocol is even mobile-compatible.

Source: Apollo DAO

Within 24 hours of the protocol’s launch last month, Apollo DAO’s vaults had reached $200M in TVL, illustrating the community’s strong interest in the protocol. Apollo DAO now has the seventh-largest TVL in the Terra ecosystem.

Does Apollo DAO have a native token?

APOLLO is the token that powers Apollo DAO.

Currently, the token serves two key purposes. First, token-holders gain voting power over DAO governance decisions—such as adding new vaults, changing the performance fee, and other protocol parameters. Second, users can stake their APOLLO to receive rewards (in the form of zAPOLLO).

Tokens will also be used to bootstrap the protocol’s early liquidity by distributing them to early vault depositors.

Source: Apollo DAO

While the APOLLO token has not yet been fully launched, distribution to the community is currently in progress. After the first Community Farming Event (3M APOLLO) was heavily oversubscribed, the team has decided to extend an additional 6M APOLLO for farming participants. If you’re interested in participating, you can learn more here.

Source: Apollo DAO

What is Apollo DAO’s “War Chest”?

Perhaps the most central element of Apollo DAO, and what differentiates it from being “just another” DeFi protocol, is the project’s War Chest.

Simply put, the War Chest is a pool of the protocol’s fees, which grows proportionally to the protocol’s usage. Apollo DAO, by default, has a “performance fee” of 20%, but it can be altered by token-holders. Almost all of these fees (99%) go directly to the War Chest—the other 1% is donated to charity via Angel Protocol.

Once funds are in the War Chest, token-holders vote to allocate capital in a way that best maximizes the endowment’s growth. By default, the funds are distributed as follows: 50% UST, 20% bETH, and 30% aUST. However, the DAO’s governors can do with the funds what they wish; they can choose to engage in yield farming, purchase different crypto-assets, or even buy back APOLLO.

Source: Apollo DAO (as of October 2021)

In the future, the War Chest could also engage in “metagovernance” of the Terra ecosystem. Since the fund will primarily own a variety of Terra-based assets, Apollo DAO could end up being an important stakeholder and participant in governance decisions, similar to an institutional fund. As the team puts it:

The APOLLO token will enable metagovernance by allowing holders to decide how to use the DAO’s voting power. Apollo will also be able to use this voting power strategically, helping to shape the Terra ecosystem, before expanding to other ecosystems. This voting power would be another reason that Apollo DAO could become a valuable partner to other protocols looking to launch on Terra.

Currently, just under $2M is locked in the War Chest.

What does the future hold?

While Apollo DAO’s flagship product is an autocompounding yield tool, the team has much more ambitious plans as it eyes the future.

For one, they plan to expand to support vaults on other, non-Terra, chains. This could include more complex, cross-chain strategies. This is certainly in line with their mission of expanding DeFi’s reach by making it more user-friendly and less frictional.

But, eventually, in their words:

The long-term vision of Apollo DAO is to create something akin to a decentralized hedge fund, initially focused on Terra assets, but soon investing into other chains. To begin with, the War Chest will consist of staked LUNA and aUST, with APOLLO token holders given the power to decide which Terra farming opportunities to deploy this capital into, as well as what to do with the rewards.

This vision of Apollo DAO as a decentralized hedge fund is what has me most excited about the project.

We’ve seen a number of other great teams tackle this “decentralized investment fund” concept—from BitDAO to Yield Guild Games—and we’re excited to see where Apollo DAO (and their token-holders) take it.

- Paul Veradittakit

DIGESTS

Introducing the NOTE

Today, we are excited to announce the NOTE token and Notional’s plans for decentralization and community ownership.

NEWS

JPMorgan Report Says CBDCs Can Save Firms $100B a Year in Cross-Border Costs

The report considers a network of multiple central bank digital currencies across the ASEAN region.

REGULATIONS

China’s CBDC Has Been Used for $9.7B of Transactions

Some 140 million people have opened wallets for the “eCNY.”

FTX US hires Gensler-era CFTC commissioner to spearhead lobbying

Wetjen's highest-profile role was as a commissioner on the Commodity Futures Trading Commission during the latter years of Obama's presidency. In that capacity, Wetjen served alongside fellow Obama appointee Gary Gensler, who at the time was chairing the CFTC.

IN THE TWEETS

NEW PRODUCTS AND HOT DEALS

Decentralized Identity Startup Spruce Raises $7.5M

Ethereal Ventures and Electric Capital led the round, with Alameda Research, Coinbase Ventures and Protocol Labs joining in.

Avalanche Developers and Investors Form $200M ‘Blizzard’ Investment Fund

The early-stage investment firm and incubator will be operated by former Ava Labs and Avalanche Foundation staff.

Thailand’s Oldest Bank Acquires Majority Stake in Country’s Largest Crypto Exchange

Siam Commercial Bank (SCB) has acquired a 51% stake in Thai cryptocurrency exchange Bitkub.

LETS MEET UP

Lisbon, Solana Breakpoint, Nov 7-10

Los Angeles, Nov 22-26

Coffee meetings or walks in San Francisco

ABOUT ME

Hi, I’m Paul Veradittakit, a Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing in blockchain companies and cryptocurrencies. I’ve been in the industry since 2014, and the firm invests in equity, early stage token projects, and liquid cryptocurrencies on exchanges. I focus on early-stage investments and share my thoughts on what’s going on in the industry in this weekly newsletter.